Qatar Film and Entertainment Market Size, Share, Trends and Forecast by Type, Genre, Revenue Source, Distribution Channel, Language, End User, and Region, 2026-2034

Qatar Film and Entertainment Market Summary:

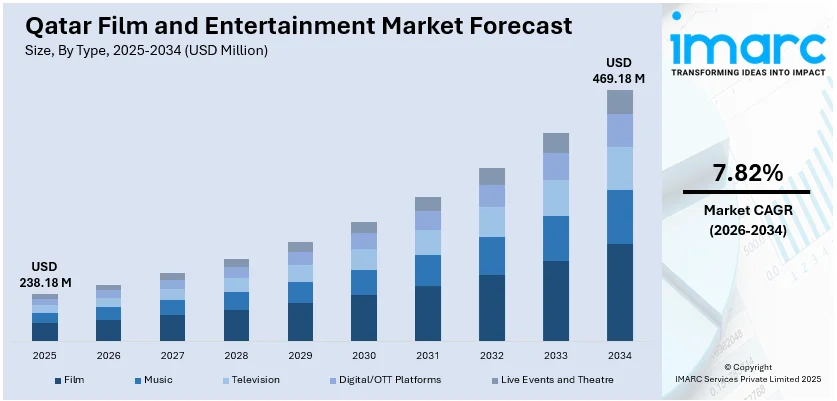

The Qatar film and entertainment market size reached USD 238.18 Million in 2025. The market is projected to reach USD 469.18 Million by 2034, growing at a CAGR of 7.82% during 2026-2034. The market is driven by substantial government investment in cultural infrastructure and production facilities aligned with Qatar National Vision 2030, the rapid expansion of digital streaming platforms offering localized and international content, and strategic partnerships between regional media entities and global entertainment powerhouses enhancing content diversity. These developments are collectively expanding the Qatar film and entertainment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 238.18 Million |

| Market Forecast in 2034 | USD 469.18 Million |

| Market Growth Rate 2026-2034 | 7.82% |

Qatar Film and Entertainment Market Outlook (2026-2034):

The Qatar film and entertainment market is positioned for robust growth, propelled by the government's strategic emphasis on cultural development as a cornerstone of economic diversification under Qatar National Vision 2030. Ongoing investments in world-class production infrastructure, including advanced studios and post-production facilities, are creating a conducive environment for both local and international content creators. The proliferation of digital streaming platforms with culturally appropriate content offerings is expanding accessibility and consumer choice, while strategic international partnerships are elevating content quality and variety, supporting sustained market expansion throughout the forecast period.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence is gradually being integrated into Qatar's entertainment ecosystem, primarily through content recommendation algorithms on streaming platforms and automated translation services for multilingual content delivery. As AI technologies mature, they are expected to play an increasingly significant role in audience analytics, personalized content curation, production workflow optimization, and real-time language dubbing and subtitling. These advancements will enhance viewer experiences and operational efficiency, though adoption remains in early stages compared to more established global markets.

Market Dynamics:

Key Market Trends & Growth Drivers:

Government-Led Infrastructure Investment Driving Production Capabilities

The Qatari government is making significant investments in world-class film and entertainment infrastructure as part of its broader economic diversification goals under Qatar National Vision 2030. This initiative focuses on developing state-of-the-art production and post-production facilities, supported by institutional frameworks that foster local creative talent. Katara Studios exemplifies this vision, offering comprehensive film production services, from casting and set design to wardrobe and post-production, and showcasing Qatar’s ability to meet international production standards. The studio’s work on the 2022 FIFA World Cup ceremonies and its unveiling of multiple feature films at international festivals highlight its growing global presence. Complementing this infrastructure, the Doha Film Institute (DFI) plays a pivotal role in nurturing filmmakers through funding, mentorship, and global networking programs, contributing to the development of hundreds of film projects across all stages of production. These initiatives collectively strengthen Qatar’s position as a regional hub for film and media production, generating employment opportunities, attracting international collaborations, and fostering a sustainable creative economy capable of competing at the global level.

