Qatar Cold Storage Warehouse Market Size, Share, Trends and Forecast by Type, Temperature Range, Warehouse Type, Application, and Region, 2026-2034

Qatar Cold Storage Warehouse Market Summary:

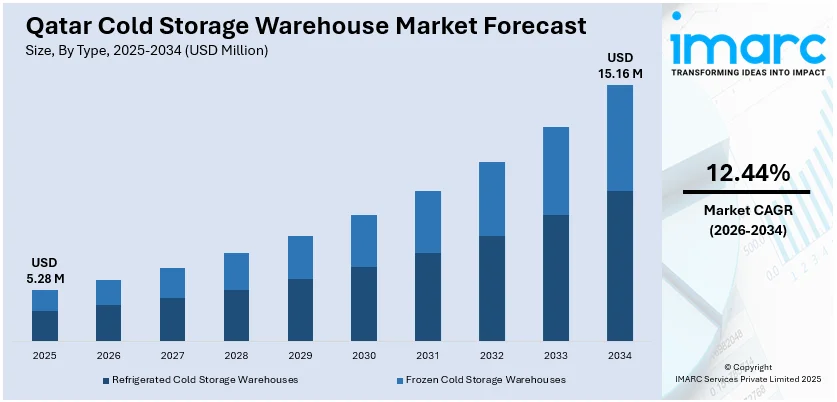

The Qatar cold storage warehouse market size reached USD 5.28 Million in 2025. The market is projected to reach USD 15.16 Million by 2034, growing at a CAGR of 12.44% during 2026-2034. The market is driven by Qatar's strategic focus on food security through government-led infrastructure development at Hamad Port and other logistics hubs, the rapid expansion of pharmaceutical and healthcare sectors requiring temperature-controlled storage solutions, and the significant growth in organized retail and e-commerce sectors demanding efficient cold chain logistics. Additionally, Qatar's position as a regional logistics hub is further propelling the Qatar cold storage warehouse market share.

Key Takeaways:

- The Qatar cold storage warehouse market was valued at USD 5.28 Million in 2025.

- It is projected to reach USD 15.16 Million by 2034, representing a compound annual growth rate of 12.44% between 2026-2034.

- Rising imports of perishable food, expanding pharmaceutical distribution needs, and growing demand for temperature-controlled logistics across retail and hospitality sectors are driving strong momentum in the Qatar Cold Storage Warehouse Market.

- Segmentation highlights:

- Type: Refrigerated Cold Storage Warehouses, Frozen Cold Storage Warehouses

- Temperature Range: 0°C to 10°C, -18°C to -25°C, Below -25°C

- Warehouse Type: Private, Public

- Application: Fruits and Vegetables, Pharmaceuticals, Dairy and Frozen Dessert, Processed Foods, Bakery and Confectionary, Others

- Regional Insights: The report covers major zones within Qatar: Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Qatar Cold Storage Warehouse Market Outlook (2026-2034):

The Qatar cold storage warehouse market is positioned for robust growth over the forecast period, driven by the government's continued implementation of the National Food Security Strategy 2024-2030 and ongoing infrastructure development at major logistics hubs. The expansion of pharmaceutical imports and the growing emphasis on vaccine and medicine storage following post-pandemic healthcare sector reforms will create sustained demand for specialized temperature-controlled facilities. Furthermore, the increasing penetration of organized retail formats and e-commerce grocery delivery services will necessitate investments in advanced cold storage solutions with last-mile delivery capabilities, supporting the market's positive trajectory.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence and Internet of Things technologies are increasingly transforming Qatar's cold storage warehouse operations by enabling real-time temperature and humidity monitoring through IoT sensors deployed across facilities. AI-powered warehouse management systems are optimizing inventory tracking, order fulfillment routing, and predictive maintenance scheduling, helping operators reduce energy consumption and prevent equipment failures. Machine learning algorithms analyze historical temperature data patterns to identify potential system inefficiencies and automate cooling adjustments, thereby lowering operational costs. As Qatar positions itself as a smart logistics hub, the integration of these technologies is expected to accelerate, enhancing supply chain transparency and supporting compliance with stringent regulatory standards.

