Pressure Sensor Market Size, Share, Trends and Forecast by Product, Type, Technology, Application, and Region, 2026-2034

Pressure Sensor Market Size and Share:

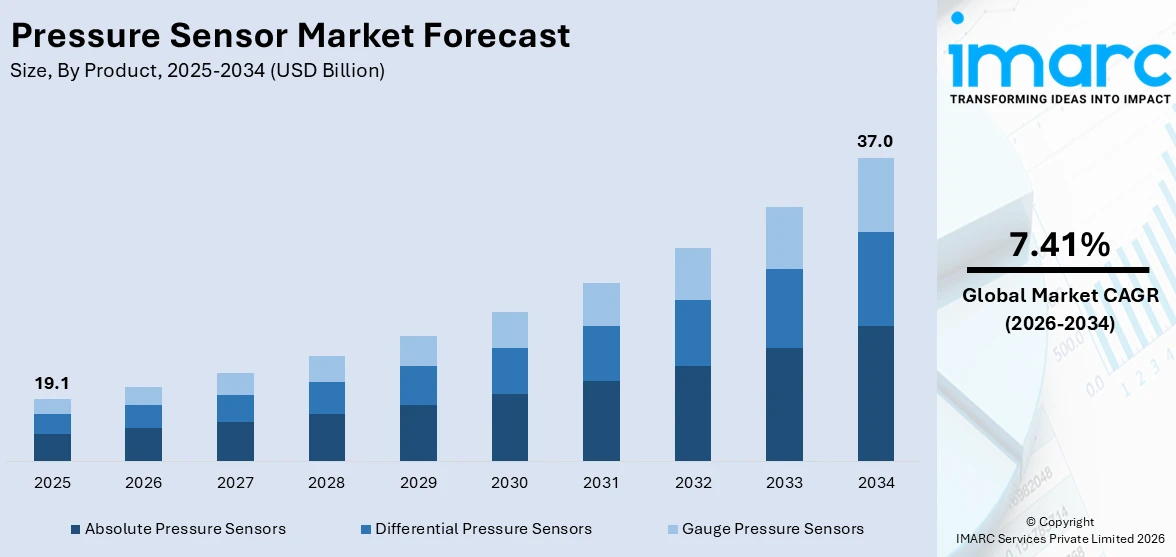

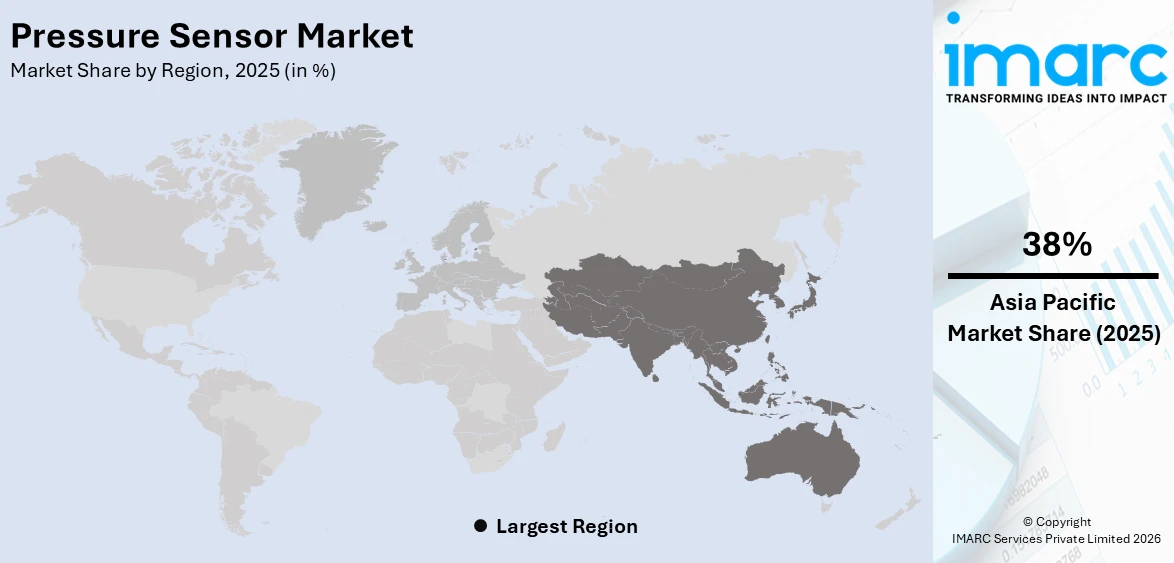

The global pressure sensor market size was valued at USD 19.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 37.0 Billion by 2034, exhibiting a CAGR of 7.41% during 2026-2034. Asia-Pacific currently dominates the market with the market share of 38% in 2025. The market is driven by rapid industrialization, increasing demand for automotive safety systems, the growing adoption of Internet of Things (IoT)-enabled devices, and rising need for accurate pressure monitoring across industrial applications. The growing emphasis on predictive maintenance, environmental monitoring, and process optimization across various industries is further contributing to the pressure sensor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 19.1 Billion |

