Qatar Ride-Hailing Market Size, Share, Trends and Forecast by Vehicle Type, Booking Type, End Use, and Region, 2026-2034

Qatar Ride-Hailing Market Summary:

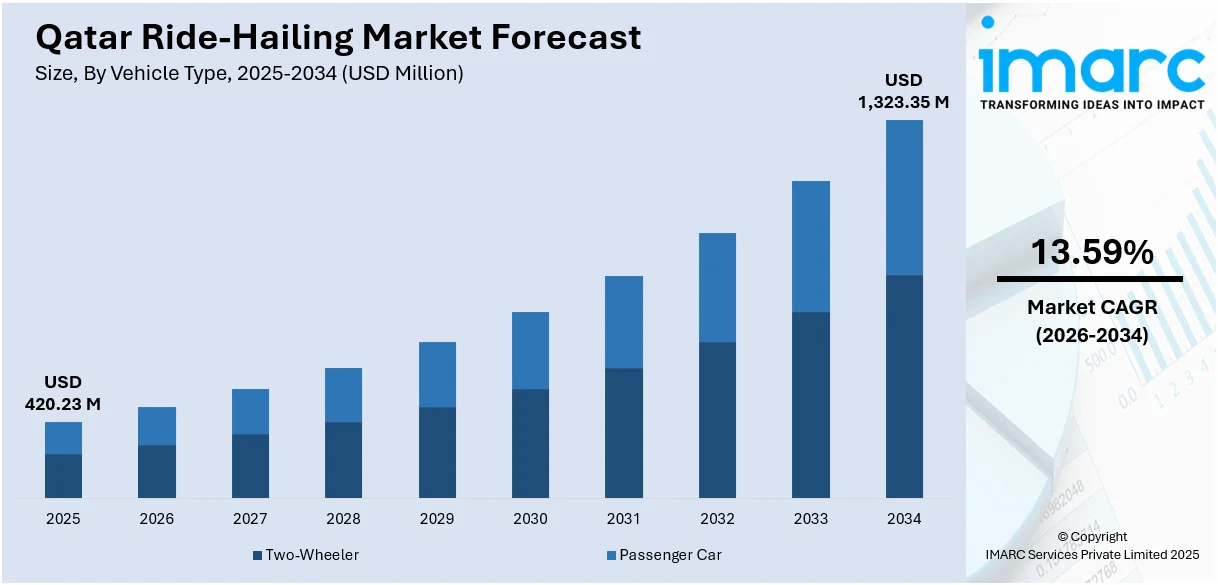

The Qatar ride-hailing market size reached USD 420.23 Million in 2025. The market is projected to reach USD 1,323.35 Million by 2034, growing at a CAGR of 13.59% during 2026-2034. The market is driven by the government's ambitious digital transformation initiatives under the Ministry of Transport Strategy 2025-2030, which emphasizes sustainable mobility and smart transportation solutions. Additionally, strategic public-private partnerships (PPPs) are enhancing service accessibility and convenience for residents and tourists, fueling the Qatar ride-hailing market share.

|

Particulars |

Details |

|

Market Size (2025) |

USD 420.23 Million |

|

Forecast (2034) |

USD 1,323.35 Million |

|

CAGR (2026-2034) |

13.59% |

|

Key Segments |

Vehicle Type (Two-Wheeler, Passenger Car), Booking Type (Online, Offline), End Use (Personal, Commercial) |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

Qatar Ride-Hailing Market Outlook (2026-2034):

The Qatar ride-hailing market is poised for sustained expansion, driven by the government's comprehensive transport modernization initiatives focused on digital integration. The Ministry of Transport's commitment to achieving 100% electrification of public transport by 2030, coupled with investments in smart control centers and advanced digital applications, is creating favorable conditions for ride-hailing operators to integrate eco-friendly fleets and leverage intelligent transportation systems. The tourism sector's projected growth will generate substantial demand for efficient, technology-enabled mobility solutions throughout the ForecastPeriod.

To get more information on this market Request Sample

Impact of AI:

AI is transforming the Qatar ride-hailing market by enhancing operational efficiency, user experience, and safety. AI-driven algorithms optimize driver allocation, predict demand patterns, and reduce passenger wait times, leading to faster and more reliable rides. Dynamic pricing models powered by AI help balance supply and demand, improving profitability for operators. AI-enabled navigation and traffic analytics support route optimization, fuel savings, and timely arrivals. Moreover, AI chatbots and voice assistants improve customer service, while predictive maintenance ensures vehicle reliability.

