Qatar Private Equity and Venture Capital Market Size, Share, Trends and Forecast by Fund Type, Investment Stage, Ticket Size, End User, and Region, 2026-2034

Qatar Private Equity and Venture Capital Market Summary:

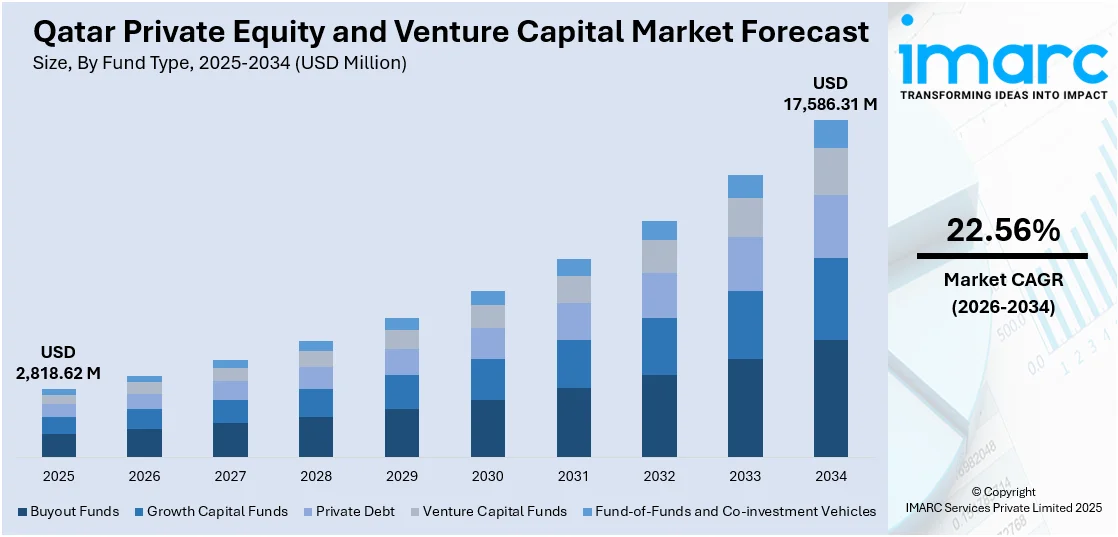

The Qatar private equity and venture capital market size reached USD 2,818.62 Million in 2025. The market is projected to reach USD 17,586.31 Million by 2034, growing at a CAGR of 22.56% during 2026-2034. The market is evolving rapidly, supported by government-led diversification efforts and an expanding startup ecosystem. Increased institutional participation, regulatory reforms, and investment in technology-driven sectors are driving market maturity. Strategic collaborations between public funds and private investors continue to enhance funding access and innovation, strengthening the overall investment environment for the Qatar private equity and venture capital market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Market Size in 2025 | USD 2,818.62 Million |

| Market Forecast in 2034 | USD 17,586.31 Million |

| Market Growth Rate (2026-2034) | 22.56% |

| Key Segments | Fund Type (Buyout Funds, Growth Capital Funds, Private Debt, Venture Capital Funds, Fund-of-Funds and Co-investment Vehicles), Investment Stage (Seed Stage, Pre-series A, Series A, Series B, Series C, Growth Stage, Late Stage), Ticket Size (Small (Less than USD 50 Million), Mid-market (USD 50–250 Million), Large (USD 250–500 Million), Mega (Above USD 500 Million)), End User (Technology, Consumer Goods/Retail, Financial Services, Real Estate and Infrastructure, Energy and Utilities) |

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

Qatar Private Equity and Venture Capital Market Outlook (2026-2034):