|

Market Forecast in 2034

|

USD 37.0 Billion |

| Market Growth Rate 2026-2034 | 7.41% |

The rising usage of automation in manufacturing and industrial operations is driving the need for pressure sensors. These tools guarantee accurate oversight, security, and effectiveness in robotics, hydraulics, and automated equipment. With the transition of industries to smart factories and predictive maintenance, pressure sensors are crucial for enhancing performance and minimizing downtime. Furthermore, the growing use of pressure sensors for optimizing engines, controlling emissions, enhancing fuel efficiency, and ensuring overall vehicle safety, is propelling the market growth. Besides this, the healthcare sector is progressively utilizing pressure sensors for essential purposes like patient observation, respiratory instruments, and diagnostic devices. Their exceptional precision and dependability render them essential in medical technology.

To get more information on this market Request Sample

In the United States, the market is driven by the incorporation of pressure sensors in consumer electronics. These sensors are commonly utilized in smartphones, devices, and smart home setups to improve automation and features. Moreover, the growing use of automation in various sectors is driving the need for pressure sensors, which are essential for maintaining precision, safety, and effectiveness in robotics, hydraulics, and manufacturing operations. As industries shift toward smart factories and predictive maintenance, real-time tracking via these sensors is critical. This growing reliance on automation highlights market opportunities, supported by projections such as the US logistics automation market, which is expected to reach USD 38.2 Billion by 2033, reflecting accelerating adoption.

Global Pressure Sensor Market Trends:

Rising Demand for Durable and Intelligent Industrial Solutions

With the expansion of industries through automation and the adoption of intelligent technologies, there is an increase in the demand for pressure sensors that integrate flexibility, connectivity, and a strong design. Sophisticated attributes like built-in digital communication interfaces, enduring reliability in challenging operating environments, and extensive pressure range compatibility are emerging as essential demands. These advancements allow for smooth integration with contemporary industrial systems, guaranteeing improved monitoring, safety, and performance enhancement. The emphasis on developing adaptable solutions that address various operational challenges indicates a transition toward more intelligent, resilient technologies, enhancing the importance of pressure sensors as essential elements in industrial and automation uses. Collectively, these factors are expected to shape pressure sensor market trends, highlighting sustained innovation, expanded adoption, and long-term growth across global industrial sectors. In 2025, Parker Hannifin launched the SCPSDI pressure switch, designed for permanent industrial use with exceptional flexibility, durability, and connectivity. It features rotatable housing, stainless steel components, a seal-free design, and integrated I/O-Link for smart automation. The SCPSDI supports pressure ranges from 4 to 600 bar, making it suitable for harsh environments and diverse applications.

Expansion of Building Automation and Energy Management

Contemporary infrastructures require highly precise, dependable, and prompt sensors to enhance heating, ventilation, air conditioning (HVAC), and general energy efficiency. Pressure sensors are essential for tracking environmental conditions, providing occupant comfort, and sustaining system efficiency. Their connection with smart building systems promotes real-time data evaluation, anticipatory upkeep, and adherence to regulations, facilitating sustainable functioning and expense reduction. Increasing focus on energy efficiency, environmental regulations, and smart building management is further contributing to the market demand. With the increasing integration of advanced automation technologies in commercial and residential buildings, pressure sensors are becoming vital for ensuring efficiency, operational reliability, and improved control. In 2025, Accuenergy launched a new BAS sensor line including the AcuPRE differential pressure, AcuHUM humidity & temperature, and AcuTEMS temperature sensors. These sensors offer high accuracy, fast response, and long-term stability for modern building automation systems. The launch aims to enhance HVAC efficiency, comfort, and regulatory compliance.

