Pressure Ulcers Treatment Market Size, Share, Trends and Forecast by Ulcer Type, Product Type, End User, and Region, 2025-2033

Pressure Ulcers Treatment Market Size and Share:

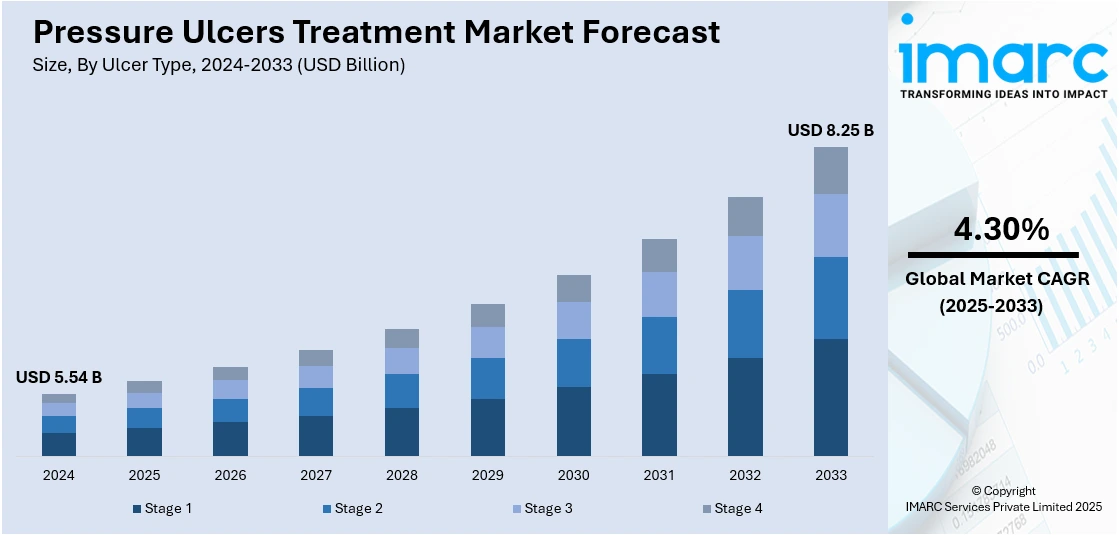

The global pressure ulcers treatment market size was valued at USD 5.54 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.25 Billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033. North America currently dominates the market, holding a market share of 40.0% in 2024. Advances in wound care treatments and products through technology are constantly improving pressure ulcer treatment effectiveness, thereby impelling the market growth. Moreover, the growing incidence of chronic conditions like diabetes, cardiovascular diseases, and obesity is positively influencing the market. Apart from this, the rise in the demand for homecare services is expanding the pressure ulcer treatment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.54 Billion |

| Market Forecast in 2033 | USD 8.25 Billion |

| Market Growth Rate (2025-2033) | 4.30% |

The market for pressure ulcers treatment is growing due to the heightened awareness about the significance of early intervention and proper management. Medical professionals are always seeking newer solutions to deal with the increasing prevalence of pressure ulcers, especially among the elderly and those with chronic diseases. The market is also growing due to innovations in medical technology, which are resulting in the creation of high-tech wound care products and treatments. These advances are enhancing patient outcomes and lowering the cost burden on healthcare systems. The incidence of chronic illnesses, including cardiovascular diseases and diabetes, is catalyzing the need for pressure ulcer treatments.

The United States market for pressure ulcer treatment is growing strongly with the presence of a range of factors influencing healthcare provision and treatment strategies. Healthcare practitioners are making efforts to enhance their methods of pressure ulcer management, emphasizing early identification and new treatment choices. Increasing recognition regarding the grave implications of untreated pressure ulcers is prompting patients and healthcare practitioners alike to seek effective and timely treatment. This increased recognition is driving the demand for more extensive wound care products, such as advanced dressings, antimicrobial treatments, and pressure relief devices. The IMARC Group predicts that the wound care market is expected to demonstrate a growth rate (CAGR) of 4.28% during 2025-2033.

