Qatar Lubricants Market Report Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Qatar Lubricants Market Summary:

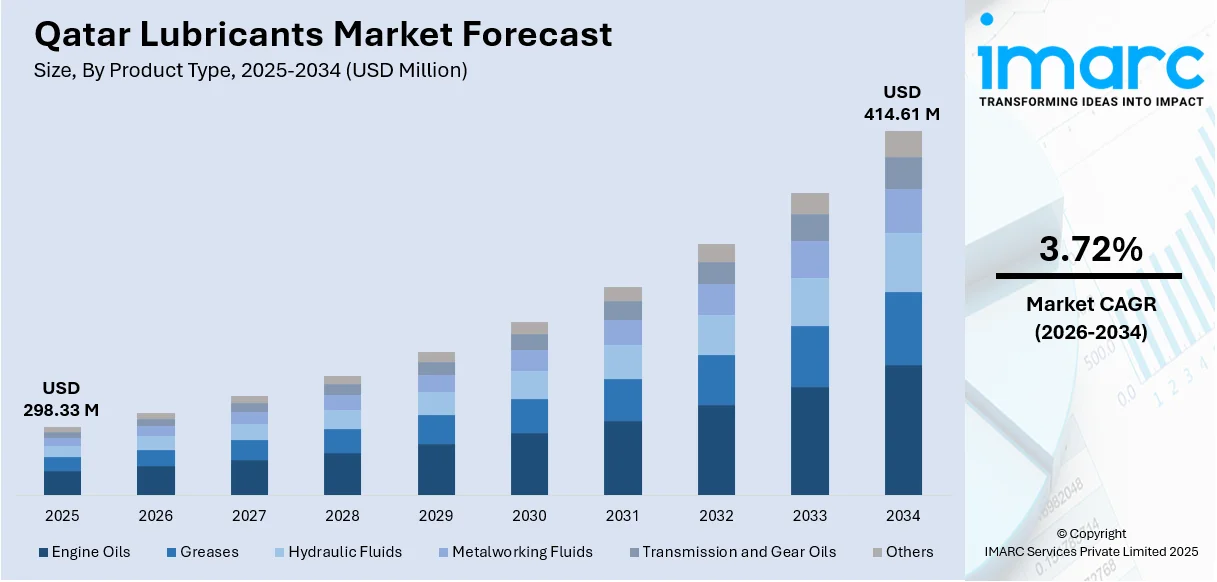

The Qatar lubricants market size reached USD 298.33 Million in 2025. The market is projected to reach USD 414.61 Million by 2034, growing at a CAGR of 3.72% during 2026-2034. The market is driven by surging vehicle ownership resulting from strong economic growth and population expansion, robust industrial development fueled by Qatar National Manufacturing Strategy 2024-2030 with substantial government investments in infrastructure and petrochemical projects, and increasingly stringent environmental regulations mandating low-emission lubricants to achieve the nation's 25 % greenhouse gas reduction target by 2030. These combined factors are significantly expanding the Qatar lubricants market share.

|

Particulars |

Details |

|

Market Size (2025) |

USD 298.33 Million |

|

Forecast (2034) |

USD 414.61 Million |

|

CAGR (2026-2034) |

3.72% |

|

Key Segments |

Product Type (Engine Oils, Greases, Hydraulic Fluids, Metalworking Fluids, Transmission and Gear Oils, Others), End User (Automotive, Heavy Equipment, Metallurgy and Metalworking, Power Generation, Others) |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

Qatar Lubricants Market Outlook (2026-2034):

