Qatar Pension Fund Market Size, Share, Trends and Forecast by Plan Type, Investment Strategy, Sponsor Type, Geography of Investment, and Region, 2026-2034

Qatar Pension Fund Market Summary:

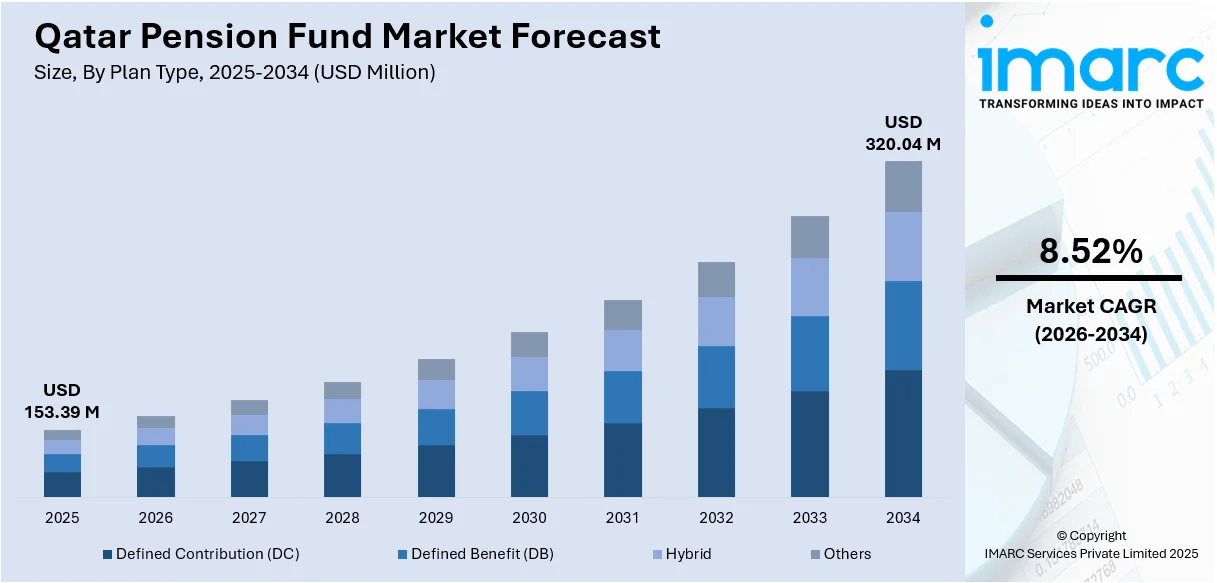

The Qatar pension fund market size reached USD 153.39 Million in 2025. The market is projected to reach USD 320.04 Million by 2034, growing at a CAGR of 8.52% during 2026-2034. The market is expanding steadily, supported by growing government initiatives to strengthen social security systems and rising private sector participation in retirement planning. The market is also benefiting from strategic investments in diversified asset classes, including real estate, infrastructure, and global equities, aimed at enhancing long-term returns and portfolio stability. These developments collectively underpin the growing Qatar pension fund market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Market Size in 2025 | USD 153.39 Million |

| Market Forecast in 2034 | USD 320.04 Million |

| Market Growth Rate 2026-2034 | 8.52% |

| Key Segments | Plan Type (Defined Contribution, Defined Benefit, Hybrid, Others), Investment Strategy (Active, Passive), Sponsor Type (Public-sector Plans, Private-sector Plans), Geography of Investment (Onshore, Offshore) |

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

Qatar Pension Fund Market Outlook (2026-2034):

The Qatar pension fund market is poised for steady expansion, propelled by regulatory enhancements that mandate higher employer and employee contributions alongside improved benefit structures for retirees. The government's commitment to aligning with international best practices in social protection and financial sustainability reinforces long-term growth prospects. Increasing allocations toward sustainable finance instruments, including green bonds and ESG-compliant investments, will further diversify fund portfolios and attract institutional capital. Moreover, the accelerating adoption of artificial intelligence and digital platforms will streamline administrative processes, enhance actuarial precision, and deliver personalized retirement planning solutions, positioning Qatar's pension system as a regional leader in innovation and member welfare throughout the forecast period.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence is transforming pension fund operations by enhancing efficiency, personalization, and decision-making capabilities across the pension value chain. AI technologies, including machine learning techniques and large language models, can boost the analytical capacities of portfolio managers, enhance actuarial analyses of pension fund risks, and keep market trend assessments current. These technologies prove especially valuable for analyzing private markets and data related to sustainable investments, while also improving member engagement through automated onboarding, communications, and retirement planning tools.

