Preclinical CRO Market Size, Share, Trends, and Forecast by Service, End Use, and Region, 2025-2033

Preclinical CRO Market 2024, Size and Trends:

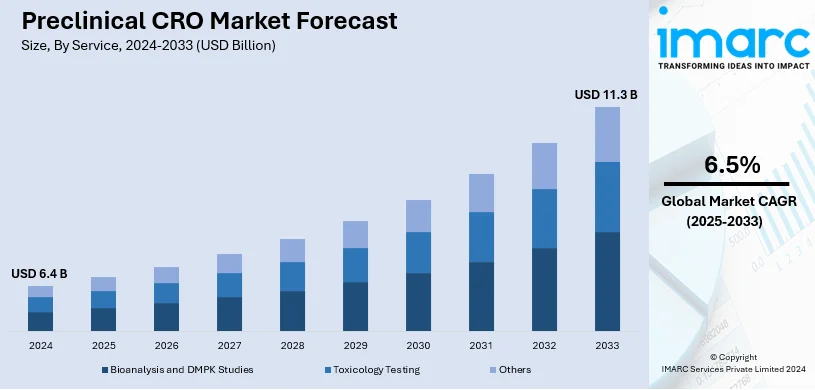

The global preclinical CRO market size was valued at USD 6.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.3 Billion by 2033, exhibiting a CAGR of 6.5% from 2025-2033. North America currently dominates the market, holding a market share of over 47.5% in 2024. The growing expenditure on research and development (R&D) activities, the rising complexity of the regulatory environment, the increasing focus on core competencies among companies, and recent advancements in specialized treatments are some of the major factors propelling the market in the region.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.4 Billion |

| Market Forecast in 2033 | USD 11.3 Billion |

| Market Growth Rate 2025-2033 | 6.5% |

The main driving force behind the growth of the preclinical contract research organization (CRO) market is the growing demand for outsourcing research and development (R&D) to streamline the discovery of drugs and save costs. Pharmaceutical and biotechnological companies have started taking considerable dependence on CRO's specialized expertise, advanced technology, and more inclusive preclinical testing services. Besides this, more extensive biopharmaceutical research, higher investments in innovative therapies, and stringent regulatory requirements that need to be fulfilled are impelling the market growth. Moreover, the escalating prevalence of chronic diseases and faster pace of drug development have led to the increased demand for preclinical CRO services. Another factor driving preclinical CRO market growth is the continuous technological progress such as artificial intelligence (AI)-driven drug discovery, and better laboratory work making the partnership with CRO more efficient and attractive worldwide.

A massive market is emerging in the United States, holding approximately 93.7% market share. Pharmaceutical and biotechnological companies are outsourcing all aspects of preclinical research increasingly to CROs just in order to save money on costs and accelerate the speed of drug development. A higher incidence of chronic diseases to be treated with new treatment options is also fueling further market demand for preclinical CROs. Along with this, the rising complexity of drug development and stricter regulatory requirements are forcing companies to seek specialized expertise from CROs. According to statistics from the Centers for Disease Control and Prevention (CDC), six in ten adults in the U.S. live with a chronic disease such as cancer, heart disease, or diabetes. Chronic diseases form the top killer in the United States. Heart disease and cancer combined take almost 40% of the total deaths. The growing rate of chronic diseases calls for a requirement of new therapies, which is strengthening the market growth.

Preclinical CRO Market Trends:

