Pulses Market Report by Type (Chick Peas, Kaspa Peas, Lentils, Pigeon Peas, Fava Beans, Black Gram, Mung Beans, and Others), End Use (Home Use, Snack Food Industry, Flour Industry), and Region 2026-2034

Market Overview:

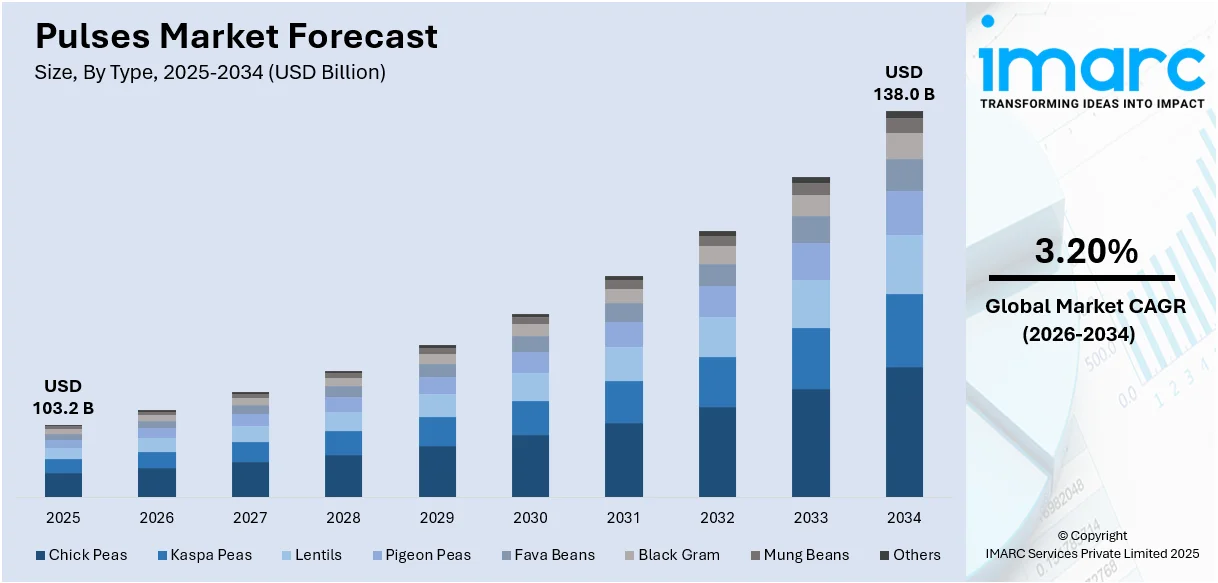

The global pulses market size reached USD 103.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 138.0 Billion by 2034, exhibiting a growth rate (CAGR) of 3.20% during 2026-2034. The increasing awareness of the health and nutritional benefits of pulses, global population growth, supply chain improvements, advancements in agricultural activities, dietary shifts and the culinary versatility of pulses are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 103.2 Billion |

| Market Forecast in 2034 | USD 138.0 Billion |

| Market Growth Rate 2026-2034 | 3.20% |

Pulses, including lentils, chickpeas, and dry peas, are the edible seeds of legume plants. They are a significant source of plant-based protein, fiber, and essential nutrients like iron, zinc, and B-vitamins. Characterized by their low-fat content and lack of cholesterol, pulses are beneficial for heart health and can aid in regulating blood sugar levels. Their high fiber content contributes to a feeling of fullness, which can be advantageous in weight management. Additionally, pulses are environmentally sustainable, requiring less water and fertilizer compared to other protein sources. They are also capable of fixing nitrogen in the soil, thereby improving soil health.

To get more information on this market Request Sample

The pulses market demand is driven by the increasing awareness about health benefits and nutritional value, with advancements such as bio-fortification and precision agriculture. Moreover, the growing demand for plant-based proteins and the scarcity of sustainable, nutrient-rich food sources are fueling the market demand for pulses. In line with this, these pulses are instrumental in enhancing dietary diversity and fulfilling essential nutrient requirements, aligning with rising consumer expectations for wholesome plant-based options. Furthermore, the expansion of e-commerce platforms and initiatives to reduce food waste are contributing to market growth. Other factors such as changing dietary patterns, the inclination towards convenient, ready-to-cook options, and an acute focus on organic and non-GMO products are bolstering the growth of the pulses across the globe.

Pulses Market Trends/Drivers:

Increasing Health Consciousness

The growing awareness of health and wellness is a key factor propelling the pulses market growth for in the country. Rich in protein, fiber, and essential nutrients, pulses are becoming the go-to choice for consumers seeking to improve their dietary habits. As rates of lifestyle diseases continue to rise, individuals are turning to pulses as a nutritious and affordable means to achieve their health goals. This growing focus on wellness makes pulses an essential element of national strategies aimed at reducing healthcare burdens and enhancing citizens' quality of life.

Governmental Support and Programs

Government initiatives aimed at encouraging sustainable agriculture and healthy eating are contributing to the pulse market's expansion. Programs that offer farmers incentives for pulse cultivation, alongside public awareness campaigns on the nutritional benefits of pulses, are leading to increased adoption of these crops. Such governmental actions not only modernize the agricultural sector but also align with international efforts aimed at promoting food security and sustainable farming practices.

