Qatar Recycled Plastics Market Size, Share, Trends and Forecast by Plastic Type, Raw Material, Application, and Region, 2026-2034

Qatar Recycled Plastics Market Summary:

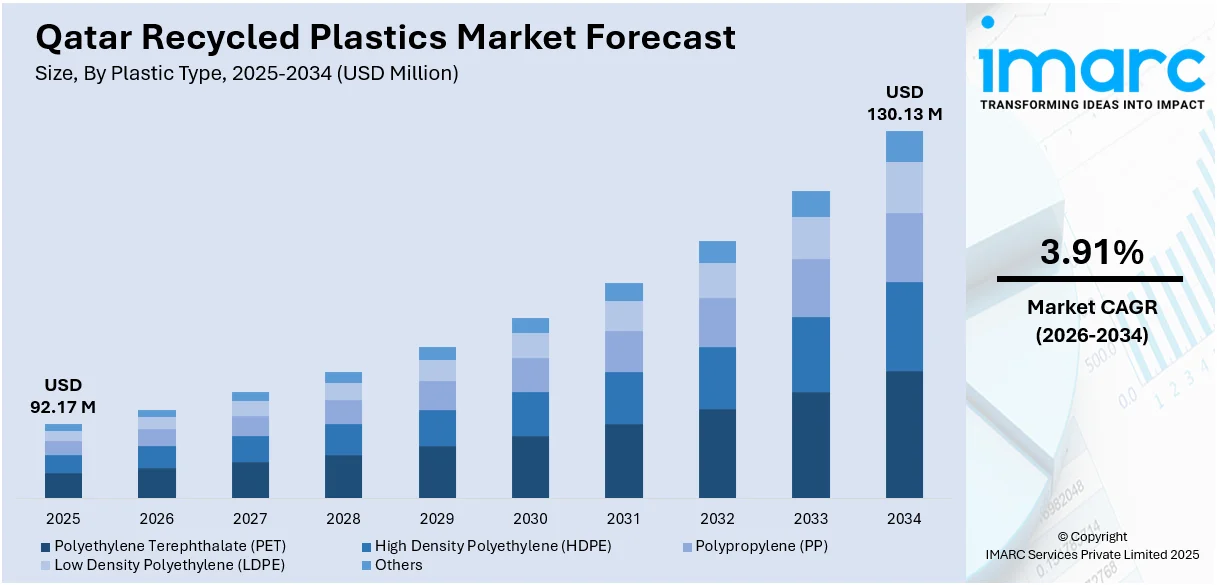

The Qatar recycled plastics market size reached USD 92.17 Million in 2025. The market is projected to reach USD 130.13 Million by 2034, growing at a CAGR of 3.91% during 2026-2034. The market is driven by government-led infrastructure development and comprehensive regulatory frameworks supporting recycling initiatives, the expansion of waste sorting at source programs across all regions, and the adoption of public-private partnership models encouraging substantial private sector investment in recycling facilities. Additionally, the increasing focus on achieving Qatar National Vision 2030 sustainability targets and the development of the Al-Afjah Recycling Hub as a dedicated industrial zone for recycling industries are expanding the Qatar recycled plastics market share.

|

Particulars |

Details |

|

Market Size (2025) |

USD 92.17 Million |

|

Forecast (2034) |

USD 130.13 Million |

|

CAGR (2026-2034) |

3.91% |

|

Key Segments |

Plastic Type (Polyethylene Terephthalate (PET), High Density Polyethylene (HDPE), Polypropylene (PP), Low Density Polyethylene (LDPE), Others), Raw Material (Plastic Bottles, Plastic Films, Rigid Plastic and Foam, Fibres, Others), Application (Non-Food Contact Packaging, Food Contact Packaging, Construction, Automotive, Others) |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

Qatar Recycled Plastics Market Outlook (2026-2034):

The Qatar recycled plastics market is positioned for steady growth, underpinned by the government's ambitious goal to increase the recycling rate across all waste streams. The phased rollout of waste sorting at source programs throughout all municipalities, combined with the ongoing development of the Al-Afjah Recycling Hub housing over 50 dedicated plots for recycling facilities, will significantly enhance collection and processing capabilities. Furthermore, the privatization of waste transfer stations and strategic public-private partnerships are expected to attract substantial investment, while growing environmental consciousness and corporate sustainability commitments will drive demand for recycled plastic materials across packaging, construction, and automotive sectors.

