Product Lifecycle Management (PLM) Software Market Report by Software Type (Portfolio Management, Design and Engineering Management, Quality and Compliance Management, Simulation, Testing and Change Management, Manufacturing Operations Management, and Others), Deployment Type (On-Premises, Cloud-Based), End User (Aerospace and Defense, Automotive and Transportation, Healthcare, It and Telecom, Industrial Equipment and Heavy Machinery, Retail, Semiconductor and Electronics, and Others), and Region 2025-2033

Market Overview:

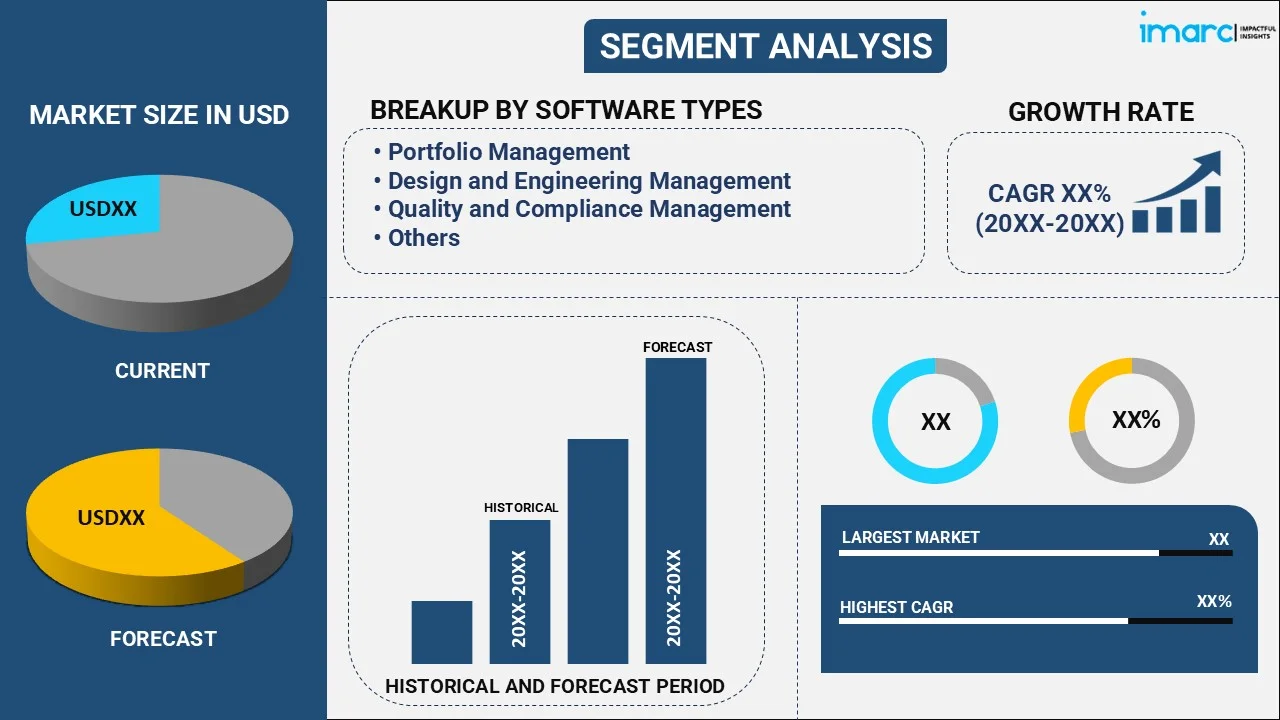

The global product lifecycle management (PLM) software market size reached USD 28.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 47.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.89% during 2025-2033. The increasing emphasis on sustainable practices, the rising customer expectations for personalized, high-quality products, and the widespread adoption of the Internet of Things (IoT), artificial intelligence (AI), and big data analytics are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.4 Billion |

| Market Forecast in 2033 | USD 47.7 Billion |

| Market Growth Rate (2025-2033) | 5.89% |

Product lifecycle management (PLM) software is a systematic approach to managing a product's lifecycle from its conceptualization to its retirement. It involves various phases including idea generation, design and development, manufacturing, distribution, and end-of-life management. PLM aims to streamline the product development process, reduce time-to-market, and improve product quality by facilitating collaboration among various departments, such as engineering, marketing, and production. Through centralized data management, it offers a single source of truth for all product-related information. The use of PLM tools and methodologies can result in cost savings, greater efficiency, and a competitive advantage for organizations.

