Qatar Petrochemicals Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2026-2034

Qatar Petrochemicals Market Overview:

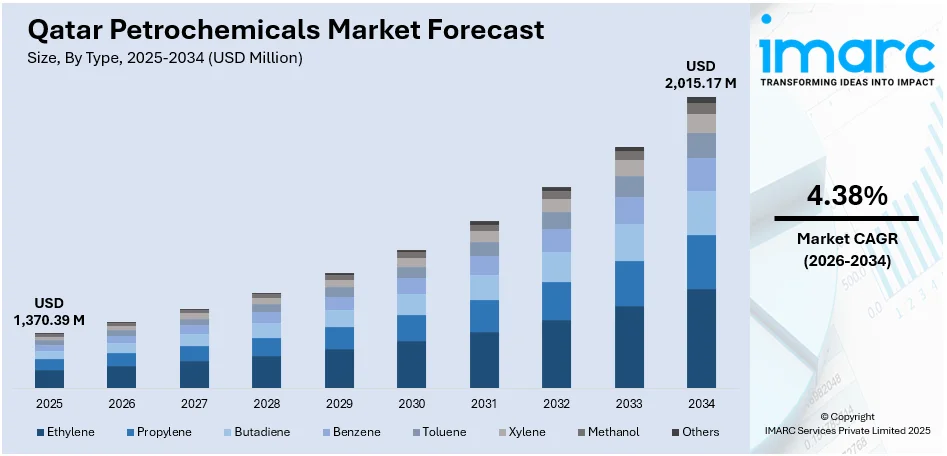

The Qatar petrochemicals market size reached USD 1,370.39 Million in 2025. The market is projected to reach USD 2,015.17 Million by 2034, exhibiting a growth rate (CAGR) of 4.38% during 2026-2034. The market is a vital part of its economic diversification, supported by abundant natural gas resources and significant investments in production facilities. The sector focuses on manufacturing a wide range of chemicals used in various industries, benefiting from access to low-cost feedstock. Continued infrastructure development and emphasis on sustainable practices are strengthening Qatar’s position in the global petrochemical landscape. These strategic efforts are expected to drive growth and influence the Qatar petrochemicals market share in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,370.39 Million |

| Market Forecast in 2034 | USD 2,015.17 Million |

| Market Growth Rate 2026-2034 | 4.38% |

Qatar Petrochemicals Market Trends:

Expansion of Petrochemical Production Capacity

Qatar is actively expanding its petrochemical production capacity as part of its long-term strategy to diversify the economy beyond natural gas exports. In February 2024, construction began on a new polymers complex at Ras Laffan Industrial City, marking a key milestone in boosting ethylene production capabilities. This project underscores the country’s commitment to strengthening its downstream sector in response to rising global demand for petrochemical products utilized in packaging, automotive, construction, and other industries. Scheduled for completion, the facility will significantly enhance Qatar’s petrochemical output and support broader economic diversification goals aligned with Qatar National Vision 2030. By adopting advanced technologies and increasing production capabilities, Qatar aims to solidify its position as a prominent petrochemical supplier on the global stage. This development will facilitate growth in exports and attract further investments, contributing to more robust integration within international petrochemical supply chains. Such initiatives are instrumental in driving sustained Qatar petrochemicals market growth and reinforcing the country’s competitive advantage.

To get more information on this market Request Sample

Strategic Partnerships and Supply Agreements

Strategic partnerships and long-term supply agreements are vital components of Qatar’s petrochemical industry expansion. In October 2024, Qatar Energy finalized a multi-year naphtha supply agreement designed to ensure steady feedstock availability for its downstream operations. This agreement strengthens Qatar’s position by securing reliable raw materials essential for continuous petrochemical production. Collaboration with global partners allows access to advanced technologies, expertise, and broader international markets, enhancing the competitiveness of Qatar’s petrochemical sector. The partnership approach supports not only production efficiency but also the development of innovative products that meet evolving global standards. Such alliances are instrumental in expanding Qatar’s influence within the international petrochemical value chain and promoting sustainable industry growth. Moreover, these agreements contribute to stabilizing supply and demand dynamics, fostering a resilient market environment. As Qatar continues to leverage strategic collaborations, these developments will shape the future landscape of the petrochemical industry. Collectively, these factors significantly impact Qatar petrochemicals market trends and play a key role in the sector’s ongoing advancement.

