Qatar Halal Food Processing Market Size, Share, Trends and Forecast by Product/Processed Food Category, Processing Type, Distribution Channel, and Region, 2026-2034

Qatar Halal Food Processing Market Summary:

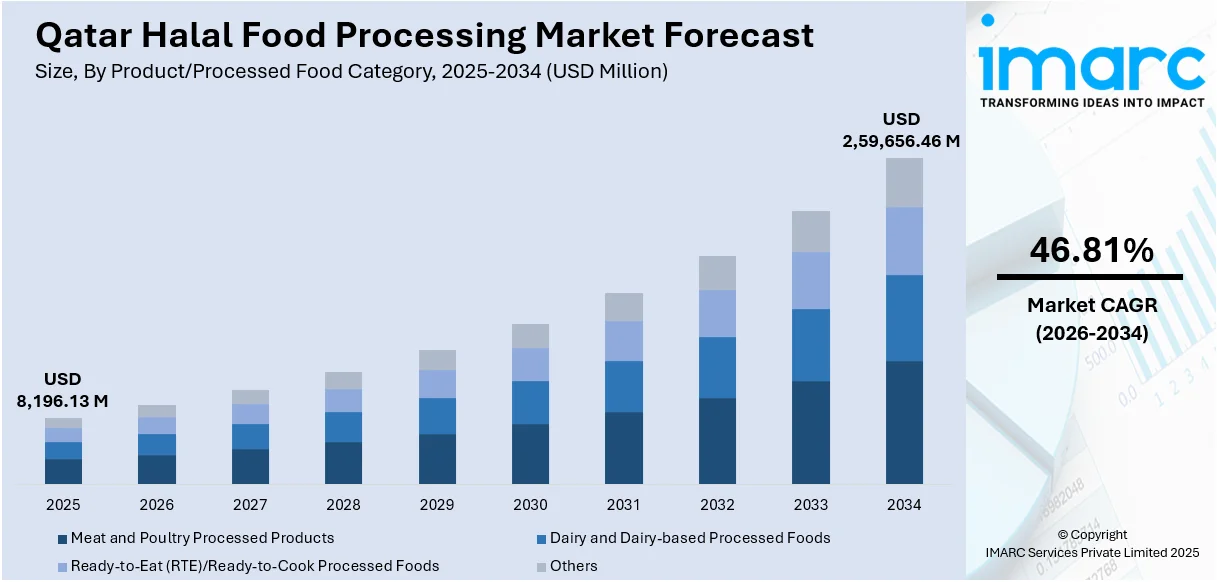

The Qatar halal food processing market size reached USD 8,196.13 Million in 2025. The market is projected to reach USD 2,59,656.46 Million by 2034, growing at a CAGR of 46.81% during 2026-2034. The market is driven by government initiatives aimed at strengthening food security and self-sufficiency through the National Food Security Strategy 2030 and increasing consumer demand for convenient ready-to-eat (RTE) and frozen halal products. Additionally, the rapid growth of e-commerce and online food delivery platforms is fueling the Qatar halal food processing market share.

|

Particulars |

Details |

|

Market Size (2025) |

USD 8,196.13 Million |

|

Forecast (2034) |

USD 2,59,656.46 Million |

|

CAGR (2026-2034) |

46.81% |

|

Key Segments |

Product/Processed Food Category (Meat and Poultry Processed Products, Dairy and Dairy-based Processed Foods, Ready-to-Eat (RTE)/Ready-to-Cook Processed Foods, Others), Processing Type (Fresh/Chilled Processed Products, Frozen Processed Products, Marinated/Ready Meals, Others), Distribution Channel (Retail, HoReCa, Online, Others) |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

Qatar Halal Food Processing Market Outlook (2026-2034):

The Qatar halal food processing market is positioned for sustained growth, driven by government support through food security programs and investments in domestic production capabilities. The expanding tourism and hospitality sectors, coupled with international events, will continue boosting the demand for diverse halal-certified processed food options. Furthermore, technological advancements, including blockchain-based traceability systems and cold chain infrastructure improvements, are expected to enhance operational efficiency and consumer confidence throughout the forecast period.

