Qatar Retail Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Qatar Retail Market Overview:

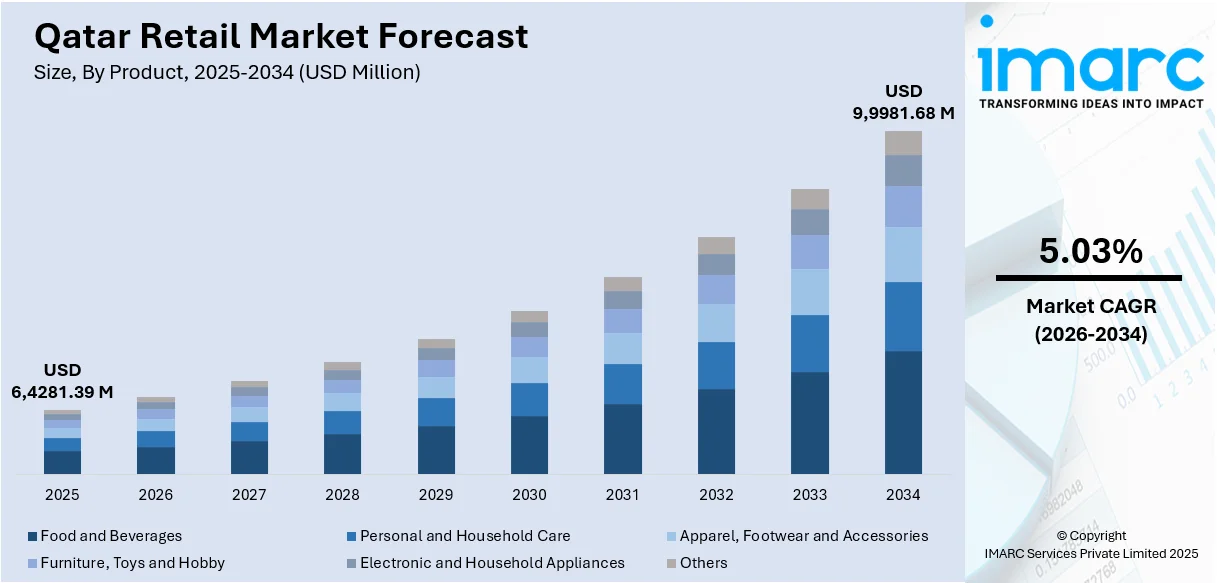

The Qatar retail market size reached USD 6,4281.39 Million in 2025. The market is projected to reach USD 9,9981.68 Million by 2034, exhibiting a growth rate (CAGR) of 5.03% during 2026-2034. The market is on a steady growth path, shaped by rising incomes, strong consumer confidence, and expanding tourism. Both brick‑and‑mortar and online channels are evolving, with more shoppers embracing digital options while still valuing in‑store experiences. Developers are boosting the supply of modern shopping centres and destination retail zones, and retailers are deploying technology to improve convenience and engagement. Policy reforms, infrastructural investment, and efforts to attract international brands are reinforcing market momentum. Together, these factors are strengthening the Qatar retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6,4281.39 Million |

| Market Forecast in 2034 | USD 9,9981.68 Million |

| Market Growth Rate 2026-2034 | 5.03% |

Qatar Retail Market Trends:

Expansion of Retail Space and Organised Formats

The retail sector in Qatar is seeing substantial growth in organised retail space, both in malls and outdoor destinations, as the country continues to build modern shopping infrastructure. In December 2024, total retail supply including both organised and unorganised spaces was recorded at millions of square metres of gross leasable area in Qatar. New shopping centres, outlet villages, and open‑air retail destinations are being developed in high‑density zones, while indoor malls are also increasing footprint with anchor tenants and mixed‑use leisure components. The inclusion of food and beverage outlets, entertainment, and experiential elements in retail projects is becoming more common, aligning with shopper expectations for destinations rather than pure transactional spaces. Urban planning and infrastructure investment are supporting this expansion, including transportation access and public amenities around new retail developments. Such supply growth is attracting both domestic consumers and tourists seeking diverse shopping experiences. Overall, the sector is evolving from simple retail presence to immersive environments. As this builds momentum, the Qatar retail market growth will be increasingly driven by organised formats and expanded retail footprints.

To get more information on this market Request Sample

Digital Integration, Tourism Synergy, and Consumer Engagement

Retail in Qatar is increasingly defined by the seamless integration of digital tools and rising tourist-driven demand. Retailers are adopting omni-channel strategies that blend online and in-store experiences, allowing customers to browse, purchase, and engage through multiple touchpoints. Features like mobile ordering, click-and-collect, and digital loyalty programmes are now common, providing greater convenience and personalization. Meanwhile, physical stores are being enhanced with smart technologies, interactive displays, and contactless services to align with the expectations of modern, tech-savvy shoppers. Tourism continues to play a vital role in shaping retail performance, particularly in categories like fashion, luxury, and lifestyle products. In March 2025, Qatar recorded over millions of international visitors in the first quarter, highlighting the growing influence of inbound travel on retail footfall and spending. This steady flow of global visitors, combined with rising local demand, is pushing retailers to rethink engagement models and promotional strategies. As technology and tourism converge, the Qatar retail market trends increasingly point toward experience-centric, digitally enabled retail ecosystems that cater to both resident and visitor segments in a competitive, high-expectation landscape.