Increasing Demand for Advanced Energy Storage Solutions

With industries prioritizing the creation of high-performance, safe, and long-lasting batteries for uses like EVs, renewable energy, and portable electronics, precise pressure measurement among battery parts is essential. Sophisticated sensors deliver immediate data that guarantees even pressure distribution, boosts safety, and increases the overall efficiency and longevity of energy storage systems. The move towards high-density and compact battery configurations highlights the need for flexible, ultra-thin, and dependable pressure sensors that can effortlessly fit into intricate assemblies. As energy storage solutions gain traction across various industries, pressure sensors are becoming vital instruments for innovation, quality assurance, and performance enhancement, offering a favorable pressure sensor market outlook. In 2024, Tekscan launched the Model 7800 pressure mapping sensor, specifically designed for battery R&D and manufacturing. It enabled precise pressure measurements between battery cells and modules, improving design, safety, and performance. The ultra-thin, flexible sensor was also compatible with Tekscan’s I-Scan System.

Global Pressure Sensor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pressure sensor market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, type, technology, application, and end user.

Analysis by Product:

- Absolute Pressure Sensors

- Differential Pressure Sensors

- Gauge Pressure Sensors

Absolute pressure sensors represent the largest segment, holding a market share 45%, because they provide highly accurate and stable readings based on a perfect vacuum reference. This distinctive ability guarantees accurate observation of pressure fluctuations in numerous settings, making them essential for uses that demand stability and dependability. Their performance stays immune to changes in atmospheric pressure, improving precision and reducing mistakes in essential systems. The strong design and flexibility of absolute pressure sensors allow them to operate efficiently across various temperature and environmental settings, guaranteeing lasting durability and reliable performance. Moreover, their adaptability in meeting various industry needs makes them an ideal option for applications where accuracy and reliability are crucial. As advanced technologies and efficient system performance gain importance, absolute pressure sensors maintain a significant market share due to their demonstrated reliability, precision, and capability to fulfill stringent measurement standards across various sectors.

Analysis by Type:

- Wired

- Wireless

Wired dominates the market holding 82%, because of its established dependability, steady performance, and capacity to provide reliable results across various operating conditions. Wired connection has reduced vulnerability to interference, providing reliable data transmission, essential for applications requiring high accuracy and constant monitoring. The strong characteristics of wired system enables it to operate efficiently in settings where wireless connections might encounter difficulties like signal interference or energy constraints. Moreover, wired pressure sensor generally provides reduced latency and increased data transfer speeds, which are crucial for real-time monitoring and control applications. Its robustness and compatibility with current industrial frameworks enhance its market position, as it blends effortlessly into existing systems. As per the pressure sensor market forecast, the affordability of wired solution, along with its extended operational life and low maintenance needs, will continue to make it a favored option across various industries.

Analysis by Technology:

- Piezoresistive

- Electromagnetic

- Capacitive

- Resonant Solid-State

- Optical

- Others

Piezoresistive holds the biggest market share with 27%, owing to its remarkable sensitivity, extensive measurement ranges, and excellent thermal stability, making it ideal for intricate industrial and automotive uses. This technology functions by utilizing silicon-based sensors that change their electrical resistance under mechanical stress, enabling accurate and dependable pressure readings. Its strong performance over a wide spectrum of temperatures and severe environmental situations increases its attractiveness for vital uses that demand reliability and precision. The capacity of piezoresistive sensor to provide reliable and repeatable outcomes facilitates its incorporation into sophisticated systems that require high performance criteria. Moreover, the scalability of silicon-based manufacturing methods enables cost efficiency and mass production, making piezoresistive technology available for both extensive industrial applications and smaller user needs. As industries place greater emphasis on accuracy, efficiency, and dependability, the demand for piezoresistive technology is increasing.