Pressure Ulcers Treatment Market Trends:

Growing Incidence of Chronic Illnesses and Aging Population

The rising prevalence of chronic conditions like diabetes, cardiovascular diseases, and obesity is driving the need for pressure ulcers treatment demand. Since these illnesses always lead to poor blood circulation and reduced mobility, patients are more likely to acquire pressure ulcers. The older population is also a major factor, as older people are more vulnerable due to frailty and extended periods of immobility, typically in medical environments such as nursing homes or hospitals. Worldwide, life expectancy at birth hit 73.3 years in 2024, marking a rise of 8.4 years since 1995. There were around 830 million people aged 65 and older around the world in 2024, as per the UN data. Owing to this, healthcare systems are continually emphasizing preventative interventions, such as routine turning of patients, complex wound dressings, and pressure relief devices, to minimize the risks of pressure ulcers. In addition, healthcare professionals are stressing early identification and full treatment protocols to improve healing rates and minimize complications. This increasing stress on chronic disease management and care for the elderly is continuously expanding the pressure ulcers treatment market.

Escalating Demand for Homecare and Outpatient Services

The rise in the demand for homecare services is offering a favorable pressure ulcers treatment market outlook. Caregivers and patients alike are constantly looking for treatments that are more convenient and less expensive, resulting in pressure ulcers being increasingly treated at home instead of in a hospital or nursing home. Homecare products, such as advanced dressings, pressure-relieving equipment, and remote monitoring systems, are gaining traction. Healthcare professionals are revising treatment procedures to ensure patients can manage pressure ulcers in home environments, often through patient education and tailored care plans. This trend is driving the demand for homecare-based wound management products and services. Additionally, the heightened usage of telemedicine and digital health technologies is allowing healthcare practitioners to remotely monitor and fine-tune treatments, further supporting home-based treatment of pressure ulcers. This ongoing shift towards outpatient and homecare services is further broadening the market substantially. The IMARC Group predicts that the telemedicine market is projected to attain USD 539.95 Billion by 2033.

Technological Advancements in Wound Care

Advances in wound care treatments and products through technology are constantly improving pressure ulcer treatment effectiveness, thereby impelling the pressure ulcer treatment market growth. The creation of sophisticated wound dressings, including hydrocolloid, foam, and alginate dressings, is enhancing the rate of healing and infection prevention. Providers are increasingly implementing these advances to offer more efficient and less traumatic treatment methods. In addition, negative pressure wound therapy (NPWT) is picking up massive momentum since it stimulates healing by encouraging tissue growth and minimizing edema. The ongoing development of antimicrobial therapies, growth factors, and biological therapies is fueling the market growth by providing patients with improved alternatives to conventional therapies. These technologies are also assisting in decreasing the overall costs of healthcare by keeping patients short of hospitals and avoiding complications, thus increasing their uptake across healthcare settings, further driving the pressure ulcer treatment market growth. In 2025, Gruppo San Donato unveiled a unique wound care network for enhancing chronic wound treatment. The network will be organized around two HUB hospitals, Istituti Clinici Zucchi in Monza and IRCCS Ospedale San Raffaele, offering advanced assistance for the most complicated cases. The remaining hospitals in the Group will operate as Spoke Centers, providing extensive and prompt care throughout the area.

Pressure Ulcers Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pressure ulcers treatment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on ulcer type, product type, and end user.

Analysis by Ulcer Type:

- Stage 1

- Stage 2

- Stage 3

- Stage 4

Stage 4 stand as the largest component in 2024, holding 39.8% of the market. The increasing prevalence of Stage 4 pressure ulcers is becoming problematic within the healthcare environment, especially among immobile or chronically ill patients. Stage 4 pressure ulcers are the worst kind, involving full-thickness tissue loss, usually with exposed muscle, bone, or tendons. The advancement is also often the result of delayed treatment or suboptimal care since pressure ulcers can be exacerbated if not addressed early. The growing population of patients with diabetes, obesity, and neurological disorders is driving this trend because these disorders tend to compromise circulation, mobility, and general healing of wounds, thus predisposing patients to deeper ulcers. With the aging population growing, there is also an increased risk for Stage 4 pressure ulcers because elderly patients are especially susceptible to immobility for long periods and skin weakness. The incidence of immobility coupled with decreased sensation and poor diet directly contributes to the formation of such severe ulcers.