To get more information on this market Request Sample

Impact of AI:

AI is transforming the halal food processing market through enhanced traceability and certification systems that ensure compliance with Islamic dietary laws. AI-powered computer vision systems monitor processing facilities for halal standards adherence, while machine learning (ML) algorithms detect supply chain anomalies and potential contamination risks. Blockchain integration with AI enables immutable record-keeping and real-time verification, strengthening consumer trust. These technologies streamline certification procedures, reduce human error, and provide transparent product provenance information through quick response (QR) code scanning systems.

Market Dynamics:

Key Market Trends & Growth Drivers:

Government-Led Food Security Initiatives

Qatar's National Food Security Strategy 2030 is fundamentally reshaping the halal food processing landscape by prioritizing self-sufficiency and reducing import dependency. The government has implemented comprehensive measures, including investments in agricultural technology, livestock development programs, and state-of-the-art processing facilities to ensure sustainable food supply. Over 950 productive farms were operational nationwide, with areas dedicated to organic farming doubling in 2024, while the country's livestock population grew to 1.4 Million animals, comprising sheep, goats, camels, and cows. The Agricultural Affairs Department provides local farms with essential resources and expertise to improve yields and product quality. Apart from this, major companies are expanding their processing capabilities to meet government contracts and support national objectives. These initiatives align with the broader Qatar National Vision 2030 framework, which emphasizes sustainability and adaptability while developing resilient food systems capable of withstanding external pressures from geopolitical crises, climate change, and supply chain disruptions.

Rapid Growth of E-Commerce and Digital Food Delivery Platforms

The rapid growth of e-commerce and digital food delivery platforms is impelling the Qatar halal food processing market growth by transforming how consumers access and purchase halal-certified products. As per the IMARC Group, the Qatar e-commerce market size reached USD 3.8 Billion in 2024. Online platforms and delivery apps have expanded the reach of halal food brands, enabling small and medium processors to connect directly with a wider audience without relying solely on traditional retail. The increasing preferences for convenient, on-demand, and home-delivered meals are boosting the demand for packaged halal-ready foods, snacks, and beverages. Digital platforms also allow transparent product labeling, certification display, and traceability information, enhancing consumer trust and confidence in halal authenticity. As Qatar’s tech-savvy population increasingly shops online, food processors are investing in digital marketing, e-commerce integration, and quick-delivery partnerships. This digital shift is strengthening supply chain efficiency, widening product accessibility, and supporting continuous growth of the halal food processing ecosystem.

Increasing Demand for Convenient RTE and Frozen Halal Products

Evolving lifestyles, characterized by busy work schedules and urbanization, are fundamentally driving consumer preferences towards convenient halal food processing formats that require minimal preparation time. According to industry reports, Qatar maintained the highest working population rate at 87.47% labor force participation, creating substantial demand for precooked and frozen meals, including vegetable preparations, meatballs, RTE options, and ready-to-cook products that accommodate hectic professional commitments. Health-conscious consumers are simultaneously demanding more nutritious options, spurring the introduction of plant-based and organic RTE meals that maintain halal certification standards. The processed poultry segment, encompassing nuggets, sausages, and marinated items, displays one of the fastest growth rates, reflecting changing consumer preferences for convenience and ready-to-cook options. Market players are responding through continuous product innovations, with several companies introducing stock-keeping units across Greek yogurt drinks, protein drinkables, flavored milk, juices, and yogurt products to capture evolving consumer preferences while maintaining stringent halal compliance throughout their expanding portfolios.

