Qatar Green Hydrogen Market Size, Share, Trends and Forecast by Technology, Application, Distribution Channel, and Region, 2026-2034

Qatar Green Hydrogen Market Overview:

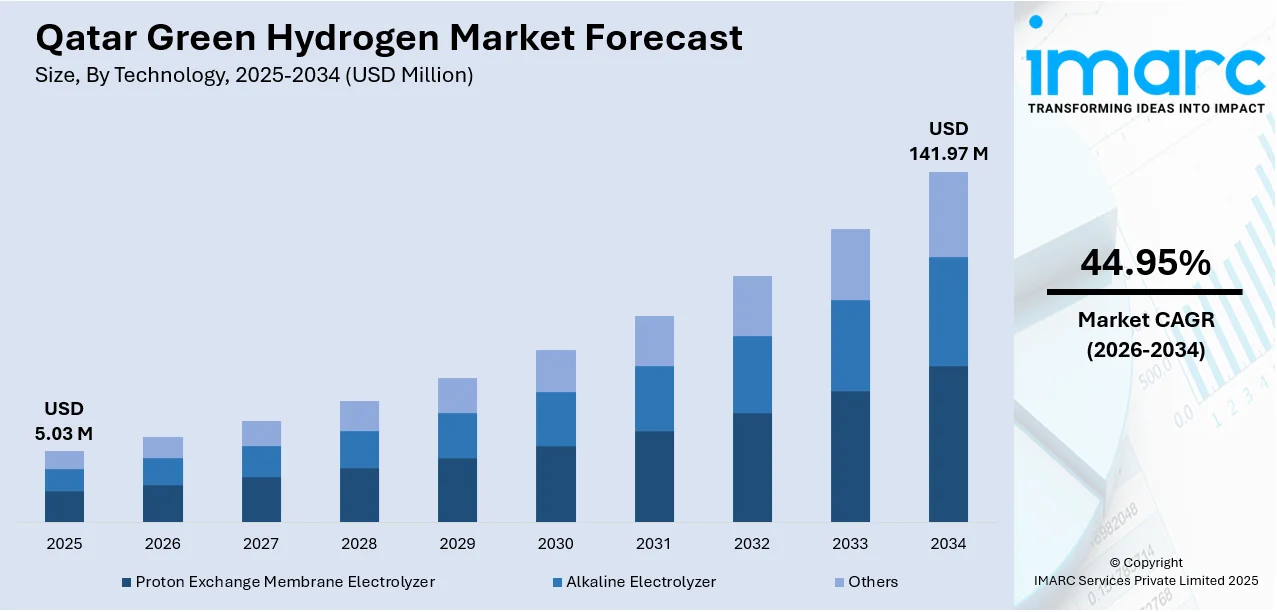

The Qatar green hydrogen market size reached USD 5.03 Million in 2025. The market is projected to reach USD 141.97 Million by 2034, exhibiting a growth rate (CAGR) of 44.95% during 2026-2034. The market is gradually gaining momentum as the country advances into its energy transition agenda and leverages its renewable energy potential. The government is pushing for pilot projects that tie solar‑power infrastructure to hydrogen generation. There is increasing interest in electrolyzer technologies, and state energy firms are exploring partnerships to build supply chains, storage, and export capability. Regulatory support, clean‑energy policy alignment, and strategic infrastructure upgrades are helping shape growth. These combined efforts are boosting the Qatar green hydrogen market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.03 Million |

| Market Forecast in 2034 | USD 141.97 Million |

| Market Growth Rate 2026-2034 | 44.95% |

Qatar Green Hydrogen Market Trends:

Pilot‑Scale Innovation and R&D Focus

Qatar is investing seriously in experimental and early‑stage research toward mature green hydrogen technologies, particularly in combining renewable input sources with novel feedstocks. One strong example is that in May 2024, a project named HyPEC successfully produced green hydrogen from wastewater and sunlight via a photo‑electro‑chemical prototype reactor. This trend emphasizes shifting from lab‑scale proofs toward pilot‑scale validation, testing viability under more realistic environmental and operational conditions. Researchers are exploring ways to reduce resource intensity (water, energy), improve efficiency, and integrate green hydrogen production into broader sustainable infrastructure (e.g. solar PV, desalination, water recycling). Over time, such innovation can help lower costs, raise reliability, and boost local capacity. Ultimately, this approach strengthens the foundation for future commercial‑scale deployment. With growing technical maturity and institutional backing, the Qatar green hydrogen market growth is being propelled by these R&D and pilot innovations, enabling confidence among investors and stakeholders about feasible pathways forward.

To get more information on this market Request Sample

Scaling and Infrastructure Integration

Another trend is the growing emphasis on large‑scale infrastructure, including integration with carbon capture, ammonia conversion, and utility‑scale renewable energy. In November 2024, ground was broken on what will become the world’s largest blue ammonia and hydrogen project (with associated CO₂ sequestration capacity) in Mesaieed Industrial City. That development signals how hydrogen (blue and green) is being positioned not in isolation but as part of an ecosystem: ammonia supply chains, export logistics, CO₂ management. At the same time, solar capacity expansions (new PV projects) are being planned to supply clean power for hydrogen electrolysis, reflecting efforts to anchor green hydrogen in renewable energy infrastructure. Energy regulation, grid modernization, and planning of hydrogen‑ready pipelines or storage are becoming more prominent in policy discourse. Together, these developments suggest that scaled infrastructure integration is at the heart of how Qatar is planning its hydrogen future. Consequently, the Qatar green hydrogen market trends show a clear pattern: moving from experimental to infrastructure‑enabled scale, aligned with renewable production and downstream use.