The rising globalization represents one of the key factors driving the growth of the market across the globe. As companies expand their reach across borders, the necessity for a unified, centralized system to manage product information and facilitate collaboration becomes paramount. The market is also driven by the increasing complexity of products. Innovations in engineering and technology are leading to more intricate designs that require sophisticated management solutions. Regulatory compliance also plays a crucial role, especially in industries like healthcare, aerospace, and automotive, where stringent standards are met. The integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data further necessitates robust PLM systems for data management and insightful analytics. Cost efficiency is another important driver. PLM systems can significantly reduce operational costs by streamlining product development processes. Additionally, the need for rapid time-to-market amid competitive pressures and rising customer expectations for high-quality, personalized products is making PLM systems more indispensable than ever, which is facilitating the market growth across the globe.

Product Lifecycle Management (PLM) Software Market Trends/Drivers:

Significant technological advancements

As technology continues to evolve at an unprecedented rate, integrating features such as the Internet of Things (IoT), Artificial Intelligence (AI), and Big Data analytics have become essential in product development and management. This technological integration is making PLM systems more sophisticated, offering advanced capabilities like real-time analytics, predictive maintenance, and smart automation. Businesses are recognizing that adopting technologically advanced PLM systems can provide them with a competitive edge. These solutions enable companies to better capture, manage, and utilize data throughout the product lifecycle, leading to more informed decision-making, optimized processes, and ultimately, more successful products.

Increasing complexity of products

With innovations in engineering and design, products are becoming more complex than ever before. Whether it's a consumer electronics device with a multitude of features or an aerospace component that must meet stringent safety and quality standards, managing this complexity is a huge challenge. PLM systems offer a centralized platform that allows various departments and teams to collaborate more effectively, thereby managing complexity in a structured manner. Features like version control, digital twin simulations, and multi-disciplinary design capabilities make PLM systems indispensable tools for handling intricate product portfolios.

Rising need for global collaboration

In the era of globalization, companies often are teaming up and manufacturing units spread across different countries and time zones which is also acting as a major growth-inducing factor. The need for a unified platform for real-time collaboration and data sharing has never been greater. PLM systems facilitate global collaboration by providing cloud-based platforms where all stakeholders can access and contribute to product-related information. This eliminates the risks of data duplication, miscommunication, and other inefficiencies that can occur in a globally distributed setup.

Product Lifecycle Management (PLM) Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global product lifecycle management (PLM) software market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on software type, deployment type, and end user.

Breakup by Software Type:

- Portfolio Management

- Design and Engineering Management

- Quality and Compliance Management

- Simulation, Testing and Change Management

- Manufacturing Operations Management

- Others

Design and engineering management dominate the market

The report has provided a detailed breakup and analysis of the market based on the software type. This includes portfolio management, design and engineering management, quality and compliance management, simulation, testing and change management, manufacturing operations management, and others. According to the report, design and engineering management represented the largest segment.

The demand for design and engineering management within the product lifecycle management (PLM) software industry is fueled by several pivotal factors that aim to address the challenges and complexities in product development and manufacturing. Advances in technology have led to increasingly intricate products that require sophisticated design and engineering capabilities. Specialized PLM modules focused on design and engineering help manage this complexity effectively. The need for seamless collaboration between departments like mechanical, electrical, and software engineering necessitates integrated design and engineering management solutions. In industries, such as aerospace, automotive, and healthcare, design and engineering stages are highly regulated. PLM assists in ensuring compliance by maintaining auditable records of design iterations and engineering changes. Competitive pressures demand quicker product rollouts. Efficient design and engineering management within PLM can accelerate development cycles, thus reducing time-to-market. Errors or inefficiencies in the design and engineering phases can lead to costly modifications later. PLM systems help in early error detection and optimization, thereby reducing overall costs.

Breakup by Deployment Type:

- On-premises

- Cloud-based

Cloud-based hold the largest share in the market

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud-based. According to the report, cloud-based represented the largest segment.

Cloud-based PLM systems offer the flexibility to scale operations up or down according to business requirements, making them suitable for both small and large enterprises. Cloud-based solutions eliminate the need for significant upfront investment in hardware and software, transitioning costs to a more manageable subscription model. Cloud platforms facilitate seamless collaboration among geographically dispersed teams, providing real-time access to centralized data and tools, thereby enabling efficient global operations. Advanced encryption and compliance measures available in cloud-based PLM systems ensure data security while meeting industry-specific regulations. Cloud-based solutions can be deployed much more quickly than on-premises systems, thereby reducing time-to-value and enabling faster responses to market changes. Cloud-based PLM ensures uninterrupted access to data and applications, as service providers typically guarantee high levels of uptime. Cloud-based platforms are generally easier to integrate with other enterprise software solutions, such as ERP and CRM, leading to a more cohesive and efficient operational structure.