Key Market Challenges:

Dependence on Imported Raw Materials and Supply Chain Vulnerability

In Qatar, one of the key challenges facing the halal food processing market is its heavy reliance on imported livestock, ingredients, and food inputs due to limited domestic agricultural capacity. Qatar’s climate restricts large-scale farming, poultry, and livestock production, making local processors dependent on international suppliers for halal-certified raw materials. Any disruption in global logistics, currency fluctuations, or geopolitical tension affects supply continuity and increases procurement costs. Ensuring halal compliance along extended supply chains, ranging from source to processing facilities, adds further complexity, particularly when multiple countries are involved. High import dependence also reduces the ability to control quality and traceability at the primary source level. Local production constraints limit product diversification and prevent economies of scale. Strengthening domestic supply chains requires long-term investment in farming infrastructure, partnerships, and technology adoption, making progress slow and challenging for halal food processors in Qatar.

Limited Skilled Workforce and Halal Certification Expertise

A shortage of trained professionals with halal processing knowledge, food science skills, and certification expertise presents a significant barrier to industry growth in Qatar. Halal processing demands strict adherence to Islamic dietary laws, including slaughtering practices, ingredient sourcing, contamination prevention, and supply chain traceability. However, the availability of specialists who understand both global halal standards and modern food manufacturing techniques is limited. Many companies rely on foreign experts or consultants to manage certification, quality audits, and compliance training, leading to higher operating costs. Frequent updates in global halal standards require ongoing workforce education, but training infrastructure within Qatar remains underdeveloped. Skill gaps reduce operational efficiency, increase error risks, and slow the scaling of new product lines. Without a strong local talent pipeline, capacity building and innovation within the halal food processing sector remain constrained, limiting competitive growth.

High Production Costs and Limited Economies of Scale

Halal food processing in Qatar is facing higher production costs due to small domestic market size, high-quality standards, imported raw materials, and premium-priced labor and operational expenses. Maintaining halal-compliant facilities requires segregation of equipment, stringent hygiene protocols, certified suppliers, and continuous auditing, which increase overhead. Limited local demand restricts large-scale production, reducing cost efficiencies and making it difficult to compete with established halal exporters, such as Malaysia or Turkey. Smaller players struggle to invest in automation, product innovations, and advanced processing technologies due to insufficient capital and narrow revenue margins. High cost structures result in premium pricing, making products less competitive against imported halal offerings sold at lower prices. Without scale-based efficiencies, local processors face profitability challenges, reducing their ability to expand, diversify product ranges, or penetrate international halal food markets.

Qatar Halal Food Processing Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar halal food processing market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on product/processed food category, processing type, and distribution channel.

Analysis by Product/Processed Food Category:

- Meat and Poultry Processed Products

- Dairy and Dairy-based Processed Foods

- Ready-to-Eat (RTE)/Ready-to-Cook Processed Foods

- Others

The report has provided a detailed breakup and analysis of the market based on the product/processed food category. This includes meat and poultry processed products, dairy and dairy-based processed foods, ready-to-eat (RTE)/ready-to-cook processed foods, and others.

Analysis by Processing Type:

- Fresh/Chilled Processed Products

- Frozen Processed Products

- Marinated/Ready Meals

- Others

A detailed breakup and analysis of the market based on the processing type have also been provided in the report. This includes fresh/chilled processed products, frozen processed products, marinated/ready meals, and others.

