Qatar Hydrogen Market Size, Share, Trends and Forecast by Sector, Application, and Region, 2026-2034

Qatar Hydrogen Market Summary:

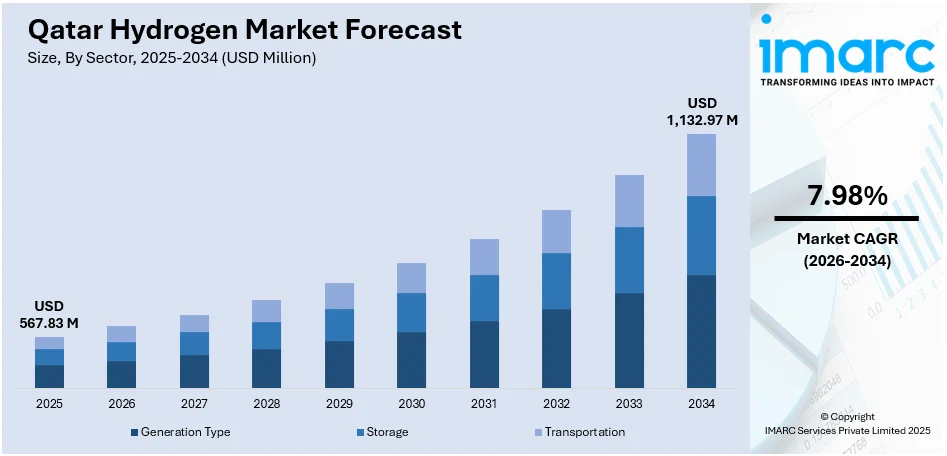

The Qatar hydrogen market size reached USD 567.83 Million in 2025. The market is projected to reach USD 1,132.97 Million by 2034, growing at a CAGR of 7.98% during 2026-2034. The market is driven by substantial government investment in blue hydrogen production and carbon capture infrastructure, strategic renewable energy expansion creating pathways for future green hydrogen capabilities, and the development of export-oriented strategies that leverage Qatar's established LNG relationships with key Asian markets. These initiatives position Qatar to transition from its traditional hydrocarbon leadership toward becoming a competitive player in the emerging global clean hydrogen economy, contributing significantly to the Qatar hydrogen market share.

Key Takeaways:

- The Qatar hydrogen market was valued at USD 567.83 Million in 2025.

- It is projected to reach USD 1,132.97 Million by 2034, growing at a CAGR of 7.98% during 2026-2034.

- Qatar's abundant natural gas reserves and advanced LNG infrastructure provide a competitive foundation for blue hydrogen production, while government support through the National Hydrogen Strategy 2023 establishes regulatory frameworks and fiscal incentives that accelerate private sector participation in hydrogen technology investments.

- Segmentation highlights:

- Sector: Generation Type, Storage, Transportation

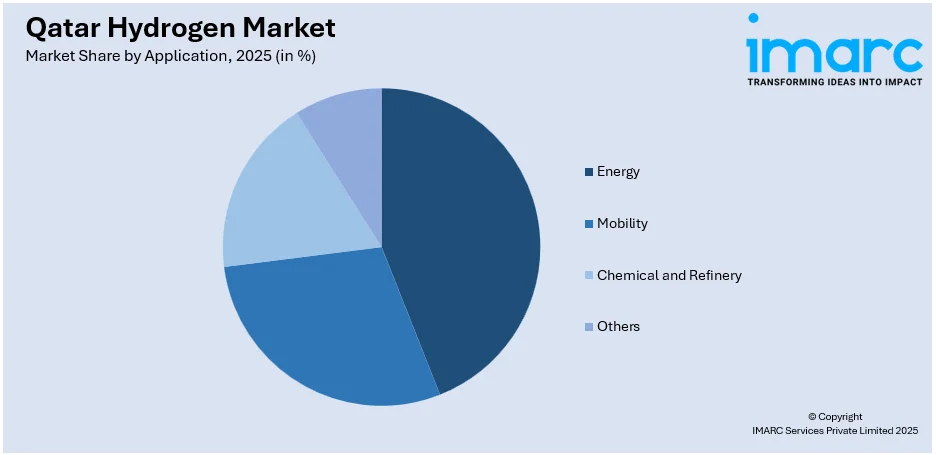

- Application: Energy, Mobility, Chemical and Refinery, Others

- Regional Insights: The report covers major zones within Qatar: Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Qatar Hydrogen Market Outlook (2026-2034):