Focus on Sustainable and Circular Economy Practices

Sustainability is becoming an increasingly important theme for Qatar's petrochemicals sector as environmental factors become more prominent. The industry is starting to embrace circular economy concepts to minimize waste and increase resource efficiency during production. There are initiatives in place to introduce sophisticated recycling technologies that facilitate the reuse of by-products and reduce environmental footprint. Also, the focus is increasingly being put on the inclusion of renewable sources of energy in petrochemical operations to reduce carbon footprints and increase energy efficiency. Such efforts are in harmony with Qatar's national environmental policy and international climate commitments. Through sustainability, the petrochemical industry not only complies with regulatory norms but also caters to the increasing requirement from the international marketplace for eco-friendly products. The transition toward cleaner production practices enhances the long-term economic strength of the sector and enhances the image of Qatar's petrochemical sector globally. While the industry continues to grow and develop, sustainable practices should become an integral part of operating strategies, promoting innovation and creating a balance between economic development and environmental responsibility.

Qatar Petrochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- Ethylene

- Propylene

- Butadiene

- Benzene

- Toluene

- Xylene

- Methanol

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes ethylene, propylene, butadiene, benzene, toluene, xylene, methanol, and others.

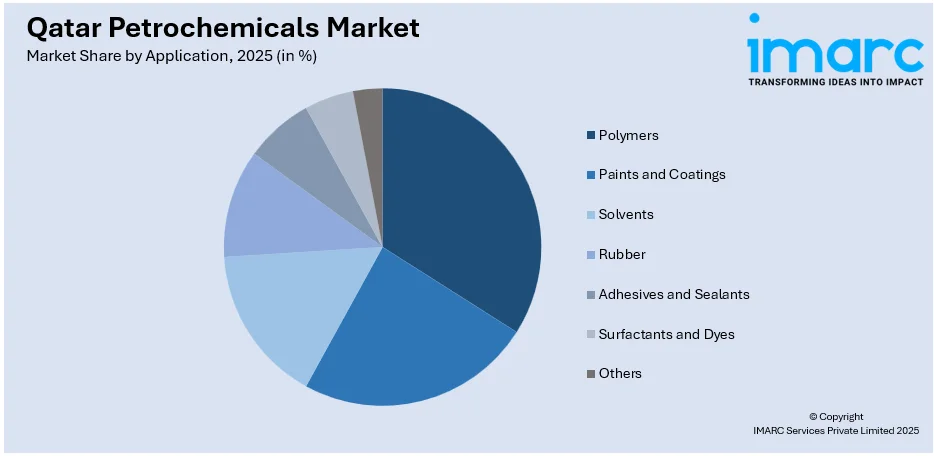

Application Insights:

Access the comprehensive market breakdown Request Sample

- Polymers

- Paints and Coatings

- Solvents

- Rubber

- Adhesives and Sealants

- Surfactants and Dyes

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes polymers, paints and coatings, solvents, rubber, adhesives and sealants, surfactants and dyes, and others.

End Use Industry Insights:

- Packaging

- Automotive and Transportation

- Construction

- Electrical and Electronics

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes packaging, automotive and transportation, construction, electrical and electronics, healthcare, and others.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Petrochemicals Market News:

- June 2024: Haldia Petrochemicals Limited has entered a long-term contract with QatarEnergy for the supply of naphtha. QatarEnergy will supply naphtha under this agreement to meet the production requirements of Haldia Petrochemicals. The agreement showcases the continued close relationship between the two nations and demonstrates Haldia Petrochemicals' continued drive to seek consistent raw material sources. The partnership showcases continued efforts towards the strengthening of energy and petrochemical relations between Qatar and India, advancing the development and stability of both sectors.

Qatar Petrochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ethylene, Propylene, Butadiene, Benzene, Toluene, Xylene, Methanol, Others |

| Applications Covered | Polymers, Paints and Coatings, Solvents, Rubber, Adhesives and Sealants, Surfactants and Dyes, Others |

| End Use Industries Covered | Packaging, Automotive and Transportation, Construction, Electrical and Electronics, Healthcare, Others |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar petrochemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar petrochemicals market on the basis of type?

- What is the breakup of the Qatar petrochemicals market on the basis of application?

- What is the breakup of the Qatar petrochemicals market on the basis of end use industry?

- What is the breakup of the Qatar petrochemicals market on the basis of region?

- What are the various stages in the value chain of the Qatar petrochemicals market?

- What are the key driving factors and challenges in the Qatar petrochemicals market?

- What is the structure of the Qatar petrochemicals market and who are the key players?

- What is the degree of competition in the Qatar petrochemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar petrochemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar petrochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar petrochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)