Market Dynamics:

Key Market Trends & Growth Drivers:

Legislative Reforms Strengthening Pension Framework and Increasing Contribution Rates

Qatar has introduced extensive legislative reforms to strengthen and modernize its social insurance and pension system, creating a more resilient and financially sustainable framework for its workforce. The new Social Insurance Law marks a pivotal step in advancing retirement protection and aligning the system with international best practices. It redefines contribution mechanisms, benefit calculations, and eligibility requirements to ensure long-term financial balance and fairness. Recent regulatory ratifications have enhanced transparency, clarified procedures for contributions and benefits, and improved overall system governance. Transitional measures safeguard individuals under the previous framework, ensuring a smooth and equitable transition. These reforms also aim to balance fiscal responsibility with social protection, reinforcing public trust in the system’s efficiency and accountability. The establishment of structured dispute resolution mechanisms and clear benefit management processes further enhances governance standards, supporting institutional integrity and stakeholder confidence. Collectively, these initiatives are bolstering the long-term stability and the Qatar pension fund market growth.

Integration of Environmental, Social and Governance Principles into Investment Strategies

Qatar is accelerating the adoption of environmental, social, and governance principles within its financial ecosystem, with pension funds increasingly aligning investment strategies to national sustainability and climate goals. The government’s regulatory initiatives have laid the foundation for embedding ESG considerations across financial operations and capital markets, positioning Qatar as a leading center for sustainable finance in the Gulf region. The country’s commitment to sustainability is reflected in policy reforms and green financing efforts that support projects in renewable energy, resource efficiency, and environmentally responsible construction. These initiatives not only enhance Qatar’s global investment appeal but also create new opportunities for pension funds to diversify portfolios through sustainable, long-term investments. Financial institutions across the country are aligning with this transition by developing green finance units and ESG-focused frameworks that promote responsible investment practices. The shift toward sustainable capital deployment strengthens the alignment between pension fund strategies and national objectives, reinforcing the role of finance in achieving long-term environmental and economic resilience.

Digital Transformation and Artificial Intelligence Adoption Enhancing Operational Efficiency

Digital transformation is reshaping the global pension landscape, with artificial intelligence and machine learning technologies driving greater efficiency, transparency, and personalization. For Qatar’s pension fund sector, these advancements present significant potential to modernize administrative systems, improve actuarial assessments, and enhance member engagement. AI tools can automate administrative processes, streamline data management, and deliver customized retirement planning insights. Intelligent platforms enable real-time scenario modeling, personalized investment education, and predictive analytics that support informed decision-making for both administrators and members. In investment management, machine learning enhances portfolio optimization by identifying emerging trends and managing risks across diverse asset classes, including sustainable investments. Additionally, AI integration can strengthen governance by improving communication among stakeholders, supporting timely decision-making, and enabling more efficient dispute resolution. Through these innovations, Qatar’s pension funds can achieve higher operational efficiency, improved service quality, and greater adaptability to future financial and demographic challenges, positioning the sector for sustained growth in a rapidly evolving digital economy.