The Qatar lubricants market is positioned for sustained expansion driven by several transformative forces reshaping the nation's industrial landscape. The government's ambitious infrastructure modernization programs, including the QR 728 Billion investment commitment extending through 2030 and preparations for the Asian Games 2030, will generate substantial demand for specialized industrial lubricants across construction, heavy equipment, and manufacturing sectors. Simultaneously, the rapid advancement of Qatar's petrochemical industry, exemplified by the QR 21.8 Billion Ras Laffan Petrochemical Complex and North Field expansion projects, creates heightened requirements for high-performance metalworking fluids and process lubricants. The automotive segment will benefit from continued vehicle fleet growth supported by favorable economic conditions, while increasing adoption of synthetic and semi-synthetic formulations addresses both performance demands and environmental compliance imperatives.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence is progressively reshaping lubricant management and optimization within Qatar's industrial ecosystem. IoT-enabled sensors integrated into machinery provide continuous real-time data on lubricant condition, including viscosity levels, contamination indicators, and thermal parameters, enabling AI algorithms to predict maintenance requirements with unprecedented accuracy. This predictive maintenance approach minimizes unplanned downtime and extends equipment lifespan across critical sectors including oil and gas, manufacturing, and heavy construction. In production facilities, AI-powered quality assurance systems monitor blending processes instantaneously, detecting formulation anomalies before defects materialize. As smart manufacturing principles gain traction throughout Qatar's industrial zones, the integration of AI and IoT technologies is expected to drive increased adoption of premium lubricants optimized for data-driven maintenance regimes.

Market Dynamics:

Key Market Trends & Growth Drivers:

Surging Vehicle Ownership and Automotive Sector Expansion

Qatar's automotive landscape is experiencing remarkable momentum, with vehicle ownership reaching unprecedented levels amid sustained economic prosperity and demographic expansion. The nation witnessed registration of 62,163 new vehicles during the initial eight months of 2024, reflecting a 13.7 % year-over-year increase from 54,656 units in the corresponding 2023 period. Private vehicles dominated this growth, comprising over 70 % of total registrations as affluent consumers continued purchasing both conventional and luxury automobiles. This upward trajectory stems from multiple converging factors including Qatar's elevated GDP per capita exceeding USD 83,000, enabling substantial discretionary spending on vehicle acquisition and premium maintenance products. The country's ongoing infrastructure enhancements, particularly the comprehensive Doha Metro network and expanded road systems supporting suburban connectivity to Lusail and other developing districts, facilitate increased vehicle utilization and consequently higher lubricant consumption. Furthermore, Qatar's extreme desert climate with temperatures frequently surpassing 45 degrees Celsius accelerates lubricant degradation, necessitating more frequent oil changes and driving consistent demand for high-quality engine oils, transmission fluids, and cooling system products. The proliferation of sport utility vehicles and luxury sedans, which constitute approximately 35 % of new car sales, generates additional demand for synthetic and semi-synthetic lubricants specifically formulated for advanced engine technologies and high-performance applications, thereby strengthening the Qatar lubricants market growth.

Industrial Growth, Infrastructure Development, and Manufacturing Diversification

Qatar's industrial sector is undergoing transformative expansion driven by deliberate economic diversification initiatives designed to reduce hydrocarbon dependency and cultivate sustainable non-oil revenue streams. The Ministry of Commerce and Industry launched the Qatar National Manufacturing Strategy 2024-2030 in January 2025, establishing a comprehensive framework encompassing 15 strategic initiatives and 60 distinct projects targeting aluminum, plastics, advanced food processing, specialty medical products, and oil and gas support industries. This ambitious strategy aspires to elevate the private sector's value-added contribution to QR 36 Billion while achieving 50 % diversification in industrial activities by decade's end. Complementing this strategic vision, the government allocated QR 210.2 Billion in the 2025 national budget, representing a 4.6 % annual increase, with substantial portions directed toward infrastructure megaprojects and industrial zone development. Major undertakings include the QR 21.8 Billion Ras Laffan Petrochemical Complex scheduled for completion in 2026, which will significantly enhance Qatar's petrochemical production capacity and create substantial demand for metalworking fluids, hydraulic oils, and specialized industrial lubricants. The North Field expansion projects, collectively exceeding USD 50 Billion in investment and designed to elevate LNG output from 77 million Tons per annum to 142 Million Tons per annum by 2030, require extensive lubrication support for compressors, turbines, and ancillary equipment. Additionally, construction sector activity remains robust with ongoing developments across Lusail City, transportation infrastructure improvements under the Transportation Master Plan 2050, and preparations for Asian Games 2030 facilities, all generating consistent demand for greases, hydraulic fluids, and heavy-duty lubricants essential for construction machinery and industrial equipment operation.