The Qatar private equity and venture capital market is positioned for robust expansion, underpinned by the government's ambitious economic diversification strategy and substantial capital deployment through sovereign wealth fund initiatives. The Qatar Investment Authority's $1 billion Fund of Funds program is expected to catalyze ecosystem maturation by attracting leading international venture capital firms and fostering local entrepreneurial talent. Additionally, the government’s strong commitment to advancing AI and digital transformation under the Digital Agenda 2030, along with sector-focused incentives for fintech, healthtech, and cleantech, is expected to generate significant investment opportunities and sustain robust deal flow growth over the forecast period.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence is fundamentally reshaping Qatar's private equity and venture capital landscape through both direct investments and infrastructure development. The Qatar Investment Authority has committed substantial capital to AI companies and data center infrastructure, including a $3 billion joint venture with Blue Owl Capital and participation in major funding rounds for xAI, Databricks, and Cresta. With the government allocating $2.5 billion under its Digital Agenda 2030 for AI initiatives and projections indicating AI could contribute $11 billion to Qatar's economy by 2030, venture capital firms are increasingly prioritizing AI-enabled startups across fintech, healthtech, and enterprise software sectors while private equity players focus on AI infrastructure assets.

Market Dynamics:

Key Market Trends & Growth Drivers:

Government-Backed Fund of Funds Initiative Catalyzing Ecosystem Development

The market growth is being propelled by the government's transformative Fund of Funds initiative, which represents the most significant institutional commitment to venture capital development in Qatar's history. Launched in February 2024 by the Qatar Investment Authority with a commitment exceeding $1 billion, this program is strategically designed to address critical funding gaps, particularly for companies transitioning from seed stage to Series A, B, and C rounds. The initiative operates by investing indirectly through established international and regional venture capital funds while also making targeted co-investments with participating funds, thereby combining financial resources with global best practices and extensive networks. The program's dual mandate focuses on generating market-level commercial returns while simultaneously fostering a vibrant startup ecosystem aligned with Qatar's Third National Development Strategy for 2024-2030. By attracting leading international venture capital firms and requiring fund managers to establish operational footprints in Doha, demonstrate commitment to the GCC venture capital ecosystem, and maintain senior-level presence in Qatar, the initiative is building bridges between local startups and the global venture capital community. Early momentum has been strong, with QIA deploying nearly half of the allocated capital by February 2025, selecting six prominent venture capital firms including B Capital, Builders VC, UTOPIA, Human Capital, Deerfield, and Qatar's first independent venture capital firm Rasmal Ventures, with two firms already establishing offices in Doha and four others in the process of doing so, marking a transformative milestone for the country's entrepreneurial landscape.

Technology Sector Diversification with Focus on Fintech, HealthTech, and EdTech

Qatar's private equity and venture capital market is witnessing a major shift toward technology-led investments, reflecting the government’s determination to diversify beyond hydrocarbons and strengthen a knowledge-based economy. Fintech has emerged as the leading sector, expanding rapidly because of favorable policies and institutional support, alongside growing investor confidence in digital financial innovation. This sector concentration is reinforced by robust infrastructure including the Qatar Financial Centre’s Fintech Circle co-working hub, Qatar Central Bank’s regulatory sandbox encouraging experimentation, and national initiatives such as the Arab FinTech Forum and Qatar’s FinTech Strategy. Beyond fintech, healthtech is gaining momentum through investments in telemedicine, AI-powered diagnostics, and precision medicine projects aligned with Qatar National Vision 2030. EdTech investments are also accelerating, supported by programs like the WISE Accelerator, which offers tailored mentorship and collaboration opportunities for education technology startups. The emphasis on digital innovation aligns seamlessly with Qatar’s Digital Agenda 2030 goals to enhance employment, expand digital inclusion, and strengthen global competitiveness. In a reflection of these ambitions, the Startup Qatar Investment Program recently supported a diverse range of emerging ventures across e-gaming, edtech, sportstech, cleantech, proptech, healthtech, fintech, and B2B SaaS, demonstrating the wide scope of opportunities arising from Qatar’s technology diversification drive and the government’s steadfast commitment to cultivating innovative startups that contribute to long-term economic transformation.