Key Market Challenges:

Longevity Risk and Increasing Life Expectancy Pressures

Pension funds worldwide face growing exposure to longevity risk as life expectancy continues to rise, extending the duration of benefit payments well beyond earlier actuarial forecasts. This demographic shift exerts mounting pressure on defined benefit schemes that promise lifetime income to retirees, potentially leading to funding imbalances when pensioners live longer than anticipated. For Qatar’s pension fund market, this challenge is increasingly relevant amid improvements in healthcare and living standards that contribute to longer lifespans. As the country’s workforce gradually ages, the ratio of active contributors to retirees will decline, intensifying fiscal obligations. To address these pressures, pension administrators must adopt more advanced actuarial models that account for medical innovation, lifestyle shifts, and socioeconomic trends influencing mortality. However, limited access to longevity risk transfer mechanisms, such as specialized insurance products, restricts the ability to hedge this exposure. Ensuring long-term sustainability will require periodic recalibration of retirement ages, contribution structures, and benefit formulas. Hybrid models that balance risk between members and sponsors may also prove effective in mitigating financial strain, fostering a more adaptive and equitable pension framework capable of sustaining Qatar’s evolving demographic profile.

Inflation Volatility and Interest Rate Fluctuations Impacting Fund Performance

Macroeconomic instability, especially inflation and fluctuating interest rates, poses a major challenge to pension fund performance, influencing both asset valuations and long-term liability projections. Persistent inflation erodes the real value of retirement income, compelling funds to adjust benefits to preserve purchasing power, which increases funding pressure. Meanwhile, sharp interest rate movements can reduce bond values and disrupt portfolio balance, particularly for funds heavily invested in fixed-income instruments. In Qatar, pension administrators must navigate these dynamics within an economy closely tied to global energy cycles, where fiscal and monetary conditions can shift rapidly. Inflation-linked instruments remain limited in regional markets, constraining effective hedging against rising price levels. Defined benefit schemes face growing funding gaps if investment returns lag behind inflation-driven liability growth, while defined contribution plans confront market volatility that can undermine members’ savings at retirement. To counter these risks, pension funds need dynamic asset-liability management frameworks that combine diversification across asset classes and geographies with agile rebalancing strategies. Balancing capital preservation and yield generation is essential for maintaining stability and ensuring the resilience of Qatar’s pension system amid global economic uncertainty.

Limited Awareness and Digital Literacy Among Participants

Pension system effectiveness relies heavily on participants’ understanding of contribution rules, investment options, and benefit entitlements. Yet, limited financial literacy and low awareness remain widespread challenges that undermine informed decision-making. Many members do not optimize their contributions, select suitable investment strategies, or plan realistically for post-retirement needs. In Qatar, recent reforms introducing new eligibility criteria, contribution rates, and benefit formulas make financial education even more critical. Without adequate awareness, participants may experience confusion or mistrust regarding their retirement security, especially during transitions between legislative frameworks. Moreover, as pension management increasingly shifts to digital platforms for account tracking and scenario modeling, limited digital literacy becomes a barrier—particularly for older workers, labor-intensive sectors, and low-income groups. This digital divide risks widening inequalities in retirement readiness. Addressing these gaps requires comprehensive education initiatives delivered through diverse channels such as workplace training, online learning, counseling sessions, and multilingual resources tailored to Qatar’s diverse workforce. Simplified digital interfaces, transparent communication, and accessible support services can further empower members to engage effectively with the system. Strengthening awareness and inclusivity will enhance public trust and ensure that the benefits of Qatar’s pension reforms reach all participants equitably.

Qatar Pension Fund Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar pension fund market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on plan type, investment strategy, sponsor type, and geography of investment.

Analysis by Plan Type:

- Defined Contribution (DC)

- Defined Benefit (DB)

- Hybrid

- Others

The report has provided a detailed breakup and analysis of the market based on the plan type. This includes defined contribution, defined benefit, hybrid, and others.

