Qatar Poultry Market Size, Share, Trends and Forecast by Product Type, Nature, Distribution Channel, and Region, 2026-2034

Qatar Poultry Market Summary:

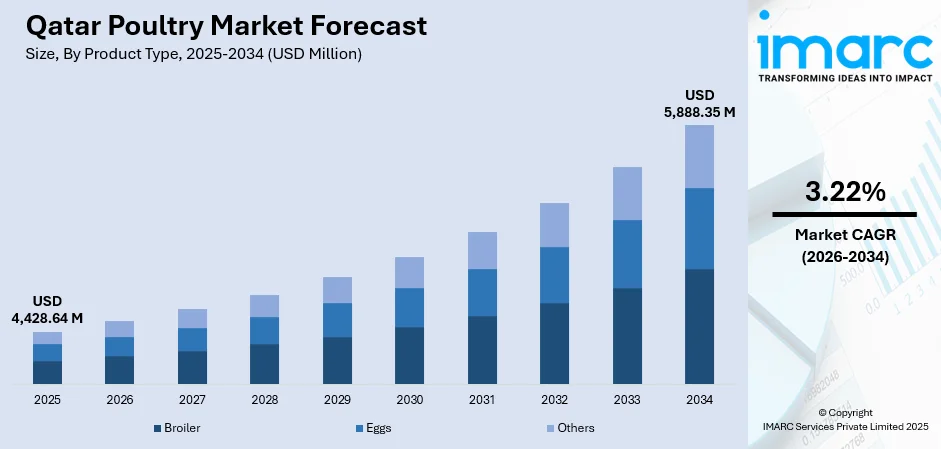

The Qatar poultry market size was valued at USD 4,428.64 Million in 2025 and is projected to reach USD 5,888.35 Million by 2034, growing at a compound annual growth rate of 3.22% from 2026-2034.

The Qatar poultry market growth is primarily driven by the strategic food security initiatives targeting near-complete self-sufficiency in fresh poultry production, substantial government investments in modern farming infrastructure, and the nation's expanding tourism sector creating sustained demand across foodservice channels. The convergence of demographic expansion, rising disposable incomes, and digital commerce transformation is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants.

Key Takeaways and Insights:

-

By Product Type: Broiler dominates the market with a share of 62% in 2025, due to strong consumer preference for fresh chicken meat, government support for domestic production facilities, and the segment's alignment with halal dietary requirements across both household and institutional consumption channels.

-

By Nature: Conventional leads the market with a share of 89% in 2025, driven by established production infrastructure, cost-effectiveness compared to organic alternatives, and widespread consumer acceptance of conventionally raised poultry products meeting stringent halal certification standards.

-

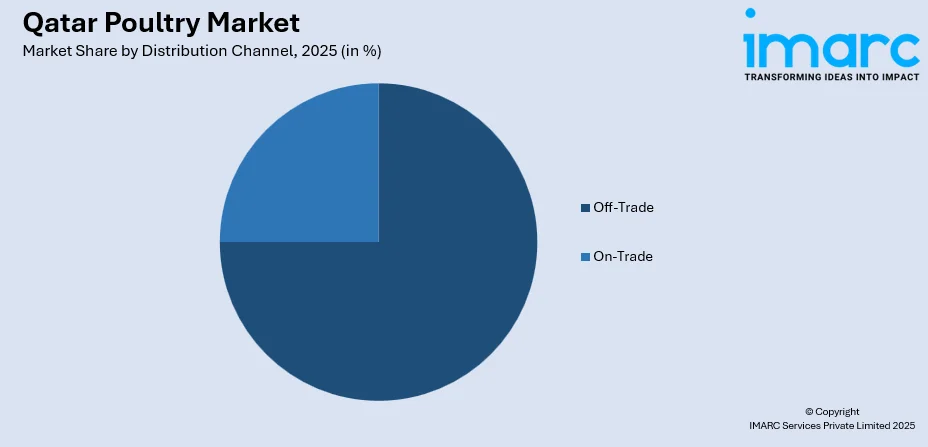

By Distribution Channel: Off-trade represents the largest segment with a market share of 75% in 2025. This leadership position reflects the expanding modern retail infrastructure, the growing preference for home cooking, and increasing penetration of supermarkets and hypermarkets offering diverse poultry product assortments across Qatar's urban centers.