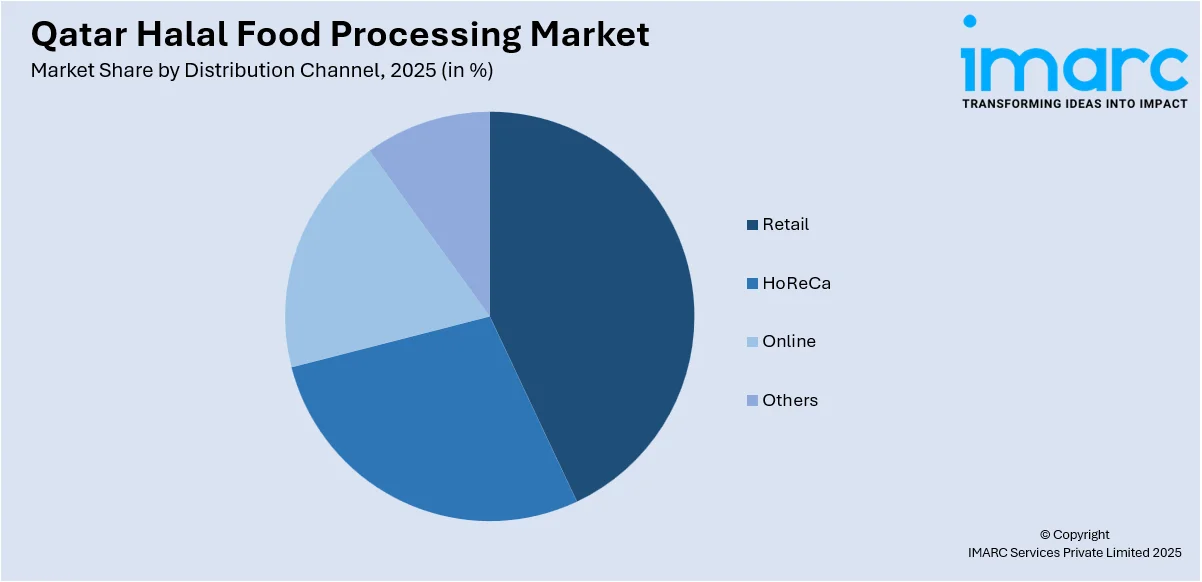

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Retail

- HoReCa

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail, HoReCa, online, and others.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar halal food processing market shows moderate concentration with established domestic players leveraging strong relationships with government entities and deep understanding of local consumer preferences. Competition centers on product quality, halal certification authenticity, distribution network strength, and brand reputation built through consistent compliance with Islamic dietary laws. Key market participants are investing significantly in vertical integration strategies encompassing raw material production, processing facilities, and distribution channels to ensure end-to-end quality control and traceability. Companies differentiate through product innovations, including convenient formats, health-focused formulations, and premium positioning while maintaining stringent halal standards. Strategic partnerships with international brands and technology providers enable access to advanced processing equipment and management expertise. The market structure allows opportunities for both established players to expand product portfolios and new entrants to capture niche segments through specialized offerings or innovative distribution models leveraging digital platforms and direct-to-consumer (D2C) channels.

Qatar Halal Food Processing Industry Latest Developments:

- November 2024: Al Islami Foods, a prominent UAE provider of halal poultry and meat items, introduced its wide array of processed food products in Qatar to cater to the requirements of contemporary households and busy people, enhancing the convenience of halal cooking. Al Islami aimed to offer numerous offerings, such as burgers, nuggets, franks, kebabs, and mince.

Qatar Halal Food Processing Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Product/Processed Food Categories Covered |

Meat and Poultry Processed Products, Dairy and Dairy-based Processed Foods, Ready-to-Eat (RTE)/Ready-to-Cook Processed Foods, Others |

|

Processing Types Covered |

Fresh/Chilled Processed Products, Frozen Processed Products, Marinated/Ready Meals, Others |

|

Distribution Channels Covered |

Retail, HoReCa, Online, Others |

|

Regions Covered |

Ad Dawhah, Al Rayyan, Al Wakrah, Others |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar halal food processing market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar halal food processing market on the basis of product/processed food category?

- What is the breakup of the Qatar halal food processing market on the basis of processing type?

- What is the breakup of the Qatar halal food processing market on the basis of distribution channel?

- What is the breakup of the Qatar halal food processing market on the basis of region?

- What are the various stages in the value chain of the Qatar halal food processing market?

- What are the key driving factors and challenges in the Qatar halal food processing market?

- What is the structure of the Qatar halal food processing market and who are the key players?

- What is the degree of competition in the Qatar halal food processing market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar halal food processing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar halal food processing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar halal food processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)