To get more information on this market Request Sample

Impact of AI:

Artificial intelligence (AI) is progressively transforming Qatar's recycled plastics sector by enhancing operational efficiency and material recovery rates. AI-driven sorting systems utilizing computer vision and machine learning (ML) algorithms are being deployed to accurately identify and separate different plastic types, colors, and grades with minimal contamination. Smart waste management solutions incorporating Internet of Things (IoT) sensors enable real-time monitoring of waste levels and optimization of collection routes, reducing operational costs and carbon footprints. As these technologies mature and become more widely adopted across Qatar's recycling facilities, AI is expected to play an increasingly critical role in improving sorting accuracy, reducing processing times, and ensuring the production of higher-quality recycled plastic materials that meet stringent industry specifications.

Market Dynamics:

Key Market Trends & Growth Drivers:

Government-Led Infrastructure Development and Regulatory Framework

Qatar's government has established a comprehensive policy environment and infrastructure foundation to accelerate the development of the recycled plastics market, aligning with Qatar National Vision 2030's sustainability pillars. The Qatar National Development Strategy sets an ambitious target to uplift the recycling rate across every waste streams to 38%, with a long-term goal of achieving 95% by 2030. This commitment is reinforced by robust regulatory frameworks, primarily guided by Law No. 30 of 2002, which serves as the foundation for environmental regulations by prohibiting illegal dumping and mandating proper waste treatment and disposal. Ministerial Decision No. 143 of 2022 specifically addresses plastic waste by restricting the use of plastic bags, complemented by the government's ban on single-use plastic bags implemented in 2023, supported by vigorous inspections and awareness campaigns. The Ministry of Municipality's 2024-2030 strategy encompasses the implementation of the National Integrated Solid Waste Program, which includes designing and building a new engineering landfill, closing and rehabilitating old landfills, enhancing waste segregation at source, and increasing the percentage of recycled materials.

Expansion of Waste Sorting at Source Programs

The nationwide implementation of waste sorting at source programs represents a fundamental shift in Qatar's approach to waste management and recycling, directly contributing to the Qatar recycled plastics market growth. The Ministry of Municipality has introduced a comprehensive dual-bin system where households receive blue containers specifically for recyclable materials such as glass, plastic, paper, and metals, alongside grey containers designated for organic waste. The second phase of this program, currently being implemented in Doha, commenced operations and will continue until 2025, aiming to cover all households in the capital. By August 2024, approximately 80% of households in Doha had received blue containers for waste segregation at source, with the collected recyclables being systematically transported to Qatar's recycling hub in Al Afjah, Mesaieed. The program follows a strategic phased rollout plan designed to achieve nationwide coverage: after completing Doha's implementation in 2025, the initiative will expand to Umm Salal, Al Daayen, Al Khor, and Al Shamal in 2026, and by the end of 2027, full implementation will be achieved in Al Wakrah, Al Rayyan, and Al Sheehaniya. This systematic approach ensures that proper waste segregation becomes embedded in daily household practices across Qatar, significantly increasing the volume and quality of recyclable plastics collected. The program brings substantial economic and environmental benefits, including reducing large quantities of waste going to landfills, ensuring environmental preservation for future generations, and creating a consistent supply of feedstock materials for the growing recycling industry.

Public-Private Partnership Model and Private Sector Investment

Qatar has strategically embraced a robust Public-Private Partnership model to accelerate the development of its recycling industry, creating significant opportunities for private sector investment and innovation in the recycled plastics market. The Al-Afjah Recycling Industries Zone in Mesaieed was specifically established to forge strong partnerships between government and private sectors, serving as a dedicated hub supporting the nation's transition to a circular economy. The comprehensive scope of activities permitted in Al-Afjah covers diverse recycling operations including oil, medical waste, metal, wood, electronic items, tires, plastic,batteries, construction waste segregation and recycling, organic cement production, and glass and textile recycling. To enhance the attractiveness of investments, the Ministry of Municipality provides recyclable materials free of cost to recycling factories operating in Qatar, eliminating a significant operational expense and ensuring a steady supply of raw materials. This initiative is complemented by the privatization of waste transfer stations, which allows private sector involvement to improve operational efficiency and attract additional investments. In 2025, the The Ministry of Municipality and the Ministry of Commerce and Industry (MOCI) have declared fresh opportunities for investors to obtain land parcels in the Al Afja Recycling Industries Zone to set up dedicated recycling facilities. This effort seeks to enhance collaboration between the public and private sectors and promote Qatar’s circular economy. The statement was delivered at a press conference held jointly at the Ministry of Municipality’s main office, with Eng. Hamad Jassim Al Bahr, Director of the Waste Recycling and Treatment Division, and Omar Jaafar Al Ali, Director of the Industrial Zones Division at MOCI.

