Qatar Foodservice Market Size, Share, Trends and Forecast by Foodservice Type, Outlet, Location, and Region, 2026-2034

Qatar Foodservice Market Overview:

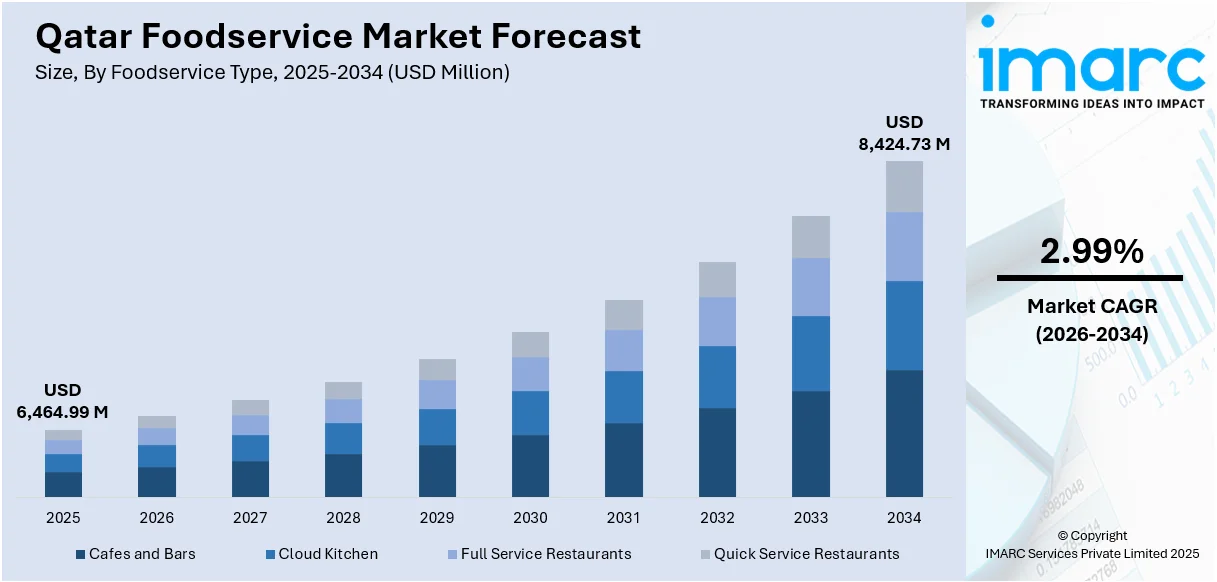

The Qatar foodservice market size reached USD 6,464.99 Million in 2025. The market is projected to reach USD 8,424.73 Million by 2034, exhibiting a growth rate (CAGR) of 2.99% during 2026-2034. The market is experiencing steady growth, driven by shifting consumer preferences, increasing urbanization, and increased demand for diversified dining options. Enhanced tourism activity and economic growth have introduced international and local foodservice players to expand. Menu innovation, online ordering, and delivery services are also transforming the way people are consuming food in the country. With continuous investment in lifestyle and hospitality infrastructure, the sector is poised for expansion. These are all interrelated to determine the Qatar foodservice market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6,464.99 Million |

| Market Forecast in 2034 | USD 8,424.73 Million |

| Market Growth Rate 2026-2034 | 2.99% |

Qatar Foodservice Market Trends:

Increased Demand from Tourist Flows

Qatar's foodservice sector is steadily growing, led in significant part by the increasing number of international travelers. With the country continuing to establish itself as a world destination for business, culture, and sport, demand for distinct and quality dining is growing across all channels. Foodservice businesses are becoming more concerned with delivering richer customer experiences through customized offerings that resonate with residents as well as visitors. From high-end restaurants to cafes in busy locations, the focus is moving towards presenting authentic, globally sourced cuisine with local flavors. This is most prominent in districts around airports, entertainment, and hospitality districts, where food establishments are gearing up to cater to the numbers and tastes of an international crowd. In March 2024, Qatar passed a key milestone in visitor arrivals, further solidifying the nation's rising appeal and its direct impact on the restaurant and hospitality industries. With this growth ongoing, operators are discovering new opportunities to expand and diversify their business. The Qatar foodservice market trends are likely to keep pace with the trend of visitor growth, underlining the sector's long-term strategic relevance.

To get more information on this market Request Sample

Digital and Delivery‑First Approaches

Digital innovation is becoming a defining element of how foodservice operates and grows in Qatar. With increasing smartphone penetration and consumer comfort with online transactions, more diners are opting for app-based ordering, real-time delivery tracking, and digital payment solutions. Operators are actively investing in cloud kitchens and automated workflows to streamline service and reduce operational overhead. These delivery-first models allow for quicker market expansion without the limitations of traditional brick-and-mortar outlets. In January 2025, digital service platforms across Qatar reported a noticeable surge in user activity, reflecting the shift toward convenience-led dining behavior. Beyond delivery, the use of data analytics is enabling personalized marketing and better inventory planning, which contributes to higher efficiency and customer satisfaction. Additionally, loyalty programs and subscription models are gaining popularity, deepening consumer engagement and repeat business. These advancements are shaping a more agile, customer-centric foodservice ecosystem across the country. Overall, the Qatar foodservice market growth is being driven by physical expansion and by how effectively businesses integrate digital capabilities into their core strategies.