Rising Research and Development Activities

The escalating R&D activities in the pharmaceutical and biotechnology industries are driving the preclinical CRO market share. Further, the modern drug development process is complex and demands a lengthy preclinical testing process for the safety and efficacy of new drugs. Researchers must use Good Laboratory Practice (GLP) defined in U.S. Food and Drug Administration (FDA) rules for regulation of medical product development for preclinical studies. Moreover, according to reports, India's preclinical CRO market, valued at USD 183.3 Million in 2023, is growing rapidly, driven by a CAGR of 11.4% through 2030. With increasing research activities and developed infrastructure, including global outsourcing demand, Indian is a prime destination in preclinical research. Innovators in toxicology, safety pharmacology, and bioanalytical services are Syngene and Jubilant Biosys. In addition, outsourcing preclinical R&D activities to CROs is more cost-effective for the pharmaceutical companies as compared to their in-house performance. CROs have specialized expertise and infrastructures that can assist in streamlining the process of drug development and making it less expensive. In January 2024, for example, the National Center of Advancing Translational Sciences developed a preclinical research toolbox in collaboration with other NIH institutes and centers. These include Assay Guidance Manual, Compound Management, NCATS Pharmaceutical Collection, PubChem, Probes, Phenotypic Drug Discovery Resource, and BioPlanet.

Complex Regulatory Environment

The complex regulatory environment in the pharmaceutical and biotechnology industries is a significant factor adding to the preclinical CRO market outlook. Regulatory agencies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), require extensive preclinical testing to demonstrate the safety and efficacy of new drugs. Moreover, for instance, the National Center for Advancing Translational Sciences partnered with academia, industry, and patient advocacy groups to enable more than 45 novel drugs to move into clinical trials. According to them, a new drug's journey from the lab to the medicine cabinet can take up to 15 years. This has led to an increased demand for preclinical CRO services to ensure compliance with regulatory requirements. In addition, the globalization of clinical trials requires pharmaceutical companies to understand the intricate regulatory landscape in various countries. Preclinical CROs with experience and familiarity with international regulatory requirements can enable them to assist companies in conquering these difficulties. For example, the Centers for Disease Control and Prevention claim that laboratory research takes 10 to 15 years to get vaccines ready, and researchers have to apply to the FDA with an investigational new drug application that includes all information on the vaccine. The FDA's Center for Biologics Evaluation and Research regulates the use of vaccines in the United States.

Increasing Cost of Drug Development

The rising cost of drug development is further pushing the revenue of the preclinical CRO market. It is a very complex and time-consuming process to discover new drugs. Extensive research and testing are essential in drug development. Thus, such complexity contributes to the high cost that goes with the performance of preclinical studies. Additionally, with respect to establishing the safety and efficacy of new drugs, both the EMA and the FDA require complete preclinical testing. Meeting these regulatory provisions is costly. Drug development is inherently risky, with many drugs failing to reach the market despite significant investments. According to Member Magazine of the American Society for Biochemistry and Molecular Biology, it takes 10 to 15 years to develop one successful drug. Researchers discovered that the drug's inability to have the desired impact in humans was between 40% and 50% of failures. About 10% to 15% resulted from poorly designed pharmacokinetic characteristics. Meanwhile, about 30% resulted from being uncontrollably toxic/toxicity/adverse. According to preclinical CRO market forecast, key companies can ease such dangers by providing preclinical research-related expertise that can guide them better in choosing the drugs to consider.

Preclinical CRO Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global preclinical CRO market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service, end use, and region.

Analysis by Service:

- Bioanalysis and DMPK Studies

- Toxicology Testing

- Others

Toxicology testing is the largest segment that commands around 51.6% of the market share in 2024, mainly due to the significant role that toxicology studies play in providing assurance regarding the safety of drugs and good compliance with high regulatory standards. The increasing demand for innovative therapies, as well as the complexity of drug formulations, has compelled pharmaceutical companies to conduct extensive toxicology testing. The in-vivo and in-vitro testing, genotoxicity studies, along with, carcinogenicity assessments are all popular services with respect to safety during early drug development. The increasing incidence of chronic diseases and increased investment in biopharmaceutical research form an underpinning driver for the demand for such services and emphasize toxicology testing as a core component of the preclinical CRO market.