Key Market Challenges:

Insufficient Recycling Infrastructure and Treatment Capacity

Despite significant government efforts and investments, Qatar's recycling infrastructure remains underdeveloped relative to the volume of plastic waste generated, creating a substantial bottleneck for market expansion. Current recycling rates for plastic waste range between only 10% to 40% according to various assessments by the Ministry of Municipality and Environment, indicating that the vast majority of plastic waste continues to bypass recovery systems. More than 50% of Qatar's total waste still ends up in landfills, reflecting the insufficient treatment capacity that limits the effectiveness of landfill diversion efforts. The absence of a comprehensive multi-bin system for waste separation at source in many areas leads to contamination of potentially recyclable materials with organic waste, significantly reducing the quality and economic value of recovered plastics. Regulatory gaps further compound these challenges, as no specific framework exists for municipal solid waste sorting facilities, including clearly defined technology standards, licensing requirements, or operational guidelines. This regulatory ambiguity can lead to inconsistencies and inefficiencies in material recovery processes across different facilities. Additionally, the lack of sufficient advanced sorting technologies and automated systems capable of handling the diverse range of plastic types and contamination levels presents ongoing technical challenges that restrict the volume and quality of recycled plastics that can be efficiently produced.

Ineffective Waste Segregation and Low Public Participation

Public engagement and behavioral adoption of recycling practices remain significant obstacles to the growth of Qatar's recycled plastics market, directly impacting the quality and quantity of materials available for processing. Mixed waste collection continues to be commonplace throughout Qatar, undermining the effectiveness of recycling infrastructure and contaminating potentially recoverable materials. Food residue contamination presents a particularly problematic technical challenge, as food waste left on plastic containers cannot be reliably processed and creates contamination when wrong materials are prepared incorrectly or placed into collection systems. Many communities lack adequate exposure to proper recycling technologies and practices, leading to resistance toward adopting new behaviors and skepticism about the efficacy of recycling systems. The awareness gap extends beyond households to include insufficient training for healthcare workers and facility operators on the proper use of recycling technologies and segregation protocols. Cultural attitudes and limited digital literacy regarding waste management technologies further impede the effective adoption of recycling practices across different segments of society.

Regulatory Fragmentation and Economic Barriers

The Qatar recycled plastics market faces substantial challenges stemming from regulatory inconsistencies and significant economic hurdles that impede both new entrants and the expansion of existing operations. No comprehensive framework exists specifically governing municipal solid waste sorting facilities, resulting in an absence of standardized technology requirements, licensing procedures, or operational guidelines that would ensure consistent quality and efficiency across the sector. Trade regulations impose additional constraints by limiting municipal solid waste trade to exports only, significantly reducing the potential for developing a robust local recycling market and increasing continued reliance on landfilling as the default waste management option. This export-focused approach restricts the circulation of recyclable materials within Qatar's domestic economy, limiting opportunities for local manufacturers to access affordable recycled plastic feedstock and stunting the development of downstream applications. High initial capital investment requirements present formidable barriers to market entry, with the establishment of a state-of-the-art recycling plant requiring significant investment. These substantial financial hurdles deter potential investors, particularly small and medium-sized enterprises that might otherwise contribute to diversifying the recycling sector and fostering innovation. The limited availability of financing mechanisms specifically tailored to support recycling ventures, combined with relatively long payback periods characteristic of waste processing operations, further discourages investment. The economic viability of recycling is additionally challenged by the low cost of landfilling and the availability of land in Qatar, typically old sand or gravel quarries, which make recycling programs appear less economically attractive in comparison. Without coordinated policy interventions to address these regulatory gaps and economic disincentives, the market's ability to scale operations and meet growing demand for recycled materials remains constrained.

Qatar Recycled Plastics Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar recycled plastics market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on plastic type, raw material, and application.

Analysis by Plastic Type:

- Polyethylene Terephthalate (PET)

- High Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low Density Polyethylene (LDPE)

- Others

The report has provided a detailed breakup and analysis of the market based on the plastic type. This includes polyethylene terephthalate (PET), high density polyethylene (HDPE), polypropylene (PP), low density polyethylene (LDPE), and others.

Analysis by Raw Material:

- Plastic Bottles

- Plastic Films

- Rigid Plastic and Foam

- Fibres

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes plastic bottles, plastic films, rigid plastic and foam, fibres, and others.