Emphasis on Rental Dynamics and Consumer Spending Patterns

In the current retail environment, rental rates and spending behaviour are showing evolving patterns that reflect changing demand and location‑sensitivity. Prime retail locations in major shopping malls are maintaining strong occupancy, and rents in those areas are stable or increasing, while secondary zones are seeing landlords offering incentives to maintain tenant mix and occupancy. Consumers are spending more per visit, particularly in high‑footfall, experiential destinations, including luxury malls and curated open‑air retail spaces. Domestic shoppers are playing a larger role in sustaining retail activity, with rising income levels and lifestyle expectations translating into demand for quality, brand variety, and convenience. Retail offerings are adjusting accordingly, with more focus on curated product assortments, enhanced customer service, and blending of dining, leisure, and shopping. All these factors contribute to healthier market fundamentals. The combination of shifting rental trends and consumer behaviour underlines that Qatar retail market will be reinforced by adaptive leasing strategies and elevated shopper expectations, helping to shape sustainable sector expansion.

Qatar Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Food and Beverages

- Personal and Household Care

- Apparel, Footwear and Accessories

- Furniture, Toys and Hobby

- Electronic and Household Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes food and beverages, personal and household care, apparel, footwear and accessories, furniture, toys and hobby, electronic and household appliances, and others.

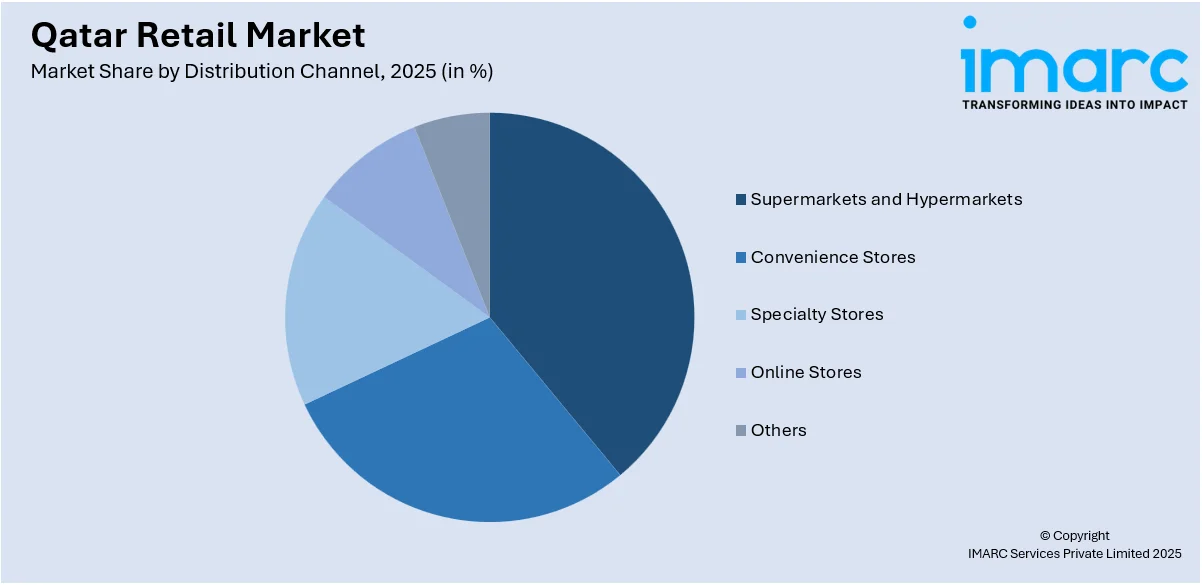

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Qatar Retail Market News:

- December 2024: Apparel Group has introduced 24 new retail concepts at Doha Mall in Abu Hamour, expanding its footprint in Qatar’s retail industry. These upcoming stores will showcase prominent international brands and aim to cater to Qatar’s style‑focused customers. Located strategically at central access points, Doha Mall is becoming a key retail destination in the region. The move reflects continued confidence in Qatar’s retail growth prospects.

Qatar Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar retail market on the basis of product?

- What is the breakup of the Qatar retail market on the basis of distribution channel?

- What is the breakup of the Qatar retail market on the basis of region?

- What are the various stages in the value chain of the Qatar retail market?

- What are the key driving factors and challenges in the Qatar retail market?

- What is the structure of the Qatar retail market and who are the key players?

- What is the degree of competition in the Qatar retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)