Exceptional Venture Capital Funding Growth Defying Regional Slowdown

Qatar's venture capital market has shown remarkable resilience and strong growth momentum, standing apart from broader global and regional slowdowns and positioning the country as an increasingly appealing hub for venture investment. As highlighted in the 2024 Qatar Venture Investment Report published by Qatar Development Bank in collaboration with MAGNiTT, the nation’s venture ecosystem has expanded significantly, even as global and regional markets faced headwinds. This growth reflects a substantial rise in deal activity and funding volume, enabling Qatar to strengthen its regional standing and attract a growing share of investment interest across diverse technology sectors. The market’s evolution also demonstrates advancing maturity, with mid-sized funding rounds gaining prominence and signaling sustained investor confidence in scaling companies. Over the years, Qatar’s capital deployment patterns have remained steady, reinforcing the strength of its startup ecosystem and its capacity to support innovation-driven enterprises. The Qatar Development Bank has played a pivotal role in this expansion, providing essential funding support and partnering with multiple venture funds to nurture high-potential startups and stimulate private sector participation. Major transactions within the ecosystem have underscored this progress, showcasing the emergence of successful, growth-oriented ventures and highlighting the government’s strategic commitment to fostering entrepreneurship, reducing investment risks, and attracting institutional investors, family offices, and high-net-worth individuals to Qatar’s dynamic venture landscape.

Key Market Challenges:

Funding Gap for Growth-Stage Companies Seeking Series A to C Rounds

One of the most significant challenges constraining the Qatar private equity and venture capital market growth has been the persistent funding gap for growth-stage companies transitioning beyond seed stage to Series A, B, and C funding rounds. Before the launch of the Qatar Investment Authority's Fund of Funds program in February 2024, there was no dedicated pool of substantial capital available for companies that had proven initial market traction and were ready to scale operations, expand market presence, or pursue regional and international growth. This gap created a phenomenon where promising startups could secure seed funding from local angel investors, early-stage funds, and government-backed programs like Qatar Science & Technology Park and Qatar Development Bank's initiatives, but subsequently struggled to access the larger funding rounds necessary for expansion, often forcing entrepreneurs to either seek capital from neighboring markets like the UAE and Saudi Arabia or abandon aggressive growth plans altogether. The funding gap was particularly acute in capital-intensive sectors requiring significant investment in technology infrastructure, regulatory compliance, market expansion, or product development before achieving profitability. While the Fund of Funds initiative is specifically designed to address this challenge by attracting international venture capital firms with expertise and capital to invest in Series A through C rounds, it remains a relatively recent intervention, and the market will require time to fully develop the depth and breadth of growth-stage capital necessary to support the expanding pipeline of maturing startups. Additionally, local institutional investors, including family offices and corporate venture arms, are still developing the expertise, risk appetite, and investment thesis required to participate meaningfully in later-stage venture rounds, creating continued reliance on government-backed initiatives and international capital rather than a fully diversified funding ecosystem.

Regulatory Framework Development and Market Transparency Requirements

Qatar’s private equity and venture capital market continues to face challenges in developing a comprehensive, transparent, and globally competitive regulatory framework. Despite notable progress through initiatives such as the Qatar Financial Centre’s independent regime based on English common law, the Qatar Central Bank’s fintech sandbox, and the creation of regulatory bodies like the Transparency Authority and National Competition Protection Authority, complexities persist that affect market efficiency. International assessments note that Qatar lacks a fully transparent rulemaking process, as ministries and regulators do not consistently release draft legislation for public consultation, creating uncertainty for investors evaluating regulatory risks. Business practices also remain influenced by personal connections, potentially limiting fair access for new entrants. Investors must navigate overlapping jurisdictions across multiple authorities, including the Ministry of Commerce and Industry, the Qatar Financial Centre Regulatory Authority, and the Qatar Central Bank. Additionally, inconsistent financial reporting standards for private companies and varying rules on foreign ownership across sectors create further compliance challenges. While publicly listed entities follow international accounting norms and some sectors permit full foreign ownership, others impose restrictions, requiring specialized legal expertise. Strengthening regulatory transparency and harmonization remains essential to fostering investor confidence and enhancing Qatar’s competitiveness as a regional investment hub.