The Qatar hydrogen market is set for consistent long term expansion, supported by the nation’s strategic shift toward cleaner energy pathways while leveraging its strong foundation in global energy trade. Large scale investments, policy alignment, and the development of integrated hydrogen production hubs are strengthening the country’s ability to serve both regional and international demand. Growing interest from global importers and Qatar’s established logistical strengths are expected to position the nation as a competitive supplier in the evolving hydrogen economy.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence is playing an increasingly important role in enhancing efficiency across Qatar’s hydrogen value chain. AI driven systems support real time monitoring, predictive maintenance, and improved coordination between hydrogen production units and renewable energy inputs. These capabilities help optimize operational performance, reduce downtime, and improve safety oversight. As AI applications advance, they will further strengthen production reliability, supply planning, and overall cost efficiency within the country’s emerging hydrogen ecosystem.

Market Dynamics:

Key Market Trends & Growth Drivers:

Expansion of Blue Hydrogen and CCS-Integrated Production Models

Qatar is increasingly positioning itself as a leading producer of blue hydrogen by capitalizing on its large natural gas reserves and highly developed carbon capture and storage (CCS) infrastructure. The country is advancing integrated hydrogen–CCS production models designed to minimize lifecycle emissions while securing long-term export competitiveness. As global industries particularly in Europe and Asia demand cleaner fuels, Qatar is prioritizing scalable blue hydrogen projects that align with international decarbonization requirements. This trend is further accelerated by collaborations focused on low-carbon ammonia, long-term supply contracts, and infrastructure upgrades dedicated to hydrogen handling, storage, and transportation. Over the coming years, the shift toward integrated hydrogen value chains will support the country’s broader energy diversification strategy and strengthen its position as a reliable supplier within the emerging clean energy economy.

Growing Investment in Hydrogen Export Infrastructure and Global Partnerships

A major trend shaping the future of the sector is the strategic build-out of export-oriented infrastructure, driven by rising international demand and the pursuit of sustained Qatar hydrogen market growth. Qatar is expanding port capabilities, storage facilities, and liquefaction technologies to support large-scale hydrogen and ammonia export operations. At the same time, the country is forming long-term collaborations with global energy importers, industrial users, and technology developers to secure off-take agreements and co-develop innovative low-carbon solutions. These partnerships enable technology transfer, guarantee market access, and accelerate the development of integrated supply chains linking production hubs in Qatar with key global consumption centers. In addition, investments in carrier technologies such as ammonia and liquid organic hydrogen carriers are positioning Qatar as a central player in future hydrogen trade routes.

Acceleration of Green Hydrogen and Renewable Energy Integration

While blue hydrogen currently dominates the landscape, Qatar is gradually expanding its focus on green hydrogen to build a balanced and forward-looking energy portfolio. The country is investing in large-scale solar power generation, pilot electrolysis projects, and renewable-powered hydrogen production to align with global sustainability targets and emerging clean fuel standards. This trend reflects Qatar’s commitment to long-term energy transition, as industries worldwide increasingly prefer renewable-based hydrogen for its minimal carbon footprint. Furthermore, the integration of green hydrogen into industrial clusters, mobility solutions, and power applications is fostering new commercial opportunities within the domestic market. Research collaborations and technology partnerships are also supporting advancements in electrolyzer efficiency, water management systems, and renewable integration strategies, ensuring Qatar remains competitive as global hydrogen ecosystems evolve toward greener solutions.