Breakup by End User:

- Aerospace and Defense

- Automotive and Transportation

- Healthcare

- IT and Telecom

- Industrial Equipment and Heavy Machinery

- Retail

- Semiconductor and Electronics

- Others

Automotive and transportation dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes aerospace and defense, automotive and transportation, healthcare, IT and telecom, industrial equipment and heavy machinery, retail, semiconductor and electronics, and others. According to the report, automotive and transportation represented the largest segment.

In the automotive and transportation industry, product lifecycle management (PLM) plays a critical role in addressing various challenges, ranging from complex engineering to stringent regulatory compliance. PLM enables seamless collaboration among design teams, suppliers, and manufacturers, streamlining the development process for intricate automotive components and systems. The industry must adhere to numerous safety and environmental regulations. PLM helps in maintaining compliance by keeping a centralized repository of standards and facilitating audits. Vehicles comprise a multitude of parts and subsystems. PLM assists in managing this complexity by offering a single source of truth for all product-related data. PLM systems allow for robust quality checks and simulation tests during the design and manufacturing stages, ensuring that the end products meet the required quality standards. PLM integrates suppliers into the product development process, enabling more efficient material sourcing, cost analysis, and logistics planning.

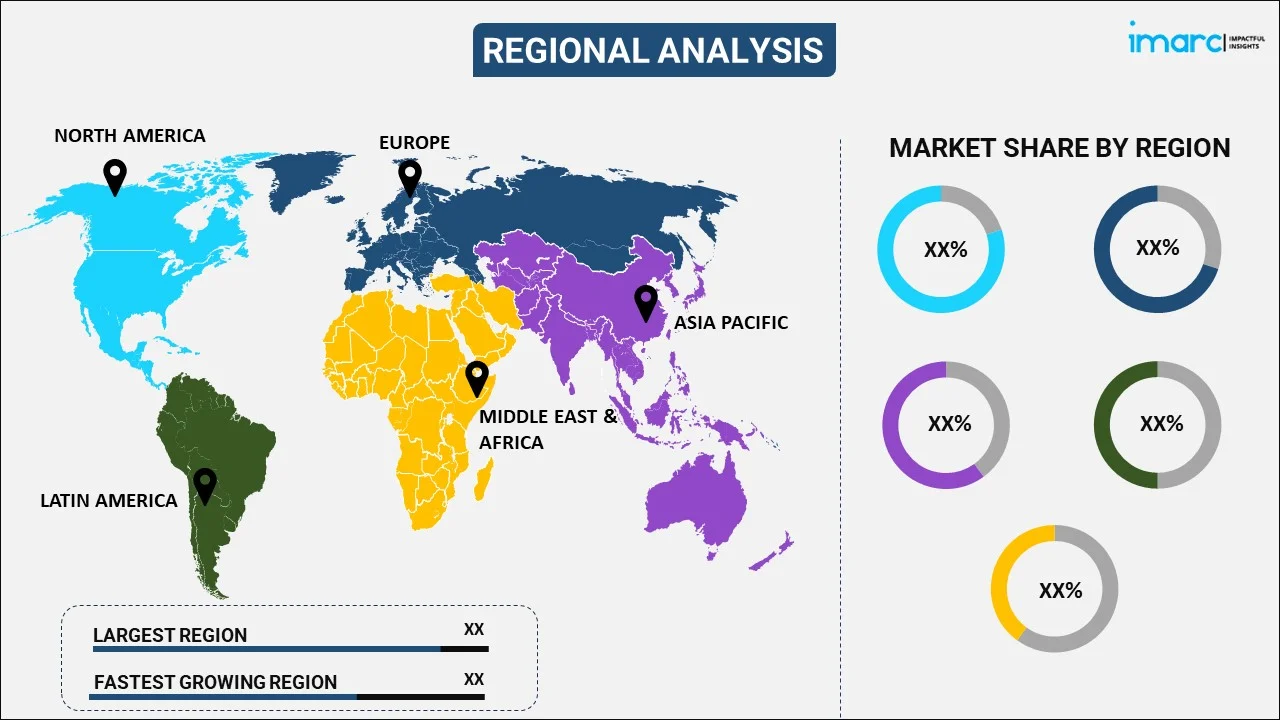

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Russia

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Russia, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America, particularly the United States, is a hub for technological innovation. This fosters an environment where advanced PLM solutions are both developed and adopted quickly. Industries like aerospace, automotive, and healthcare, which have intricate product development cycles, are prevalent in the region. The complexity drives the need for robust PLM systems. Strict regulations in sectors such as healthcare and aerospace necessitate effective compliance management, one of the core capabilities of PLM systems. Many North American companies operate globally, requiring scalable and flexible PLM solutions to manage distributed teams and supply chains effectively. The highly competitive market landscape forces companies to reduce time-to-market and improve product quality, both facilitated by PLM systems. With Industry 4.0 and digital transformation initiatives gaining traction, there's a growing need for PLM systems that can integrate with IoT, AI, and data analytics tools. High levels of investment in research and development (R&D) activities further necessitate systems for effective lifecycle management of products.