-

Key Players: The Qatar poultry market experiences moderate competitive intensity, with government-supported domestic producers competing alongside regional suppliers and international brands. This competition spans various product segments and distribution channels, driving innovation and market expansion as companies strive to meet the growing consumer demand for poultry products.

To get more information on this market Request Sample

The growth of the Qatar poultry market is driven by a combination of factors, including increasing consumer demand for protein-rich, affordable food and the rising preference for poultry over other meats due to its health benefits and sustainability. The expansion of modern retail channels, including supermarkets and e-commerce platforms, is making poultry products more accessible to a wider consumer base. For instance, in 2024, Nesto Group announced its expansion into Qatar with the signing of an agreement to open its first hypermarket in Doha, set to launch in the second quarter of 2025. Spanning 180,000 square feet across two floors, the flagship store aimed to provide a high-quality shopping experience at competitive prices. Additionally, the strong growth in Qatar's hospitality and foodservice sectors, driven by both local demand and the influx of international visitors, is driving the need for high-quality poultry products.

Qatar Poultry Market Trends:

Government Support for Domestic Poultry Production

The increasing efforts of the governing body to bolster local production and diminish reliance on imports serve as a crucial factor impelling the market growth. Through strategic initiatives encompassing subsidies incentives and financial aid to local farmers Qatar aims to significantly enhance its national food security and build a more robust agricultural sector. These governmental commitments are resulting in considerable capital expenditure in state-of-the-art poultry farms and processing infrastructure ensuring a consistent local supply. The success of these policies is evident, as the Ministry of Municipality's Animal Resources Department reported in 2025, that Qatar achieved full self-sufficiency in dairy and fresh poultry production with domestic output now meeting one hundred percent of the national demand. This pivotal accomplishment reflects the country’s determined push to reduce its exposure to volatile global supply chains and price fluctuations by fostering a resilient and high-capacity domestic poultry industry.

Changing Dietary Habits and Preferences

Shifting dietary habits in Qatar, with a growing preference for poultry over meats like beef and lamb, are driving the expansion of the poultry market. The younger population, in particular, is more inclined toward healthier, lean protein options, viewing poultry as a more sustainable and nutritious choice. As of 2025, Qatar's population is projected to reach 3.1 million, with 83% of people falling within the working-age group of 15-64 years, according to the United Nations Population Fund (UNFPA). This demographic shift, coupled with the increasing focus on healthier food choices, is further catalyzing the demand for poultry products in the region.

Improvement in Supply Chain and Logistics

The Qatar poultry market is being significantly driven by ongoing improvements in supply chain and logistics infrastructure. The development of advanced cold storage, transportation, and distribution networks plays a crucial role in meeting the rising demand for fresh poultry products across the nation. These enhancements ensure timely delivery, minimize spoilage, and enable consumers to access high-quality poultry at competitive prices. This focus on cold chain excellence is also fueling strategic mergers and acquisitions (M&A). In 2025, Green Dome Investments (GDI) announced the acquisition of Transcorp International, a specialist in cold-chain logistics. This acquisition strengthens GDI’s position in Qatar’s temperature-controlled logistics sector, improving the reliability, efficiency, and traceability of the poultry supply chain, which is vital for sustaining market growth and enhancing food safety practices.

Market Outlook 2026-2034:

The Qatar poultry market is poised for strong growth, driven by strategic government initiatives and shifting consumption patterns. Increasing demand for poultry products, coupled with a growing population and a focus on food security, supports the market growth. The market generated a revenue of USD 4,428.64 Million in 2025 and is projected to reach a revenue of USD 5,888.35 Million by 2034, growing at a compound annual growth rate of 3.22% from 2026-2034. This growth reflects the evolving dietary preferences and enhanced production capacity in the country.

Qatar Poultry Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Broiler |

62% |

|

Nature |

Conventional |

89% |

|

Distribution Channel |

Off-Trade |

75% |

Product Type Insights:

- Broiler

- Eggs

- Others

Broiler dominates with a market share of 62% of the total Qatar poultry market in 2025.

