Private LTE Market Size, Share, Trends and Forecast by Component, Technology, Frequency Band, Deployment Model, Industry Vertical, and Region, 2025-2033

Private LTE Market Size and Share:

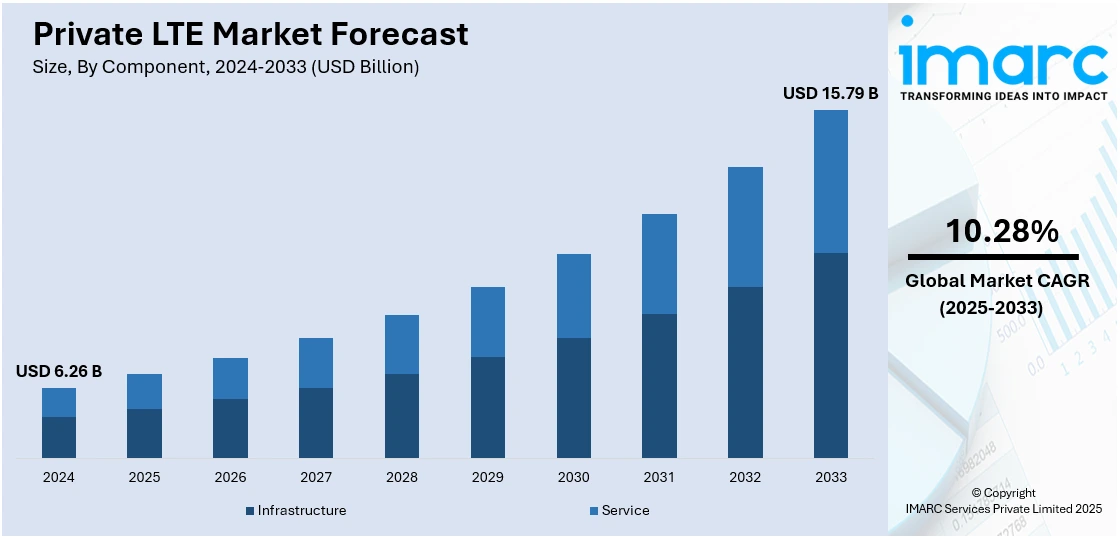

The global private LTE market size was valued at USD 6.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.79 Billion by 2033, exhibiting a CAGR of 10.28% during 2025-2033. North America dominated the market in 2024. Industries are increasingly deploying secure, low-latency networks to support automation, IoT, and critical operations, driven by performance, control, and reliability, contributing to the private LTE market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.26 Billion |

|

Market Forecast in 2033

|

USD 15.79 Billion |

| Market Growth Rate 2025-2033 | 10.28% |

The private LTE market is growing rapidly due to rising demand for secure, reliable, and high-performance wireless connectivity in sectors like manufacturing, energy, mining, and logistics. These networks offer enterprises more control over coverage, latency, and data security compared to public cellular networks. The growth of IoT, smart infrastructure, and Industry 4.0 initiatives has further increased the need for dedicated wireless networks capable of supporting real-time operations. Availability of shared and unlicensed spectrum, such as CBRS in the U.S., is lowering entry barriers and encouraging deployments. Improvements in LTE infrastructure and integration with edge computing are also enhancing network efficiency. Enterprises are choosing private LTE to manage mission-critical applications, ensure continuous operations, and support a wide range of connected devices under secure and customizable network environments. These combined factors are actively driving private LTE market growth.

To get more information on this market, Request Sample

In the United States, rising cyber threats and regional connectivity demands are prompting utility operators to strengthen private LTE network security. Deployments now focus on advanced identity management, real-time threat detection, and improved visibility to ensure resilient, mission-critical communications in infrastructure-intensive regions, where reliable and secure wireless systems are essential. For instance, in April 2025, Southern Linc enhanced the management and security of its private LTE network by deploying OneLayer’s Bridge platform, addressing a 70% surge in cyber attacks on U.S. utilities from 2023 to 2024. The move reflected Southern Company’s push to secure its CriticalLinc LTE system amid growing connectivity demands across Mississippi, Alabama, and Georgia.