Market Dynamics:

Key Market Trends & Growth Drivers:

Government-Led Digital Transformation and Sustainable Mobility Initiatives

Government-led digital transformation and sustainable mobility initiatives are major forces impelling the growth of the market in Qatar. As part of its Smart Nation and Vision 2030 strategies, the government is promoting digitalization, intelligent transport systems, and eco-friendly urban mobility solutions. In September 2025, Qatar revealed the national transportation plan for 2025–2030, with the goal of turning the nation into a worldwide center for sustainable logistics and intelligent mobility. The initiative, launched with the motto ‘Reaching Beyond Horizons,’ encompassed 125 projects within 42 initiatives, nearly 40% of which involved the private sector. The plan was consistent with Qatar National Vision 2030 and the Third National Development Strategy, focusing on top-tier transport infrastructure, enhanced logistics efficiency, and creative, eco-friendly mobility solutions. Investments in 5G connectivity and data-driven mobility platforms are supporting seamless integration of ride-hailing apps and real-time tracking systems. Additionally, policies encouraging electric vehicles (EVs), shared mobility, and reduced carbon emissions align with the expansion of sustainable ride-hailing fleets.

Strategic Alliances Between Public and Private Sectors

The convergence of public and private sector capabilities through strategic partnerships has emerged as a defining characteristic of Qatar's evolving mobility landscape, substantially enhancing ride-hailing accessibility and operational efficiency. The landmark partnership between Mowasalat (Karwa), Qatar's state-owned transport operator, and Uber, announced in May 2024, exemplified the power of public-private collaboration in driving transportation innovations and expanding service coverage. Through this strategic alliance, Karwa's extensive public transport taxi fleet became accessible via the Uber platform, enabling users to book Karwa taxis directly through the Uber app by simply selecting the ‘Taxi’ option. This integration provides residents and tourists with enhanced travel options, faster pickup times, more affordable fares, and improved reliability through increased vehicle availability on the platform. The Qatar ride-hailing market growth benefits significantly from multi-dimensional partnerships, as they create a comprehensive transportation network that addresses first-mile and last-mile connectivity challenges while offering consumers flexibility in choosing transportation modes based on convenience, cost, and travel requirements.

Surging Tourism Activities

Rising tourism activities in Qatar are positively influencing the market. As per the government data, in 2024, Qatar tourism exceeded its annual visitor target of 4.79 Million, achieving a total of 5.08 Million visitors. With international visitor numbers increasing due to global events, cultural attractions, and expanding hospitality infrastructure, the demand for convenient, safe, and on-demand transportation has surged. Tourists prefer app-based ride-hailing services for their reliability, language-friendly interfaces, transparent pricing, and ease of navigation in unfamiliar cities. The proximity of major landmarks, hotels, and airports amplifies short-distance travel needs, boosting ride volumes. Partnerships between ride-hailing platforms and hotels or travel operators further enhance accessibility and convenience for tourists. Additionally, government efforts to position Qatar as a premium travel destination and improve last-mile connectivity support sustained demand. As tourism continues to flourish, ride-hailing platforms play a vital role in enhancing visitor mobility and overall travel experiences.

Key Market Challenges:

Regulatory Restrictions and Tight Licensing Requirements

Stringent regulatory frameworks and complex licensing rules for ride-hailing operations create barriers for scaling the market in Qatar. Authorities maintain tight control over fare structures, driver permits, vehicle eligibility, and company licensing to align ride-hailing services with national transportation policies. Traditional taxi unions and regulated transport operators exert pressure to maintain regulated pricing and protect their interests, often resulting in restrictive guidelines for app-based operators. Compliance costs for drivers, such as vehicle registration, approvals, and mandatory inspections, discourage new driver sign-ups. Regulatory ambiguity regarding insurance, safety accountability, and permitted operating zones further complicates business expansion plans. Frequent policy revisions and limited stakeholder consultation slow innovation and reduce operational agility. With ride-hailing treated more as a controlled transport service than a tech-enabled mobility solution, companies are facing administrative burdens that delay market penetration, fleet growth, and digital mobility integration.

Dependence on Expat Workforce and Driver Shortage Issues

Qatar’s heavy reliance on expatriate labor creates structural constraints for the ride-hailing driver ecosystem. Workforce sponsorship systems, job visa limitations, and employment restrictions make it difficult for many expatriates to legally register as full-time or part-time drivers for ride-hailing services. This limits the pool of eligible drivers, causing supply shortages during high-demand hours. Driver retention is also challenging due to competing job opportunities in the hospitality, logistics, or delivery sectors, which sometimes offer more stable income or better benefits. Frequent turnover increases onboarding and training costs for platforms. Local citizens show limited interest in gig-based driving roles, restricting the growth of a national driver base. As demand fluctuates with tourist influxes and seasonal events, supply gaps lead to increased wait times, surge pricing complaints, and inconsistent service quality, making market expansion difficult for ride-hailing operators.

