Qatar Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2026-2034

Qatar Cybersecurity Market Overview:

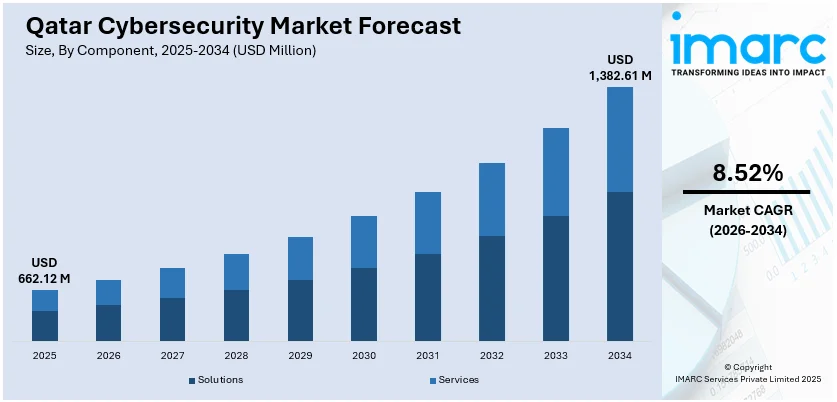

The Qatar cybersecurity market size reached USD 662.12 Million in 2025. The market is projected to reach USD 1,382.61 Million by 2034, exhibiting a growth rate (CAGR) of 8.52% during 2026-2034. The market is bolstering its cybersecurity infrastructure to facilitate the country's expanding digital infrastructure and secure important information. Greater emphasis on data protection and network security in many industries is fueling developments in cybersecurity provisions. The nation is embracing holistic approaches to improve resilience to cyber-attacks and secure safe digital operations. This emphasis on strong security solutions will drive growth and innovation within the sector, helping to expand the Qatar cybersecurity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 662.12 Million |

| Market Forecast in 2034 | USD 1,382.61 Million |

| Market Growth Rate 2026-2034 | 8.52% |

Qatar Cybersecurity Market Trends:

Government Initiatives and Strategic Investments

Qatar's administration is actively encouraging cybersecurity with strategic investment and initiative geared toward strengthening the country's digital framework. In May 2025, Invest Qatar rolled out a $1 billion investment incentive package to encourage investment in technology sectors, such as cybersecurity, cloud computing, artificial intelligence, and data innovation. The program offers financial incentives for up to 40% of costs over five years for projects in infrastructure development, automation, and sophisticated logistics. The emphasis of the program on cybersecurity is a testament to the government's determination to improve the digital resilience of the country and create a secure environment for technological growth. The attraction of investments and adoption of new technologies are expected to strengthen Qatar's position as a digital economy leader. These initiatives are poised to fuel considerable expansion in the cybersecurity industry, complementing the country's wider goals of economic diversification and innovation. The ongoing focus on cybersecurity projects is a major driver of Qatar cybersecurity market growth.

To get more information on this market Request Sample

Cybersecurity Workforce Growth and Skill Enhancement

With the development of Qatar's digital environment, there is a rising priority to increase the cybersecurity workforce and improve skill building to keep up with the rising need for cybersecurity experts. In July 2024, the Qatar University announced that it would offer a new cybersecurity training program to prepare students with the skills needed to deal with emerging cyber threats. The initiative targets fields like ethical hacking, network security, and digital forensics, engaging students in hands-on practice and topic-relevant training. The project is indicative of Qatar's aspirations to establish a strong human resource base that can secure critical infrastructure and electronic assets. Further driving the cybersecurity talent pool is the establishment of educational partnerships with industry players, leading to the development of specialist training courses and certification programs. The government backing of education programs and workforce development plays a critical role in creating a solid cybersecurity ecosystem. Qatar, through investing in human capital, is ensuring that its cybersecurity industry will be resilient and able to respond to the needs of a more interconnected digital world. This emphasis on skill building is a major Qatar cybersecurity market trend.