Analysis by End Use:

- Biopharmaceutical Companies

- Government and Academic Institutes

- Medical Device Companies

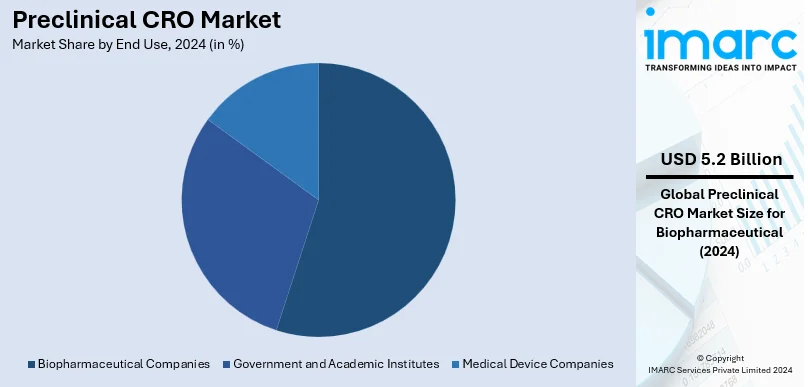

Biopharmaceutical companies are the largest end-users of preclinical CRO services in 2024, taking about 81.0% of the market share. This is due to the biologics and targeted therapies, which come along with heavy preclinical research undertaken on them to ascertain efficacy and safety. These firms believe in the best use of available preclinical CRO services in meeting advanced testing capabilities, making the research more effective, and standing rigorous regulatory requirements. Another factor propelling investments in drug development from biopharmaceutical companies is the rising incidence of chronic diseases, combined with increased demand for personalized medicine. CRO outsourcing also enables such companies to decrease operational costs and speed up time-to-market for innovative therapies, making these companies the principal drivers of growth in the preclinical CRO market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the largest chunk of the preclinical CRO market in 2024, with around 47.5% of the world's share. The reasons behind this can be attributed to the strength of the pharmaceutical and biotechnology industries, higher research grants, and an established regulatory framework within that region. With cutting-edge health infrastructure, significant chronic disease prevalence, and majorly research and innovation-based drug development within this region, the US contributes the most in bringing forward growth. In fact, biopharmaceutical firms are outsourcing more than before to save on operational cost and time while managing a research pipeline. Furthermore, higher penetration of more advanced technologies is in AI-driven drug discovery, laboratory automation, and the further strengthening of North America's presence as a major hub of preclinical CRO activity.

Key Regional Takeaways:

United States Preclinical CRO Market Analysis

The adoption of preclinical research services is significantly advancing the United States' biomedical and pharmaceutical sectors by allowing precise drug development and regulatory compliance. For example, the U.S. pharmaceutical industry, generating over USD 550 Billion in 2021 and employing 1.3 Million people, is driving the adoption of preclinical CRO through robust R&D investments and its dominant global market position. By utilizing cutting-edge technologies such as AI-driven drug modeling and advanced imaging systems, the U.S. is best positioned to lead in healthcare innovations. The research on personalized medicine in California and the breakthroughs in oncology in Massachusetts are examples of such leadership. States like Texas and North Carolina are also emerging as prominent hubs, benefiting from streamlined preclinical services that reduce development timelines and costs. These innovations bolster competitiveness on a global scale, attracting investments from countries including Germany and Japan. The U.S. stands out for its ability to integrate advancements with localized expertise, such as leveraging robust research facilities in academic centers. This strategic adoption enhances the country’s role in addressing complex health challenges while maintaining its status as a global powerhouse in preclinical development.

Europe Preclinical CRO Market Analysis

Europe holds a prominent position in the preclinical Contract Research Organization (CRO) market, driven by its advanced healthcare infrastructure and a focus on biotechnological and pharmaceutical innovation. Countries such as Germany, the United Kingdom, and France are leading contributors, with a strong presence of global biopharma companies and research institutions. The region benefits from robust regulatory frameworks and streamlined drug approval processes, which make it an attractive destination for preclinical research. For instance, Germany's National Pharma Strategy aims to reverse its declining share in global clinical trials, down to 3.9% in 2021, by fostering faster approvals, reducing bureaucracy, and incentivizing local research. These reforms, including the Medical Research Act, are driving preclinical CRO adoption to support pharmaceutical innovation and competitiveness. Key advancements, such as the integration of AI in drug discovery and precision medicine studies, are transforming the preclinical landscape in Europe. For instance, Germany's thriving pharmaceutical sector supports extensive preclinical toxicology and pharmacokinetics research, while the UK fosters innovation through partnerships between CROs and academic centers. Locations such as Switzerland and Belgium further enhance the region’s capabilities, offering specialized services like disease modeling and high-throughput screening. With significant investments in biopharma R&D, Europe is addressing critical unmet medical needs, reinforcing its role as a global hub for preclinical CRO services.