Private LTE Market Trends:

Growing Focus on Communication Infrastructure Modernization

There is a noticeable shift toward increased spending on modern communication services, reflecting a broader push to enhance network capabilities across industries. Organizations are moving away from outdated systems in favor of more reliable, secure, and high-speed connectivity solutions. This environment is creating favorable conditions for the adoption of dedicated wireless networks, especially in settings that require low-latency, high-reliability communication. Private LTE networks are gaining traction as they offer greater control, flexibility, and scalability for industrial and enterprise use cases. The modernization of communication infrastructure is no longer limited to urban areas but is also extending to remote and mission-critical environments, supporting the needs of IoT integration, real-time operations, and seamless mobility across diverse locations. It had been reported that the worldwide spending on telecommunication and pay TV services reached USD 1.55 Trillion in 2023, an increase of 3.0% over 2022, by the International Data Corporation (IDC) Worldwide Semiannual Telecom Services Tracker.

Expanding Device Ecosystem Driving Network Demand

Based on the private LTE market outlook, the rising uptake of smartphones reflects a broader shift toward greater connectivity and digital engagement across users and industries. As mobile devices become more advanced and widely adopted, the pressure on existing networks to deliver seamless, high-speed, and reliable communication intensifies. Enterprises are increasingly turning to private LTE solutions to manage this growing demand, especially in environments where consistent performance, security, and control are critical. These dedicated networks support a wide range of connected devices, enabling real-time data exchange and operational efficiency. The expanding ecosystem of mobile and IoT devices is prompting industries to adopt private networks that offer tailored connectivity, enhanced management capabilities, and the ability to support future-ready applications across diverse operational landscapes. For instance, the worldwide smartphone market experienced a 10% year-on-year growth in Q1 2024, reaching 296.2 Million units.

Maritime Sector Accelerating Adoption of Dedicated Networks

The private LTE market forecast indicates that there is growing momentum in adopting private LTE networks within the maritime industry, driven by the need for reliable, high-speed connectivity beyond terrestrial limits. Replacing legacy systems with LTE-based infrastructure allows vessels to maintain uninterrupted communication and data flow, even in remote oceanic regions. This shift supports real-time monitoring, enhances cargo visibility, and streamlines fleet operations. The use of onboard core infrastructure eliminates dependence on satellite connectivity, improving resilience and performance. As digitalization deepens in maritime logistics, dedicated wireless networks are becoming essential for enabling smart vessel operations, supporting IoT integration, and achieving greater operational efficiency across global shipping routes. For example, in May 2025, Onomondo, in partnership with Maersk, launched the world’s largest private LTE network at sea, covering 450 vessels. This deployment replaces legacy 2G with LTE-based connectivity, enabling real-time IoT data transmission and operational visibility. Onboard LTE core infrastructure ensures uninterrupted service even without satellite, marking a major advancement in maritime communications.

Private LTE Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global private LTE market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, technology, frequency band, deployment model, and industry vertical.

Analysis by Component:

- Infrastructure

- Service

Infrastructure stood as the largest component in 2024 as enterprises and governments increasingly invest in robust, secure, and high-performance wireless networks to support mission-critical operations. Private LTE infrastructure, including base stations, core networks, and backhaul components, is essential for enabling seamless connectivity in large-scale industrial environments such as manufacturing plants, mining sites, ports, and transportation hubs. The need for ultra-low latency, higher data throughput, and enhanced control over network operations is pushing organizations to deploy dedicated LTE infrastructure instead of relying on public networks. Moreover, the rise of Industry 4.0, IoT, and automation demands scalable and secure infrastructure, making this segment crucial to market expansion as it lays the foundation for enterprise-grade wireless communication systems.