Regulatory, Strategy, and Sector Coupling Alignment

Qatar is placing significant emphasis on aligning its regulatory framework and strategic initiatives to support the development of a robust green hydrogen ecosystem. National strategies prioritize decarbonization goals and the integration of green hydrogen across multiple sectors, including power generation, industrial processes, and transport. This holistic approach ensures that green hydrogen is not developed in isolation but as part of a broader energy transition plan. Policies are being crafted to encourage investment while facilitating coordination between hydrogen production, renewable energy expansion, and infrastructure modernization. Sector coupling linking hydrogen with electricity grids, natural gas networks, and export logistics is becoming a key pillar in strategic planning. These measures foster an environment conducive to innovation and scaling, reinforcing the role of green hydrogen in meeting both domestic sustainability objectives and global energy demand shifts. By embedding green hydrogen within Qatar’s long-term energy vision, the regulatory and strategic landscape is shaping a favorable and coordinated framework that supports continued market development and future commercialization.

Qatar Green Hydrogen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, application, and distribution channel.

Technology Insights:

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Others

The report has provided a detailed breakup and analysis of the market based on technology. This includes proton exchange membrane electrolyzer, alkaline electrolyzer, and others.

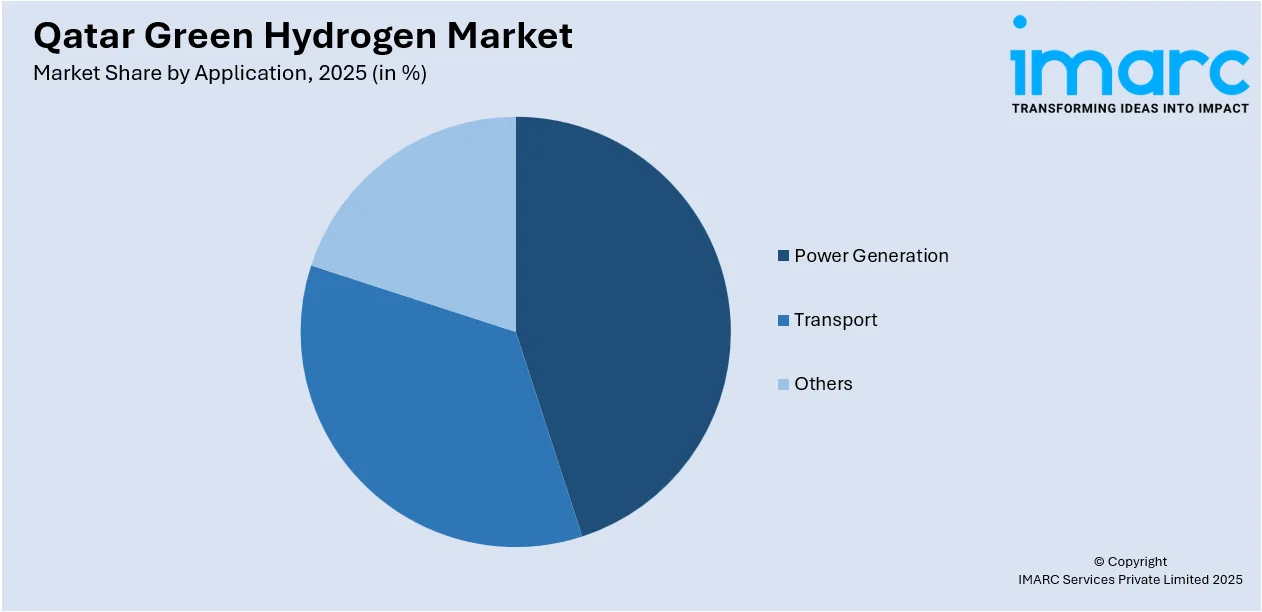

Application Insights:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power generation, transport, and others.

Distribution Channel Insights:

- Pipeline

- Cargo

The report has provided a detailed breakup and analysis of the market based on technology. This includes pipeline and cargo.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Green Hydrogen Market News:

- June 2024: Qatar Shell Research and Technology Centre (QSRTC) achieved a significant milestone with its HyPEC project, producing green hydrogen from wastewater. The project, a collaboration with Texas A&M University at Qatar and the National Chemical Laboratories in India, received support from the Qatar National Research Fund. After successful laboratory tests, a prototype chemical reactor was established at Qatar Science and Technology Park. Following safety reviews, the pilot program commenced, utilizing sunlight and wastewater to generate green hydrogen. This initiative aligns with Qatar's Vision 2030, emphasizing innovation and sustainability.

Qatar Green Hydrogen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Others |

| Applications Covered | Power Generation, Transport, Others |

| Distribution Channels Covered | Pipeline, Cargo |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar green hydrogen market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar green hydrogen market on the basis of technology?

- What is the breakup of the Qatar green hydrogen market on the basis of application?

- What is the breakup of the Qatar green hydrogen market on the basis of distribution channel?

- What is the breakup of the Qatar green hydrogen market on the basis of region?

- What are the various stages in the value chain of the Qatar green hydrogen market?

- What are the key driving factors and challenges in the Qatar green hydrogen market?

- What is the structure of the Qatar green hydrogen market and who are the key players?

- What is the degree of competition in the Qatar green hydrogen market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar green hydrogen market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar green hydrogen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar green hydrogen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)