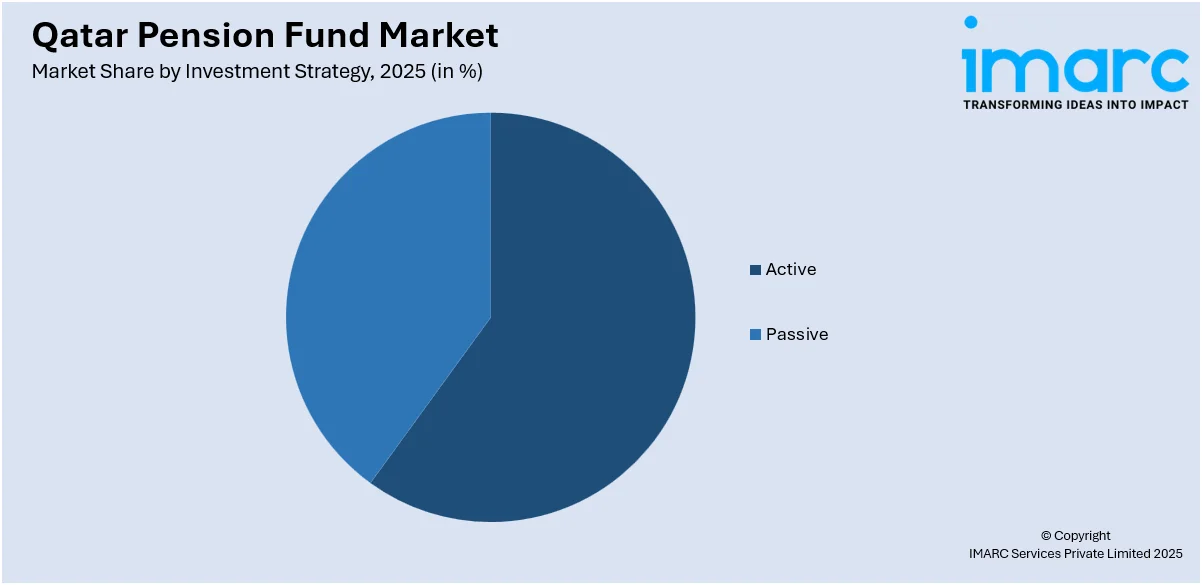

Analysis by Investment Strategy:

Access the comprehensive market breakdown Request Sample

- Active

- Passive

A detailed breakup and analysis of the market based on the investment strategy have also been provided in the report. This includes active and passive.

Analysis by Sponsor Type:

- Public-sector Plans

- Private-sector Plans

The report has provided a detailed breakup and analysis of the market based on the sponsor type. This includes public-sector plans and private-sector plans.

Analysis by Geography of Investment:

- Onshore

- Offshore

A detailed breakup and analysis of the market based on the geography of investment have also been provided in the report. This includes onshore and offshore.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar pension fund market is dominated by the General Retirement and Social Insurance Authority, which serves as the primary pension fund administrator for Qatari citizens and manages substantial assets invested predominantly in domestic listed and unlisted companies, bonds, and sukuks. The competitive landscape is characterized by centralized government oversight, with GRSIA operating as the monopolistic provider of mandatory social insurance coverage for the national workforce. The market structure reflects Qatar's broader economic model, where state institutions play a leading role in managing strategic sectors and ensuring social welfare for citizens. While private pension schemes and voluntary retirement savings products exist to serve expatriate workers and provide supplementary benefits, these arrangements remain secondary to the mandatory state-sponsored system. The implementation of Social Insurance Law reforms has further reinforced GRSIA's central position by extending coverage requirements and standardizing contribution frameworks across both public and private sector employers, thereby consolidating the authority's regulatory and operational influence.

Qatar Pension Fund Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Plan Types Covered | Defined Contribution, Defined Benefit, Hybrid, Others |

| Investment Strategies Covered | Active, Passive |

| Sponsor Types Covered | Public-sector Plans, Private-sector Plans |

| Geography of Investments Covered | Onshore, Offshore |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar pension fund market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar pension fund market on the basis of plan type?

- What is the breakup of the Qatar pension fund market on the basis of investment strategy?

- What is the breakup of the Qatar pension fund market on the basis of sponsor type?

- What is the breakup of the Qatar pension fund market on the basis of geography of investment?

- What is the breakup of the Qatar pension fund market on the basis of region?

- What are the various stages in the value chain of the Qatar pension fund market?

- What are the key driving factors and challenges in the Qatar pension fund market?

- What is the structure of the Qatar pension fund market and who are the key players?

- What is the degree of competition in the Qatar pension fund market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar pension fund market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar pension fund market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar pension fund industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)