Analysis by Product Type:

- Wound-Care Dressings

- Wound-Care Devices

- Others

Wound-care dressings lead the market with 65.4% of market share in 2024. Wound-care dressings are formatted to develop a healing environment that is optimal through sustaining moisture balance around the wound area. This promotes accelerated healing, minimizes dehydration of tissues, and aids in cell regeneration. More advanced types of dressings, including hydrocolloids, foams, and alginates, are continually being formulated to trigger faster healing by giving the amount of moisture and temperature regulation that strengthens tissue repair. These dressings are especially useful in the context of chronic wounds, in which healing is otherwise slow and complex. One of the key roles of wound-care dressings is to serve as a barrier to external infectants, such as bacteria, dirt, and other pathogens. Dressings decrease infection risk by covering the wound and excluding direct contact with the environment, thus being a key point of concern in wound care. Most contemporary dressings include antimicrobial activity, like silver or iodine, which actually prevents dangerous microorganisms from multiplying and improves a more hygienic healing process. This prevention of infection is especially important for those who have chronic illnesses, like diabetes, who are at greater risk for wound infections.

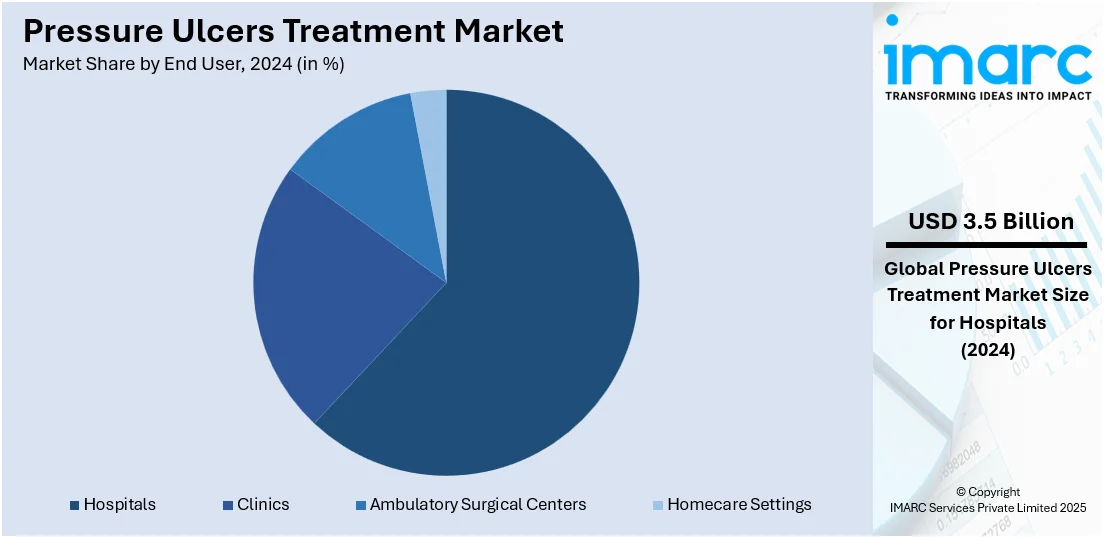

Analysis by End User:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Homecare Settings

Hospitals lead the market with 62.3% of market share in 2024. Hospitals are a significant end-user in the market, playing a crucial role in the management and care of patients suffering from severe wounds, including pressure ulcers. Within the hospital setting, patients who are bedridden, immobile, or suffering from chronic conditions such as diabetes, neurological disorders, or cardiovascular diseases are at an elevated risk of developing pressure ulcers. These patients often require advanced wound care, which includes the use of specialized dressings, pressure-relieving devices, and wound therapies. Hospitals are continuously adopting the latest medical technologies and treatment options to improve patient outcomes. The availability of skilled healthcare professionals and advanced medical equipment in hospitals allows for the early detection and aggressive management of pressure ulcers. Healthcare providers are also focusing on preventative measures, such as regular repositioning, the use of pressure-relieving mattresses, and monitoring devices, to reduce the occurrence of these ulcers among hospitalized patients.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%. The North America pressure ulcers treatment sector is experiencing steady growth, driven by rising healthcare awareness, an aging population, and the increasing prevalence of chronic conditions. Healthcare providers across the region are continuously focusing on early intervention and advanced treatment strategies to reduce the incidence and severity of pressure ulcers. Long-term care facilities, hospitals, and home healthcare providers are adopting innovative wound care solutions, which is catalyzing the demand for pressure ulcers treatment products and services. Chronic diseases such as diabetes, obesity, and vascular disorders are becoming more common in North America, leading to a higher risk of pressure ulcer development, especially among immobile and elderly patients. Healthcare systems are responding by investing in better patient management protocols, including regular risk assessments, patient repositioning techniques, and the use of pressure-relieving devices. These practices are forming the backbone of preventative strategies, which are being widely implemented to address the increasing pressure ulcer burden.

