Qatar OTT Media Market Size, Share, Trends and Forecast by Type, Device Type, and Region, 2026-2034

Qatar OTT Media Market Summary:

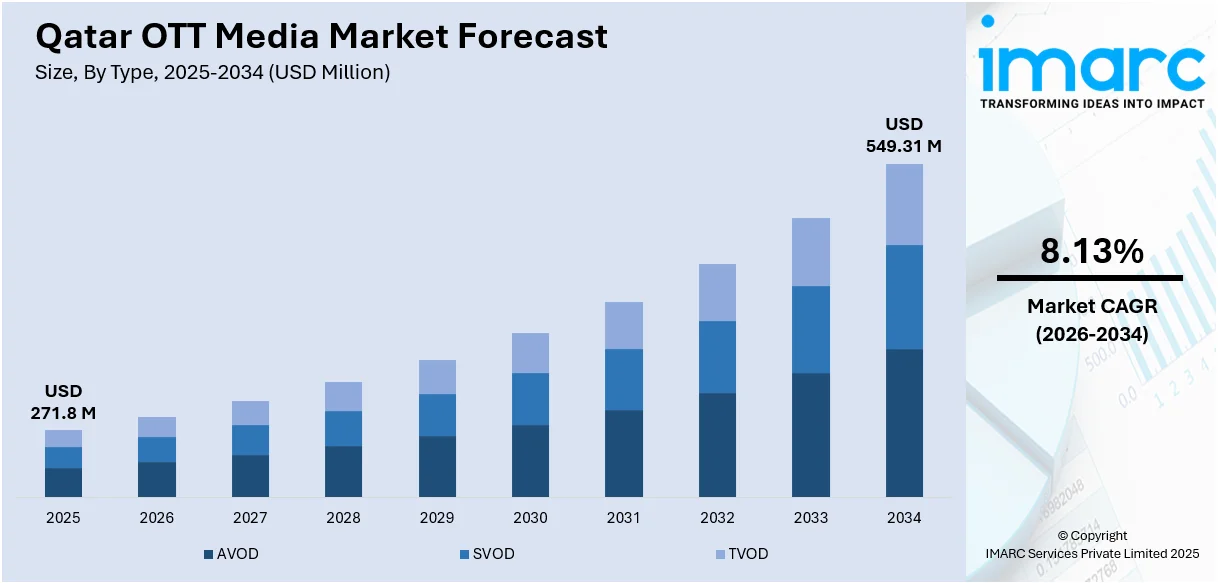

The Qatar OTT media market size reached USD 271.8 Million in 2025. The market is projected to reach USD 549.31 Million by 2034, growing at a CAGR of 8.13% during 2026-2034. The market is driven by Qatar's exceptional digital infrastructure with rising internet penetration, the proliferation of 5G networks enabling seamless high-definition streaming, and the increasing demand for localized Arabic content that resonates with both local audiences and the substantial expatriate population. Moreover, strategic partnerships between telecommunications providers and streaming platforms are creating bundled service offerings that enhance accessibility and convenience, while the young, tech-savvy demographic increasingly favors on-demand, personalized content experiences over traditional broadcasting, expanding the Qatar OTT media market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Market Size in 2025 | USD 271.8 Million |

| Market Forecast in 2034 | USD 549.31 Million |

| Market Growth Rate (2026-2034) | 8.13% |

| Key Segments | Type (AVOD, SVOD, TVOD), Device Type (Smart TVs and Set-top Box, Mobile Devices and Computers/Laptops, Gaming Consoles and Streaming Devices) |

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

Qatar OTT Media Market Outlook (2026-2034):

The Qatar OTT media market is positioned for sustained expansion, fueled by aggressive infrastructure investments in fiber-optic networks and 5G technology that enable buffer-free 4K streaming experiences. Government initiatives aligned with Qatar National Vision 2030 and the Digital Agenda 2030 are accelerating digital transformation across all sectors, creating a highly connected ecosystem conducive to streaming consumption. Additionally, the convergence of telecommunications and media services through innovative bundling strategies will reduce subscription barriers and combat churn, while the rising production of high-quality Arabic original content by both regional and international platforms ensures culturally relevant offerings that drive viewer engagement and long-term platform loyalty.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence is revolutionizing the Qatar OTT media market by enabling hyper-personalized content recommendations, adaptive streaming quality, and enhanced user engagement. Leading platforms utilize AI-powered algorithms to analyze viewing patterns, preferences, and behavioral data to deliver customized content suggestions, with Netflix reporting that over 80% of viewer activity is driven by AI-based recommendations. AI technologies also optimize streaming quality dynamically based on network conditions, personalize thumbnail images for individual users, and enable features such as automated recaps and intelligent search functions, significantly improving user satisfaction and reducing subscriber churn.

