Qatar Hospitality Market Size, Share, Trends and Forecast by Type, Segment, and Region, 2026-2034

Qatar Hospitality Market Summary:

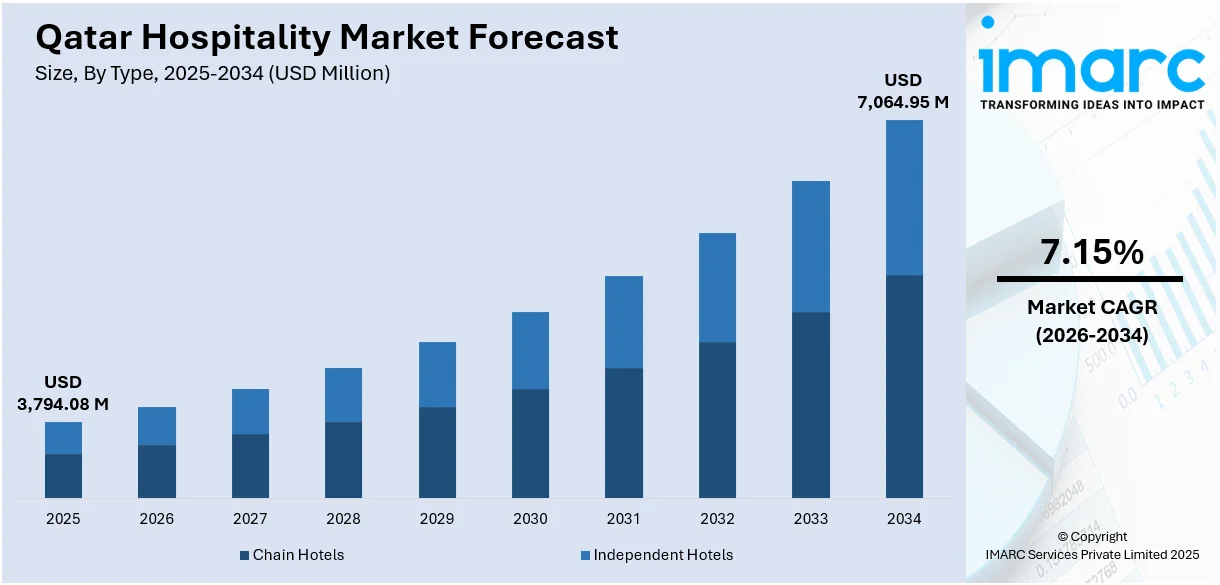

The Qatar hospitality market size reached USD 3,794.08 Million in 2025. The market is projected to reach USD 7,064.95 Million by 2034, growing at a CAGR of 7.15% during 2026-2034. The market is driven by strong international tourism growth fueled by Qatar's strategic positioning as a premier events destination, hosting major sporting tournaments and cultural festivals throughout the year. Additionally, substantial government investment in hospitality infrastructure under the Qatar National Vision 2030 is accelerating the expansion of luxury hotel offerings and diversified accommodation options. Furthermore, the rising significance of domestic and regional tourism, combined with the development of MICE facilities, is expanding the Qatar hospitality market share.

Key Takeaways:

- The Qatar hospitality market was valued at USD 3,794.08 Million in 2025.

- It is projected to reach USD 7,064.95 Million by 2034, growing at a CAGR of 7.15% during 2026-2034.

- Qatar's hospitality industry is experiencing unprecedented growth following record-breaking visitor arrivals, with the country welcoming over 5 million international visitors in 2024. The nation's events-driven tourism strategy and world-class infrastructure are positioning it as a leading destination in the Middle East.

- Segmentation highlights:

- Type: Chain Hotels, Independent Hotels

- Segment: Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, Luxury Hotels

- Regional Insights: The report covers major zones within Qatar: Ad Dawhah, Al Rayyan, Al Wakrah, and Others.

To get more information on this market Request Sample

Qatar Hospitality Market Outlook (2026-2034):

The Qatar hospitality market is poised for sustained expansion, driven by the country's ambitious National Tourism Strategy 2030, which aims to attract 6 million visitors annually and increase tourism's contribution to GDP to 12%. The continued development of Lusail City as a premier destination, along with upcoming mega events including the FIFA World Cup legacy events and potential 2036 Olympics bid, will bolster accommodation demand. Furthermore, the introduction of the unified GCC tourist visa and enhanced air connectivity through Hamad International Airport are expected to increase regional and international visitor inflows. The diversification into wellness tourism, cultural experiences, and sustainable hospitality offerings will create additional revenue streams throughout the forecast period.

Impact of AI:

Artificial intelligence is increasingly transforming Qatar's hospitality landscape by enabling hotels to optimize operations, enhance guest experiences, and reduce costs. AI-powered tools are being deployed for energy management systems that achieve up to 20% savings through tariff-aware scheduling and predictive maintenance. Hotels are implementing AI-driven revenue management systems for dynamic pricing strategies, particularly during major events when occupancy rates peak. Additionally, AI-powered chatbots and virtual concierges are streamlining guest services, while data analytics platforms are enabling personalized marketing and loyalty programs. As Qatar positions itself as a smart tourism destination, AI integration is expected to accelerate across the hospitality sector.