Increasing Market Saturation in Private Credit and Competition for Quality Deals

Qatar’s private equity market is facing growing competition and emerging signs of market saturation, particularly within the private credit segment, where the availability of capital is beginning to outpace the supply of high-quality investment opportunities. Industry leaders have cautioned that this environment increases the risk of mispricing and could lead to weaker returns if conditions shift. The trend mirrors broader regional dynamics, as sovereign wealth funds across the Gulf have expanded allocations to private equity and private credit as part of diversification efforts away from hydrocarbons, creating intense competition for a limited pool of attractive deals. Qatar’s relatively young private sector further compounds this challenge, as the number of mature companies suited for traditional buyout and growth equity investments remains constrained. While venture capital activity has flourished, traditional private equity faces headwinds from economic uncertainty, fluctuating energy markets, and longer holding periods required to realize value. At the same time, the growing presence of global private equity firms in Qatar and the wider GCC is elevating competition, driving up valuations, and compressing returns. To remain competitive, investors increasingly need to demonstrate operational expertise, sector specialization, and the ability to pursue complex transactions rather than relying solely on financial structuring strategies.

Qatar Private Equity and Venture Capital Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar private equity and venture capital market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on fund type, investment stage, ticket size, and end user.

Analysis by Fund Type:

- Buyout Funds

- Growth Capital Funds

- Private Debt

- Venture Capital Funds

- Fund-of-Funds and Co-investment Vehicles

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout funds, growth capital funds, private debt, venture capital funds, and fund-of-funds and co-investment vehicles.

Analysis by Investment Stage:

- Seed Stage

- Pre-series A

- Series A

- Series B

- Series C

- Growth Stage

- Late Stage

A detailed breakup and analysis of the market based on the investment stage have also been provided in the report. This includes seed stage, pre-series A, series A, series B, series C, growth stage, and late stage.

Analysis by Ticket Size:

- Small (Less than USD 50 Million)

- Mid-Market (USD 50–250 Million)

- Large (USD 250–500 Million)

- Mega (Above USD 500 Million)

The report has provided a detailed breakup and analysis of the market based on the ticket size. This includes small (less than USD 50 million), mid-market (USD 50–250 million), large (USD 250–500 million), and mega (above USD 500 million).