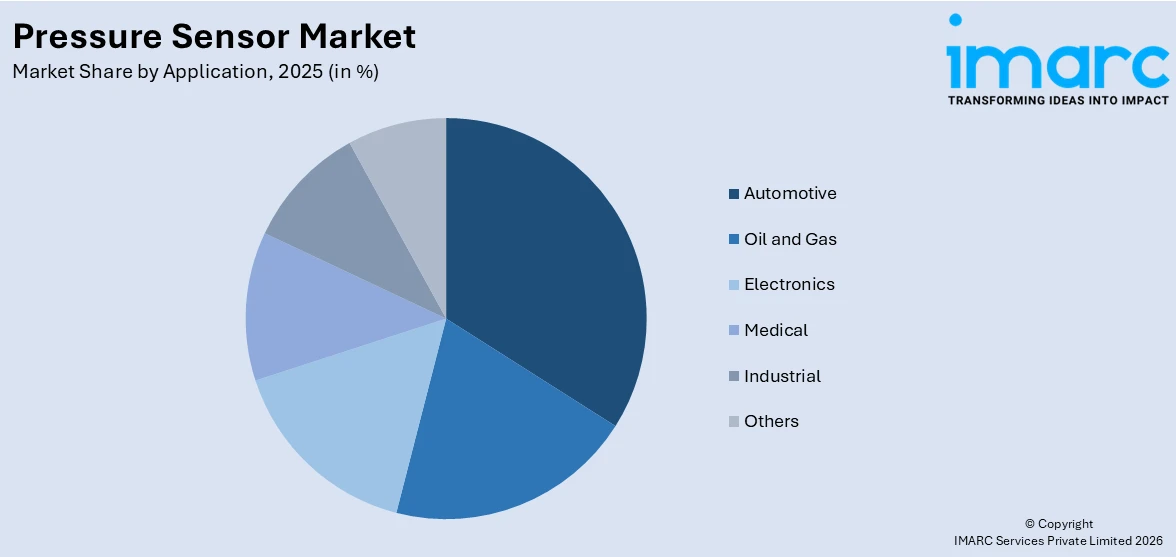

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Automotive

- Oil and Gas

- Electronics

- Medical

- Industrial

- Others

Automotive represents the largest segment, accounting for 30% market share, owing to the industry's growing dependence on cutting-edge technologies to improve safety, efficiency, and performance. The industry is constantly advancing with developments in engine management, emission control, and vehicle monitoring systems, all of which demand accurate and dependable pressure measurement. The increasing need for smart and connected vehicles is further increasing the incorporation of sensors for real-time data analysis and enhanced decision-making. Moreover, the growing emphasis on fuel efficiency, environmental regulations, and compliance standards is making pressure sensors into a crucial part of contemporary automobiles. Their capacity to enhance system efficiency, guarantee operational safety, and bolster overall vehicle dependability supports their extensive utilization. With the automotive industry moving towards enhanced digitalization and technological complexity, the significance of pressure sensors is rising, establishing this as the leading segment in the market.

Analysis by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific leads the market in 2025 with a share of 38%, because of its robust manufacturing environment, quick technology adoption, and the growing use in the industrial sector. The area benefits from considerable investments in cutting-edge technologies, along with a substantial workforce of skilled professionals and affordable production abilities that facilitate mass sensor manufacturing. Fast urban growth and digital advancements in economies are increasing the need for contemporary sensing solutions in areas like healthcare, electronics, automotive, and industrial automation. For example, in 2024, MICROSENSOR's MDM7000 Smart Pressure Transmitters were certified by the Korean Register (KR), a major global authority in marine and shipbuilding standards. This certification recognized MICROSENSOR's world-class quality and technical capabilities. It supported the company's strategic expansion into international maritime markets. Furthermore, regional governments are prioritizing innovation, infrastructure enhancement, and the integration of smart technology, fostering an environment conducive to market expansion. The growing emphasis on sustainability, energy efficiency, and interconnected systems is encouraging the adoption, as sectors search for dependable, precise, and effective solutions.

Key Regional Takeaways:

United States Pressure Sensor Market Analysis

The market in the United States, holding a share of 71.30%, is mainly propelled by robust demand from various sectors, such as automotive, healthcare, consumer electronics, aerospace, and industrial manufacturing. In the automotive industry, the rising use of electric and self-driving vehicles is leading to a higher demand for sophisticated pressure sensors for uses like tire pressure monitoring, engine control, and battery systems. As per an August 2024 report from the Smart Electric Power Alliance (SEPA), the number of electric vehicles (EVs) in the US is projected to hit 26.4 million by 2030, representing 10% of all vehicles in operation. Moreover, the growth of remote patient monitoring and wearable medical devices in healthcare is driving the demand for small, highly precise pressure sensors. The consumer electronics sector is also aiding market growth, as these sensors are being more frequently incorporated into smartphones, tablets, and smartwatches to improve functionality and user experience. Additionally, industrial automation and intelligent manufacturing are increasing demand, as pressure sensors are essential for process control, safety, and efficiency. Apart from this, the rising focus on energy efficiency and regulatory standards in the United States is encouraging industries to adopt accurate monitoring systems, where these sensors play vital roles.