Broiler represents the largest segment due to its high demand for meat production, favored for its fast growth rate and cost-efficiency. Broiler provides a consistent and affordable source of protein, making it the preferred choice for individuals and businesses.

Broiler is versatile and widely used in various culinary applications, further boosting its popularity. The increased consumption of poultry in Qatar, driven by both local preferences and the growing population, ensures that broiler remains the dominant product type in the market.

Nature Insights:

- Organic

- Conventional

Conventional leads with a market share of 89% of the total Qatar poultry market in 2025.

Conventional holds the biggest market share owing to its cost-effectiveness and established production systems. With lower production costs, conventional poultry farming remains the most accessible option for consumers and businesses, providing a reliable source of affordable chicken.

Additionally, conventional poultry is widely available in various forms, catering to diverse consumer preferences. Its consistency in taste, texture, and price makes it a staple in Qatar’s poultry consumption. As a result, conventional poultry continues to hold a dominant position, even as demand for alternative options grows.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

Off-trade exhibits a clear dominance with a 75% share of the total Qatar poultry market in 2025.

Off-trade leads the market, driven by the strong presence of supermarkets, hypermarkets, and specialty stores where consumers purchase poultry for home cooking. These retail outlets offer a wide range of poultry products, ensuring convenience and accessibility for shoppers.

Additionally, off-trade distribution allows consumers to choose from various poultry options and brands, catering to different preferences and price points. The dominance of off-trade distribution, which offers consumers diverse poultry options and is supported by a growing retail infrastructure, is demonstrated by the continuous expansion of major chains, such as Safari Hypermarket, which opened its seventh outlet at Ezdan Mall, Al Gharafa in 2025.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

Ad Dawhah is a crucial segment in the market due to its urbanization and high population density. Its thriving retail sector, including supermarkets and specialty stores, drives the demand for poultry products, making it a key market hub.

Al Rayyan, one of Qatar’s largest municipalities, experiences increasing demand for poultry due to its expanding population and increasing number of retail outlets. The area's residential growth and higher-income households contribute to the rising consumption of poultry products.

Al Wakrah, a rapidly developing city near Doha, sees a steady rise in poultry consumption driven by its growing population and urbanization. The demand is fueled by increasing retail infrastructure, with supermarkets and local shops catering to a broad consumer base.

Others are witnessing gradual growth in poultry consumption, as rural and suburban areas gain better access to retail outlets. Rising awareness about quality poultry products, along with expanding distribution networks, supports the broader market development in these areas.

Market Dynamics:

Growth Drivers:

Why is the Qatar Poultry Market Growing?

Expanding Retail and Distribution Channels

The increasing prominence of supermarkets, hypermarkets, and digital grocery platforms is greatly improving consumer access to poultry products. Retailers now offer a broader selection of high-quality options, including fresh, frozen, and processed varieties, catering to diverse consumer preferences. This enhanced accessibility, combined with competitive pricing, supports market growth. Additionally, the rapid expansion of the digital landscape, with Qatar's e-commerce market reaching USD 3.8 billion in 2024, according to the data reported by IMARC group, further contributes to this trend. The modernization of both physical and online distribution channels ensures that consumer demand for convenience and variety is efficiently met, driving continued development in the market.

Advancements in Poultry Farming Technology

Innovations in breeding techniques, feed efficiency, and disease management are boosting the productivity and sustainability of poultry farming in Qatar. Automation and precision farming technologies enable better resource management, including water and feed, which improves operational efficiency and reduces costs. These advancements result in higher yields, making domestic poultry farming more competitive and supporting the market growth. In 2024, Qatar University (QU) introduced a pioneering sustainable cooling system for poultry houses, designed to address challenges posed by Qatar’s hot and humid climate. Led by Dr. Djamel Ouahrani, the system integrated Dew-Point Indirect Evaporative Cooling (DPIEC) with a desiccant system to enhance energy efficiency, reduce heat stress, and improve overall productivity and sustainability in poultry farming.

