Qatar Electricity Transmission Market Size, Share, Trends and Forecast by Voltage Level, Component Type, Technology, Ownership, End User, and Region, 2026-2034

Qatar Electricity Transmission Market Summary:

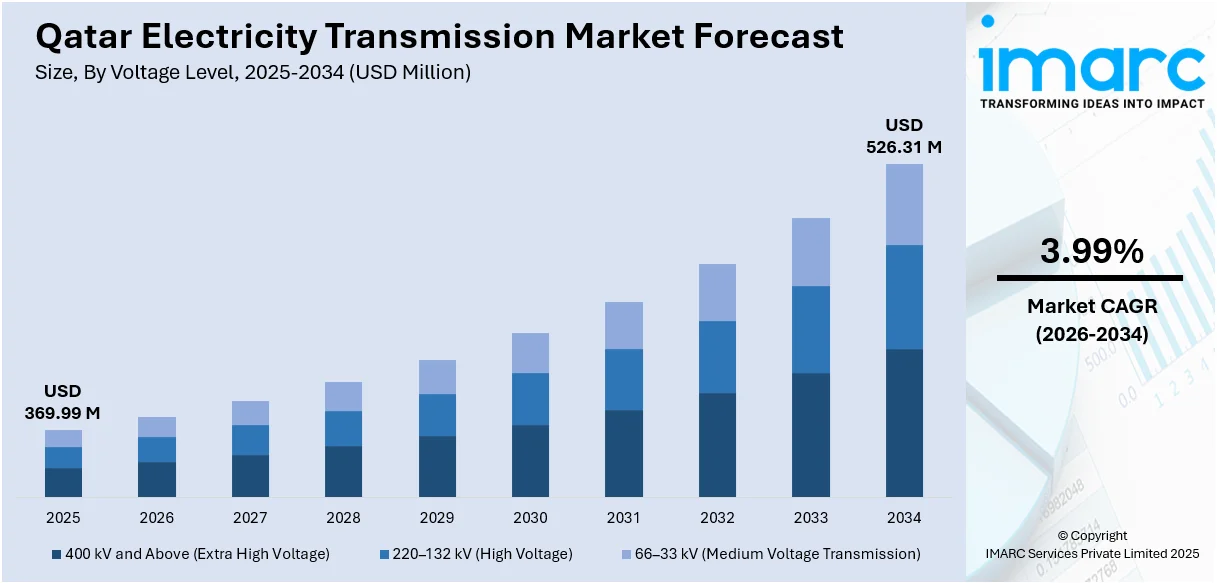

The Qatar electricity transmission market size reached USD 369.99 Million in 2025. The market is projected to reach USD 526.31 Million by 2034, growing at a CAGR of 3.99% during 2026-2034. The market is driven by substantial renewable energy integration, particularly solar power expansion requiring enhanced transmission capacity, infrastructure modernization investments through strategic projects expanding substations and transmission lines, and smart grid technology adoption enabling digital transformation of grid management systems. These developments are collectively expanding the Qatar electricity transmission market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Market Size in 2025 | USD 369.99 Million |

| Market Forecast in 2034 | USD 526.31 Million |

| Market Growth Rate (2026-2034) | 3.99% |

| Key Segments | Voltage Level (400 kV and Above (Extra High Voltage), 220–132 kV (High Voltage), 66–33 kV (Medium Voltage Transmission)), Component Type (Overhead Transmission Lines, Underground Cables, Substations, Transformers, Switchgear, Control Systems), Technology (Conventional Grid Systems, Smart Grid and Automation Solutions, SCADA and Real-time Monitoring Systems, High-voltage Direct Current (HVDC) Applications), Ownership (Public Sector, Private Sector Participation Models), End User (National Grid Operator, Power Generation Companies, Industrial and Economic Zones) |

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

Qatar Electricity Transmission Market Outlook (2026-2034):

