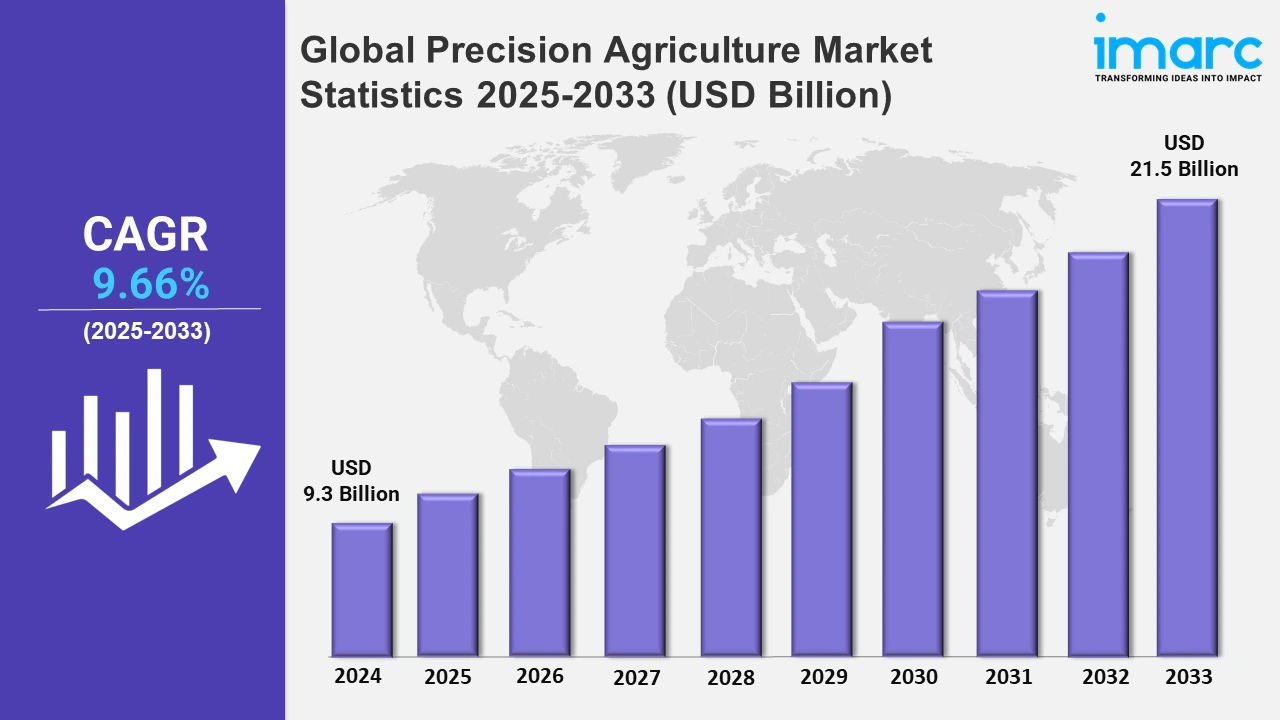

Global Precision Agriculture Market to Grow at 9.66% During 2025-2033, Reaching USD 21.5 Billion by 2033

Global Precision Agriculture Market Statistics, Outlook and Regional Analysis 2025-2033

The global precision agriculture market size was valued at USD 9.3 Billion in 2024, and it is expected to reach USD 21.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.66% from 2025 to 2033.

To get more information on this market, Request Sample

Drones equipped with multispectral, infrared, and RGB cameras enable farmers to monitor crop health across broad areas. This allows for early detection of issues like pest infestations, nutritional deficits, and water stress, allowing for timely action before problems worsen, lowering crop losses and increasing yields. Drones can instantly collect high-resolution data from entire fields, revealing specific information on soil health, plant height, and crop density. They can also assist farmers in making better educated decisions about irrigation, fertilization, and pest management by collecting correct data, which increases production while lowering wasteful input expenses. They enable precise field mapping and soil analysis, which are required for optimal planting patterns and input applications. As per the IMARC Group’s report, the global agriculture drones market is expected to reach USD 31,882.6 Million by 2033.

Labor limitations in agriculture, particularly in developed countries, make it difficult to run large-scale farms manually. Agricultural robots, such as autonomous tractors, weeding robots, and robotic harvesters, eliminate the need for manual labor. These robots can work around the clock, lowering personnel expenses and increasing operational efficiencies. Robots with improved sensors and cameras can accurately identify weeds and pests. Robots, such as laser or chemical-spot weeding robots, deliver herbicides and pesticides precisely where they are needed, considerably lowering chemical use and boosting crop health. This focused method reduces expenses while minimizing the environmental impact of herbicides and pesticides. Autonomous planting robots can analyze soil composition, moisture, and other factors to guarantee seeds are planted in the optimal place and depth. This precision saves waste, improves plant establishment, and maximizes yield potential, thereby promoting more sustainable and profitable crop production. The IMARC Group’s report shows that the global agricultural robots market is expected to reach USD 35.7 Billion by 2032.

Global Precision Agriculture Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, the Middle Eastern Africa, and Latin America. According to the report, Asia Pacific accounts for the largest market share on account of its advanced agricultural infrastructure, high adoption of technology-driven farming practices, and substantial investments in agri-tech innovations.

North America Precision Agriculture Market Trends:

North America dominates the precision agriculture market owing to the widespread technological adoption and improved farming methods in nations, such as the United States and Canada. Farmers in this region make significant investments in precise technologies, such as global positioning system (GPS)-enabled equipment, sensors, and self-driving machinery to increase productivity, minimize worker dependency, and meet expanding demand for sustainable agriculture. Government actions like funding and subsidies for precision agriculture solutions is propelling the market growth. Furthermore, the region's emphasis on sustainable agriculture to mitigate the effects of climate change encourages the development of resource-conserving and waste-reducing technology. With a well-established agricultural infrastructure and a tech-savvy farming industry, North America continues to lead the way in technologies that is supporting the market growth. As per the IMARC Group’s report, the North America precision agriculture market is expected to reach US$ 10.7 Billion by 2032.