Asia Pacific Preclinical CRO Market Analysis

The Asia-Pacific region is emerging as a global leader in adopting preclinical Contract Research Organizations (CROs), driven by advancements in biotechnology, innovative drug discovery, and increasing demand for cost-effective research solutions. Countries like China, India, and South Korea, along with key locations such as Singapore, have positioned themselves as hubs for preclinical outsourcing due to their robust infrastructure, skilled workforce, and favorable regulatory frameworks. For instance, The Asia-Pacific (APAC) region, driving over 50% of global clinical trials from 2017 to 2021, is rapidly adopting preclinical CROs due to lower costs, robust site availability, and streamlined regulatory processes. Enhanced growth across therapeutic areas, coupled with APAC’s pharmacogenomic advantages, positions it as a leader in clinical trial innovation. Notable advantages include reduced timelines for drug development, access to advanced technologies, and the ability to leverage expertise in diverse therapeutic areas. For instance, China's integration of AI in preclinical studies has accelerated precision medicine research, while India's cost-efficient services have attracted global pharmaceutical firms. South Korea's emphasis on immuno-oncology trials exemplifies the region's focus on innovative therapeutic areas. The Asia-Pacific's strategic location also enables seamless collaboration with Western markets, ensuring its prominence as a preferred destination for preclinical CRO partnerships.

Latin America Preclinical CRO Market Analysis

Latin America is emerging as a dynamic hub for preclinical CROs due to advancements in biomedical research and innovation. Countries like Brazil, Mexico, and Argentina are leveraging state-of-the-art facilities, competitive costs, and skilled professionals to attract global collaborations. For instance, Brazil recorded 625,000 new cancer cases in 2022, yet only 2.2% of global cancer clinical trials are conducted there, driving the need for preclinical CROs to address barriers such as limited trials, regulatory delays, and resource shortages. This highlights Brazil's growing role in advancing oncology research through increased CRO adoption. Strategic positioning near North American markets enhances its appeal. Preclinical CROs in Latin America specialize in drug safety and efficacy studies, with examples like Mexican CROs excelling in toxicology and Brazilian firms leading in pharmacokinetics. These developments are positioning the region as a critical player in the global preclinical research landscape.

Middle East and Africa Preclinical CRO Market Analysis

The adoption of preclinical CROs is significantly advancing the Middle East and Africa's position in global healthcare innovation. Countries such as the UAE, Saudi Arabia, and South Africa are leveraging CRO services to streamline drug development and boost research capabilities. For instance, the Middle East’s pharmaceutical market, valued at USD 36 Billion in 2023, is fostering preclinical CRO adoption, driven by rising investments in drug development and regulatory demands. This growth highlights the region's increasing focus on advanced research services to meet expanding healthcare needs. These advancements reduce costs and accelerate timelines, fostering a competitive edge. Key hubs like Dubai and Cape Town are becoming research centers due to infrastructure investments and collaborations. This strategic approach is strengthening the region's role in global clinical research and pharmaceutical innovation.

Competitive Landscape:

The global preclinical CRO market is characterized by intense competition, driven by the growing demand for specialized services and the increasing trend of outsourcing drug development. Leading players dominate the market with comprehensive service portfolios, advanced technological capabilities, and global footprints. These companies invest heavily in research and development, strategic partnerships, and acquisitions to expand their offerings and stay ahead in the competitive landscape. Smaller and mid-sized CROs are also gaining traction by focusing on niche services, cost-effectiveness, and flexibility in client engagement. The market sees innovation as a key competitive factor, with companies adopting AI, predictive analytics, and automated platforms to improve efficiency and accuracy. Regional players are expanding their presence in emerging markets like Asia-Pacific, further intensifying the competition. The industry's growth potential continues to attract new entrants, adding to the dynamic and competitive nature of the market.