The Qatar electricity transmission market is positioned for sustained expansion driven by ambitious renewable energy targets requiring sophisticated grid infrastructure capable of managing variable solar generation. Strategic government investments in high-voltage substations and extensive transmission networks will enhance reliability and capacity to serve rapidly developing urban areas and industrial zones. Advanced digital technologies, including artificial intelligence-powered grid management, SCADA systems, and HVDC applications, will optimize operational efficiency while supporting Qatar's energy transition objectives aligned with Qatar National Vision 2030 sustainability commitments.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence is revolutionizing Qatar's electricity transmission operations through advanced predictive maintenance, real-time demand forecasting, and automated load balancing capabilities. Kahramaa's collaboration with Microsoft and KPMG has established a comprehensive AI-powered platform for operational optimization, while Iberdrola Innovation Middle East's AI solutions are enhancing network efficiency. These technologies enable sophisticated renewable energy integration, minimize transmission losses, and improve grid stability, positioning AI as a critical enabler for Qatar's sustainable energy infrastructure modernization throughout the forecast period.

Market Dynamics:

Key Market Trends & Growth Drivers:

Renewable Energy Integration Driving Transmission Infrastructure Expansion

Qatar's ambitious solar power expansion is fundamentally reshaping electricity transmission requirements and driving substantial infrastructure investments. The country has prioritized renewable energy development as part of Qatar National Vision 2030, with solar projects becoming increasingly central to the national energy mix. In May 2025, QatarEnergy successfully commissioned 875 megawatts of solar capacity through its Ras Laffan and Mesaieed solar power projects, with both facilities beginning electricity production. These projects elevated Qatar's total operational solar capacity to approximately 1,675 megawatts and are expected to meet around 15 percent of the country's total peak power demand, marking a substantial advancement in renewable energy integration that necessitates enhanced transmission infrastructure to accommodate variable solar generation patterns. The intermittent nature of solar power generation requires sophisticated grid management capabilities, bidirectional power flow management, and enhanced transmission capacity to distribute solar-generated electricity from remote generation sites to urban consumption centers. This transition is compelling transmission operators to upgrade voltage management systems, install advanced monitoring equipment, and expand high-voltage transmission corridors. The integration of large-scale solar facilities also demands robust interconnection infrastructure, including dedicated substations and reinforced transmission lines capable of handling fluctuating generation profiles. As Qatar continues pursuing its renewable energy targets, transmission infrastructure will require continuous expansion and technological enhancement to maintain grid stability while maximizing clean energy utilization, fundamentally driving the Qatar electricity transmission market growth.

Strategic Infrastructure Modernization and Network Expansion Investments

Qatar is undertaking comprehensive electricity transmission infrastructure modernization to support rapid urbanization, economic diversification, and growing electricity demand across residential, commercial, and industrial sectors. The country's strategic location, hosting major events, and ongoing development projects are generating unprecedented electricity requirements necessitating expanded transmission capacity. In May 2025, Qatar General Electricity and Water Corporation (Kahramaa) signed four strategic contracts valued at nearly 3.1 billion Qatari riyals with Elsewedy Cables Qatar Company, Voltage Engineering, Best and Betash Consortium, and Taihan Cable & Solution. The contracts stipulate the construction of seven high-voltage substations along with 212 kilometers of underground cables and overhead transmission lines to connect these substations, representing a significant investment in expanding and modernizing the country's electricity transmission network to accommodate growing electricity demand from urban development. These infrastructure projects demonstrate Kahramaa's commitment to proactive capacity expansion, ensuring adequate transmission infrastructure precedes demand growth rather than reacting to capacity constraints. The investments encompass both underground and overhead transmission solutions, reflecting geographical considerations and urban planning requirements across different regions. Notably, the contracts allocated 58.4 percent of the total value to Qatari companies, supporting local private sector development while building national technical capabilities in transmission infrastructure construction and maintenance. The substations and transmission lines will incorporate modern technologies including advanced protection systems, remote monitoring capabilities, and automation features that enhance operational efficiency and reliability. As Qatar continues developing new residential communities, industrial zones, and commercial districts, sustained infrastructure investment will remain essential for maintaining reliable electricity supply, positioning transmission network expansion as a fundamental market driver throughout the forecast period.