Analysis by Technology:

- FDD

- TDD

FDD led the market in 2024 due to its ability to provide stable, high-quality voice and data communication with minimal latency. FDD operates by using separate frequency bands for uplink and downlink, ensuring consistent and uninterrupted transmission, ideal for industries like utilities, manufacturing, and defense where reliability is critical. It is especially well-suited for rural and wide-area coverage scenarios, making it a preferred choice for private networks deployed across large industrial zones or remote locations. Additionally, FDD supports better spectral efficiency in low to medium traffic conditions, allowing enterprises to optimize network performance while maintaining control over secure communications. These advantages are boosting FDD adoption in private LTE deployments.

Analysis by Frequency Band:

- Licensed

- Unlicensed

- Shared Spectrum

Licensed led the market in 2024 as enterprises seek enhanced security, interference-free communication, and guaranteed quality of service (QoS) for their critical operations. Licensed spectrum offers exclusive access, reducing the risk of congestion and signal disruption often seen in unlicensed bands. This is especially valuable for sectors such as oil and gas, utilities, transportation, and public safety, where uninterrupted connectivity is essential. Governments and regulatory bodies are increasingly opening licensed spectrum for private use, enabling organizations to deploy dedicated LTE networks with full control. The reliability and regulatory backing associated with licensed spectrum are encouraging more enterprises to invest in this segment, positioning it as a key enabler of secure and scalable private LTE infrastructure.

Analysis by Deployment Model:

- Centralized

- Distributed

Distributed led the market in 2024 as it allows for decentralized network architectures that enhance flexibility, scalability, and reliability across large and complex operational areas. In distributed private LTE networks, network functions are spread across multiple locations rather than being centralized, which improves local processing, reduces latency, and ensures continuous service even if one node fails. This setup is particularly beneficial for industries with multiple facilities or expansive field operations, such as manufacturing, logistics, mining, and utilities. The distributed model supports edge computing and seamless integration of IoT devices, enabling real-time data processing and decision-making. As enterprises prioritize resilient and responsive connectivity, adoption of distributed architectures in private LTE networks continues to accelerate.

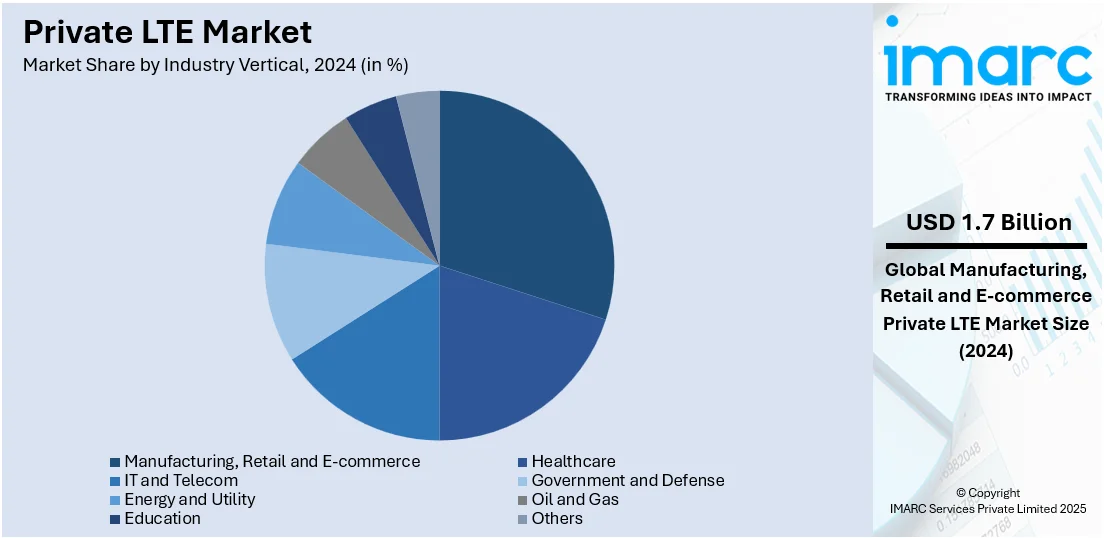

Analysis by Industry Vertical:

- Healthcare

- IT and Telecom

- Manufacturing, Retail and E-commerce

- Government and Defense

- Energy and Utility

- Oil and Gas

- Education

- Others

Government and defense led the market in 2024 due to its demand for secure, reliable, and mission-critical communications. Defense agencies and public safety organizations require dedicated networks that can operate independently of public infrastructure, especially during emergencies or national security operations. Private LTE networks offer enhanced control, encryption, and priority access, essential for field communication, surveillance, border security, and disaster response. Governments worldwide are investing in private LTE to modernize military communication systems and support smart city initiatives, critical infrastructure, and first responder networks. The need for uninterrupted, low-latency connectivity with strong cybersecurity measures is pushing this segment to adopt private LTE solutions, significantly contributing to market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

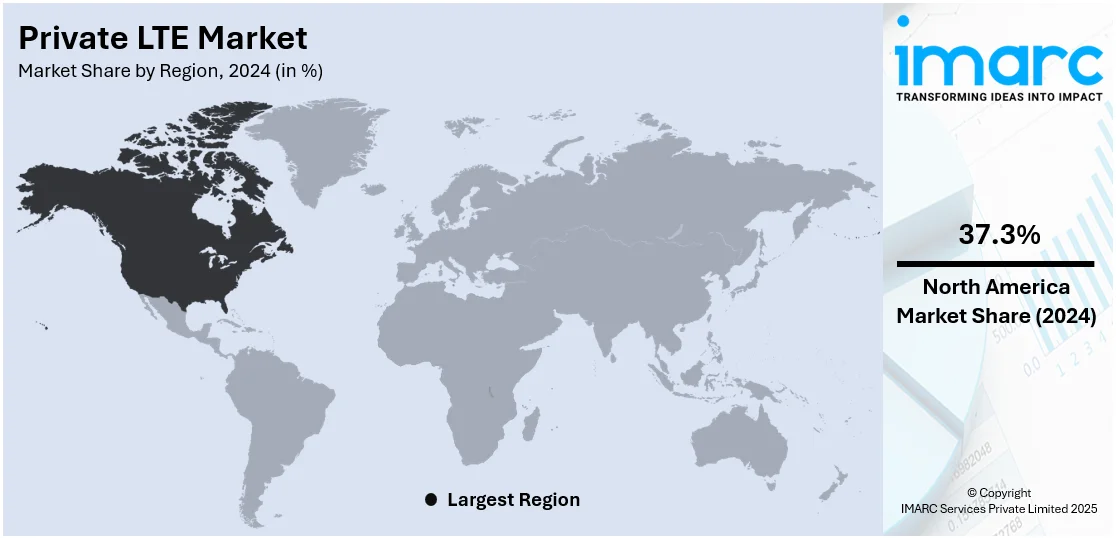

In 2024, North America accounted for the largest market share, driven by several key factors. The early availability and adoption of the Citizens Broadband Radio Service (CBRS) spectrum in the United States has enabled enterprises to deploy private LTE networks at reduced costs. The region also has a strong ecosystem of telecom providers, technology vendors, and system integrators supporting end-to-end deployment. High industrial adoption of IoT and automation technologies, especially in manufacturing, logistics, mining, and energy sectors, is boosting demand for dedicated, secure, and high-performance wireless networks. Additionally, robust digital infrastructure, rising focus on edge computing, and increasing cybersecurity concerns are prompting enterprises to invest in private LTE solutions. These conditions collectively support the region’s leadership and continued expansion in the private LTE market.