Rapid Expansion of Digital and OTT Platform Penetration

The digital entertainment landscape in Qatar is experiencing transformative growth driven by widespread high-speed internet connectivity and evolving consumer preferences for on-demand content consumption. Streaming platforms are proliferating across the market, offering diverse content libraries that span Arabic, Turkish, and international programming tailored to regional tastes. Major platforms operating in the market include TOD, a subscription-based OTT platform that delivers exclusive access to beIN Sports' live sports content alongside 35,000-plus hours of premium entertainment including blockbusters, Arabic and Turkish series, and children's programming. International services like Netflix, Shahid, and StarzPlay have also established significant presence, adapting their content offerings to align with local preferences and regulatory requirements. The COVID-19 pandemic accelerated this trend, with lockdowns and restrictions leading to a surge in streaming subscriptions as consumers spent more time at home, demonstrating both increased consumption of digital content and willingness to pay for premium services. The Qatar film and entertainment market growth is further supported by telecom operators facilitating payment methods, localization of offers in terms of language and pricing, and platform differentiation in specific premium segments, allowing for multiple subscriptions per household. Streaming platforms are implementing sophisticated content recommendation systems, multilingual interfaces, and culturally appropriate programming strategies to maximize audience engagement across Qatar's diverse demographic landscape.

Strategic International Partnerships Enhancing Content Diversity

Major Qatari media entities are forging strategic alliances with global entertainment powerhouses, significantly enhancing content offerings and expanding market reach. These partnerships enable access to premium international programming while creating co-production opportunities that blend regional storytelling with global production values. beIN Media Group, Qatar's state-owned global sports and entertainment network headquartered in Doha, has established partnerships with leading international content providers, including BBC Studios, Warner Bros., CBS, DreamWorks Animation, and Discovery. The group's full acquisition of Miramax in 2016, combined with extensive broadcasting rights portfolios spanning sports and entertainment, demonstrates Qatar's ambition to serve as a bridge between regional audiences and international content. In October 2024, Paramount Global signed a multi-year volume deal with beIN Media Group to boost content available on the TOD streaming platform across the Middle East, North Africa, and Turkey, granting exclusive access to Paramount's extensive library of movies and series and strengthening TOD's competitive position with a 4 percent share of the MENA streaming market. Additionally, in May 2025, Qatar positioned itself as a potential financing partner for Hollywood through high-level discussions at the Cannes Film Festival, with the Qatar Film Committee initiating conversations with US entertainment executives about co-financing and producing original content, as Hollywood seeks new financing sources amid tightening studio budgets. These international collaborations are not limited to content licensing but extend to co-productions, technical expertise sharing, and capacity building initiatives that elevate local production standards while ensuring content resonates with both regional and international audiences.

Key Market Challenges:

Content Censorship and Regulatory Compliance Requirements

The Qatar entertainment sector operates within a comprehensive regulatory framework designed to ensure content aligns with national cultural, religious, and moral values. All film and entertainment content distributed in Qatar undergoes review processes by government bodies, including the Censorship Committee, which evaluates material for adherence to established guidelines. These regulations encompass restrictions on content related to political criticism of the government or ruling family, religious sensitivities, romantic or intimate content, violent material, and topics considered contrary to societal norms. For filmmakers and content distributors, this regulatory environment necessitates careful content curation and often results in edited versions of international films and television programs. Film festival organizers, including the Doha Film Institute, face particular challenges in presenting artistic works in their entirety, as censorship requirements can impact the authentic presentation of films selected for screening. This regulatory complexity extends to digital platforms, where streaming services must balance international content libraries with local compliance requirements. The 2014 Cybercrime Prevention Law introduced additional considerations, including potential penalties for publishing information deemed to violate social values or harm national interests. While these regulations aim to maintain societal harmony and protect cultural identity, they create operational complexities for content creators and distributors who must navigate approval processes, potentially adapt content for local consumption, and ensure all offerings meet regulatory standards before distribution.