Digital Transformation Through Smart Grid and Advanced Control Technologies

Qatar is advancing the modernization of its electricity transmission network through the integration of smart grid technologies, automation systems, and advanced digital control platforms. This transformation marks a shift from traditional grid operations toward intelligent, interconnected systems capable of managing dynamic electricity flows with greater efficiency and precision. The recent regional collaboration to upgrade interconnection infrastructure with cutting-edge digital control and protection technologies highlights Qatar’s commitment to enhancing cross-border power exchange, improving grid stability, and increasing operational flexibility. Smart grid adoption enables real-time monitoring through supervisory control systems, advanced metering for detailed consumption insights, and automated switching that can quickly isolate faults and restore power flow. These innovations provide transmission operators with greater situational awareness and operational agility, allowing for predictive maintenance, faster response to disruptions, and optimized use of grid assets. Qatar’s grid modernization efforts also prioritize cybersecurity, resilient communication networks, and advanced data analytics to convert operational information into actionable insights. The integration of artificial intelligence and machine learning further strengthens forecasting, renewable integration, and maintenance planning. As power systems evolve with distributed generation and growing renewable capacity, smart grid technologies will play a central role in ensuring reliable transmission performance and driving ongoing investment in Qatar’s energy infrastructure.

Key Market Challenges:

Managing Renewable Energy Intermittency and Grid Stability

The rapid integration of solar power generation presents significant technical challenges for transmission system operators in maintaining grid stability and power quality. Solar energy production fluctuates based on weather conditions, time of day, and seasonal variations, creating voltage fluctuations and frequency deviations that can compromise grid stability if not properly managed. Unlike conventional thermal power plants that provide consistent baseload generation and inherent grid stabilization through rotating generators, solar photovoltaic systems lack mechanical inertia and can inject highly variable power into transmission networks. This intermittency requires transmission operators to maintain substantial reserve capacity, implement sophisticated voltage regulation equipment, and deploy advanced forecasting systems to anticipate generation variations. The challenge intensifies during rapid weather changes when solar generation can drop dramatically within minutes, necessitating immediate compensatory generation from backup sources or energy storage systems. Qatar's transmission infrastructure must accommodate these rapid power flow changes while maintaining voltage and frequency within acceptable tolerances across all network segments. Additionally, the geographical concentration of solar facilities in specific locations creates transmission congestion risks, where transmission line capacity may become insufficient during peak solar generation periods. Addressing these challenges requires substantial investments in grid flexibility measures including battery energy storage systems, demand response programs, enhanced interconnection capacity with neighboring countries, and advanced grid management systems capable of real-time optimization. Without effective mitigation strategies, renewable energy intermittency could constrain further solar capacity additions and compromise the reliability that consumers and industries expect from Qatar's electricity system.

Cybersecurity Threats to Critical Electricity Infrastructure

The increasing digitalization of electricity transmission systems and adoption of interconnected smart grid technologies expose Qatar's critical infrastructure to sophisticated cyber threats that could potentially disrupt electricity supply. Modern transmission networks rely extensively on networked control systems, SCADA platforms, remote terminal units, and communication infrastructure that create multiple potential entry points for cyberattacks. State-sponsored actors, criminal organizations, and hackers continuously target electricity infrastructure due to its strategic importance and potential for widespread disruption. Successful cyberattacks could manipulate grid operations, cause equipment damage, trigger cascading failures, or create widespread blackouts affecting critical facilities including hospitals, water treatment plants, communication systems, and industrial operations. The interconnection with neighboring GCC countries through the Gulf Cooperation Council Interconnection Authority creates additional cybersecurity considerations, as vulnerabilities in any member state's systems could potentially affect the broader regional network. Protecting transmission infrastructure requires comprehensive cybersecurity strategies encompassing network segmentation, intrusion detection systems, continuous security monitoring, regular vulnerability assessments, employee training programs, and incident response protocols. The challenge intensifies as transmission operators adopt cloud computing platforms, artificial intelligence tools, and Internet of Things devices that expand the attack surface. International standards including IEC 62351 for power system communications security and NERC CIP requirements provide frameworks, but implementation requires sustained investment, specialized expertise, and ongoing vigilance against evolving threats. As Qatar's transmission infrastructure becomes increasingly dependent on digital technologies, cybersecurity will remain a persistent challenge requiring continuous adaptation and resource allocation to protect critical electricity supply systems.

