Qatar Pharmaceutical Market Size, Share, Trends and Forecast by Prescription Type, Therapeutic Category, and Region, 2026-2034

Qatar Pharmaceutical Market Overview:

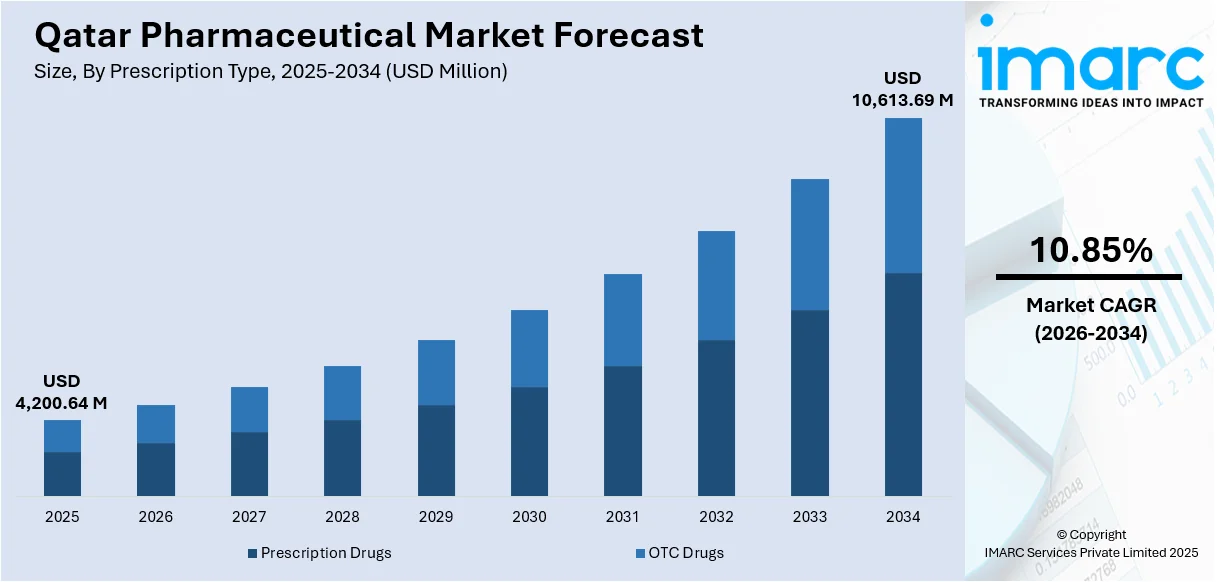

The Qatar pharmaceutical market size reached USD 4,200.64 Million in 2025. The market is projected to reach USD 10,613.69 Million by 2034, exhibiting a growth rate (CAGR) of 10.85% during 2026-2034. The market is advancing through a combination of innovation, self-reliance, and digital evolution. The rise of biologics supports more effective treatments, while advanced digital systems improve accessibility and care coordination. Commitment to domestic manufacturing ensures security of essential medicines and supports long-term sustainability. Together, these trends demonstrate a sector transitioning toward advanced healthcare delivery, improved patient outcomes, and strategic independence. Growth will remain closely aligned with evolving treatment priorities and regulatory enhancements shaping Qatar’s future healthcare framework, strengthening Qatar pharmaceutical market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,200.64 Million |

| Market Forecast in 2034 | USD 10,613.69 Million |

| Market Growth Rate 2026-2034 | 10.85% |

Qatar Pharmaceutical Market Trends:

Expansion of Biologics and Specialty Medicines

The growing focus on advanced therapies is shaping the future of healthcare in Qatar, where biologics and specialty medicines are steadily becoming key components of treatment strategies for complex diseases. Increased clinical adoption of targeted therapies reflects a transition toward precision care and innovative pharmaceutical solutions, supported by policy enhancements and improved market access pathways. In August 2025, Sidra Medicine in Qatar has been awarded a G-Rex® Grant by ScaleReady to develop a CAR-T cell production platform for pediatric oncology, accelerating local advanced therapy manufacturing capabilities. Moreover, healthcare institutions are placing emphasis on next-generation medicines that improve treatment outcomes and long-term patient well-being. Continued investments in advanced manufacturing capacities and distribution frameworks reinforce this shift toward specialty drugs managing chronic and rare conditions with higher therapeutic efficacy. Enhanced physician awareness and evolving patient preferences provide essential momentum to this transition. The nation is also prioritizing long-term sustainability and capacity-building efforts to establish a stable supply chain for these advanced therapies. This trajectory is significantly contributing to Qatar pharmaceutical market growth, setting the foundation for sustained healthcare advancement.

To get more information on this market Request Sample

Digitalization and e-Health Adoption

Digital transformation is emerging as a cornerstone of the evolving healthcare landscape, enabling efficiency across pharmaceutical distribution, patient monitoring, and clinical decision-making. Adoption of advanced e-health tools and electronic prescribing systems is driving safer and more coordinated medication practices. Expansion of telemedicine and remote pharmacy services plays a pivotal role in improving accessibility and continuity of care across the country. Artificial intelligence (AI) and real-time data analytics are increasingly used to support evidence-based treatment plans and optimize pharmacotherapy outcomes. Regulatory bodies are collaborating on frameworks to strengthen digital integration and ensure secure, interoperable platforms that benefit both patients and providers. Enhanced digital literacy among healthcare professionals further supports this transformation. The growing alignment between technology adoption and healthcare policy reinforces the shifting paradigm where innovative delivery methods and smart health tools support improved treatment experiences, contributing to progressive Qatar pharmaceutical market trends initiatives.