Market Dynamics:

Key Market Trends & Growth Drivers:

Advanced Digital Infrastructure Enabling Superior Streaming Experiences

Qatar’s world-class telecommunications infrastructure remains a central enabler of OTT media adoption and long-term market growth. With near-universal internet connectivity and widespread smartphone ownership, the country provides an ideal foundation for high-quality streaming experiences. Major operators such as Ooredoo and Vodafone Qatar continue to expand 5G coverage and fiber networks, ensuring fast, low-latency access that supports seamless high-definition and ultra-high-definition content delivery. This robust connectivity is reshaping viewing habits, shifting audiences from traditional broadcast schedules to flexible, on-demand consumption. The growing adoption of smart TVs further enhances home entertainment experiences, catering to Qatar’s affluent, tech-savvy consumers. Complementing these advancements, the Communications Regulatory Authority has implemented initiatives to enhance digital infrastructure and promote fair competition, including the opening of nationwide telecom duct systems and the introduction of Network Neutrality Guidelines to safeguard open internet access. Together, these measures strengthen the reliability, accessibility, and equity of Qatar’s digital ecosystem. Continuous investment in next-generation infrastructure positions the nation as one of the Middle East’s most advanced digital markets, fostering an ecosystem that encourages innovation, attracts global streaming providers, and supports the continued expansion of the country’s rapidly evolving OTT entertainment sector.

Growing Demand for Culturally Relevant Arabic and Localized Content

The increasing production and consumption of Arabic-language original content represents a transformative trend reshaping Qatar's OTT media landscape. While international platforms like Netflix and Disney+ initially gained traction through Western content libraries, regional audiences increasingly demand programming that reflects their cultural values, linguistic preferences, and social narratives. This shift has prompted both global streaming giants and regional players to invest heavily in Arabic content production, ranging from high-budget drama series and reality shows to locally adapted formats of international hits. Qatar's diverse population, comprising approximately 88% expatriates alongside Qatari nationals, creates demand for multilingual content offerings that serve Arab, South Asian, and Western audiences simultaneously. Platforms that successfully curate content libraries addressing this demographic complexity achieve higher engagement rates and subscriber retention. The cultural sensitivity and linguistic authenticity of locally produced content create emotional resonance that international titles often cannot replicate, driving higher viewership hours and repeat consumption. Moreover, Qatar's strategic positioning as a regional media hub, exemplified by initiatives like Qatar Media City offering attractive incentives to content creators and production companies, fosters an ecosystem conducive to content development. The growing recognition that culturally tailored content outperforms generic international offerings in regional markets continues to drive substantial investments in Arabic original productions, documentaries, and adaptations, solidifying the importance of localization as a competitive differentiator in the Qatar OTT media market growth.

Strategic Telecommunications Bundling Creating Enhanced Value Propositions

The convergence of telecommunications and entertainment services through strategic bundling initiatives represents a pivotal growth driver transforming Qatar's OTT landscape. Major telecommunications operators, recognizing the declining revenues from traditional voice and SMS services, are repositioning themselves as comprehensive digital service providers by integrating streaming platforms into their core offerings. These bundled packages typically combine mobile data plans, broadband internet access, and subscriptions to one or multiple streaming services at discounted rates compared to standalone purchases, creating compelling value propositions that attract price-conscious consumers. Such partnerships benefit all stakeholders: telecommunications companies reduce customer churn and increase average revenue per user, streaming platforms gain immediate access to established subscriber bases without expensive customer acquisition costs, and consumers enjoy simplified billing and cost savings. The bundling strategy proves particularly effective in combating subscription fatigue, a growing challenge as consumers juggle multiple platform subscriptions with overlapping content. Furthermore, partnerships between telecom operators and streaming platforms often include exclusive content deals, early access to premium programming, or bundled family plans that provide additional household value. The integration of OTT services into existing telecommunications infrastructure also facilitates superior quality of service monitoring and network optimization specifically tuned for streaming traffic, ensuring consistent user experiences. As the telecommunications sector continues evolving toward comprehensive digital ecosystem orchestration, bundling strategies will remain instrumental in driving OTT adoption, particularly among demographics that prioritize convenience and consolidated service management over platform proliferation.