Key Regional Takeaways:

United States Private LTE Market Analysis

The United States is witnessing an upsurge in private LTE adoption driven by the increasing number of smartphone users and the expanding need for secure, high-speed mobile communication. For instance, almost all Americans (98%) own a mobile phone. This translates to almost 331 Million people. More than nine out of 10 (91%) of Americans own a smartphone. With a growing reliance on mobile applications for both enterprise and personal use, the demand for efficient and dedicated wireless infrastructure is surging. Private LTE offers a scalable and secure solution, catering to organizations that prioritize data privacy and low-latency networks. The rise in connected devices and the need for uninterrupted mobile communication across industries is further propelling demand. Organizations are transitioning from legacy systems to private LTE networks to support real-time communication and ensure operational efficiency. This trend is reinforced by growing smartphone users, creating a foundation for enhanced network deployment across commercial and industrial landscapes throughout the United States.

Asia Pacific Private LTE Market Analysis

Asia Pacific continues to expand its private LTE deployments in response to escalating demand for strong connectivity and wireless networks. According to Ericsson, India was reported to have 780 Million VoLTE subscriptions by 2023; 4G accounted for 78% of total subscriptions. Enterprises in the region are increasingly turning to private LTE solutions to meet the challenges posed by dense population centers and rapidly growing data consumption. As wireless networks evolve to support more devices and high-bandwidth applications, private LTE provides the capacity, reliability, and security that traditional public networks often lack. Industries ranging from manufacturing to transportation are investing in network upgrades that allow them to optimize operational efficiency and minimize downtime. Strong connectivity is now a key priority for emerging digital infrastructures, making private LTE a compelling choice. The rise in mobility and digital transformation across sectors reinforces this momentum, aligning perfectly with growing wireless networks demand and robust infrastructure initiatives across Asia Pacific.

Europe Private LTE Market Analysis

Europe is experiencing rising interest in private LTE adoption, primarily fuelled by the expansion of its IT sector. According to reports, the EU's information and communication services sector numbered around 1.3 Million enterprises in 2021, an increase of 11.1% compared with 2020. As enterprises modernize their digital environments, the need for dedicated, low-latency communication platforms becomes essential for managing critical workloads. The IT sector’s focus on cybersecurity, cloud computing, and data-driven services demands a reliable and secure network infrastructure. Private LTE networks offer high levels of performance, mobility, and scalability that are well-suited to enterprise IT operations. This technological shift is helping organizations create seamless communication channels across multiple sites and reduce reliance on public spectrum. With the IT sector growing steadily across various economies, private LTE is emerging as a viable solution to handle increased digital traffic and ensure data integrity. The region’s regulatory support for spectrum allocation also enhances this trend.

Latin America Private LTE Market Analysis

Latin America is experiencing a steady rise in private LTE demand as internet penetration increases across diverse communities. According to GSMA, smartphone connections in Latin America will reach 500 Million at the end of 2021, an adoption rate of 74%. More individuals and enterprises are connecting online, necessitating robust network solutions that deliver consistent service levels. Private LTE supports this digital acceleration by offering reliable, secure communication frameworks to meet the region’s expanding connectivity needs. The growth in internet penetration is pushing organizations to move toward custom wireless networks that allow better control over bandwidth and security. This makes private LTE an attractive option in Latin America.

Middle East and Africa Private LTE Market Analysis

The Middle East and Africa are experiencing growth in private LTE adoption, driven by increasing investment in the ICT sector. According to IDC, overall spending on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) was reported to top USD 238 Billion in 2024, an increase of 4.5% over 2023. Governments and enterprises are channelling resources into digital infrastructure, aiming to enhance connectivity and technological capabilities. As investment in the ICT sector accelerates, private LTE is seen as a strategic solution to support scalable, secure, and dedicated wireless environments for industrial and commercial applications.

