Qatar Packaging Market Size, Share, Trends and Forecast by Material, Product Type, Packaging Type, End Use, and Region, 2026-2034

Qatar Packaging Market Summary:

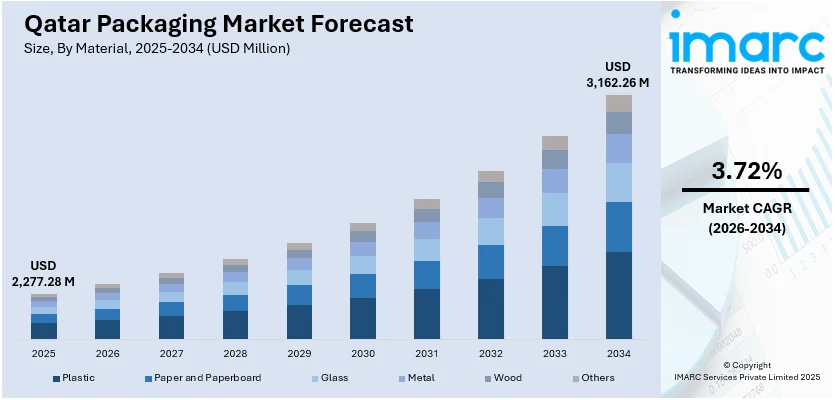

The Qatar packaging market size reached USD 2,277.28 Million in 2025. The market is projected to reach USD 3,162.26 Million by 2034, growing at a CAGR of 3.72% during 2026-2034. The market is driven by rapid expansion of retail infrastructure, increasing consumer goods consumption, and Qatar's strategic position as a regional logistics hub. Moreover, the government's emphasis on food security through local production and imports is necessitating advanced packaging solutions across food and beverage sectors. Preparations for major sporting events and tourism initiatives are expanding demand for packaging across hospitality and consumer products industries, thereby expanding the Qatar packaging market share.

|

Particulars |

Details |

|

Market Size 2025 |

USD 2,277.28 Million |

|

Forecast 2034 |

USD 3,162.26 Million |

|

CAGR (2026-2034) |

3.72% |

|

Key Segments |

Material (Plastic, Paper and Paperboard, Glass, Metal, Wood, Others), Product Type (Rigid Packaging, Flexible Packaging), Packaging Type (Primary Packaging, Secondary Packaging, Tertiary Packaging), End Use (Food, Beverages, Cosmetics and Personal Care, Chemicals and Lubricants, Healthcare, Consumer Products, Building and Constructions, Electronics, Automotives, Others) |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

Qatar Packaging Market Outlook (2026-2034):

The Qatar packaging market is positioned for steady growth, propelled by the nation's economic diversification strategy under Qatar National Vision 2030. Expanding food and beverage imports to ensure food security, coupled with rising domestic manufacturing capabilities, will drive demand for varied packaging solutions. Additionally, the proliferation of e-commerce platforms and retail modernization initiatives will necessitate innovative packaging formats. The healthcare sector's expansion, supported by world-class medical infrastructure development, will further stimulate demand for specialized pharmaceutical and medical device packaging throughout the forecast period.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence is beginning to transform Qatar's packaging industry by optimizing supply chain efficiency and quality control processes. AI-powered systems are being deployed in manufacturing facilities to detect defects, monitor production lines, and predict maintenance requirements, thereby reducing waste and enhancing consistency. Smart packaging solutions incorporating AI-enabled sensors for tracking freshness and authenticity are gaining traction, particularly in food and pharmaceutical sectors. As Qatar continues investing in digital infrastructure, AI's role in demand forecasting, inventory management, and personalized packaging design is expected to expand significantly.

Market Dynamics:

Key Market Trends & Growth Drivers:

Infrastructure Development and Major Event Preparations

Qatar's ongoing infrastructure development, particularly in preparation for hosting major international events, has significantly accelerated packaging demand across multiple sectors. The construction of new hotels, retail complexes, entertainment venues, and transportation networks has created substantial requirements for construction materials packaging, consumer goods packaging, and food service packaging. The hospitality industry's expansion necessitates premium packaging solutions for amenities, food delivery, and guest services. Moreover, the influx of international visitors has driven demand for multilingual and culturally appropriate packaging designs that cater to diverse consumer preferences. Retail infrastructure modernization, including the opening of luxury shopping destinations and modern supermarkets, has elevated standards for product presentation and shelf appeal. The government's commitment to maintaining world-class facilities beyond major events ensures sustained investment in packaging innovations that meet international quality standards while reflecting Qatar's cultural identity and sustainability ambitions.