Key Market Challenges:

Subscription Fatigue Driving Elevated Churn Rates

The rapid proliferation of streaming platforms has created a paradox where content abundance both attracts and overwhelms consumers, resulting in widespread subscription fatigue and rising churn across the OTT industry. In Qatar, although consumers generally possess strong purchasing power, many experience decision fatigue from managing multiple subscriptions spanning international and regional platforms such as Netflix, Disney+, Amazon Prime Video, Shahid, StarzPlay, and OSN+. The need to navigate separate applications, logins, and payment systems diminishes user satisfaction and blurs the perceived value of maintaining several subscriptions simultaneously. This fragmentation leads to confusion over content availability and fosters “binge-and-cancel” habits, where users subscribe briefly for specific releases before canceling until new must-watch titles emerge. Such behavior undermines predictable revenue streams and heightens financial volatility for service providers. Economic caution and price sensitivity further amplify this trend as consumers reassess discretionary spending and streamline entertainment budgets. For platforms operating in Qatar, mitigating subscription fatigue demands comprehensive strategies—expanding and refreshing content libraries, optimizing user experience for effortless content discovery, introducing flexible pricing and ad-supported tiers, and pursuing bundled partnerships that offer consolidated access. By addressing convenience, affordability, and engagement simultaneously, OTT providers can reduce churn and reinforce long-term subscriber loyalty in an increasingly crowded market.

Content Piracy and Unauthorized Streaming Undermining Revenue Generation

Digital content piracy remains a significant and economically damaging obstacle for Qatar’s OTT media market, undermining legitimate revenues and discouraging investment in premium content. Unauthorized streaming platforms, illegal IPTV services, and widespread account sharing continue to draw users away from licensed providers, fueled by convenience, limited content availability, and weak enforcement mechanisms. Despite Qatar’s high income levels and advanced digital infrastructure, many viewers still turn to pirated alternatives that aggregate content from multiple sources into single, easily accessible interfaces. This behavior erodes subscription revenues, diminishes the value proposition of legitimate platforms, and complicates negotiations with content owners, who often demand higher licensing fees to offset anticipated piracy losses. The challenge is further amplified by high-speed internet access and widespread VPN usage, which enable seamless viewing of pirated high-definition content and evasion of regional content restrictions. Addressing this issue requires coordinated action among regulators, telecom operators, and streaming platforms to dismantle illegal networks, enforce intellectual property protections, and raise consumer awareness about the risks of piracy. Equally important, legitimate platforms must focus on improving user experience, offering broader content libraries, localized pricing, and enhanced convenience to make lawful streaming a more attractive and competitive alternative.

Fragmented Regulatory Frameworks Complicating Regional Content Distribution

The lack of harmonized regulatory standards across Gulf Cooperation Council countries and the wider Middle East presents major operational hurdles for OTT platforms serving Qatar and expanding regionally. Each market enforces its own content licensing rules, censorship criteria, data localization mandates, and taxation frameworks, compelling streaming providers to manage complex compliance processes when distributing content across borders. In Qatar, the Communications Regulatory Authority oversees digital media standards, while neighboring countries like Saudi Arabia and the UAE apply differing frameworks reflecting distinct cultural and policy priorities. This fragmentation forces platforms to maintain customized content libraries and moderation systems for each jurisdiction, raising costs and undermining regional economies of scale. Recent legislation in the UAE, for example, mandates strict edits to content that conflicts with social or religious norms, prompting country-specific review processes. Producers must navigate multiple media laws across Gulf markets, inflating legal costs and prolonging approval cycles. These challenges are especially acute for pan-Arab productions, which often avoid controversial themes to preempt censorship risks, limiting creative depth and audience engagement. Additionally, rising data localization requirements compel platforms to build separate national data infrastructures, burdening smaller players and reinforcing the dominance of large international platforms capable of managing these multi-jurisdictional complexities.

Qatar OTT Media Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar OTT media market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on type and device type.

Analysis by Type:

- AVOD

- SVOD

- TVOD

The report has provided a detailed breakup and analysis of the market based on the type. This includes AVOD, SVOD, and TVOD.