Health, Sustainability and Local Sourcing

Consumer tastes in Qatar are increasingly moving toward healthier, more environmentally friendly food options, transforming the way foodservice operators create menus and manage sourcing strategies. Increased demand is being seen for plant-based foods, clean-label products, and menus supportive of well-being-centric lifestyles. Meanwhile, sustainability is affecting operational choices reducing food waste, going green on packaging and using locally sourced suppliers whenever possible. These changes are more than trends; they are an indication of a deeper cultural compatibility with health and environmental consciousness. Local sourcing is of particular significance as operators seek to reduce supply chains, advance national goals for food security, and provide fresher, more traceable offerings to consumers. Government campaigns in support of agricultural self-sufficiency are driving this movement forward, pushing foodservice companies to align with domestic suppliers. The outcome is a market that prizes transparency, nutrition, and geographic authenticity. While consumers increasingly look for dining experiences that align with their values, Qatar foodservice market trends increasingly focus on sustainability, wellness, and the incorporation of local ingredients in mainstream offerings.

Qatar Foodservice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on foodservice type, outlet, and location.

Foodservice Type Insights:

- Cafes and Bars

- Cuisine Type

- Bars and Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- Cuisine Type

- Cloud Kitchen

- Full Service Restaurants

- Cuisine Type

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- Cuisine Type

- Quick Service Restaurants

- Cuisine Type

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

- Cuisine Type

The report has provided a detailed breakup and analysis of the market based on the foodservice type. This includes cafes and bars [cuisine type (bars and pubs, cafes, juice/smoothie/desserts bars, and specialist coffee and tea shops)], cloud kitchen, full service restaurants [cuisine type (Asian, European, Latin American, Middle Eastern, North American, and others)], and quick service restaurants [cuisine type (bakeries, burger, ice cream, meat-based cuisines, pizza, and others)].

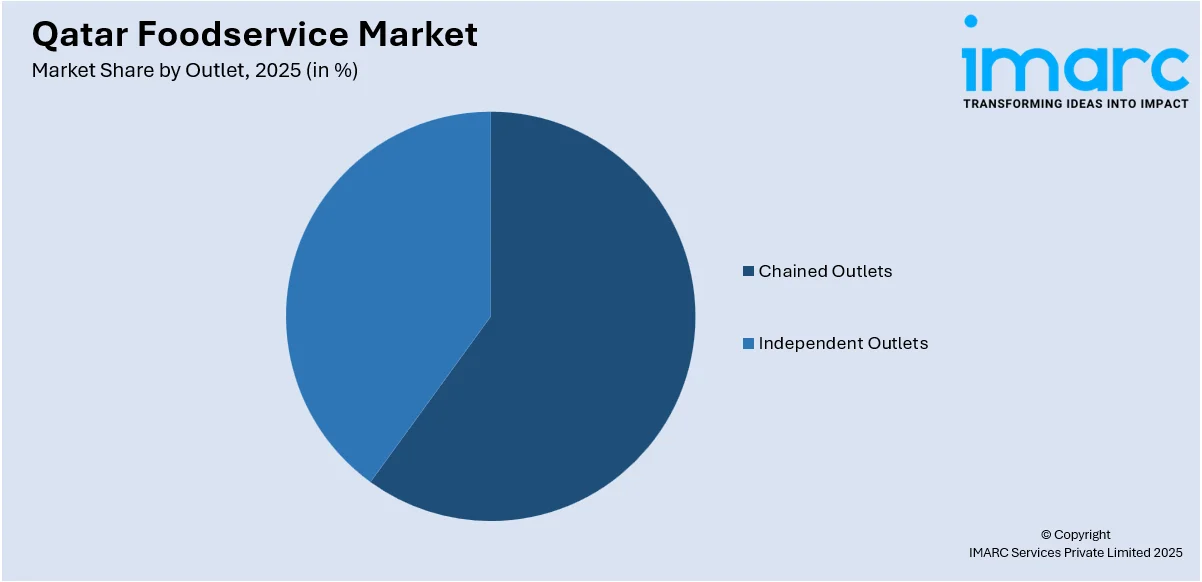

Outlet Insights:

Access the comprehensive market breakdown Request Sample

- Chained Outlets

- Independent Outlets

A detailed breakup and analysis of the market based on the outlet have also been provided in the report. This includes chained outlets and independent outlets.

Location Insights:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

The report has provided a detailed breakup and analysis of the market based on the location. This includes leisure, lodging, retail, standalone, and travel.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Foodservice Market News:

- In July 2025, Qatar‑based Snoonu will remain under its own brand following a strategic investment by Saudi firm Jahez, marking Jahez’s formal entry into the Qatari market. Jahez will acquire a majority stake through a combination of share purchase and capital injection, while the founder retains a minority position and continues leading operations. The companies plan to collaborate on enhancing platform capabilities, expanding service offerings, and leveraging synergies across logistics and technology in Qatar.

Qatar Foodservice Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Foodservice Types Covered |

|

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar foodservice market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar foodservice market on the basis of foodservice type?

- What is the breakup of the Qatar foodservice market on the basis of outlet?

- What is the breakup of the Qatar foodservice market on the basis of location?

- What is the breakup of the Qatar foodservice market on the basis of region?

- What are the various stages in the value chain of the Qatar foodservice market?

- What are the key driving factors and challenges in the Qatar foodservice market?

- What is the structure of the Qatar foodservice market and who are the key players?

- What is the degree of competition in the Qatar foodservice market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar foodservice market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar foodservice market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar foodservice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)