Market Dynamics:

Key Market Trends & Growth Drivers:

Rising Demand for Temperature Control

The Qatar cold storage warehouse market is witnessing increasing demand as food security, pharmaceutical distribution, and modern retail expansion take center stage in the country’s economic agenda. Growing reliance on imported perishables, coupled with rising consumer preference for fresh and premium quality foods, is pushing businesses to invest in advanced cold chain systems. The hospitality sector, driven by tourism and upscale dining, is also fueling the need for consistent temperature regulated facilities. Additionally, operational efficiency is improving as operators adopt automation, remote monitoring, and energy efficient cooling technologies to maintain product integrity while reducing costs.

Tech Integration Driving Expansion

Digital transformation is becoming a defining trend, significantly accelerating Qatar cold storage warehousing market growth. Operators are adopting advanced warehouse management systems, IoT based tracking, and predictive maintenance tools to enhance real time visibility and asset utilization. Automated storage systems and robotics are being integrated to reduce human error and optimize workflow efficiency. Sustainability is also emerging as a key focus, with companies exploring renewable energy adoption and intelligent cooling to cut operational emissions. This tech forward transition is helping build more resilient supply chains and strengthening the country’s capacity to support pharmaceuticals, frozen foods, and high value perishables.

Growth in Retail and Logistics

Expansion in modern retail, e commerce fulfillment, and last mile logistics is reshaping the demand for cold storage spaces across Qatar. The shift toward fast moving consumer goods, online grocery platforms, and premium food imports is encouraging companies to scale their frozen and chilled storage capabilities. Logistics companies are increasingly forming strategic collaborations to build multi temperature distribution centers that support efficient nationwide delivery. The rising presence of international food brands and specialty cuisine markets is further enhancing the need for diversified storage solutions. This broad based commercial expansion is positioning cold storage as a cornerstone of Qatar’s evolving supply chain ecosystem.

Key Market Challenges:

High Energy Consumption and Operating Costs

One of the most significant challenges in the Qatar cold storage warehouse market is the high energy requirement needed to maintain consistent temperature levels in a desert climate. Cooling systems operate under extreme conditions, pushing electricity consumption and operational expenses far above global averages. Many facilities still rely on older, less efficient refrigeration technologies, adding further strain on energy budgets. Additionally, sustainability requirements are increasing the pressure on operators to adopt greener systems, which involve substantial upfront investment. Balancing cost efficiency with temperature consistency remains difficult, especially for small and medium scale players that lack capital for modernization. As demand for cold storage grows, the ability to manage power usage without compromising product quality is becoming a major operational constraint for the industry.

Skill Gaps and Workforce Limitations

The industry faces considerable challenges due to limited availability of skilled labor capable of managing advanced refrigeration, warehouse automation, and IoT enabled monitoring systems. While cold storage operations are becoming increasingly digital and data driven, the workforce capabilities have not kept pace with technological advancements. Many operators struggle to attract and retain trained technicians who can maintain modern cooling systems or troubleshoot automation and control software. The physically demanding nature of cold storage environments also contributes to high turnover rates. As Qatar pushes toward more complex, integrated supply chains, the shortage of specialized talent may slow operational efficiency and delay technology adoption. Addressing these gaps through training programs and industry specific upskilling is crucial for long term market resilience.

Infrastructure Constraints and Fragmented Logistics

Despite growing investment in logistics, the Qatar cold storage warehouse market still faces bottlenecks due to limited infrastructure integration across supply chain networks. Many cold storage facilities are concentrated in specific industrial zones, creating logistical inefficiencies for distributors serving varied retail and food service locations. Fragmented last mile connectivity often leads to longer transportation cycles, increasing the risk of temperature excursions during transit. The absence of fully synchronized cold chain systems, especially across smaller transport operators, complicates end to end quality control. Moreover, expanding multi temperature storage capacity requires significant land allocation and regulatory approvals, which can extend project timelines. As the market expands, improving connectivity, regulatory coordination, and multimodal cold chain infrastructure will be essential to ensure product freshness and reduce operational inconsistencies.

