Qatar Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Qatar Duty-Free and Travel Retail Market Overview:

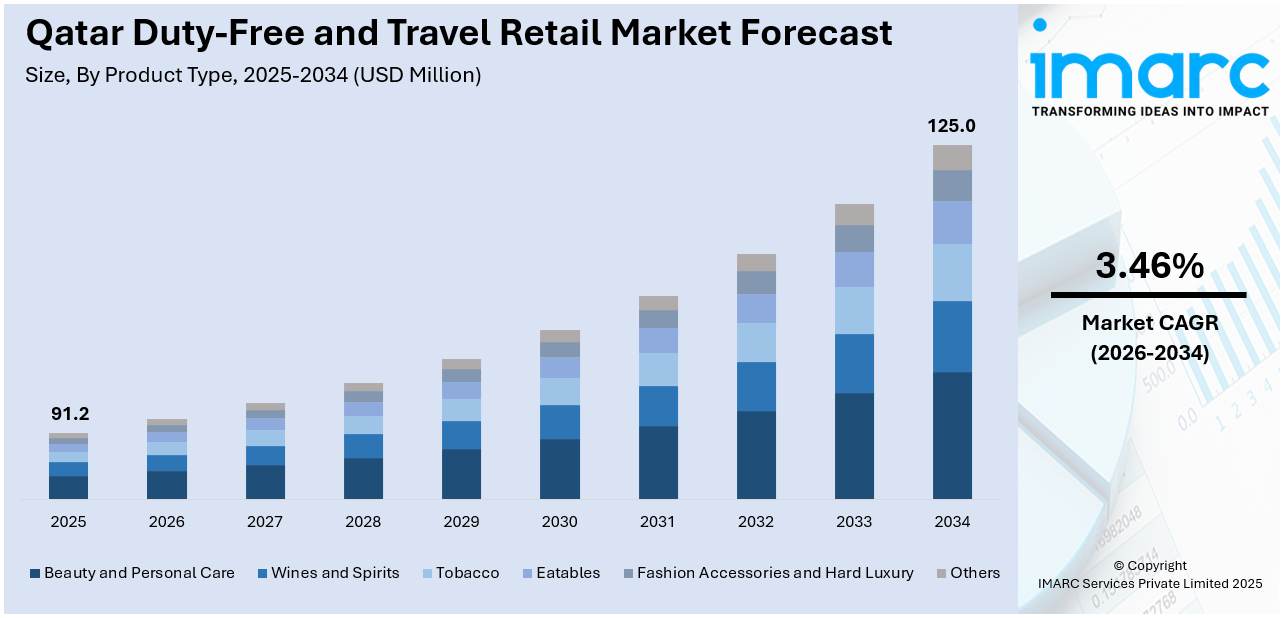

The Qatar duty-free and travel retail market size reached USD 91.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 125.0 Million by 2034, exhibiting a growth rate (CAGR) of 3.46% during 2026-2034. Rising inbound tourism, expanding Hamad International Airport, premium shopping demand, luxury brand presence, strategic location as a transit hub, rising disposable income, World Cup legacy impact, and government investments boosting retail infrastructure and traveler experiences are some of the factors contributing to the Qatar duty-free and travel retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 91.2 Million |

| Market Forecast in 2034 | USD 125.0 Million |

| Market Growth Rate 2026-2034 | 3.46% |

Qatar Duty-Free and Travel Retail Market Trends:

Strong Growth in Airport Retail

Luxury shopping at airports in Qatar shows steady strength, with spending rising faster than passenger numbers. Higher sales volumes, millions of transactions, and healthy profits show that travelers are willing to spend more time and money during stopovers or before flights. This signals that travel retail remains a resilient source of revenue for operators connected to busy hubs. Duty-free outlets benefit from high foot traffic, premium brands, and unique product ranges that attract passengers looking for value and exclusivity. Continued investment in upgraded stores, better customer service, and partnerships with global brands keeps spending levels healthy. With passenger numbers climbing, operators are likely to keep expanding retail space and adding fresh concepts to hold travelers’ interest. A combination of better airport facilities, special promotions, and rising incomes in the region supports stable spending growth in this sector, even when the wider market faces challenges. These factors are intensifying the Qatar duty-free and travel retail market growth. For example, Qatar Duty Free hit record results for the year ending 31 March, with sales up 12% year-on-year from over 15 Million transactions, beating Hamad International Airport’s 7.7% passenger growth to 52.5 Million. Part of Qatar Airways Group, QDF contributed to the group’s all-time high profit of QAR 7.85 Billion (USD 2.15 Billion), marking a 28% annual increase.