Key Regional Takeaways:

United States Pressure Ulcers Treatment Market Analysis

The United States holds 85.50% share in North America. The United States is witnessing increased pressure ulcers treatment adoption due to the growing obesity rates, which have significantly heightened the risk of immobility-related skin conditions. For instance, approximately 3 in 4 adults in the U.S. are regarded as overweight or have obesity, according to a 2024 study. As obesity often leads to limited physical movement, individuals are more prone to developing pressure ulcers, particularly in long-term care settings. Healthcare providers are focusing more on pressure ulcers treatment to reduce complications associated with obesity-induced skin breakdowns. Enhanced awareness among healthcare professionals, alongside better reimbursement policies, is also encouraging the implementation of pressure ulcers treatment solutions. Technological advancements in wound care and patient support systems are complementing the need for effective treatment modalities. The rise in bariatric patients is further pushing hospitals to improve treatment protocols, positioning pressure ulcers treatment as a critical component in managing obesity-related complications in the United States.

Asia Pacific Pressure Ulcers Treatment Market Analysis

Asia-Pacific is experiencing accelerated pressure ulcers treatment adoption driven by a growing number of ulcers cases across diverse patient demographics. For instance, in India, the occurrence of pressure ulcers in hospitalized patients has been reported to be 4.94% in a study conducted. The rising incidence is linked to aging populations, increased hospitalization, and prolonged bed rest among patients suffering from critical illnesses. These conditions elevate susceptibility to ulcers, prompting a surge in demand for preventive and therapeutic options. Healthcare systems are emphasizing training programs, early intervention techniques, and access to cost-effective treatment protocols. The region is also witnessing technological advancements in wound care, improving treatment efficacy and patient outcomes. Investments in medical infrastructure and policy support are enabling broader accessibility to ulcer care.

Europe Pressure Ulcers Treatment Market Analysis

Europe is seeing rising pressure ulcers treatment adoption due to growing chronic medical diseases that lead to extended periods of immobility among patients. A study of OECD nations, in February 2025, across the EU, has revealed that approximately eight in ten individuals aged 45 and above who consulted a primary care worker during the last six months have a minimum of one long-term condition. Conditions such as diabetes, vascular disorders, and neurological impairments significantly increase the risk of pressure ulcer development. As chronic diseases become more prevalent, hospitals and care facilities are implementing comprehensive ulcer management programs to mitigate complications. The region is actively integrating evidence-based therapies, including advanced dressings and negative pressure wound therapy, to support recovery. Collaborative healthcare policies and reimbursement frameworks are supporting access to effective treatments. Medical professionals are emphasizing routine screening and timely interventions to manage chronic disease-related ulcers.

Latin America Pressure Ulcers Treatment Market Analysis

Latin America is undergoing a steady expansion in hospitals and clinics, supporting pressure ulcers treatment adoption across healthcare facilities. For instance, in Brazil, the incidence of PUs has been estimated to range from 10.8% to 25.6%, being more common in ICU patients and less common among older individuals residing in long-term care facilities. Increased access to care and healthcare investments are encouraging early diagnosis and effective treatment of pressure ulcers. New hospitals are being equipped with specialized wound care units to manage pressure ulcers efficiently. Clinics are also integrating standard treatment protocols to reduce ulcer-related complications and hospital readmissions.

Middle East and Africa Pressure Ulcers Treatment Market Analysis

The Middle East and Africa are recording higher pressure ulcers treatment adoption due to the growing prevalence of ulcer diseases linked to aging populations and chronic health conditions. For instance, in Saudi Arabia, the proportion of the older population (60+) varied between 5.59% and 6.9% of the population from 2020 to 2022. The increasing burden of pressure ulcers is compelling healthcare providers to adopt improved wound care practices. Rising awareness and availability of treatment products are enhancing disease management capabilities. As ulcer diseases continue to escalate, hospitals and clinics are prioritizing preventive care and advanced therapies to manage pressure ulcers more effectively in the region.