Rising Demand in Hospitality and Foodservice Sector

With a robust tourism industry a significant number of international events and an expanding restaurant and catering landscape, the institutional demand for consistent high-quality poultry products is growing. Hotels restaurants and fast-food chains require large-scale supplies to service both the local populace and international clientele. This dependency is underscored by the tourism sector's performance. As per the 2024 Annual Performance Report by Qatar Tourism International visitors surpassed five million for the first time in 2024 representing an annual growth of twenty-five percent. Concurrently hotel supply reached 40405 room keys by the end of 2024. This notable growth of Qatar's hospitality capacity directly translates into a sustained and rising need for poultry products thereby strengthening the market's underlying growth trajectory.

Market Restraints:

What Challenges the Qatar Poultry Market is Facing?

Heavy Import Dependency on Animal Feed Creating Supply Chain Vulnerabilities

Qatar relies substantially on imported animal feed to sustain its domestic poultry production operations, creating exposure to international commodity price fluctuations and supply chain disruptions. Efforts to increase domestic feed production are ongoing but remain insufficient to fully mitigate this dependency, with feed imports arriving primarily from Southeast Asian suppliers experiencing occasional delivery delays exceeding three weeks.

Challenging Climatic Conditions Requiring Substantial Infrastructure Investment

Qatar's extreme temperatures and arid climate require substantial investments in climate-controlled poultry facilities and advanced cooling systems to maintain optimal conditions for poultry farming. These environmental challenges drive up operational costs and energy consumption, making local poultry production more expensive than imports from regions with more favorable climates, thereby influencing the competitiveness of domestic production in comparison to imported poultry products.

Feed Price Volatility Impacting Production Cost Predictability

Fluctuating global commodity prices for essential feed ingredients, such as corn, soybean meal, and other protein sources, create uncertainty in production cost management for Qatar's poultry operators. These price fluctuations challenge the competitiveness of local poultry production against imported products, forcing market players to adopt strategic measures to maintain profitability and stabilize operational costs amid the volatile pricing environment.

Competitive Landscape:

The Qatar poultry market exhibits moderate competitive intensity characterized by the presence of government-backed domestic producers alongside regional manufacturers and international suppliers competing across product segments and distribution channels. Market dynamics reflect strategic positioning ranging from premium, innovation-driven offerings emphasizing quality and freshness to value-oriented products targeting cost-conscious consumers. The competitive landscape is increasingly shaped by vertical integration strategies, with leading players controlling operations from poultry farming through processing and distribution to ensure supply chain efficiency. Domestic producers benefit from government support programs promoting food security while international players leverage established brands and extensive distribution networks. Future competitive dynamics will be influenced by sustainability initiatives, cold chain infrastructure development, and digital commerce capabilities.

Recent Developments:

-

In July 2025, Qatar outlined ambitious targets under its National Food Security Strategy 2030, aiming for 30% self-sufficiency in red meat and 70% in table eggs. The country also plans to maintain full self-sufficiency in dairy and poultry. These efforts are part of a broader strategy to boost local food production, improve resilience, and reduce reliance on imports, with strong support from both public and private sectors.

Qatar Poultry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Broiler, Eggs, Others |

| Natures Covered | Organic, Conventional |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Qatar poultry market size was valued at USD 4,428.64 Million in 2025.

The Qatar poultry market is expected to grow at a compound annual growth rate of 3.22% from 2026-2034 to reach USD 5,888.35 Million by 2034.

The broiler segment dominated the Qatar poultry market with a share of approximately 62% in 2025, driven by strong consumer preference for fresh chicken meat, government support for domestic production, and alignment with halal dietary requirements.

Key factors driving the Qatar poultry market include the increasing efforts of the governing body to boost local production and reduce reliance on imports. In 2025, the Ministry of Municipality’s Animal Resources Department reported that Qatar achieved full self-sufficiency in dairy and fresh poultry, meeting 100% of national demand.

Major challenges include heavy import dependency on animal feed creating supply chain vulnerabilities, challenging climatic conditions requiring substantial infrastructure investment in climate-controlled facilities, feed price volatility impacting production cost predictability, and the need for continued technological advancement to maintain competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)