Aging Infrastructure Components Requiring Systematic Replacement

Despite Qatar's relatively modern electricity infrastructure compared to many countries, certain transmission system components are approaching the end of their design life and require systematic replacement to maintain reliability and prevent service disruptions. Transformers, circuit breakers, protective relays, and transmission conductors installed during earlier development phases may lack the capacity, efficiency, and technological capabilities required for contemporary grid operations. Aging equipment experiences higher failure rates, increased maintenance requirements, and reduced operational flexibility compared to modern alternatives incorporating digital technologies and advanced materials. The challenge involves balancing ongoing maintenance of existing assets with strategic replacement programs that minimize service disruptions while optimizing capital expenditure. Deferred maintenance or delayed replacement can result in catastrophic equipment failures, extended outages, and costly emergency repairs that far exceed planned replacement costs. Qatar's harsh climatic conditions, including extreme temperatures, humidity, and dust exposure, accelerate equipment degradation and shorten operational lifespans compared to temperate regions. Transmission operators must conduct comprehensive asset health assessments, prioritize replacement based on condition monitoring data and criticality analysis, and coordinate replacement projects with system operations to maintain continuous electricity supply. The financial burden of systematic infrastructure renewal competes with expansion requirements for serving new developments and integrating renewable energy. Additionally, replacement projects must incorporate modern standards, environmental considerations, and future capacity requirements rather than simply replicating existing infrastructure. Successfully managing aging infrastructure requires strategic asset management frameworks, predictive maintenance technologies, adequate budgetary allocations, and coordination between planning, engineering, and operations departments to ensure Qatar's transmission system maintains high reliability standards while accommodating future growth and technological evolution.

Qatar Electricity Transmission Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar electricity transmission market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on voltage level, component type, technology, ownership, and end user.

Analysis by Voltage Level:

- 400 kV and Above (Extra High Voltage)

- 220–132 kV (High Voltage)

- 66–33 kV (Medium Voltage Transmission)

The report has provided a detailed breakup and analysis of the market based on the voltage level. This includes 400 kV and above (extra high voltage), 220–132 kV (high voltage), and 66–33 kV (medium voltage transmission).

Analysis by Component Type:

- Overhead Transmission Lines

- Underground Cables

- Substations

- Transformers

- Switchgear

- Control Systems

A detailed breakup and analysis of the market based on the component type have also been provided in the report. This includes overhead transmission lines, underground cables, substations, transformers, switchgear, and control systems.

Analysis by Technology:

- Conventional Grid Systems

- Smart Grid and Automation Solutions

- SCADA and Real-time Monitoring Systems

- High-voltage Direct Current (HVDC) Applications

The report has provided a detailed breakup and analysis of the market based on the technology. This includes conventional grid systems, smart grid and automation solutions, SCADA and real-time monitoring systems, and high-voltage direct current (HVDC) applications.

Analysis by Ownership:

- Public Sector

- Private Sector Participation Models

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes public sector and private sector participation models.