The report provides a comprehensive analysis of the competitive landscape in the preclinical CRO market with detailed profiles of all major companies, including:

- Charles River Laboratories Inc.

- Covance Inc. (Laboratory Corporation of America Holdings)

- Eurofins Scientific

- ICON Plc

- MD Biosciences Inc. (MLM Medical Labs)

- Medpace

- Parexel International Corporation

- PPD Inc.

- Wuxi AppTec

Latest News and Developments:

- September 2024: PharmaLegacy strengthens its preclinical services with the acquisition of BTS Research, a prominent preclinical CRO. This strategic move expands PharmaLegacy’s laboratory operations into North America, enhancing its capabilities in drug discovery and development. The acquisition aims to deliver integrated solutions to clients, addressing the growing demand for preclinical research. It reflects PharmaLegacy's commitment to scaling its global footprint and innovation in life sciences.

- September 2024: Navigating the preclinical CRO outsourcing process focuses on strategies for selecting the right partner, emphasizing alignment of capabilities, communication, and regulatory compliance. The article discusses the importance of understanding project-specific needs and fostering collaboration for successful preclinical study outcomes.

- April 2024: LabCorp enhanced its precision oncology portfolio to advance global patient care and cancer research. The expansion focuses on leveraging innovative scientific, diagnostic, and laboratory capabilities. By investing in cutting-edge technologies, Labcorp aims to support pharmaceutical, biotechnology, and clinical research. This initiative is expected to improve cancer therapies and patient outcomes worldwide.

- March 2024: Veeda Clinical Research Limited acquired Heads, a European CRO specializing in oncology clinical trials. This strategic move strengthens Veeda’s global presence in oncology-focused research. The acquisition aims to expand Veeda’s services and enhance its capacity to conduct complex oncology studies. It reinforces Veeda’s commitment to providing full-spectrum clinical research solutions.

- January 2024: The National Center for Advancing Translational Sciences (NCATS) collaborated with NIH institutes to create a comprehensive preclinical research toolbox. It includes diverse resources such as the Assay Guidance Manual, PubChem, and BioPlanet. These tools aim to streamline drug discovery and translational research. The initiative seeks to bridge gaps in preclinical studies and support innovative therapeutic development.

Preclinical CRO Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Bioanalysis and DMPK Studies, Toxicology Testing, Others |

| End Uses Covered | Biopharmaceutical Companies, Government and Academic Institutes, Medical Device Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Charles River Laboratories Inc., Covance Inc. (Laboratory Corporation of America Holdings), Eurofins Scientific, ICON Plc, MD Biosciences Inc. (MLM Medical Labs), Medpace, Parexel International Corporation, PPD Inc., Wuxi AppTec, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the preclinical CRO market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global preclinical CRO market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the preclinical CRO industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Preclinical Contract Research Organizations (CROs) provide outsourced services to pharmaceutical and biotechnology companies, focusing on preclinical testing and research to ensure the safety and efficacy of new drugs before clinical trials begin. They streamline development processes, improve regulatory compliance, and reduce operational costs for their clients.

The preclinical CRO market was valued at USD 6.4 Billion in 2024.

IMARC estimates the global preclinical CRO market to exhibit a CAGR of 6.5% during 2025-2033.

Key factors driving the preclinical CRO market include rising research and development (R&D) expenditure, regulatory complexities, outsourcing trends among companies, and advancements in specialized treatments for chronic and rare diseases.

In 2024, toxicology testing represented the largest segment by service, driven by the growing need for safety testing and regulatory compliance.

Biopharmaceutical companies lead the market by end use, owing to their increasing focus on outsourcing to accelerate drug development and reduce costs.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global preclinical CRO market include Charles River Laboratories Inc., Covance Inc. (Laboratory Corporation of America Holdings), Eurofins Scientific, ICON Plc, MD Biosciences Inc. (MLM Medical Labs), Medpace, Parexel International Corporation, PPD Inc., Wuxi AppTec, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)