Stringent Environmental Regulations and Sustainability Push

Qatar's environmental governance framework is evolving rapidly, introducing progressively stricter compliance requirements that fundamentally reshape lubricant specifications and market dynamics. The Qatar National Environment and Climate Change Strategy established ambitious targets including 25 % greenhouse gas emissions reduction by 2030, with manufacturing and automotive sectors specifically identified as priority areas for carbon footprint minimization. Regulatory authorities commenced rigorous enforcement of low-emission lubricant mandates throughout 2024, compelling manufacturers and distributors to accelerate research and development investments in environmentally compliant formulations. These regulations align Qatar with international environmental agreements while responding to growing corporate sustainability commitments from major industrial consumers. The shift manifests in multiple dimensions including accelerated adoption of low-viscosity engine oils that enhance fuel efficiency while reducing tailpipe emissions, with year-over-year growth in such products reaching 15 %. Bio-lubricant interest is expanding as environmental consciousness increases among both commercial fleet operators and individual consumers, although adoption rates remain modest compared to conventional products. Industrial facilities throughout Mesaieed and Ras Laffan industrial cities face mounting pressure to implement lubricants with reduced toxicity profiles and improved biodegradability, particularly in marine and environmentally sensitive applications. This regulatory transformation creates opportunities for lubricant suppliers offering innovative formulations meeting or exceeding environmental standards, while simultaneously challenging traditional product portfolios requiring reformulation. The Qatar government's parallel focus on circular economy principles and waste management, exemplified by ministerial resolutions on solid waste sorting and liquid waste transportation controls, further reinforces the imperative for sustainable lubrication solutions throughout industrial and automotive applications.

Key Market Challenges:

Volatile Raw Material Prices and Supply Chain Disruptions

The Qatar lubricants market confronts persistent headwinds from fluctuating base oil and additive costs that compress profit margins and complicate pricing strategies. Base oils, which constitute the primary component of finished lubricants, derive predominantly from petroleum refining processes subject to crude oil price volatility and global supply-demand imbalances. Recent years witnessed significant price swings as geopolitical tensions, OPEC production decisions, and macroeconomic uncertainties triggered rapid crude oil value fluctuations translating directly into base oil cost instability. Specialty additives including detergents, dispersants, antioxidants, and viscosity index improvers originate from complex chemical synthesis processes dependent on specific petrochemical feedstocks, themselves vulnerable to supply constraints and price escalation. International supply chains extending across multiple continents introduce additional vulnerabilities including shipping delays, port congestion, and logistics cost inflation that periodically disrupt product availability and elevate landed costs. For Qatar's lubricant distributors and blenders, many relying on imported base stocks and additive packages, these dynamics create inventory management challenges and margin compression during price spike periods. Smaller market participants lacking substantial purchasing power or long-term supply contracts face disproportionate impact, potentially reducing market competitiveness and accelerating consolidation trends. Furthermore, the necessity to maintain diverse product portfolios spanning multiple viscosity grades and performance specifications across automotive, industrial, and specialty applications amplifies inventory complexity and working capital requirements when raw material prices fluctuate unpredictably.