Enhanced Collaboration and Regulatory Regimes

Qatar is enhancing its cyber security environment by enhanced cooperation between government institutions, private sector institutions, and global partners. Such partnerships are centered on exchanging threat intelligence, best practices, and resources toward establishing a unified front against cyber threats. More robust regulatory frameworks are being formulated to support international cyber security requirements to ensure compliance with international cyber security standards to help foster data privacy and protection across all industries. Such efforts involve the development of succinct guidelines for protecting critical infrastructure and incident response techniques. Through cooperation among various stakeholders, Qatar is developing an adversarial-resilient ecosystem with the ability to predict and reduce future cyber threats. Moreover, public education initiatives and awareness campaigns are being executed to promote cybersecurity literacy among individuals and businesses. This holistic strategy not only lends itself to a safer online space but also to trust and confidence in Qatar's digitalization efforts. The consistent focus on cooperation and regulation is necessary to ensure long-term security and resilience against the developing cyber threat landscape.

Qatar Cybersecurity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, deployment type, user type and industry vertical.

Component Insights:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (identity and access management (IAM), infrastructure security, governance, risk and compliance, unified vulnerability management service offering, data security and privacy service offering, and others) and services (professional services and managed services).

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type has also been provided in the report. This includes cloud-based and on-premises.

User Type Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the user type. This includes large enterprises and small and medium enterprises.

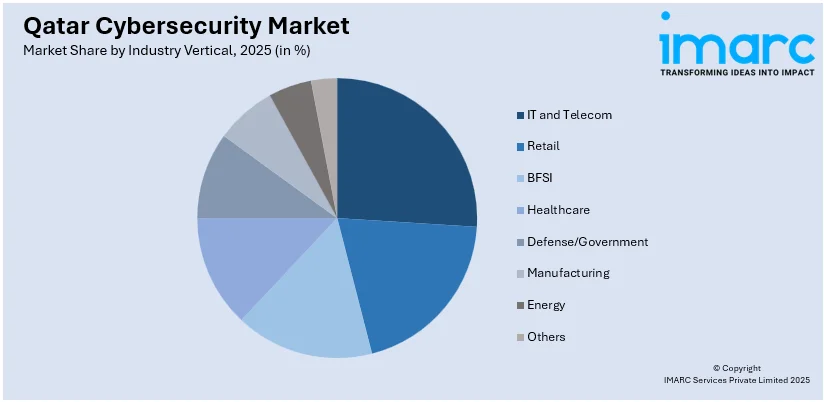

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

A detailed breakup and analysis of the market based on the industry vertical has also been provided in the report. This includes IT and telecom, retail, BFSI, healthcare, defense/government, manufacturing, energy, and others.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Cybersecurity Market News:

- June 2025: Atos, a leader in digital transformation and cybersecurity, has launched an AI-powered Security Operations Center (SOC) in Qatar. This cutting-edge SOC raises Qatar's cybersecurity strength with 24/7 Managed Detection and Response (MDR) services. With its use of cutting-edge AI and machine learning technologies, the SOC actively identifies and neutralizes emerging cyber threats. The center is blended with local expertise and Atos's worldwide network of cybersecurity experts, guaranteeing round-the-clock threat response and protection of vital digital infrastructures in the region.

Qatar Cybersecurity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar cybersecurity market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar cybersecurity market on the basis of component?

- What is the breakup of the Qatar cybersecurity market on the basis of deployment type?

- What is the breakup of the Qatar cybersecurity market on the basis of user type?

- What is the breakup of the Qatar cybersecurity market on the basis of industry vertical?

- What is the breakup of the Qatar cybersecurity market on the basis of region?

- What are the various stages in the value chain of the Qatar cybersecurity market?

- What are the key driving factors and challenges in the Qatar cybersecurity market?

- What is the structure of the Qatar cybersecurity market and who are the key players?

- What is the degree of competition in the Qatar cybersecurity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar cybersecurity market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar cybersecurity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar cybersecurity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)