Market Dynamics:

Key Market Trends & Growth Drivers:

Strong International Tourism Growth Driven by Major Events

The Qatar hospitality market is experiencing robust growth fueled by a consistent surge in international visitor arrivals and the country's strategic events calendar. Qatar welcomed over 5 million international visitors in 2024, representing a 25% increase compared to the previous year, with the GCC contributing 41% of total arrivals followed by Europe at 23%. The nation's events-driven tourism strategy, featuring major sporting tournaments such as the Formula 1 Qatar Grand Prix, MotoGP, and cultural festivals, ensures sustained visitor inflows throughout the year. The AFC Asian Cup in January 2024 set the stage for record-breaking arrivals, while the cruise season and school holiday periods from neighboring countries further boosted occupancy rates. The continued enhancement of Qatar Airways' global connectivity and the development of Hamad International Airport as a world-class hub are facilitating seamless access for international travelers seeking both leisure and business experiences.

Strategic Infrastructure Investment and Hotel Expansion

Massive infrastructure investments and continued development of hospitality facilities are propelling the Qatar hospitality market growth. The country has invested approximately USD 7 billion in expanding its hotel capacity, with the total supply reaching over 40,000 keys by the end of 2024. Qatar Tourism reported that the country's hospitality sector sold 10 million hotel room nights in 2024, a 23% increase from the previous year, with international visitor arrivals surpassing 5 million for the first time. The hospitality landscape is being transformed by the opening of ultra-luxury properties that cater to discerning travelers seeking premium experiences. Major international hotel brands are expanding their footprint, with Marriott International, Accor, Hilton, and Rosewood Hotels among those introducing new properties. The government's focus on developing Lusail City as a futuristic destination and the Simaisma tourism project, valued at QR20 billion, are creating new hospitality zones that will further expand accommodation capacity.

Economic Diversification and MICE Tourism Development

Qatar's commitment to economic diversification under the National Vision 2030 is positioning hospitality as a cornerstone of sustainable growth. The MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism segment is emerging as a significant driver, with the Doha Exhibition and Convention Centre hosting international events that attract business travelers year-round. The expansion of state-of-the-art convention facilities, combined with Qatar's strategic geographic location bridging East and West, is establishing the country as a premier hub for corporate gatherings and large-scale exhibitions. Furthermore, the development of cultural tourism offerings, including world-class museums and heritage sites, is attracting visitors seeking authentic experiences. The rise of domestic and regional tourism, supported by relaxed visa requirements and competitive exchange rates, is building resilience within the industry by reducing dependence on international arrivals. This diversified approach is ensuring consistent demand across accommodation categories, from luxury hotels to mid-scale properties and serviced apartments.

Key Market Challenges:

Labor Shortages and Skilled Workforce Gaps

The rapid expansion of Qatar's hospitality sector has intensified demand for skilled professionals across various roles, creating significant recruitment challenges. The country's reliance on expatriate labor, with foreign workers representing over 94% of the workforce, necessitates continuous international recruitment efforts and investment in training programs. Attracting and retaining talent in a competitive regional market, where neighboring countries are also expanding their hospitality sectors, poses ongoing difficulties for hotel operators. The shortage extends across front-line positions including housekeeping, food service, and front desk operations, as well as specialized roles such as revenue managers and executive chefs. Hotels must invest in comprehensive training and development programs while offering competitive compensation packages to maintain service standards. Collaboration with educational institutions for specialized hospitality courses and certifications is becoming essential to bridge skill gaps and develop a sustainable talent pipeline for the industry's future growth.

Intensifying Regional Competition

Qatar faces strong competition from neighboring GCC countries, particularly the UAE and Saudi Arabia, which are aggressively investing in their tourism and hospitality sectors. Dubai and Abu Dhabi continue to attract significant visitor volumes with their diversified offerings, while Saudi Arabia's Vision 2030 is driving unprecedented hospitality development including mega projects such as NEOM and the Red Sea Project. This competitive landscape requires Qatar to continuously innovate its tourism products and maintain its positioning as a premium destination. The concentration of luxury hotel development across the region is intensifying pressure on room rates and occupancy levels, particularly during non-peak periods. Hotels must differentiate through exceptional service quality, unique experiences, and targeted marketing to specific traveler segments. Maintaining the momentum achieved following the 2022 FIFA World Cup requires strategic investments in new attractions and sustained promotional efforts to compete effectively for international and regional travelers.

Regulatory Compliance and Workforce Nationalization Pressures

Navigating Qatar's regulatory environment presents operational challenges for hospitality businesses. Hotels must comply with stringent food safety, hygiene, and health regulations enforced by government authorities, requiring continuous monitoring, frequent inspections, and adherence to strict standards. The Qatarization policy, aimed at increasing employment of Qatari nationals in the private sector from 17% to 20% by 2030, adds complexity to workforce planning as hotels balance nationalization requirements with the need for specialized expatriate expertise. Environmental regulations mandating sustainable practices, including waste management and reduction of single-use plastics, require ongoing investment and operational adaptation. Smaller hospitality operators may struggle with the administrative requirements and costs associated with full regulatory compliance, potentially limiting their competitiveness. Additionally, evolving visa and employment regulations for foreign workers necessitate careful navigation to ensure operational continuity while maintaining compliance with labor laws.