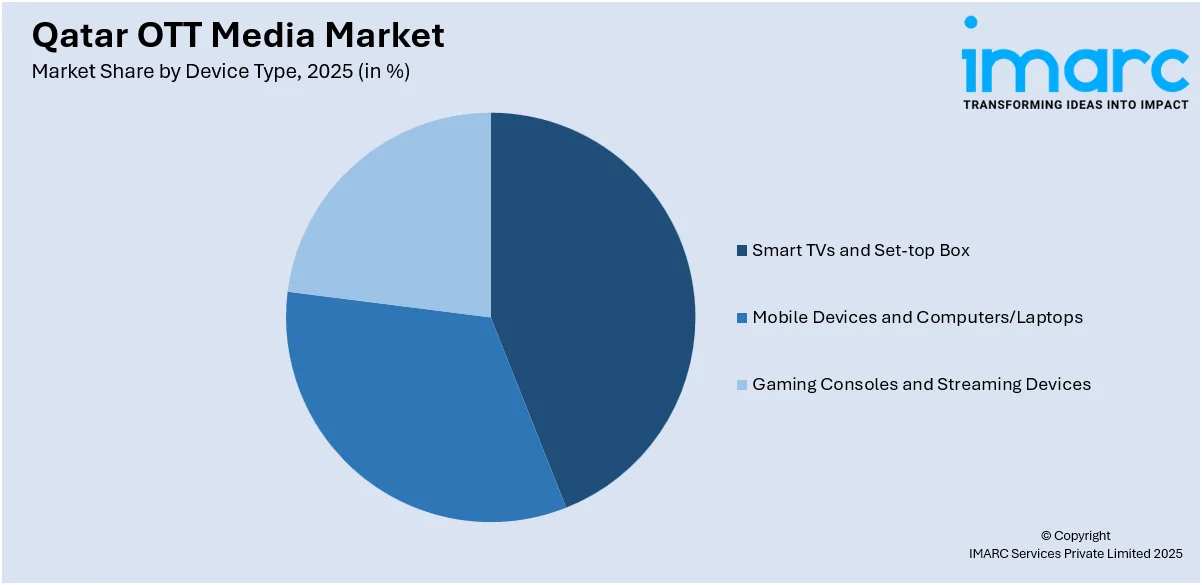

Analysis by Device Type:

Access the comprehensive market breakdown Request Sample

- Smart TVs and Set-top Box

- Mobile Devices and Computers/Laptops

- Gaming Consoles and Streaming Devices

A detailed breakup and analysis of the market based on the device type have also been provided in the report. This includes smart TVs and set-top box, mobile devices and computers/laptops, and gaming consoles and streaming devices.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar OTT media market exhibits a dynamic competitive structure characterized by the coexistence of global streaming giants and regional specialized platforms, each pursuing distinct positioning strategies. International players like Netflix, Amazon Prime Video, and Disney+ leverage their extensive content libraries, substantial production budgets, and advanced technological capabilities to attract Qatar's cosmopolitan audience seeking Western entertainment and original productions. These platforms benefit from strong brand recognition, sophisticated recommendation algorithms, and cross-regional content libraries that appeal to the country's diverse expatriate population. Conversely, regional platforms such as Shahid, OSN+, and StarzPlay Arabia differentiate themselves through curated Arabic-language content, regional sports broadcasting rights, and cultural relevance that resonates with local audiences. The competitive landscape further intensifies through telecommunications operators' entry into content aggregation, exemplified by Ooredoo's Go Play Market initiative, which combines multiple content sources into unified platforms. Competition increasingly centers on exclusive content acquisition, original production investments, user experience optimization, and strategic partnerships that enhance distribution reach and reduce customer acquisition costs while maintaining sustainable pricing structures.

Qatar OTT Media Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | AVOD, SVOD, TVOD |

| Device Types Covered | Smart TVs and Set-top Box, Mobile Devices and Computers/Laptops, Gaming Consoles and Streaming Devices |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar OTT media market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar OTT media market on the basis of type?

- What is the breakup of the Qatar OTT media market on the basis of device type?

- What is the breakup of the Qatar OTT media market on the basis of region?

- What are the various stages in the value chain of the Qatar OTT media market?

- What are the key driving factors and challenges in the Qatar OTT media market?

- What is the structure of the Qatar OTT media market and who are the key players?

- What is the degree of competition in the Qatar OTT media market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar OTT media market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar OTT media market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar OTT media industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)