Adapting to Electric Vehicle Transition and Extended Drain Intervals

The emerging electric vehicle ecosystem represents a fundamental long-term challenge to conventional lubricants demand, particularly within the automotive segment that historically dominated market volumes. While Qatar's electric vehicle penetration remains minimal currently, the government established ambitious targets aiming for electric vehicles to constitute 10 % of domestic sales by 2030, with plans to expand charging infrastructure from 25 stations in 2023 to 600 by 2025 supporting this transition. Electric powertrains eliminate traditional internal combustion engines, thereby obviating engine oil requirements entirely while simultaneously reducing transmission fluid and differential lubricant consumption through simplified drivetrains. Although this transformation unfolds gradually over extended timeframes, forward-looking lubricant suppliers must anticipate declining conventional product demand and develop alternative revenue streams including specialized electric vehicle fluids such as thermal management coolants, e-gear oils, and battery cooling lubricants commanding different performance specifications and pricing structures. Concurrently, advancing conventional engine technologies incorporating extended drain intervals, sophisticated filtration systems, and high-efficiency designs progressively reduce per-vehicle lubricant consumption even within the traditional fleet. Original equipment manufacturers increasingly specify 15,000 to 20,000 kilometer service intervals compared to historical 5,000 to 10,000 kilometer norms, effectively halving lubricant consumption per vehicle annually despite fleet growth. These trends compound to create structural headwinds requiring strategic repositioning toward higher-value synthetic products, industrial applications, and value-added services compensating for declining conventional automotive volumes.

Intense Market Competition and Consolidation Pressures

Qatar's lubricants market exhibits moderately concentrated competitive dynamics with established multinational corporations commanding substantial market shares alongside specialized regional distributors and the domestic manufacturer. Global industry leaders including ExxonMobil, Shell, TotalEnergies, and Castrol leverage extensive brand recognition cultivated through decades of market presence, comprehensive product portfolios spanning all major application segments, and technical support capabilities reinforcing customer loyalty particularly among large industrial accounts and fleet operators. These international players benefit from economies of scale in procurement, blending, and distribution while maintaining quality consistency through globally standardized formulations and rigorous quality assurance protocols. Qatar Lubricants Company (QALCO), as the sole domestic blending facility, provides localized manufacturing capabilities and competes through understanding of regional requirements and responsive customer service, yet faces challenges matching the comprehensive technical resources and product breadth of multinational competitors. The market's import-dependent nature, with significant volumes entering through established distribution channels controlled by major trading houses and automotive dealership networks, creates barriers for new entrants lacking existing relationships and logistical infrastructure. Price competition intensifies periodically when overcapacity situations emerge or aggressive market share expansion strategies prompt promotional activities, compressing margins across all participants. Recent partnership announcements including Al Abdulghani Motors' October 2025 agreement to distribute Petromin lubricants and Q-Tire's February 2024 collaboration with Qatol exemplify strategic maneuvering as distributors seek differentiated product offerings and manufacturers pursue expanded market access through established retail networks, indicating ongoing competitive pressures driving consolidation and strategic alliance formation.

Qatar Lubricants Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar lubricants market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on product type, and end user.

Analysis by Product Type:

- Engine Oils

- Greases

- Hydraulic Fluids

- Metalworking Fluids

- Transmission and Gear Oils

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes engine oils, greases, hydraulic fluids, metalworking fluids, transmission and gear oils, and others.

