Qatar Car Rental Market Report by Booking Type (Offline Booking, Online Booking), Rental Length (Short Term, Long Term), Vehicle Type (Luxury, Executive, Economy, SUVs, and Others), Application (Leisure/Tourism, Business), End User (Self-Driven, Chauffeur-Driven), and Region 2026-2034

Qatar Car Rental Market Overview:

The Qatar car rental market size reached USD 105.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 213.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.70% during 2026-2034. The market is primarily driven by growing tourism due to major events like the FIFA World Cup, robust economic development fostering business travel, ongoing infrastructure projects, supportive government policies, and increasing urbanization and population trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 105.7 Million |

| Market Forecast in 2034 | USD 213.1 Million |

| Market Growth Rate (2026-2034) | 7.70% |

Access the full market insights report Request Sample

Qatar Car Rental Market Trends:

Tourism Growth and its Impact on Qatar's Car Rental Market

According to Alpen Capital, Qatar wants the travel and tourism sector to contribute 12% of its gross domestic product to the country's GDP by 2030. Additionally, the country targets to have welcomed over 6 million tourists, due to the encouraging government programs and regular hosting of international events as part of its Tourism Strategy 2030. Furthermore, Qatar has a strong pipeline of hotel developments in progress to handle the increasing number of visitors. By the end of 2023, there were 36 active projects in Qatar, and 8,922 rooms were being built. The need to accommodate guests for the FIFA World Cup 2022, which began in November 2022, was a major factor in this development and increased demand for car rentals across the region. In addition, travelers look for easy and adaptable ways to learn about Qatar's many attractions, which range from contemporary entertainment centers to historical sites. Hence, the region's prospects for the car rental industry are further growing by the development in tourist arrivals. This rise demonstrates the mutually beneficial link between the growth of tourism and the car rental sector, emphasizing the latter as a key beneficiary of Qatar's tourist-focused economic initiatives.

Infrastructure Development in Qatar

Significant infrastructural developments, especially in major cities like Doha, are transforming the automobile rental industry in Qatar. Additionally, the easy accessibility and transportation within the country have been greatly improved by the creation of important infrastructure, such as Hamad International Airport. In addition, more tourists and business travelers are arriving due to the extended aircraft routes and upgraded airport amenities, which are escalating the demand for rental cars to enable smooth travel experiences. For instance, car rental services are available at Hamad International Airport (HIA) with a wide range of cars that include ordinary sedans and opulent high-end vehicles. A vast range of well-known vehicle rental providers are available to choose from, each providing a variety of brands, models, packages, and extra amenities to meet individual demands. Moreover, Al Muftah is Qatar’s first car rental company and one of the largest in the industry that has been awarded as the ‘best local brand’ car rental company of the region and its fleet ranges from economy sedans to luxury vehicles in additions to its commercial vehicle segment of pick up, buses, vans and trucks. These services cater to diverse customer needs, offering a range of vehicles and convenient rental options that appeal to both short-term visitors and long-term residents, thus benefiting the car rental market across the region.

Qatar Car Rental Market News:

- July 30, 2023: Al-Futtaim Vehicle Rentals (AVR) celebrates the opening of its newest branch, located within the new Honda and GAC showroom facility in the Industrial Area, Doha, Qatar.

- May17, 2024: Carwiz International recently expanded into one of the most dynamic tourist regions globally, the Middle East and Africa, by sealing its largest contract to date.

This latest contract, spanning 16 new countries including UAE, Qatar, and Saudi Arabia, bolsters the company's global network and enhances operational efficiency as one of the fastest-growing car rental franchises worldwide.

Qatar Car Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on booking type, rental length, vehicle type, application, and end user.

Booking Type Insights:

To get detailed segment analysis of this market Request Sample

- Offline Booking

- Online Booking

The report has provided a detailed breakup and analysis of the market based on the booking type. This includes offline booking and online booking.

Rental Length Insights:

- Short Term

- Long Term

A detailed breakup and analysis of the market based on the rental length have also been provided in the report. This includes short term and long term.