Strong Focus on Local Manufacturing and Self-Sufficiency

Qatar continues to emphasize self-sufficiency in essential medicines through development of domestic production capabilities and resilient supply networks. Strategic initiatives supporting pharmaceutical manufacturing are intended to reduce dependency on imports and strengthen the long-term security of essential drug availability. The focus on locally manufactured formulations aligns with national efforts to foster innovation, encourage industrial diversification, and enhance the healthcare ecosystem. Strengthened infrastructure, skilled workforce expansion, and technology transfer initiatives are supporting this direction. The emphasis on high-quality regulatory standards encourages continuous improvement, ensuring that domestically produced medicines achieve international compliance. Increased collaboration between healthcare authorities and industrial sectors further enhances production scaling and long-term sustainability. The advancement in research-driven production and the move toward complex formulations illustrate a market transforming to meet growing therapeutic needs within the region. Domestic capability-building is emerging as a central pillar of resilience and national healthcare readiness.

Qatar Pharmaceutical Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on prescription type and therapeutic category.

Prescription Type Insights:

- Prescription Drugs

- Branded

- Generics

- OTC Drugs

The report has provided a detailed breakup and analysis of the market based on the prescription type. This includes prescription drugs (branded and generics) and OTC drugs.

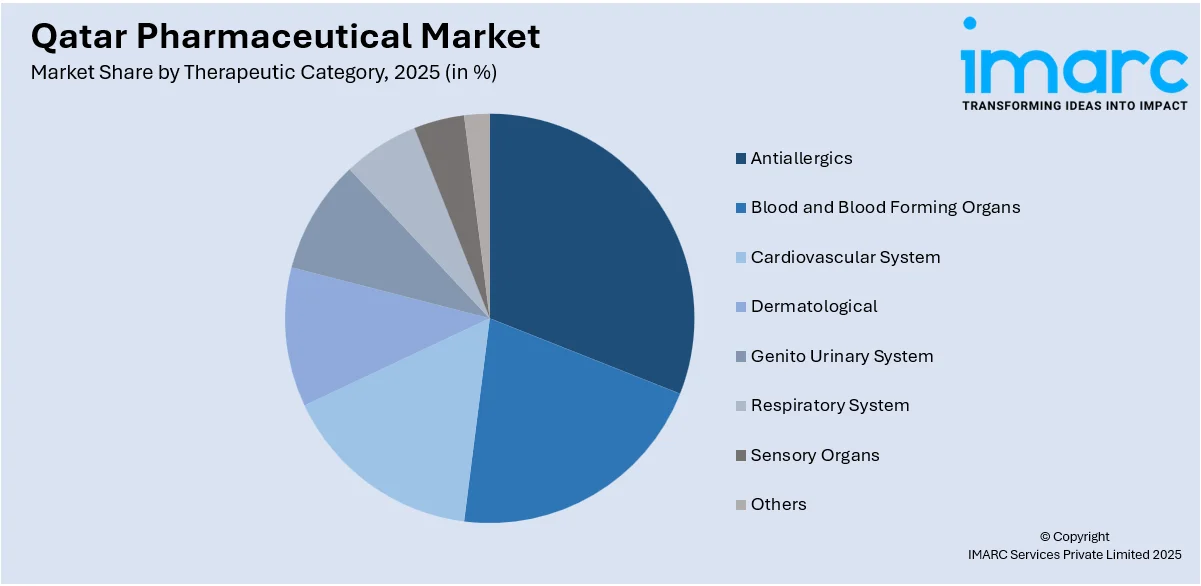

Therapeutic Category Insights:

Access the comprehensive market breakdown Request Sample

- Antiallergics

- Blood and Blood Forming Organs

- Cardiovascular System

- Dermatological

- Genito Urinary System

- Respiratory System

- Sensory Organs

- Others

A detailed breakup and analysis of the market based on the therapeutic category have also been provided in the report. This includes antiallergics, blood and blood forming organs, cardiovascular system, dermatological, genito urinary system, respiratory system, sensory organs, and others.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Pharmaceutical Market News:

- September 2025: Cure announced the launch of the Cure by Deerfield Middle East Health Accelerator in Qatar, inviting global healthcare startups to join a 12-week mentorship and investor-focused program. The initiative supports commercialization and regional expansion, culminating in a 2026 pitch competition in Doha to foster healthcare innovation across MENA.

- June 2025: Daewoong Pharmaceutical launched its high-purity botulinum toxin NABOTA in Qatar, marking the completion of its expansion across key GCC aesthetic markets. The launch event in Doha gathered healthcare specialists to highlight product quality and advanced injection techniques, positioning NABOTA for strong competitive growth in Qatar’s premium aesthetics sector.

Qatar Pharmaceutical Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Prescription Types Covered |

|

|

Therapeutic Categories Covered |

Antiallergics, Blood and Blood Forming Organs, Cardiovascular System, Dermatological, Genito Urinary System, Respiratory System, Sensory Organs, Others |

|

Regions Covered |

Ad Dawhah, Al Rayyan, Al Wakrah, Others |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar pharmaceutical market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar pharmaceutical market on the basis of prescription type?

- What is the breakup of the Qatar pharmaceutical market on the basis of therapeutic category?

- What is the breakup of the Qatar pharmaceutical market on the basis of region?

- What are the various stages in the value chain of the Qatar pharmaceutical market?

- What are the key driving factors and challenges in the Qatar pharmaceutical market?

- What is the structure of the Qatar pharmaceutical market and who are the key players?

- What is the degree of competition in the Qatar pharmaceutical market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar pharmaceutical market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)