Qatar Carbon Capture and Storage Market Size, Share, Trends and Forecast by Service, Technology, End Use Industry, and Region, 2026-2034

Qatar Carbon Capture and Storage Market Overview:

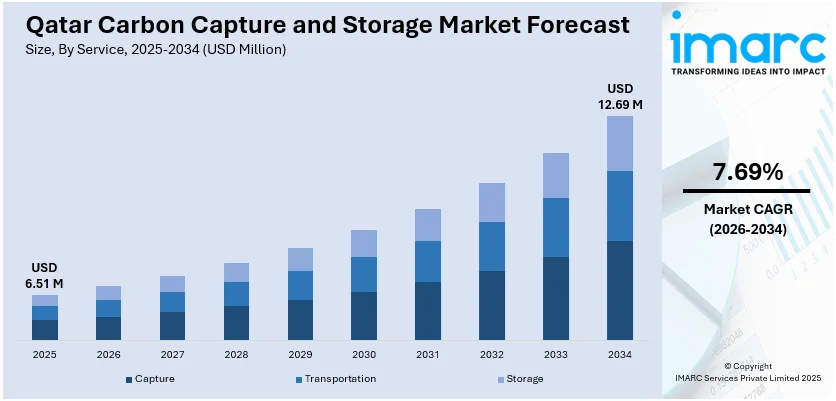

The Qatar carbon capture and storage market size reached USD 6.51 Million in 2025. The market is projected to reach USD 12.69 Million by 2034, growing at a CAGR of 7.69% during 2026-2034. The market is driven by Qatar's strong commitment to achieving reduction in greenhouse gas emissions by 2030 through its National Climate Change Action Plan, the integration of CCS technologies across all major LNG expansion projects, and record-level investments in large-scale carbon capture infrastructure. These strategic initiatives position Qatar at the forefront of global carbon management deployment and reinforce the Qatar carbon capture and storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.51 Million |

| Market Forecast in 2034 | USD 12.69 Million |

| Market Growth Rate 2026-2034 | 7.69% |

Qatar Carbon Capture and Storage Market Trends:

Expansion of Carbon Capture Facilities

Qatar is diligently working to enhance its carbon capture infrastructure to tackle increasing industrial emissions from crucial sectors such as power generation, oil and gas, and fertilizer production. The country intends to install sophisticated carbon capture systems at emission sources to lower its carbon footprint while aiding overarching environmental and sustainability goals. These facilities not only assist in fulfilling regulatory obligations but also boost operational efficiency by curbing CO₂ emissions into the atmosphere. The growth of such infrastructure showcases Qatar's dedication to advancing cleaner energy practices and strengthens the nation’s strategy to incorporate sustainable technologies within its industrial framework, thus paving the way for long-lasting environmental and economic advantages.

To get more information on this market Request Sample

Integration with Energy and Industrial Sectors

CCS technology is progressively being integrated into essential energy and industrial activities, like natural gas processing, petrochemical production, and ammonia generation. Qatar carbon capture and storage market growth is being fueled by this integration, as industries seek to minimize emissions while maintaining production levels. Incorporating CCS solutions into these high-emission sectors enables immediate capture and management of CO₂, allowing companies to meet environmental goals while enhancing operational effectiveness. This integration also fosters technological advancement, as industrial processes are adapted for optimized carbon capture. By aligning CCS with specific sector needs, Qatar is positioning itself as a regional frontrunner in low-carbon industrial practices and advancing its broader climate and energy transition objectives.

Development of Geological Storage Solutions

To guarantee the long-term storage of captured carbon, Qatar is prioritizing the development of geological storage solutions. These solutions involve using depleted oil and gas fields and deep saline aquifers as reliable storage sites capable of containing substantial amounts of CO₂ for extended timelines. Careful site selection, monitoring, and management are essential to avoid leaks and ensure environmental safety. Geological storage represents a vital aspect of the carbon capture value chain, allowing industries to effectively offset emissions and support national carbon reduction initiatives. By investing in these solutions, Qatar strengthens the reliability and scalability of its CCS efforts, laying a solid groundwork for sustainable industrial growth and contributing to global climate mitigation strategies.

Qatar Carbon Capture and Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service, technology, and end use industry.

Analysis by Service:

- Capture

- Transportation

- Storage

The report has provided a detailed breakup and analysis of the market based on the service. This includes capture, transportation, and storage.

Analysis by Technology:

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes post-combustion capture, pre-combustion capture, and oxy-fuel combustion capture.

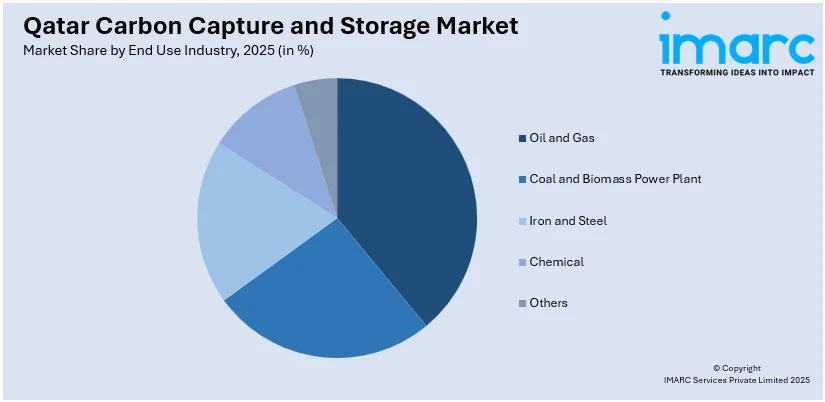

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, coal and biomass power plant, iron and steel, chemical, and others.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Carbon Capture and Storage Market News:

- In October 2025, Qatar Energy announced its plans to launch its CCS-ammonia plant, Qafco 7, in April 2026 with an initial output of 900,000 t/yr.

Qatar Carbon Capture and Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Capture, Transportation, Storage |

| Technologies Covered | Post-combustion Capture, Pre-combustion Capture, Oxy-fuel Combustion Capture |

| End Use Industries Covered | Oil and Gas, Coal and Biomass Power Plant, Iron and Steel, Chemical, Others |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar carbon capture and storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar carbon capture and storage market on the basis of service?

- What is the breakup of the Qatar carbon capture and storage market on the basis of technology?

- What is the breakup of the Qatar carbon capture and storage market on the basis of end use industry?

- What is the breakup of the Qatar carbon capture and storage market on the basis of region?

- What are the various stages in the value chain of the Qatar carbon capture and storage market?

- What are the key driving factors and challenges in the Qatar carbon capture and storage market?

- What is the structure of the Qatar carbon capture and storage market and who are the key players?

- What is the degree of competition in the Qatar carbon capture and storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar carbon capture and storage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar carbon capture and storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar carbon capture and storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)