Qatar Hospitality Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar hospitality market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on type and segment.

Analysis by Type:

- Chain Hotels

- Independent Hotels

The report has provided a detailed breakup and analysis of the market based on the type. This includes chain hotels and independent hotels.

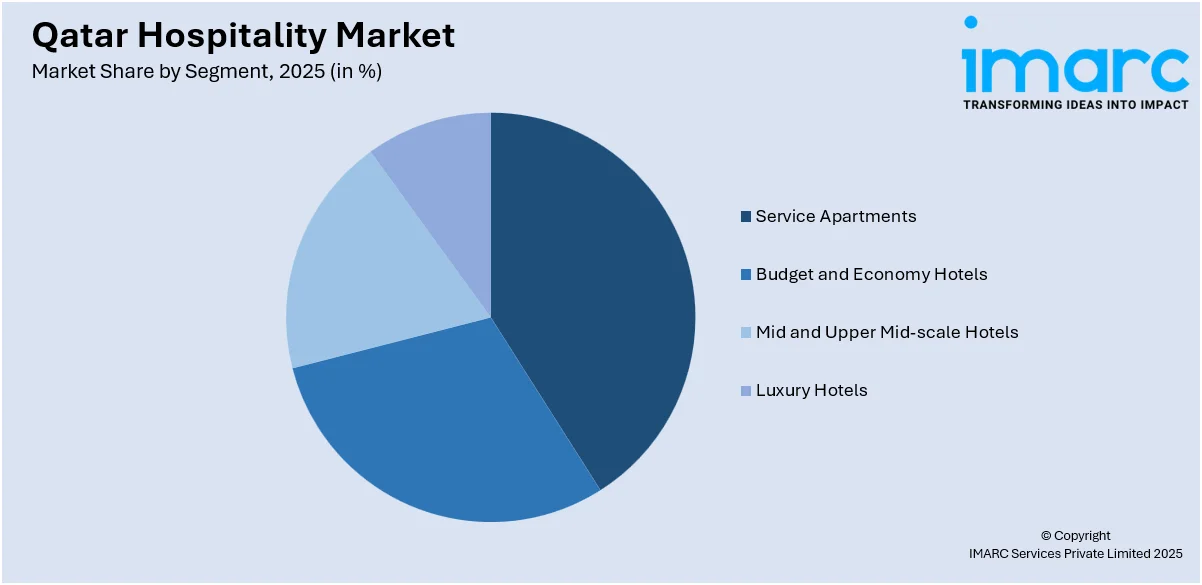

Analysis by Segment:

Access the comprehensive market breakdown Request Sample

- Service Apartments

- Budget and Economy Hotels

- Mid and Upper Mid-scale Hotels

- Luxury Hotels

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes service apartments, budget and economy hotels, mid and upper mid-scale hotels, and luxury hotels.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and Others.

Competitive Landscape:

The Qatar hospitality market features a moderately concentrated competitive environment characterized by the presence of major international hotel chains alongside domestic operators. Katara Hospitality, Qatar's flagship hospitality organization, plays a pivotal role as one of the largest domestic hotel owner, developer, and operator, with a portfolio spanning 42 properties and targeting 60 hotels by 2030. Competition primarily centers on service quality, brand reputation, location, and the ability to cater to diverse traveler segments including business travelers, families, and luxury seekers. International brands continue to introduce lifestyle and boutique concepts to differentiate their offerings, while local operators leverage cultural authenticity and heritage experiences to attract guests.

Qatar Hospitality Industry Latest Developments:

- July 2025: Rosewood Hotels & Resorts opened Rosewood Doha in the Lusail Marina District, marking the brand's debut in Qatar. The property features 155 guest rooms and suites, 162 apartments, and 276 residences, along with eight dining venues and Asaya wellness club.

- February 2025: Hyatt Hotels Corporation announced the opening of Andaz Doha in Qatar's West Bay district, marking the debut of the lifestyle brand in the country. The hotel features 256 guestrooms, 32 suites, and 56 residences with design celebrating Qatari culture.

Qatar Hospitality Market Report Coverage:

|

Report Features |

Details |

|---|---|

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Types Covered |

Chain Hotels, Independent Hotels |

|

Segments Covered |

Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, Luxury Hotels |

|

Regions Covered |

Ad Dawhah, Al Rayyan, Al Wakrah, Others |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar hospitality market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar hospitality market on the basis of type?

- What is the breakup of the Qatar hospitality market on the basis of segment?

- What is the breakup of the Qatar hospitality market on the basis of region?

- What are the various stages in the value chain of the Qatar hospitality market?

- What are the key driving factors and challenges in the Qatar hospitality market?

- What is the structure of the Qatar hospitality market and who are the key players?

- What is the degree of competition in the Qatar hospitality market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar hospitality market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar hospitality market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar hospitality industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)