Vehicle Type Insights:

- Luxury

- Executive

- Economy

- SUVs

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes luxury, executive, economy, SUVs, and others.

Application Insights:

- Leisure/Tourism

- Business

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes leisure/tourism and business.

End User Insights:

- Self-Driven

- Chauffeur-Driven

The report has provided a detailed breakup and analysis of the market based on the end user. This includes self-driven and chauffeur-driven.

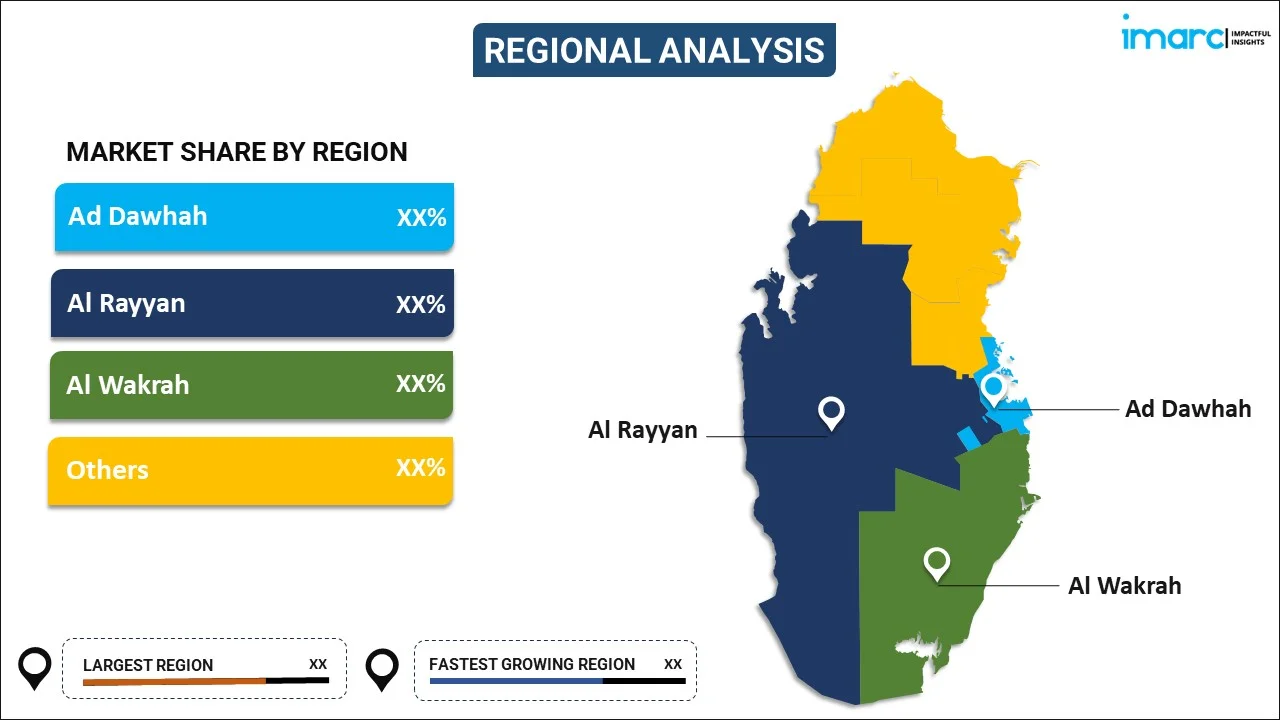

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Car Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End Users Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Qatar car rental market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Qatar car rental market?

- What is the breakup of the Qatar car rental market on the basis of booking type?

- What is the breakup of the Qatar car rental market on the basis of rental length?

- What is the breakup of the Qatar car rental market on the basis of vehicle type?

- What is the breakup of the Qatar car rental market on the basis of application?

- What is the breakup of the Qatar car rental market on the basis of end user?

- What are the various stages in the value chain of the Qatar car rental market?

- What are the key driving factors and challenges in the Qatar car rental?

- What is the structure of the Qatar car rental market and who are the key players?

- What is the degree of competition in the Qatar car rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar car rental market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar car rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)