Food Security Initiatives and Agricultural Development

Qatar's strategic focus on food security following regional trade disruptions has fundamentally reshaped the packaging landscape. The government has invested heavily in domestic agricultural production, establishing advanced greenhouse facilities and dairy farms that require specialized packaging to preserve freshness and extend shelf life. In 2024, Qatar's Ministry of Municipality announced the expansion of the Al Sulaiteen agricultural project, which increased local vegetable production capacity by 40%, necessitating substantial investments in modified atmosphere packaging and temperature-controlled distribution systems. Simultaneously, diversification of import sources has introduced new packaging requirements to accommodate products from various international suppliers with different standards and regulations. Cold chain infrastructure development, including state-of-the-art warehouses and refrigerated transport networks, demands packaging materials that maintain product integrity under extreme temperature variations typical of Qatar's climate. The emphasis on reducing food waste through improved preservation techniques has accelerated adoption of active and intelligent packaging technologies that monitor product conditions and communicate freshness information to consumers, thereby supporting the Qatar packaging market growth.

Sustainability Regulations and Circular Economy Initiatives

Environmental consciousness and regulatory frameworks are driving a fundamental transformation in Qatar's packaging industry toward sustainable materials and circular economy principles. The Qatar National Vision 2030 emphasizes environmental sustainability, prompting the government to introduce regulations targeting single-use plastics and promoting recyclable packaging alternatives across various sectors. In response, major manufacturers and retailers are switching to recycled content solutions, compostable packaging, and biodegradable materials that satisfy consumer preferences and legal requirements. The establishment of waste management infrastructure, including recycling facilities and material recovery operations, is creating economic incentives for designing packaging with end-of-life considerations. International brands operating in Qatar are implementing global sustainability commitments locally, introducing innovative packaging formats such as refillable containers, lightweight designs, and mono-material structures that facilitate recycling. The packaging industry is also witnessing increased collaboration between material suppliers, converters, and brand owners to develop closed-loop systems where packaging waste is collected, processed, and reintegrated into new packaging production cycles.

Key Market Challenges:

Extreme Climate Conditions and Material Performance Requirements

Qatar's harsh desert climate presents significant technical challenges for packaging materials and supply chain logistics. Ambient temperatures regularly exceeding 45°C during summer months can compromise packaging integrity, particularly for plastic materials that may deform, lose barrier properties, or release unwanted substances into packaged products. Glass packaging faces thermal stress risks during transportation and storage, while adhesives and seals can fail under extreme heat exposure. The high humidity levels in coastal areas further complicate material selection, particularly for paper-based packaging that may lose structural integrity when exposed to moisture. These environmental factors necessitate specialized material formulations, protective coatings, and quality control protocols that increase production costs and limit material choices. The requirement for temperature-controlled storage and transportation throughout the supply chain adds logistical complexity and expense, particularly for food, pharmaceutical, and cosmetic products. Packaging designers must balance functionality, aesthetics, and cost-effectiveness while ensuring products remain protected from Qatar's challenging environmental conditions throughout their shelf life.

Import Dependency and Supply Chain Vulnerabilities

Qatar's packaging industry remains heavily dependent on imported raw materials, machinery, and finished packaging products, creating significant supply chain vulnerabilities and cost pressures. The limited domestic manufacturing capacity for packaging materials, particularly specialized films, coatings, and advanced barrier materials, necessitates reliance on international suppliers primarily located in Asia, Europe, and North America. Geopolitical tensions, trade disputes, or disruptions in global shipping networks can cause material shortages, price volatility, and extended lead times that impact packaging availability and costs. Currency fluctuations affect the competitiveness of imported materials and can erode profit margins for packaging converters and end users. The relatively small market size limits economies of scale, making it challenging to justify investments in local manufacturing facilities that require substantial capital expenditure and technical expertise. Quality consistency can vary among international suppliers, requiring rigorous testing and verification processes that add time and expense to procurement operations.

Skilled Workforce Shortage and Technical Expertise Gaps

The packaging industry in Qatar faces persistent challenges in recruiting and retaining skilled technical personnel capable of operating advanced machinery, implementing quality management systems, and driving innovation. The sector requires specialized knowledge spanning material science, printing technology, automation systems, and regulatory compliance that is not readily available in the local labor market. Expatriate workers with relevant expertise often command premium salaries and may face visa restrictions or cultural adjustment challenges that affect retention rates. Limited local educational programs focused on packaging engineering or technology create a talent pipeline gap that hinders industry development and innovation capacity. The rapid evolution of packaging technologies, including digital printing, smart packaging, and sustainable materials, demands continuous workforce training and development that smaller companies may struggle to afford. Language barriers and differences in technical standards between Qatar and major packaging equipment manufacturing countries can complicate technology transfer and knowledge acquisition.