North America Pressure Sensor Market Analysis

The North America market is propelled by a combination of technological improvements, the growing use of industrial automation, and the rising demand for smart devices. The area's significant emphasis on innovation and digital transformation throughout sectors is driving the need for high-precision sensing solutions that enhance efficiency and safety. The growth of the market is also being driven by expanding applications in industries like automotive, healthcare, oil and gas, and consumer electronics. The increasing focus on energy efficiency, predictive maintenance, and interconnected infrastructure is promoting the incorporation of sophisticated sensors into multiple systems. Moreover, encouraging regulatory structures that enhance safety standards and environmental adherence are accelerating implementation. The area's strong investment environment, solid manufacturing foundation, and swift adoption of next-generation technologies like IoT and wireless connectivity are bolstering the market growth. In 2024, Future Electronics, an electronic components company based in Canada, announced the release of Melexis Triphibian™ MEMS pressure sensor technology, designed for high robustness in harsh environments. The sensor featured a patented cantilever structure that equalizes pressure spikes, allowing it to function reliably in liquid and frozen media. This innovation marked a significant advancement for automotive and adjacent markets.

Europe Pressure Sensor Market Analysis

The growth of the market in Europe is primarily driven by rising industrial automation, rigorous environmental regulations, and the increasing use of smart technologies in various sectors. In automotive production, pressure sensors are greatly sought after for uses like emission regulation, fuel oversight, and advanced driver-assistance technologies, corresponding with the growing emphasis in Europe on cleaner, more efficient vehicles. Additionally, the area's significant focus on renewable energy sources, such as wind and solar, is driving the demand for accurate pressure monitoring systems to maintain operational efficiency and safety. For example, in 2024, new wind energy installations in Europe totaled 16.4 GW, bringing the overall wind power capacity in the region to 285 GW. Between 2025 and 2030, Europe is projected to increase its wind power capacity by 187 GW, reaching a total of 450 GW by 2030. Moreover, Europe's prominence in environmental sustainability is motivating industries to implement pressure-sensing technologies for real-time tracking of emissions and resource usage. The growing connection of pressure sensors with IoT systems and cloud analytics is also improving predictive maintenance and operational efficiency in manufacturing and transportation industries. Apart from this, the region's established research institutions and engineering knowledge foster ongoing innovation and advancement of high-performance, compact pressure sensors tailored for various and changing market demands.

Asia Pacific Pressure Sensor Market Analysis

The market in the Asia Pacific region is growing due to swift industrialization, urban development, and a rising adoption of smart technologies in major industries like automotive, electronics, healthcare, and manufacturing. The growing automotive sector in the region, especially in nations like China, Japan, and India, is driving the need for pressure sensors in engine systems, tire pressure monitoring, and safety uses. For example, total automobile output for passenger cars, three-wheelers, two-wheelers, and quadricycles in India hit 24,76,915 units in March 2025, according to the India Brand Equity Foundation (IBEF). Moreover, in consumer electronics, the prevalent utilization of smartphones, wearables, and smart devices is significantly enhancing the incorporation of small and efficient pressure sensors. The increasing emphasis on automation in production and the emergence of Industry 4.0 are also catalyzing the demand for systems that allow real-time monitoring and control. Additionally, the existence of leading electronics manufacturers and a robust supply chain network positions the region as a global center for sensor manufacturing and innovation.

Latin America Pressure Sensor Market Analysis

The market in Latin America is witnessing growth driven by rising demand for industrial automation, increased automotive manufacturing, and heightened emphasis on energy efficiency. As manufacturing industries upgrade in countries like Brazil and Mexico, pressure sensors are increasingly utilized for process regulation, safety, and equipment supervision. The automotive sector is incorporating these sensors into fuel systems, emission regulations, and tire pressure monitoring to adhere to both regulatory and performance criteria. Moreover, the growth of 5G networks and the IoT is further driving the demand, as pressure sensors are crucial for real-time data acquisition in interconnected devices and systems. According to recent industry reports, 5G network connections in Latin America reached 67 million in Q3 2024, showing a growth rate of 19%.

Middle East and Africa Pressure Sensor Market Analysis

The pressure sensor market growth in the Middle East and Africa is significantly influenced by the rising industrial development, increased focus on automation, and the expanding oil and gas sector. Pressure sensors are essential in monitoring and controlling processes in energy production, making them critical in this resource-rich region. The rise of smart city projects and infrastructure modernization, particularly in Gulf countries, is also boosting the demand in water management, HVAC systems, and public utilities. According to a report published by the IMARC Group, the smart cities market in the Middle East reached a value of USD 62,965.8 Million in 2024 and is forecasted to grow at a CAGR of 21.89% during 2025-2033. Apart from this, improved connectivity and digitalization are also supporting broader integration of sensor technologies.