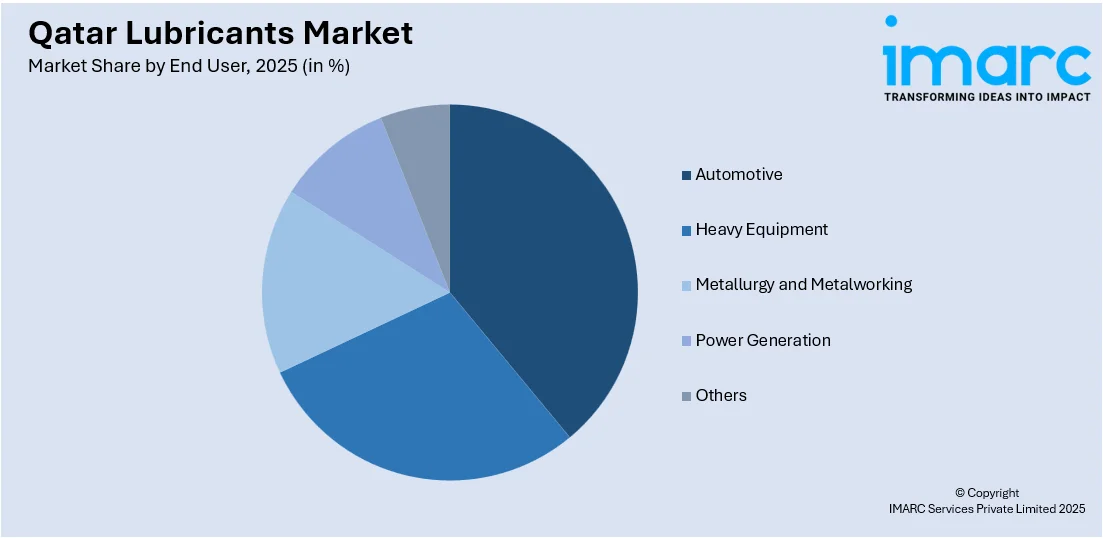

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Automotive

- Heavy Equipment

- Metallurgy and Metalworking

- Power Generation

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, heavy equipment, metallurgy and metalworking, power generation, and others.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar lubricants market demonstrates a moderately consolidated structure characterized by the dominance of established multinational corporations alongside specialized regional distributors and a single domestic manufacturer. International petroleum companies with extensive Middle Eastern operations maintain commanding positions through comprehensive product portfolios, substantial technical support capabilities, and entrenched relationships with major industrial consumers and automotive dealerships. These global players compete primarily on brand reputation, product performance consistency, and ability to provide integrated lubrication solutions spanning multiple application segments from passenger vehicles to heavy industrial machinery. Local market participants differentiate through responsive customer service, competitive pricing structures, and understanding of specific regional operating conditions including extreme temperature requirements and desert environment challenges that necessitate specialized formulations.

Qatar Lubricants Industry Latest Developments:

- October 2025: Al Abdulghani Motors formalized a partnership agreement with Petrolube Group, establishing exclusive distribution rights for Petromin lubricants throughout Qatar. This collaboration aligns with Al Abdulghani Motors' strategic objective of providing integrated mobility solutions while responding to growing customer demand for reliable products maintaining engine performance under diverse operating conditions. The partnership leverages Al Abdulghani Motors' extensive dealership network and after-sales service infrastructure to ensure Petromin lubricants achieve broad market availability through resellers nationwide.

- February 2024: Q-Tire entered a strategic partnership with Qatol, a prominent manufacturer of premium lubricants designed and engineered within Qatar. The contract signing ceremony formalized this collaboration between two leading automotive service providers, establishing a framework for delivering comprehensive vehicle maintenance solutions combining Q-Tire's tire expertise with Qatol's specialized lubricant formulations. This alliance enables both organizations to leverage complementary strengths while enhancing customer value propositions across Qatar's automotive aftermarket segment.

Qatar Lubricants Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Product Types Covered |

Engine Oils, Greases, Hydraulic Fluids, Metalworking Fluids, Transmission and Gear Oils, Others |

|

End Users Covered |

Automotive, Heavy Equipment, Metallurgy and Metalworking, Power Generation, Others |

|

Regions Covered |

Ad Dawhah, Al Rayyan, Al Wakrah, Others |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar lubricants market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar lubricants market on the basis of product type?

- What is the breakup of the Qatar lubricants market on the basis of end user?

- What is the breakup of the Qatar lubricants market on the basis of region?

- What are the various stages in the value chain of the Qatar lubricants market?

- What are the key driving factors and challenges in the Qatar lubricants market?

- What is the structure of the Qatar lubricants market and who are the key players?

- What is the degree of competition in the Qatar lubricants market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar lubricants market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar lubricants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)