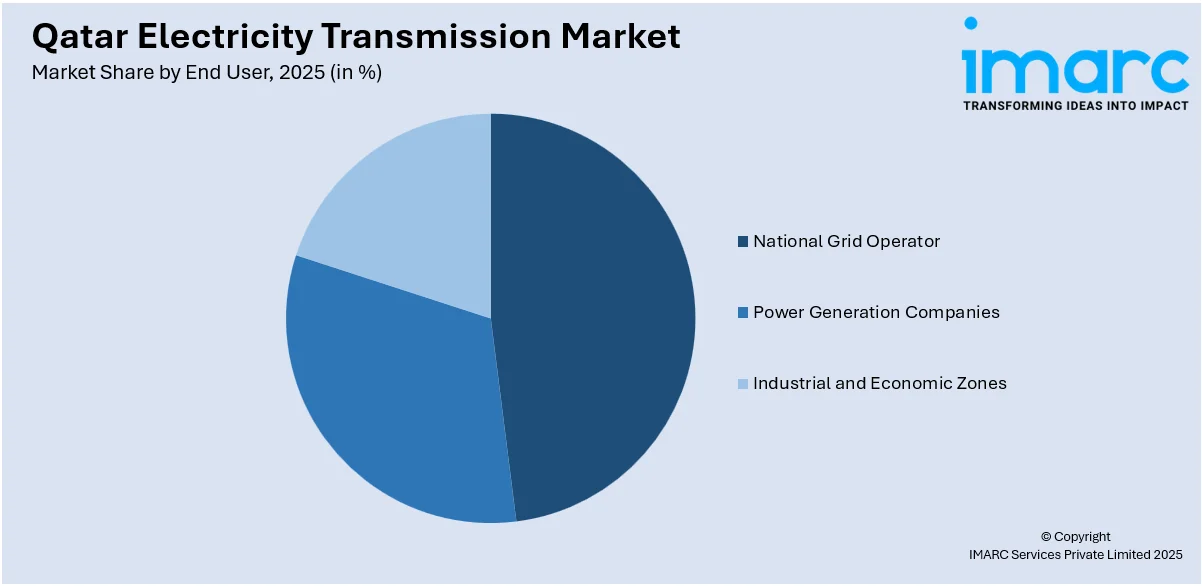

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- National Grid Operator

- Power Generation Companies

- Industrial and Economic Zones

The report has provided a detailed breakup and analysis of the market based on the end user. This includes national grid operator, power generation companies, and industrial and economic zones.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar electricity transmission market exhibits a highly concentrated structure dominated by state-owned enterprises and public sector entities, with Qatar General Electricity and Water Corporation (Kahramaa) serving as the primary transmission system operator and infrastructure developer. The market operates under a regulated framework where government entities control strategic infrastructure assets, establish technical standards, and oversee network expansion projects aligned with national energy policies. Competition primarily manifests through engineering, procurement, and construction contract tenders where international technology providers, equipment manufacturers, and local contractors compete to deliver transmission infrastructure projects. International companies including Hitachi Energy, Siemens Energy, ABB, and General Electric provide advanced equipment and technological solutions, while regional contractors and Qatari companies participate in construction and installation activities. The competitive dynamics increasingly emphasize technological capabilities, particularly in smart grid solutions, digital automation, and renewable energy integration technologies.

Qatar Electricity Transmission Industry Latest Developments:

- May 2025: Qatar General Electricity and Water Corporation (Kahramaa) signed four strategic infrastructure contracts worth nearly 3.1 billion Qatari riyals with Elsewedy Cables Qatar Company, Voltage Engineering, Best and Betash Consortium, and Taihan Cable & Solution for the construction of seven high-voltage substations and 212 kilometers of transmission lines. The contracts allocated 58.4 percent of the total value to Qatari companies, reflecting Kahramaa's policy of supporting local private sector participation while expanding transmission capacity to meet growing electricity demand.

Qatar Electricity Transmission Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Voltage Levels Covered | 400 kV and Above (Extra High Voltage), 220–132 kV (High Voltage), 66–33 kV (Medium Voltage Transmission) |

| Component Types Covered | Overhead Transmission Lines, Underground Cables, Substations, Transformers, Switchgear, Control Systems |

| Technologies Covered | Conventional Grid Systems, Smart Grid and Automation Solutions, SCADA and Real-time Monitoring Systems, High-voltage Direct Current (HVDC) Applications |

| Ownership Covered | Public Sector, Private Sector Participation Models |

| End Users Covered | National Grid Operator, Power Generation Companies, Industrial and Economic Zones |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar electricity transmission market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar electricity transmission market on the basis of voltage level?

- What is the breakup of the Qatar electricity transmission market on the basis of component type?

- What is the breakup of the Qatar electricity transmission market on the basis of technology?

- What is the breakup of the Qatar electricity transmission market on the basis of ownership?

- What is the breakup of the Qatar electricity transmission market on the basis of end user?

- What is the breakup of the Qatar electricity transmission market on the basis of region?

- What are the various stages in the value chain of the Qatar electricity transmission market?

- What are the key driving factors and challenges in the Qatar electricity transmission market?

- What is the structure of the Qatar electricity transmission market and who are the key players?

- What is the degree of competition in the Qatar electricity transmission market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar electricity transmission market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar electricity transmission market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar electricity transmission industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)