Qatar Cold Storage Warehouse Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar cold storage warehouse market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on type, temperature range, warehouse type, and application.

Analysis by Type:

- Refrigerated Cold Storage Warehouses

- Frozen Cold Storage Warehouses

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerated cold storage warehouses and frozen cold storage warehouses.

Analysis by Temperature Range:

- 0°C to 10°C

- -18°C to -25°C

- Below -25°C

A detailed breakup and analysis of the market based on the temperature range have also been provided in the report. This includes 0°C to 10°C, -18°C to -25°C, and below -25°C.

Analysis by Warehouse Type:

- Private

- Public

The report has provided a detailed breakup and analysis of the market based on the warehouse type. This includes private and public.

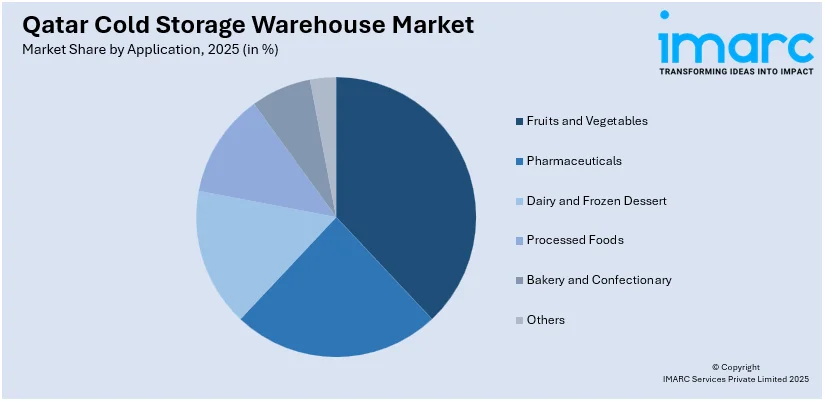

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Fruits and Vegetables

- Pharmaceuticals

- Dairy and Frozen Dessert

- Processed Foods

- Bakery and Confectionary

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, pharmaceuticals, dairy and frozen dessert, processed foods, bakery and confectionary, and others.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The competitive landscape of the Qatar cold storage warehouse market is characterized by a mix of established logistics operators, specialized cold chain service providers, and emerging regional players expanding capacity to meet rising demand. Competition is intensifying as companies focus on building modern temperature-controlled facilities, integrating automation, and adopting advanced monitoring systems to improve efficiency and reduce spoilage risks. Market participants are increasingly investing in multi chamber warehouses, energy efficient refrigeration technologies, and value-added services such as repackaging, labeling, and distribution support. Partnerships with retailers, food importers, and pharmaceutical distributors are becoming more common as operators seek long term contracts and stable utilization rates. Overall, differentiation is driven by service reliability, technical capabilities, and operational scalability.

Qatar Cold Storage Warehouse Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Refrigerated Cold Storage Warehouses, Frozen Cold Storage Warehouses |

| Temperature Ranges Covered | 0°C to 10°C, -18°C to -25°C, Below -25°C |

| Warehouse Types Covered | Private, Public |

| Applications Covered | Fruits and Vegetables, Pharmaceuticals, Dairy and Frozen Dessert, Processed Foods, Bakery and Confectionary, Others |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar cold storage warehouse market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar cold storage warehouse market on the basis of type?

- What is the breakup of the Qatar cold storage warehouse market on the basis of temperature range?

- What is the breakup of the Qatar cold storage warehouse market on the basis of warehouse type?

- What is the breakup of the Qatar cold storage warehouse market on the basis of application?

- What is the breakup of the Qatar cold storage warehouse market on the basis of region?

- What are the various stages in the value chain of the Qatar cold storage warehouse market?

- What are the key driving factors and challenges in the Qatar cold storage warehouse market?

- What is the structure of the Qatar cold storage warehouse market and who are the key players?

- What is the degree of competition in the Qatar cold storage warehouse market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar cold storage warehouse market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar cold storage warehouse market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar cold storage warehouse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)