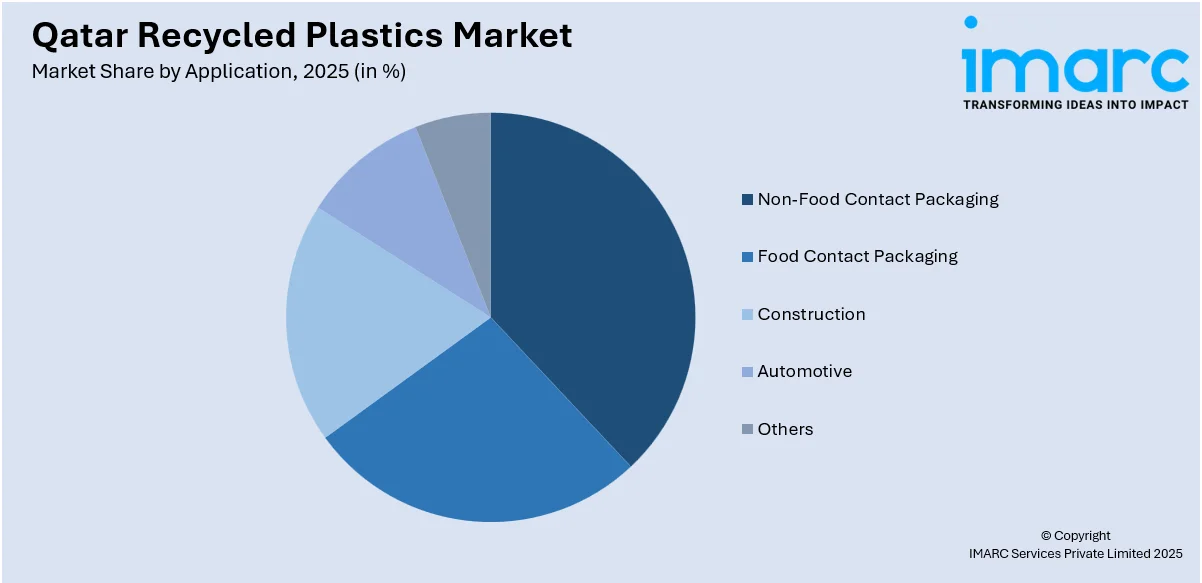

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Non-Food Contact Packaging

- Food Contact Packaging

- Construction

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes non-food contact packaging, food contact packaging, construction, automotive, and others.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar recycled plastics market is characterized by a developing competitive environment with a growing mix of local players and emerging private sector participants responding to government incentives and infrastructure development. Competition is shaped by the availability of processing technology, access to consistent feedstock supplies provided by the government's waste sorting programs, and the ability to meet quality standards for different end-use applications. Established waste management companies and plastic manufacturing firms are increasingly integrating recycling capabilities into their operations to capitalize on the circular economy transition. The development of the Al-Afjah Recycling Hub with dedicated industrial plots and the government's provision of recyclable materials free of cost to participating factories create favorable conditions for new entrants, though high initial capital investment requirements remain a barrier. Companies are differentiating themselves through investments in advanced sorting and processing technologies, securing strategic partnerships with government entities and international technology providers, and developing specialized capabilities for producing high-quality recycled resins suitable for food-contact and automotive applications.

Qatar Recycled Plastics Industry Latest Developments:

May 2025: In honor of World Environment Day on June 5, Al Meera Consumer Goods Company (Q.P.S.C) is introducing a groundbreaking national recycling initiative for residents, focused on fostering a culture of sustainability and promoting environmental practices in the local community. This initiative is unprecedented in the country and revolves around a community challenge among residents via their nearest or preferred Al Meera branches equipped with recycling machines. The branch with the most recycled plastic bottles and aluminum cans will be declared the winner.

Qatar Recycled Plastics Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Plastic Types Covered |

Polyethylene Terephthalate (PET), High Density Polyethylene (HDPE), Polypropylene (PP), Low Density Polyethylene (LDPE), Others |

|

Raw Materials Covered |

Plastic Bottles, Plastic Films, Rigid Plastic and Foam, Fibres, Others |

|

Applications Covered |

Non-Food Contact Packaging, Food Contact Packaging, Construction, Automotive, Others |

|

Regions Covered |

Ad Dawhah, Al Rayyan, Al Wakrah, Others |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar recycled plastics market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar recycled plastics market on the basis of plastic type?

- What is the breakup of the Qatar recycled plastics market on the basis of raw material?

- What is the breakup of the Qatar recycled plastics market on the basis of application?

- What is the breakup of the Qatar recycled plastics market on the basis of region?

- What are the various stages in the value chain of the Qatar recycled plastics market?

- What are the key driving factors and challenges in the Qatar recycled plastics market?

- What is the structure of the Qatar recycled plastics market and who are the key players?

- What is the degree of competition in the Qatar recycled plastics market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar recycled plastics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar recycled plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar recycled plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)