Balancing International Content Appeal with Local Cultural Relevance

Content providers in Qatar face the multifaceted challenge of curating entertainment offerings that satisfy diverse audience preferences while maintaining cultural appropriateness and regulatory compliance. The market's demographic composition, which includes Qatari nationals alongside substantial expatriate populations from Arab nations, Asia, and Western countries, creates varied content consumption patterns and expectations. Streaming platforms and broadcasters must develop strategies that provide sufficient diversity to attract broad audiences while ensuring all content aligns with local sensitivities. This balancing act requires substantial investment in content licensing negotiations, rights management systems, and localization efforts, including Arabic dubbing, subtitling, and cultural adaptation. Additionally, the challenge extends to developing original productions that authentically represent Qatari and regional stories while possessing production values and narrative approaches that enable international distribution and commercial viability. The need for seamless user experiences across various devices and network conditions, combined with evolving consumer preferences for personalized viewing, adds technological complexity to content delivery strategies. Monetization approaches must account for regional pricing sensibilities, payment method preferences, and competitive dynamics among multiple platform providers. The relatively small domestic market size compared to major regional neighbors necessitates that locally-produced content achieve production quality and storytelling appeal sufficient for export to larger markets to ensure economic sustainability.

Development of Sustainable Domestic Production Ecosystem

Despite significant government investment and institutional support, Qatar's domestic entertainment production infrastructure is still evolving compared to established global production centers. Building a comprehensive and sustainable value chain that encompasses all aspects of content creation, from scriptwriting and pre-production through filming, post-production, and distribution, requires continued ecosystem development. The domestic talent pool, while growing through initiatives like DFI's training programs, workshops, and mentorship opportunities at events like Qumra, needs ongoing nurturing to achieve the depth and breadth required for scaled production activity. Challenges include attracting and retaining experienced professionals across specialized roles, developing sufficient production service companies to support multiple concurrent projects, and creating sustainable career pathways that prevent talent migration to larger regional markets. Additionally, the domestic market's limited size creates economic constraints on local-language productions, necessitating regional or international distribution strategies for commercial viability. While government grants and institutional support provide crucial financial backing, developing diverse financing mechanisms including private investment, co-production arrangements, and commercial revenue streams, remains an ongoing priority for achieving long-term industry sustainability and reducing dependency on public funding.

Qatar Film and Entertainment Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar film and entertainment market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on type, genre, revenue source, distribution channel, language, and end user.

Analysis by Type:

- Film

- Music

- Television

- Digital/OTT Platforms

- Live Events and Theatre

The report has provided a detailed breakup and analysis of the market based on the type. This includes film, music, television, digital/OTT platforms, and live events and theatre.

Analysis by Genre:

- Action

- Drama

- Comedy

- Horror

- Documentary

- Others

A detailed breakup and analysis of the market based on the genre have also been provided in the report. This includes action, drama, comedy, horror, documentary, and others.

Analysis by Revenue Source:

- Box Office Revenue

- Advertising Revenue

- Subscription Fees

- Sponsorship and Brand Partnerships

- Merchandising and Ancillary Sales

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes box office revenue, advertising revenue, subscription fees, sponsorship and brand partnerships, and merchandising and ancillary sales.

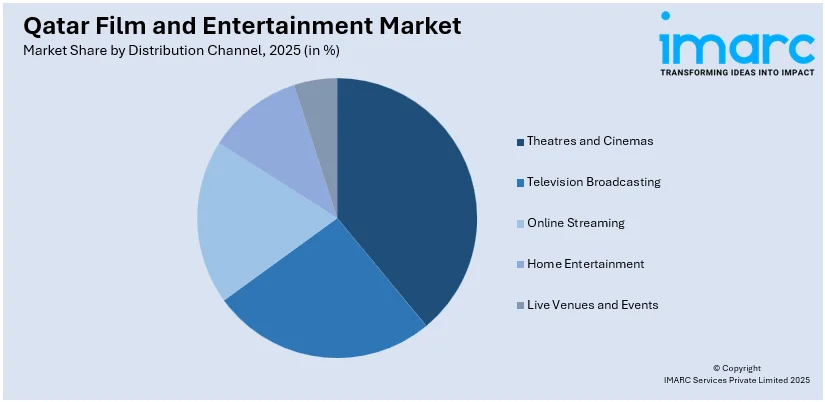

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Theatres and Cinemas

- Television Broadcasting

- Online Streaming

- Home Entertainment

- Live Venues and Events

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes theatres and cinemas, television broadcasting, online streaming, home entertainment, and live venues and events.