To get more information on this market Request Sample

Immersive Experiences Shaping Airport Retail

Collaborations in Qatar’s airport retail scene are moving beyond standard shopfronts. Recent projects show how brands, retailers, airports, airlines, and media can work together to create pop-ups that feel more like interactive showcases than traditional stores. Passengers are greeted with eye-catching displays, personalized service, and limited-edition products designed to make shopping part of the journey. These multi-partner campaigns turn airport terminals into premium retail zones where travelers are encouraged to spend extra time and explore new launches. Such experiences boost brand visibility and deepen customer connections right at departure gates. With long layovers and rising international traffic, immersive retail concepts are becoming a strong draw for shoppers seeking novelty. Operators see this approach as a way to lift sales and stand out from regional competition. Combining technology, design, and storytelling, these partnerships keep travelers engaged and spending, setting higher expectations for what airport shopping can deliver. For instance, in November 2024, L’Oréal Travel Retail and Qatar Duty Free launched a unique five-way partnership to boost YSL Beauty at Hamad International Airport. Running from July to October, the ‘Summer Mirage’ pop-up offered travelers an immersive retail experience. The project united airline, airport, retailer, brand, and media, setting a new standard for integrated, personalized campaigns in Qatar’s travel retail market.

Qatar Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

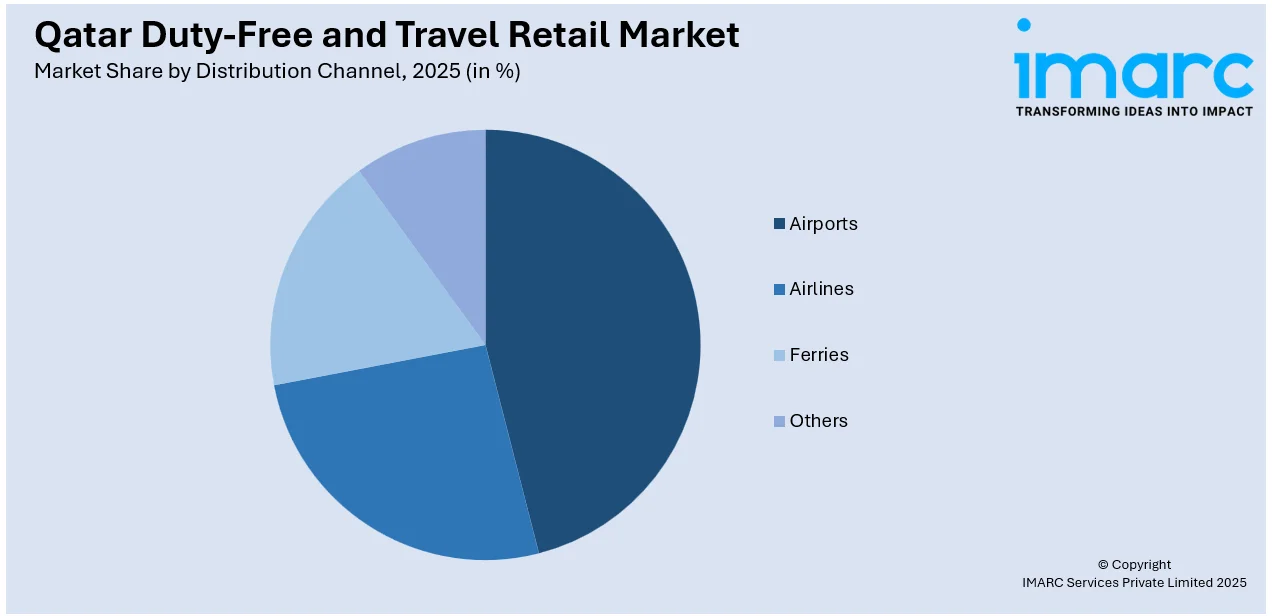

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Duty-Free and Travel Retail Market News:

- In May 2025, Qatar Duty Free marked 25 years with a tribute video celebrating its growth from a small 50-person team in 2000 to over 200 retail and dining outlets at Hamad International Airport today. Backed by 4,000 staff from 84 countries, QDF now operates across 32,889sq m of retail and F&B space, boosted by the recent launch of concourses D and E.

Qatar Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar duty-free and travel retail market on the basis of product type?

- What is the breakup of the Qatar duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Qatar duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Qatar duty-free and travel retail market?

- What are the key driving factors and challenges in the Qatar duty-free and travel retail market?

- What is the structure of the Qatar duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Qatar duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar duty-free and travel retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)