Qatar Packaging Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar packaging market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on material, product type, packaging type, and end use.

Analysis by Material:

- Plastic

- Paper and Paperboard

- Glass

- Metal

- Wood

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastic, paper and paperboard, glass, metal, wood, and others.

Analysis by Product Type:

- Rigid Packaging

- Boxes and Containers

- Bottles and Jars

- Pails and Cans

- Trays and Pallets

- Caps and Closures

- Tubes

- Others

- Flexible Packaging

- Bags and Sacks

- Films and Wraps

- Labels

- Sachets and Pouches

- Tapes

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes rigid packaging (boxes and containers, bottles and jars, pails and cans, trays and pallets, caps and closures, tubes, and others) and flexible packaging (bags and sacks, films and wraps, labels, sachets and pouches, tapes, and others).

Analysis by Packaging Type:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes primary packaging, secondary packaging, and tertiary packaging.

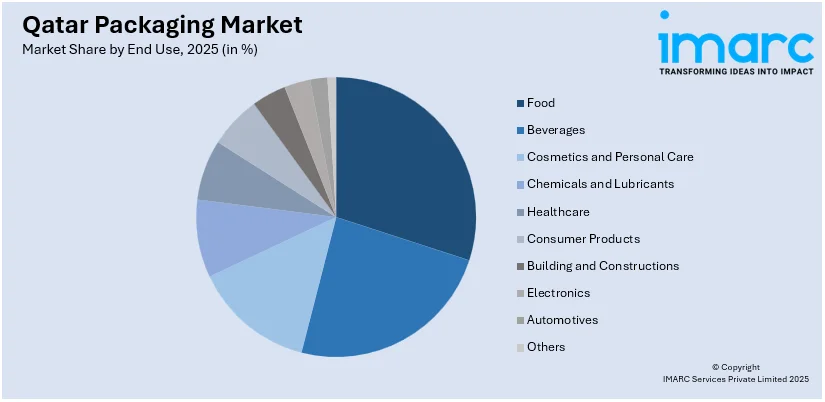

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Food

- Dairy Product

- Meat, Poultry, and Seafood

- Agricultural Produce

- Others

- Beverages

- Alcoholic Beverages

- Non-alcoholic Beverages

- Cosmetics and Personal Care

- Skin Care

- Hair Care

- Others

- Chemicals and Lubricants

- Healthcare

- Pharmaceuticals

- Medical Devices

- Others

- Consumer Products

- Building and Constructions

- Electronics

- Automotives

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food (dairy product, meat, poultry, and seafood, agricultural produce, and others), beverages (alcoholic beverages and non-alcoholic beverages), cosmetics and personal care (skin care, hair care, and others), chemicals and lubricants, healthcare (pharmaceuticals, medical devices, and others), consumer products, building and constructions, electronics, automotives, and others.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar packaging market is characterized by moderate competition with a mix of international packaging companies operating through local partnerships, regional Gulf Cooperation Council manufacturers expanding their presence, and specialized local converters serving niche segments. Competition centers on service reliability, technical capabilities, and ability to meet customized requirements rather than purely on price. Larger multinational corporations leverage their global expertise, advanced technology platforms, and comprehensive product portfolios to secure contracts with major retailers, food manufacturers, and industrial clients. Regional players capitalize on proximity advantages, faster response times, and understanding of local market preferences and regulatory requirements. The market is witnessing increasing consolidation as larger entities acquire smaller specialized converters to expand capabilities and market coverage while achieving operational efficiencies.

Qatar Packaging Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Materials Covered |

Plastic, Paper and Paperboard, Glass, Metal, Wood, Others |

|

Product Types Covered |

|

|

Packaging Types Covered |

Primary Packaging, Secondary Packaging, Tertiary Packaging |

|

End Uses Covered |

|

|

Regions Covered |

Ad Dawhah, Al Rayyan, Al Wakrah, Others |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar packaging market on the basis of material?

- What is the breakup of the Qatar packaging market on the basis of product type?

- What is the breakup of the Qatar packaging market on the basis of packaging type?

- What is the breakup of the Qatar packaging market on the basis of end use?

- What is the breakup of the Qatar packaging market on the basis of region?

- What are the various stages in the value chain of the Qatar packaging market?

- What are the key driving factors and challenges in the Qatar packaging market?

- What is the structure of the Qatar packaging market and who are the key players?

- What is the degree of competition in the Qatar packaging market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)