Analysis by Language:

- Arabic

- English

- Others

The report has provided a detailed breakup and analysis of the market based on the language. This includes Arabic, English, and others.

Analysis by End User:

- Kids and Family

- Teenagers and Young Adults

- Adults

- Senior Citizens

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes kids and family, teenagers and young adults, adults, and senior citizens.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar film and entertainment market exhibits a unique competitive structure characterized by a mix of government-supported institutions, international platform operators, and emerging local content creators. Major cinema operators including VOX Cinemas and Novo Cinemas dominate the theatrical exhibition segment with modern multiplex facilities featuring premium viewing experiences such as IMAX, 4DX, and VIP auditoriums. The streaming and broadcasting landscape is anchored by beIN Media Group, Qatar's state-owned global network that operates both traditional broadcasting channels and the TOD digital platform, commanding significant market presence through exclusive sports and entertainment content rights. International OTT platforms including Netflix, Shahid, and StarzPlay compete for subscriber growth through content differentiation and localization strategies. On the production side, Katara Studios and the Doha Film Institute represent Qatar's institutional commitment to developing local content creation capabilities, with both entities actively producing original content and supporting emerging filmmakers through funding and technical resources. The competitive environment is characterized by substantial barriers to entry given regulatory requirements, significant capital investment needs for quality production, and the advantages held by established players with existing content libraries and distribution infrastructure.

Qatar Film and Entertainment Industry Latest Developments:

- December 2024: Katara Studios unveiled a four-picture production slate at the Red Sea International Film Festival in Jeddah, marking the studio's first major international roadshow event. The lineup includes "Sakhr," a biopic of Kuwaiti tech pioneer Mohamed Al Sharekh who developed the first Arabic language operating system; "Sari & Amira," a fantasy epic by Qatari filmmaker A.J. Al Thani; "Sa3oud Wainah," a mystery thriller with an all-Qatari cast; and "Anne Everlasting," a documentary about Anne Lorimor who climbed Mount Kilimanjaro at 89. The announcement demonstrates Qatar's expanding production capabilities and ambitions for international content distribution.

- October 2024: beIN Media Group signed a multi-year volume deal with Paramount Global, significantly expanding the content available on the TOD streaming platform across the Middle East, North Africa, and Turkey. The agreement grants beIN exclusive media rights to Paramount's extensive library of movies and series, strengthening the platform's competitive position in the regional streaming market where TOD currently holds a 4 percent market share through its combination of premium sports and scripted entertainment content.

Qatar Film and Entertainment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Film, Music, Television, Digital/OTT Platforms, Live Events and Theatre |

| Genres Covered | Action, Drama, Comedy, Horror, Documentary, Others |

| Revenue Sources Covered | Box Office Revenue, Advertising Revenue, Subscription Fees, Sponsorship and Brand Partnerships, Merchandising and Ancillary Sales |

| Distribution Channels Covered | Theatres and Cinemas, Television Broadcasting, Online Streaming, Home Entertainment, Live Venues and Events |

| Languages Covered | Arabic, English, Others |

| End Users Covered | Kids and Family, Teenagers and Young Adults, Adults, Senior Citizens |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar film and entertainment market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar film and entertainment market on the basis of type?

- What is the breakup of the Qatar film and entertainment market on the basis of genre?

- What is the breakup of the Qatar film and entertainment market on the basis of revenue source?

- What is the breakup of the Qatar film and entertainment market on the basis of distribution channel?

- What is the breakup of the Qatar film and entertainment market on the basis of language?

- What is the breakup of the Qatar film and entertainment market on the basis of end user?

- What is the breakup of the Qatar film and entertainment market on the basis of region?

- What are the various stages in the value chain of the Qatar film and entertainment market?

- What are the key driving factors and challenges in the Qatar film and entertainment market?

- What is the structure of the Qatar film and entertainment market and who are the key players?

- What is the degree of competition in the Qatar film and entertainment market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar film and entertainment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar film and entertainment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar film and entertainment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)