Competitive Landscape:

The private LTE market is currently experiencing significant activity across various fronts. Recent developments include the launch of new products and solutions, strategic partnerships, mergers and acquisitions, and increased investments in research and development. Governments worldwide are implementing initiatives to promote digital transformation and smart city development, which is boosting the adoption of private LTE networks. Among these activities, forming partnerships and collaborations stands out as a common practice, as companies aim to expand their offerings and enter new markets. These collaborations are instrumental in driving innovation and ensuring the scalability and efficiency of private LTE solutions across different industries.

The report provides a comprehensive analysis of the competitive landscape in the private LTE market with detailed profiles of all major companies, including:

- Affirmed Networks

- Airspan

- AT&T

- Comba Telecom Systems Holdings Ltd

- Druid Software

- Future Technologies

- Huawei Technologies Co., Ltd

- Mavenir

- Motorola Solutions, Inc

- Nokia Corporation

- RUCKUS Networks

- Sierra Wireless

Latest News and Developments:

- March 2025: OneLayer and Ericsson launched a Zero Trust Network Access (ZT-ZTNA) solution for private LTE and 5G networks, enhancing automated device onboarding and eliminating manual provisioning. Announced on March 24, 2025, the solution aimed to strengthen security across industrial sectors like utilities and manufacturing.

- March 2025: Ubiik unveiled the Maverick 220, marking the industry's first high-power LTE-M/NB-IoT module tailored for utility and private LTE applications. By exceeding the traditional 23dBm limit with 28dBm for LTE-M and 30dBm for NB-IoT, the module significantly expanded long-range IoT connectivity capabilities.

- March 2025: Quectel launched the EG950A-ENL LTE Cat 4 module, offering cost-effective LTE 450 and 410 connectivity tailored for smart metering applications. The module supported Private LTE networks, enabling robust, low-power, two-way communication for utilities as smart meter deployments surpassed one Billion by the end of 2023.

- February 2025: Ericsson was appointed to deploy private LTE for the Lower Colorado River Authority (LCRA) to support smart-grid operations across parts of 68 Texas counties. The project, aligned with LCRA’s 900 MHz Anterix licenses, aimed to enhance grid resilience through IoT monitoring, SCADA systems, and secure, geo-redundant 4G/5G infrastructure.

Private LTE Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Infrastructure, Service |

| Technologies Covered | FDD, TDD |

| Frequency Bands Covered | Licensed, Unlicensed, Shared Spectrum |

| Deployment Models Covered | Centralized, Distributed |

| Industry Verticals Covered | Healthcare, IT and Telecom, Manufacturing, Retail and E-commerce, Government and Defense, Energy and Utility, Oil and Gas, Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Affirmed Networks, Airspan, AT&T, Comba Telecom Systems Holdings Ltd, Druid Software, Future Technologies, Huawei Technologies Co., Ltd, Mavenir, Motorola Solutions, Inc, Nokia Corporation, RUCKUS Networks, Sierra Wireless, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the private LTE market from 2019-2033.

- The private LTE market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the private LTE industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The private LTE market was valued at USD 6.26 Billion in 2024.

The private LTE market is projected to exhibit a CAGR of 10.28% during 2025-2033, reaching a value of USD 15.79 Billion by 2033.

Key factors driving the private LTE market include rising demand for secure and reliable wireless communication, growing adoption in industrial automation, increasing use in mission-critical applications, enhanced data privacy needs, and advancements in LTE infrastructure. Enterprises also seek better control over network performance, coverage, and latency for IoT and smart operations.

North America dominated the private LTE market in 2024 due to early adoption of CBRS spectrum, strong presence of industrial IoT, advanced infrastructure, and high enterprise demand for secure, low-latency wireless connectivity.

Some of the major players in the private LTE market include Affirmed Networks, Airspan, AT&T, Comba Telecom Systems Holdings Ltd, Druid Software, Future Technologies, Huawei Technologies Co., Ltd, Mavenir, Motorola Solutions, Inc, Nokia Corporation, RUCKUS Networks, Sierra Wireless, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)