Rapid Socioeconomic Changes

The country's swift economic growth and urban development are creating new opportunities for pulse-based products. As urban areas expand and lifestyles change, there is increasing demand for convenient and healthy food options. Pulses are finding their way into a range of food products, from ready-to-eat meals to fortified foods, serving both traditional and emerging consumer preferences. Their versatile nature makes them apt for diverse culinary applications, thereby matching the nation's development objectives. In addition, pulses are seen as a sustainable choice in urban planning, from community gardens to large-scale farming, aligning with the goal of building resilient and sustainable cities capable of supporting a growing population.

Pulses Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pulses market report, along with forecasts at the global and country levels for 2026-2034. Our report has categorized the market based on type and end use.

Breakup by Type:

- Chick Peas

- Kaspa Peas

- Lentils

- Pigeon Peas

- Fava Beans

- Black Gram

- Mung Beans

- Others

Kaspa peas dominate the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes chick peas, kaspa peas, lentils, pigeon peas, fava beans, black gram, mung beans and others. According to the report, kaspa peas represented the largest segment.

Kaspa peas, also known as Kaspa beans or Lablab beans, are indeed a type of pulses that holds significance in the market. Pulses are a subgroup of legumes, and Kaspa peas are no exception. They are popular in various cuisines and are valued for their nutritional content, which includes protein, fiber, vitamins, and minerals. These yellow peas are commonly used for their creamy texture in a range of dishes, from classic pea soup to innovative plant-based protein products. They are also gaining popularity in specialized applications like gluten-free baking, where their flour form serves as an excellent alternative to traditional wheat flour. Kaspa peas offer a rich source of nutrients for specific dietary needs, such as in high-protein, low-fat meals and snacks. Innovative food tech solutions, including the development of pea-based protein powders and meat alternatives, are allowing consumers to incorporate Kaspa peas into their diets more conveniently. These, pulses market trends not only provide diverse and nutritious options for consumption but also align with broader goals of sustainable and healthy living. These multiple roles solidify Kaspa peas as an essential component in modern culinary practices, reflecting market research companies' insights into evolving food trends and applications.

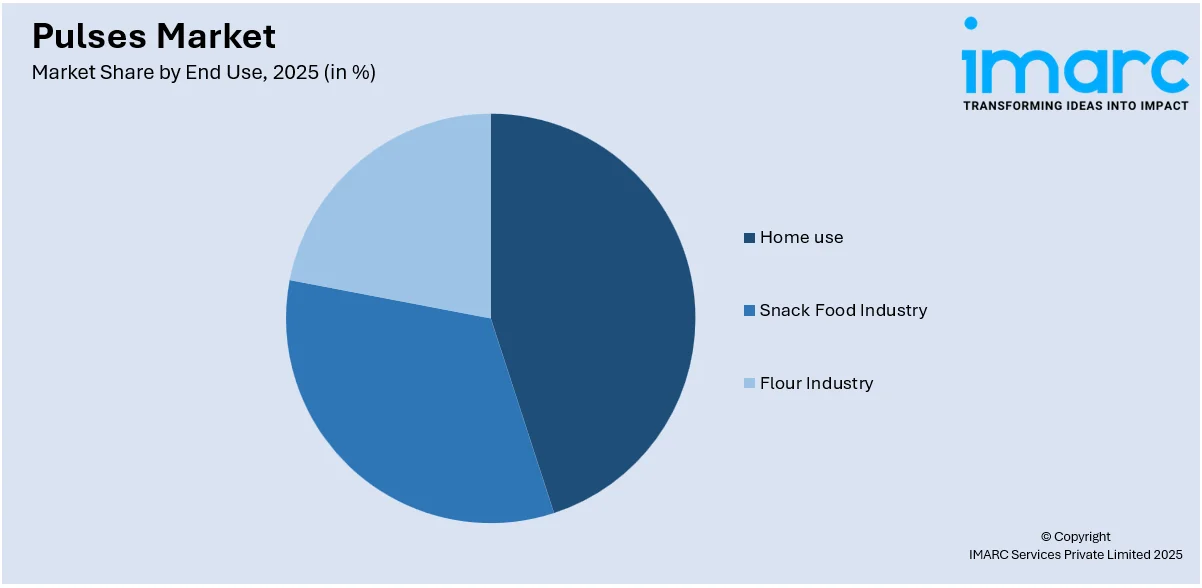

Breakup by End Use:

Access the comprehensive market breakdown Request Sample

- Home use

- Snack Food Industry

- Flour Industry

Home use holds the largest share in the market

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes home use, snack food industry and flour industry. According to the report, home use accounted for the largest market share.