Competitive Landscape:

Market players in the pressure ulcers treatment sector are actively engaging in product improvement, strategic collaborations, and geographical expansion to strengthen their market position. Leading companies are continuously developing advanced wound care solutions, including specialized dressings, negative pressure wound therapy devices, and antimicrobial treatments. They are also focusing on enhancing the effectiveness of existing products through research and development. Additionally, players are forming partnerships with healthcare providers and research institutions to improve clinical outcomes and expand product offerings. Many companies are also entering emerging markets, where the demand for advanced pressure ulcer treatments is growing, further diversifying their product portfolios and increasing global reach. As per the pressure ulcers treatment market forecast, these activities are expected to drive competition and accelerate market growth.

The report provides a comprehensive analysis of the competitive landscape in the pressure ulcers treatment market with detailed profiles of all major companies, including:

- 3M Company

- Arjo AB

- B. Braun Melsungen AG (B. Braun Holding GmbH & Co. KG)

- Cardinal Health Inc.

- Coloplast A/S

- Hill-Rom Holdings Inc. (Baxter International Inc.)

- Invacare Corporation

- Mölnlycke Health Care AB

- Smith & Nephew plc

- Span America (UTi Worldwide Inc.)

- Stiegelmeyer GmbH & Co. KG

- Stryker Corporation

Latest News and Developments:

- April 2025: Care of Sweden officially launched its operations in Spain, marking a significant step in its global expansion. Renowned for preventing and treating pressure ulcers, the company aims to enhance patient safety and healthcare quality in Spain by providing innovative, evidence-based solutions and fostering close collaborations with local healthcare professionals.

- March 2025: Open Wound Research and Venture Medical collaborated to advance pressure ulcer treatment by analyzing CAMPS products against standard care. They aim to assess CAMPS efficacy in hard-to-heal cases in order to improve healing outcomes and inform clinical practices in pressure ulcer treatment.

- January 2025: BioStem Technologies launched the BR-AM-DFU clinical trial to assess Vendaje in treating non-healing diabetic foot ulcers, comparing it with standard care across 12 U.S. sites. The study enrolled 60 participants and monitored wound closure and durability over 12 weeks with an added 4-week follow-up. It also addresses pressure ulcers treatment by leveraging BioREtain technology’s placental allografts to preserve tissue integrity.

- January 2025: Beiersdorf launched the brand’s first plaster with a wound dressing under the name Hansaplast. The brand also launched a novel plaster based on improved hydrocolloid technology.

Pressure Ulcers Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ulcer Types Covered | Stage 1, Stage 2, Stage 3, Stage 4 |

| Product Types Covered | Wound-Care Dressings, Wound-Care Devices, Others |

| End Users Covered | Hospitals, Clinics, Ambulatory Surgical Centers, Homecare Settings |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Arjo AB, B. Braun Melsungen AG (B. Braun Holding GmbH & Co. KG), Cardinal Health Inc., Coloplast A/S, Hill-Rom Holdings Inc. (Baxter International Inc.), Invacare Corporation, Mölnlycke Health Care AB, Smith & Nephew plc, Span America (UTi Worldwide Inc.), Stiegelmeyer GmbH & Co. KG and Stryker Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pressure ulcers treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pressure ulcers treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pressure ulcers treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pressure ulcers treatment market was valued at USD 5.54 Billion in 2024.

The pressure ulcers treatment market is projected to exhibit a CAGR of 4.30% during 2025-2033, reaching a value of USD 8.25 Billion by 2033.

Major drivers include the heightened frequency of chronic diseases like diabetes and cardiovascular conditions, technological advancements in wound care products, and growing demand for homecare services. The aging population and increased awareness regarding early intervention are further fuelling the market growth.

North America currently dominates the pressure ulcers treatment market, accounting for a share of 40.0%. This is driven by a high prevalence of chronic conditions and an aging population.

Some of the major players in the pressure ulcers treatment market include 3M Company, Arjo AB, B. Braun Melsungen AG (B. Braun Holding GmbH & Co. KG), Cardinal Health Inc., Coloplast A/S, Hill-Rom Holdings Inc. (Baxter International Inc.), Invacare Corporation, Mölnlycke Health Care AB, Smith & Nephew plc, Span America (UTi Worldwide Inc.), Stiegelmeyer GmbH & Co. KG, Stryker Corporation. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)