Competitive Landscape:

Key players in the market are undertaking a range of strategies to maintain a competitive edge and expand their market share. Companies like Siemens, Dassault Systèmes, and PTC are heavily investing in research and development to introduce advanced features, such as integration with IoT, AI, and Big Data analytics, into their PLM solutions. Major players are acquiring specialized firms to broaden their product portfolios. Collaborations with other tech firms and industry leaders are common. These partnerships aim to deliver more comprehensive solutions by combining expertise in various domains. Key companies are focusing on entering new markets and strengthening their presence in existing ones by setting up local offices, and data centers, and through channel partnerships. Tailoring PLM systems to specific industry needs is another strategy. Companies are also investing in educational initiatives to increase user proficiency, thereby driving product adoption rates.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ANSYS Inc.

- Aras Corporation

- Autodesk Inc.

- Coats Digital

- Dassault Systèmes SE (Dassault Group)

- Infor (Koch Industries Inc.)

- Oracle Corporation

- PROCAD GmbH & Co. KG

- Ptc Inc.

- Pulse Technology Systems Ltd.

- SAP SE

- Siemens Aktiengesellschaft.

Recent Developments:

- In September 2023, Ansys Speos GPU was recognized among the best by the 2023 Laser Focus World Innovators Awards.

- In September 2023, Aras Corporation announced that with the launch of Aras Innovator® 28, they are now delivering a new Platform Component, Reporting, which allows for an increase in collaboration and traceability throughout the platform.

- In April 2023, Siemens Digital Industries Software and IBM (NYSE:IBM) announced that they are expanding their long-term partnership by collaborating to develop a combined software solution integrating their respective offerings for systems engineering, service lifecycle management and asset management.

Product Lifecycle Management (PLM) Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Software Types Covered | Portfolio Management, Design and Engineering Management, Quality and Compliance Management, Simulation, Testing and Change Management, Manufacturing Operations Management, Others |

| Deployment Types Covered | On-Premises, Cloud-Based |

| End Users Covered | Aerospace and Defense, Automotive and Transportation, Healthcare, It and Telecom, Industrial Equipment and Heavy Machinery, Retail, Semiconductor and Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ANSYS Inc., Aras Corporation, Autodesk Inc., Coats Digital, Dassault Systèmes SE (Dassault Group), Infor (Koch Industries Inc.), Oracle Corporation, PROCAD GmbH & Co. KG, Ptc Inc., Pulse Technology Systems Ltd., SAP SE and Siemens Aktiengesellschaft etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the product lifecycle management (PLM) software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global product lifecycle management (PLM) software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the product lifecycle management (PLM) software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global Product Lifecycle Management (PLM) software market was valued at USD 28.4 Billion in 2024.

We expect the global Product Lifecycle Management (PLM) software market to exhibit a CAGR of 5.89% during 2025-2033.

The rising adoption of PLM software across numerous modern manufacturing units to enhance collaborations and decrease inefficiency by using information precisely is primarily driving the global product lifecycle management (PLM) software market.

The sudden outbreak of the COVID-19 pandemic has led to the growing utilization of cloud-based solution, such as Product Lifecycle Management (PLM) software, across various organizations for streamlining the flow of information, during remote working and Bring-Your-Own-Device (BYOD) models.

Based on the software type, the global Product Lifecycle Management (PLM) software market can be categorized into portfolio management, design and engineering management, quality and compliance management, simulation, testing and change management, manufacturing operations management, and others. Among these, design and engineering management currently accounts for the majority of the total market share.

Based on the deployment type, the global Product Lifecycle Management (PLM) software market has been segregated into on-premises and cloud-based, where cloud-based holds the largest market share.

Based on the end user, the global Product Lifecycle Management (PLM) software market can be bifurcated into aerospace and defense, automotive and transportation, healthcare, IT and telecom, industrial equipment and heavy machinery, retail, semiconductor and electronics, and others. Currently, the automotive and transportation industry exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global Product Lifecycle Management (PLM) software market include ANSYS Inc., Aras Corporation, Autodesk Inc., Coats Digital, Dassault Systèmes SE (Dassault Group), Infor (Koch Industries Inc.), Oracle Corporation, PROCAD GmbH & Co. KG, Ptc Inc., Pulse Technology Systems Ltd., SAP SE, and Siemens Aktiengesellschaft.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)