Home use as an end-use segment for the pulses market is a significant and vital component of the overall pulse consumption landscape. Pulses, which include various legumes like lentils, chickpeas, and beans, have been a staple in diets across the globe for centuries. Home consumption of pulses serves as a fundamental source of nutrition and sustenance for countless households. Pulses are renowned for their high protein content, making them an essential dietary component, especially for vegetarians and vegans. They are also rich in fiber, vitamins, and minerals, contributing to a balanced and nutritious diet. Many cultures have deep-rooted traditions of incorporating pulses into their culinary heritage. This tradition has been passed down through generations, highlighting the cultural significance of pulses in home cooking.

Breakup by Country:

- India

- Canada

- Myanmar

- China

- Brazil

- Others

India holds the largest share in the market

A detailed breakup and analysis of the market based on the country has also been provided in the report. This includes India, Canada, Myanmar, China, Brazil, and others. According to the report, India accounted for the largest market share.

The increasing emphasis on nutritious and plant-based diets in India is acting as a significant driver for the pulses market share. Concurrently, advancements in agricultural techniques are leading to higher yield varieties of pulses, thereby boosting their market availability. Additionally, the expanding middle class in the country is showing a growing preference for diverse, protein-rich foods like pulses. Online grocery platforms are also playing a role, making a wide variety of pulses more accessible to the general populace, thus positively impacting market dynamics. The rising focus on sustainable farming practices is drawing attention to pulses as they are known to enrich soil with essential nutrients, aligning with the government's sustainability objectives and enhancing the market landscape. Events such as food and agriculture expos, as well as online webinars on nutrition and sustainability, are cumulatively contributing to a vibrant growth outlook for the pulses market in India.

Competitive Landscape:

In the global pulses market size, leading firms are actively employing a range of strategies to assert their market dominance and address the changing needs of consumers. These companies are heavily investing in research and development to cultivate new pulse varieties that offer enhanced nutritional profiles, shorter growing cycles, and better resistance to diseases. Collaborations with local farmers and agricultural bodies are being forged to guarantee a wide-reaching supply chain that spans multiple geographies. Additionally, comprehensive marketing efforts are underway to enlighten both consumers and industries about the health advantages and sustainability of incorporating pulses into diets and products. Some of these market leaders are even committing resources to establish or upgrade processing facilities, thus boosting local economies and providing employment opportunities. Partnerships with governmental agencies and endorsements from health organizations are solidifying their stand on adhering to quality standards and sustainable farming practices. These key players are also embracing technological advancements like blockchain for transparent sourcing and artificial intelligence for predictive yield analysis. Through a judicious mix of innovation, consumer education, strategic alliances, and sustainability initiatives, these firms are fortifying their standing in the global pulses market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AGT Food and Ingredients Inc.

- Archer Daniels Midland Company

- BroadGrain Commodities Inc.

- ETC Group

- Louis Dreyfus Company

- Tata Consumer Products Limited

Recent Developments:

- On August 21, 2023, shares of Adani Power saw a 5% rise, reaching a peak of Rs 321.90 on the NSE during Monday's market activity. This upward movement extended the stock's gains for a second consecutive session, after the company sold an 8.1% stake to the American investment firm GQG and other participating investors, in a transaction valued at $1.1 billion.

- On September 13, 2023, AGT Food and Ingredients Inc. announced that they have entered into a pact to expedite the growth, verification, and market introduction of mutually branded functional ingredients, derived from Equinom's ultra-high protein yellow pea strains.

- On July 14, 2023, the Louis Dreyfus Company announced plans to enlarge its refining facility located in Lampung, Indonesia. This initiative is in line with the company's broader strategic objectives to venture further into downstream markets and augment income streams through specialized, value-added products.

Pulses Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Chick Peas, Kaspa Peas, Lentils, Pigeon Peas, Fava Beans, Black Gram, Mung Beans, Others |

| End Uses Covered | Home Use, Snack Food Industry, Flour Industry |

| Countries Covered | Canada, Myanmar, China, Brazil, India, Others |

| Companies Covered | AGT Food and Ingredients Inc., Archer Daniels Midland Company, BroadGrain Commodities Inc., ETC Group, Louis Dreyfus Company, Tata Consumer Products Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the global pulses market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pulses market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pulses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global pulses market reached a value of USD 103.2 Billion in 2025.

We expect the global pulses market to grow at a CAGR of 3.20% during 2026-2034.

The growing awareness towards numerous health benefits associated with pulses, along with the increasing usage of pulses in the ready-to-eat food products are some of the key factors catalyzing the global pulses market.

Sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of pulses and pulses-related products.

Based on the type, the global pulses market has been bifurcated into chick peas, kaspa peas, lentils, pigeon peas, fava beans, black gram, mung beans, and others. Currently, kaspa peas exhibit a clear dominance in the market.

Based on the end-use, the global pulses market can be divided into home use, snack food industry, flour industry and others. Among these, the home use sector currently represents the largest segment.

On a regional level, the market has been classified into India, Canada, Myanmar, China, Brazil, and others, where India currently dominates the global market.

India is the largest producer of pulses globally, holding the highest market share due to diverse agro-climatic zones and strong domestic demand. Major pulses include chickpeas, lentils, and pigeon peas. Government support through MSP and schemes like NFSM continues to boost production, ensuring India’s leading position in the global pulses market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)