Asia-Pacific Precision Agriculture Market Trends:

Asia Pacific is a fast-expanding region in the precision agriculture industry, driven by the rising food demand due to population expansion and increased awareness about sustainable agricultural practices. Countries, such as China, India, and Japan, are implementing precision agriculture to increase crop yields, manage resources more efficiently, and resist the consequences of climate change. Governments and commercial organizations are promoting agri-tech projects, resulting in the spread of technology like remote sensing, drone-based crop monitoring, and precision irrigation systems.

Europe Precision Agriculture Market Trends:

Europe is a major market for precision agriculture owing to strict environmental legislation, technical breakthroughs, and government support for sustainable farming practices. The European Union's Green Deal and Common Agricultural Policy (CAP) encourage farmers to use precise technologies to achieve environmental goals, such as using less pesticide and fertilizer. Countries, such as Germany, France, and the Netherlands, are at the forefront of deploying drones, GPS-based systems, and AI-powered analytics to improve productivity and resource management.

Latin America Precision Agriculture Market Trends:

The precision agriculture business in Latin America is growing as large-scale farming enterprises look for ways to increase productivity and optimize resource use. Brazil and Argentina, the region's agricultural powerhouses, are driving the use of precision technologies, particularly in commodity crops, such as soybeans, corn, and sugarcane. The region's agriculture sector benefits from digital transformation initiatives and investments from foreign agri-tech firms looking to capitalize on Latin America's lush soils.

Middle East Precision Agriculture Market Trends:

Precision agriculture is gaining popularity in the Middle East owing to water shortages and the necessity for resource optimization in harsh climes. Countries, such as Israel and the UAE, are pioneering the use of water-saving technology including drip irrigation, remote sensing, and climate-controlled greenhouses. Precision agricultural technologies increase crop output while conserving water, which is a crucial goal in arid regions.

Africa Precision Agriculture Market Trends

Africa's precision agriculture market is still in its early phases, with increased attempts to improve food security and agricultural output across the continent. Key countries like South Africa, Kenya, and Nigeria are starting to use precision technologies to solve issues including climate change, soil degradation, and water constraint.

Top Companies Leading in the Precision Agriculture Industry

Some of the leading precision agriculture market companies include Ag leader Technology, AgEagle Aerial Systems Inc., CropX Inc., Deere & Company, DICKEY-john, Lindsay Corporation, PTx Trimble, Raven Industries Inc., Teejet Technologies, Topcon Positioning Systems, Inc., Yara International ASA, among many others. In March 2024, Bayer CropScience AG unveiled a prototype of an expert GenAI system to assist farmers and advanced agronomists in their daily job. This system can rapidly and accurately respond to inquiries about agronomy, farm management, and Bayer agricultural goods.

Global Precision Agriculture Market Segmentation Coverage

- On the basis of the technology, the market has been categorized into GNSS/GPS systems, GIS, remote sensing, variable rate technology (VRT), and others. GNSS/GPS systems represent the leading segment. GNSS/GPS systems are vital in precision agriculture because they enable accurate localization and mapping, allowing farmers to better monitor field conditions and manage land use. These systems aid the operation of autonomous vehicles, drones, and sensors by delivering precise positioning data, which is essential for tasks like field mapping, crop scouting, and targeted spraying. The technology's capacity to increase efficiency, lower input costs, and maximize yields makes it extremely useful.

- Based on the type, the market has been classified into automation and control systems, sensing and monitoring devices, and farm management system. Automation and control systems currently dominate the market. These systems are critical for precision agriculture as they enable real-time data processing and automated operations, resulting in lower labor and resource utilization. These systems include instruments like variable rate controllers, self-driving tractors, and irrigation management, which streamline operations by automating monotonous processes and making data-driven modifications in real time. This improves crop yields while reducing waste, making farming more sustainable and economical.

- On the basis of the component, the market has been bifurcated into hardware and software. Among these, hardware accounts for the majority of the market share. Hardware is a critical component in precision agriculture, including GPS units, sensors, drones, and tractors. These technologies are essential for collecting real-time data, applying precise inputs, and conducting automated activities. The demand for modern, durable, and precise hardware is significant since it serves as the foundation for data collection and analysis in the field.

- Based on the application, the market is segregated into mapping, crop scouting, yield monitoring, soil monitoring, precision irrigation, and others. Yield monitoring exhibits a clear dominance in the market. Yield monitoring is a popular application in precision agriculture because it provides useful insights into crop yield and allows farmers to make more educated decisions about input management and field variability. Farmers can use yield data to examine field performance, identify high and low yield areas, and alter procedures to increase uniformity and output.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.3 Billion |

| Market Forecast in 2033 | USD 21.5 Billion |

| Market Growth Rate 2025-2033 | 9.66% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | GNSS/GPS Systems, GIS, Remote Sensing, Variable Rate Technology (VRT), Others |

| Types Covered | Automation and Control Systems, Sensing and Monitoring Devices, Farm Management Systems |

| Components Covered | Hardware, Software |

| Applications Covered | Mapping, Crop Scouting, Yield Monitoring, Soil Monitoring, Precision Irrigation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Ag leader Technology, AgEagle Aerial Systems Inc., CropX Inc., Deere & Company, DICKEY-john, Lindsay Corporation, PTx Trimble, Raven Industries Inc., Teejet Technologies, Topcon Positioning Systems, Inc., Yara International ASA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Precision Agriculture Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)