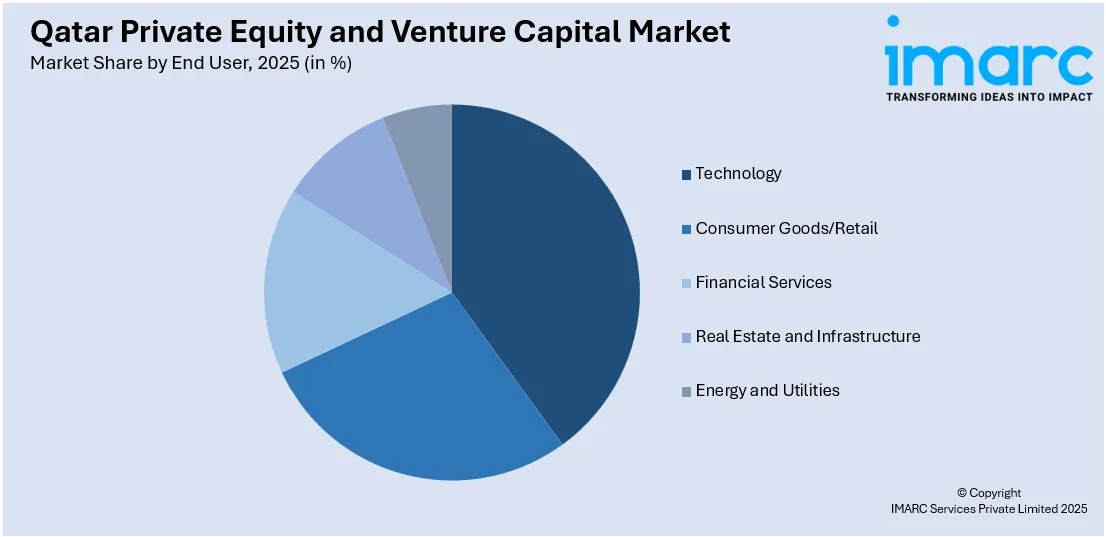

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Technology

- Consumer Goods/Retail

- Financial Services

- Real Estate and Infrastructure

- Energy and Utilities

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes technology, consumer goods/retail, financial services, real estate and infrastructure, and energy and utilities.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar private equity and venture capital market exhibits a dynamic competitive landscape characterized by a strategic mix of government-backed investment vehicles, emerging independent venture capital firms, and international players establishing regional presence through the Fund of Funds program. Competition is primarily driven by sector expertise, access to deal flow through government relationships and ecosystem partnerships, and the ability to provide value-added support beyond capital including operational guidance, market access, and network connections. The Qatar Investment Authority and Qatar Development Bank remain the most influential market participants, leveraging substantial capital resources and strategic mandates to catalyze private sector participation and de-risk early-stage investments. The recent establishment of Qatar's first independent venture capital firm, Rasmal Ventures, alongside the entry of prominent international firms including B Capital, Builders VC, UTOPIA, Human Capital, and Deerfield through the Fund of Funds program, is intensifying competitive dynamics and elevating professional standards across due diligence, portfolio management, and exit execution. Market participants are increasingly differentiating through sector specialization, with particular focus on fintech, healthtech, artificial intelligence, and climate technology, while also competing on the basis of regional expertise spanning Qatar, the broader GCC, the Levant, Pakistan, and Turkey to provide portfolio companies with pathways for geographic expansion and market penetration beyond Qatar's relatively small domestic market.

Qatar Private Equity and Venture Capital Industry Latest Developments:

- September 2025: The Qatar Investment Authority partnered with Blue Owl Capital to launch a digital infrastructure platform with more than $3 billion in data center assets. QIA committed approximately $1 billion in new equity to the venture, which aims to expand as demand for computing power and data storage accelerates in support of the booming artificial intelligence sector, marking QIA's latest significant bet on AI infrastructure.

- February 2025: Rasmal Ventures, Qatar's first independent venture capital firm, announced it secured strategic funding from the Qatar Investment Authority as part of its $1 billion Fund of Funds program. The flagship Rasmal Innovation Fund I LLC, launched in June 2024, is investing in high-growth startups across fintech, B2B SaaS, HealthTech, supply chain logistics, and artificial intelligence at pre-Series A, Series A, and Series B stages, with commitments from institutional investors, corporates, family offices, and high-net-worth individuals targeting $100 million in total investment commitments.

- February 2025: UTOPIA announced the launch of A-typical Ventures in partnership with Qatar Investment Authority and Qatar Development Bank at Web Summit Qatar. The new venture studio, backed by QIA's Fund of Funds program, will support Pre-Seed, Seed, and Pre-Series A founders across the GCC, Levant, Pakistan, and Turkey in sectors including FinTech, HealthTech, e-Commerce, Logistics & Mobility, and ClimateTech, with QDB providing hands-on strategic and operational support through a dedicated venture studio.

Qatar Private Equity and Venture Capital Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout Funds, Growth Capital Funds, Private Debt, Venture Capital Funds, Fund-of-Funds and Co-investment Vehicles |

| Investment Stages Covered | Seed Stage, Pre-series A, Series A, Series B, Series C, Growth Stage, Late Stage |

| Ticket Sizes Covered | Small (Less than USD 50 Million), Mid-market (USD 50–250 Million), Large (USD 250–500 Million), Mega (Above USD 500 Million) |

| End Users Covered | Technology, Consumer Goods/Retail, Financial Services, Real Estate and Infrastructure, Energy and Utilities |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar private equity and venture capital market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar private equity and venture capital market on the basis of fund type?

- What is the breakup of the Qatar private equity and venture capital market on the basis of investment stage?

- What is the breakup of the Qatar private equity and venture capital market on the basis of ticket size?

- What is the breakup of the Qatar private equity and venture capital market on the basis of end user?

- What is the breakup of the Qatar private equity and venture capital market on the basis of region?

- What are the various stages in the value chain of the Qatar private equity and venture capital market?

- What are the key driving factors and challenges in the Qatar private equity and venture capital market?

- What is the structure of the Qatar private equity and venture capital market and who are the key players?

- What is the degree of competition in the Qatar private equity and venture capital market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar private equity and venture capital market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar private equity and venture capital market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar private equity and venture capital industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)