Key Market Challenges:

High Production Costs and Technology Maturity Constraints

One of the primary challenges facing the Qatar hydrogen market is the high cost associated with hydrogen production, conversion, and transportation. Despite Qatar’s strong natural gas foundation, blue hydrogen production requires significant investment in carbon capture, storage, and emission-management systems to meet international low-carbon standards. For green hydrogen, the challenge is even greater due to the high capital expenditure for electrolyzers, renewable energy infrastructure, and advanced water-treatment systems required for large-scale production. Technology maturity remains another barrier, as many hydrogen solutions such as long-distance transport technologies, new storage materials, and high-efficiency electrolyzers are still evolving. These cost and technology hurdles slow down commercial adoption, limit market competitiveness, and delay the development of integrated hydrogen value chains.

Limited Domestic Demand and Uncertain Global Market Signals

Hydrogen adoption within Qatar’s domestic economy is still at an early stage, with limited large-scale industrial and mobility applications to stimulate internal demand. Most hydrogen projects are designed for export markets, which exposes the sector to fluctuations in global energy policies, shifting demand patterns, and long-term off-take uncertainties. This creates commercial risk, especially as importing countries continue to refine their hydrogen standards, certification frameworks, and carbon-intensity thresholds. Global price volatility, competition from other major hydrogen-producing nations, and geopolitical shifts further complicate long-term planning. Without strong domestic consumption to anchor the market, Qatar must rely on external buyers, making it more vulnerable to international market uncertainty and policy inconsistencies.

Infrastructure Gaps and Supply Chain Readiness Challenges

Developing a fully functional hydrogen ecosystem requires extensive infrastructure, including pipelines, port facilities, liquefaction units, hydrogen carriers, and specialized storage systems. Qatar currently faces gaps in these areas, particularly for large-scale green hydrogen and ammonia export logistics. As international standards for hydrogen transport and certification continue to evolve, infrastructure planning becomes more complex and costly. Additionally, supply chain readiness such as availability of skilled labor, specialized equipment, and transportation networks remains a critical challenge. Many components required for advanced hydrogen technologies are imported, leading to procurement delays and higher project costs. Ensuring the compatibility of new hydrogen infrastructure with existing energy networks also requires careful planning, engineering, and long-term investment, delaying the commercialization timeline for several emerging projects.

Qatar Hydrogen Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar hydrogen market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on sector and application.

Analysis by Sector:

- Generation Type

- Gray Hydrogen

- Blue Hydrogen

- Green Hydrogen

- Storage

- Physical

- Material-based

- Transportation

- Long Distance

- Short Distance

The report has provided a detailed breakup and analysis of the market based on the sector. This includes generation type (gray hydrogen, blue hydrogen, and green hydrogen), storage (physical and material-based), and transportation (long distance and short distance).

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Energy

- Power Generation

- Combined Heat and Power (CHP)

- Mobility

- Chemical and Refinery

- Petroleum Refinery

- Ammonia Production

- Methanol Production

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy (power generation and combined heat and power), mobility, chemical and refinery (petroleum refinery, ammonia production, and methanol production), and others.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The competitive landscape of the Qatar hydrogen market is characterized by the presence of large energy developers, industrial players, and technology partners working to build integrated low-carbon and renewable hydrogen value chains. Competition is centered around securing long-term export agreements, advancing blue hydrogen capabilities, and piloting green hydrogen projects supported by solar energy. Companies are focusing on scaling carbon capture systems, optimizing production efficiencies, and developing hydrogen-derived fuels to meet global decarbonization requirements. Strategic collaborations with international buyers, engineering firms, and research entities play a critical role, enabling access to advanced technologies and specialized expertise. Across the ecosystem, the emphasis is on innovation, cost optimization, and expanding infrastructure to strengthen Qatar’s position in the global hydrogen economy.

Qatar Hydrogen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered |

|

| Applications Covered |

|

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar hydrogen market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar hydrogen market on the basis of sector?

- What is the breakup of the Qatar hydrogen market on the basis of application?

- What is the breakup of the Qatar hydrogen market on the basis of region?

- What are the various stages in the value chain of the Qatar hydrogen market?

- What are the key driving factors and challenges in the Qatar hydrogen market?

- What is the structure of the Qatar hydrogen market and who are the key players?

- What is the degree of competition in the Qatar hydrogen market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar hydrogen market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar hydrogen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar hydrogen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)