Competitive Landscape:

Main participants in the market are concentrating on creating sophisticated, high-performance sensors that cater to the increasing demand in automotive, medical, industrial, and consumer electronics industries. They are making substantial investments in research activities to improve precision, resilience, and compatibility with new technologies like IoT and automation. Numerous firms are broadening their product ranges with compact and wireless sensor solutions to meet changing applications, while also focusing on cost-effectiveness and energy efficiency. For example, in 2025, Baumer launched its 50 Series of ultra-compact sensors, including the PP56H/PP56 pressure sensors with flush membrane and touchscreen. These sensors offer precise pressure measurement with active temperature compensation, ideal for hygienic and industrial applications. Besides this, strategic efforts comprise enhancing worldwide distribution systems, establishing partnerships with tech providers, and expanding production capacities to address the growing demand, securing competitiveness in a swiftly changing market.

The report provides a comprehensive analysis of the competitive landscape in the pressure sensor market with detailed profiles of all major companies, including:

- ABB Ltd

- All Sensors Corporation (Amphenol)

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- Endress+Hauser Group Services AG

- Honeywell International Inc.

- Infineon Technologies AG

- Kistler Group (Kistler Holding AG)

- NXP Semiconductors N.V.

- Rockwell Automation Inc.

- Sensata Technologies Inc.

- Siemens AG

- Texas Instruments Incorporated

Latest News and Developments:

- June 2025: Bosch officially launched the SMP290, a novel tire pressure sensor featuring Bluetooth capabilities. The standardized Bluetooth interface of the sensor allows for direct communication with smartphones, while its incredibly low energy usage guarantees a longer lifespan.

- June 2025: Crane Company announced plans for the acquisition of Precision Sensors & Instrumentation, a prominent manufacturer of sensor-based technologies, including pressure sensors. The acquisition is expected to strengthen Crane Company’s position in the pressure sensors sector across various crucial applications.

- May 2025: IFM officially launched its most recent high-resolution pressure sensors, which include the PI series made particularly for hygienic uses. These cutting-edge sensors provide accuracy and dependability in operations in sectors such as the manufacturing of food and beverages.

- April 2025: Trensor, a provider of pressure sensor technologies based in China, announced plans to establish its first overseas manufacturing plant in Malaysia in 2026. This marks a major milestone in Trensor’s international expansion objectives.

- April 2025: Kistler announced the launched of its new 4012A absolute pressure sensor for the measurement of hydrogen pressure. Created for usage in H2 settings, the novel sensor has a high resistance to hydrogen, as proven by robust testing.

Global Pressure Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Absolute Pressure Sensors, Differential Pressure Sensors, Gauge Pressure Sensors |

| Types Covered | Wired, Wireless |

| Technologies Covered | Piezoresistive, Electromagnetic, Capacitive, Resonant Solid-State, Optical, Others |

| Applications Covered | Automotive, Oil and Gas, Electronics, Medical, Industrial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, All Sensors Corporation (Amphenol), Bosch Sensortec GmbH (Robert Bosch GmbH), Endress+Hauser Group Services AG, Honeywell International Inc., Infineon Technologies AG, Kistler Group (Kistler Holding AG), NXP Semiconductors N.V, Rockwell Automation Inc., Sensata Technologies Inc., Siemens AG and Texas Instruments Incorporated |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pressure sensor market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pressure sensor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pressure sensor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pressure sensor market was valued at USD 19.1 Billion in 2025.

The pressure sensor market is projected to exhibit a CAGR of 7.41% during 2026-2034, reaching a value of USD 37.0 Billion by 2034.

The market is driven by rapid industrialization, increasing automotive safety requirements, the growing IoT adoption, expanding MEMS technology applications, and rising demand for precision monitoring across industrial processes. Technological advancements in wireless sensing capabilities and environmental monitoring regulations further contribute to the market growth across diverse application segments.

Asia-Pacific currently dominates the pressure sensor market with a market share of 38%. The dominance is driven by rapid industrialization, expanding automotive production, significant manufacturing investments, and growing adoption of advanced sensing technologies across China, Japan, India, and South Korea.

Some of the major players in the pressure sensor market include ABB Ltd, All Sensors Corporation (Amphenol), Bosch Sensortec GmbH (Robert Bosch GmbH), Endress+Hauser Group Services AG, Honeywell International Inc., Infineon Technologies AG, Kistler Group (Kistler Holding AG), NXP Semiconductors N.V., Rockwell Automation Inc., Sensata Technologies Inc., Siemens AG, and Texas Instruments Incorporated, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)