High Operating Costs

High vehicle maintenance expenses, fuel costs, insurance requirements, and commission charges create financial pressure for drivers and ride-hailing operators in Qatar. The cost of owning or leasing a car that meets platform eligibility standards is relatively high, reducing driver profit margins. App commission fees and promotional discounting strategies often reduce earnings, causing dissatisfaction among drivers and discouraging long-term engagement. Operators also face high customer acquisition and regulatory compliance costs, which limit the feasibility of lowering fares or offering financial incentives to drivers. Price-sensitive customers compare ride-hailing fares with public transport and traditional taxi rates, limiting how much pricing flexibility platforms can exercise. When high operational expenses are not matched by ride frequency and stable passenger revenue, it weakens platform profitability and driver motivation. This cost-return imbalance slows network expansion, making the ecosystem financially unsustainable for many stakeholders.

Qatar Ride-Hailing Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Qatar ride-hailing market, along with forecasts at the country and regional levels for 2026-2034. The market has been categorized based on vehicle type, booking type, and end use.

Analysis by Vehicle Type:

- Two-Wheeler

- Passenger Car

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes two-wheeler and passenger car.

Analysis by Booking Type:

- Online

- Offline

A detailed breakup and analysis of the market based on the booking type have also been provided in the report. This includes online and offline.

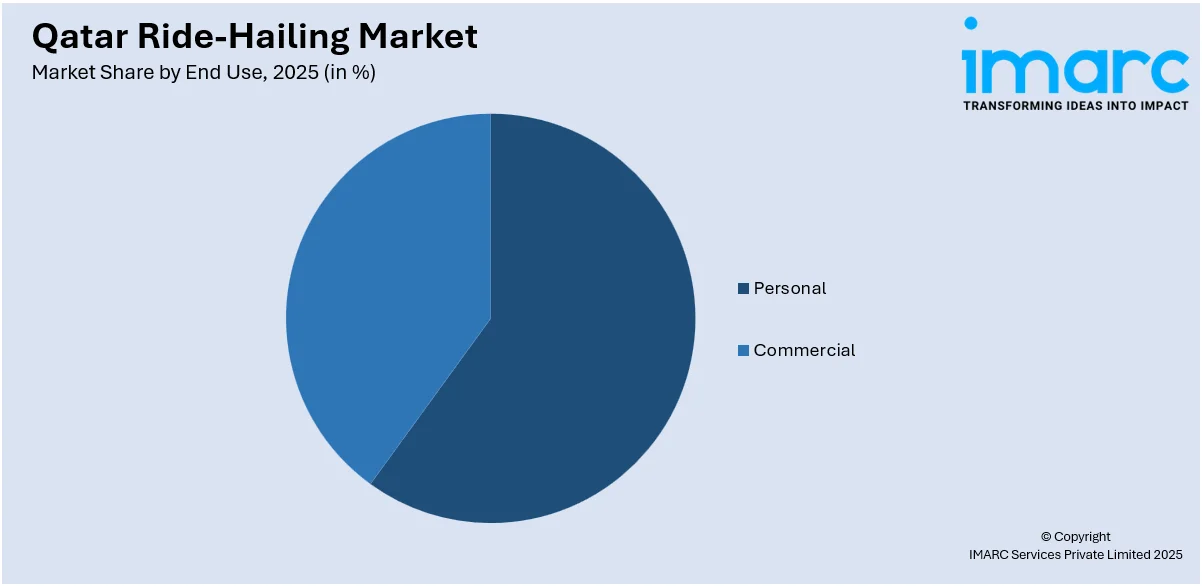

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Personal

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end use. This includes personal and commercial.

Analysis by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ad Dawhah, Al Rayyan, Al Wakrah, and others.

Competitive Landscape:

The Qatar ride-hailing market operates within a highly regulated and moderately concentrated competitive environment, characterized by limited licensed operators and strong government oversight. The market structure reflects a blend of international platform giants and local transportation service providers, operating under stringent Ministry of Transport authorization. Competition centers primarily on service reliability, pricing competitiveness, application user experience, driver availability, and vehicle quality standards. International ride-hailing platforms leverage their global technological capabilities, established brand recognition among international tourists, and sophisticated matching algorithms to attract users, while local operators focus on understanding domestic market nuances, building relationships with Qatari communities, and offering personalized services tailored to regional preferences. The stringent licensing requirements create barriers to entry that limit the number of active competitors while simultaneously ensuring that authorized operators meet rigorous safety and quality standards.

Qatar Ride-Hailing Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Vehicle Types Covered |

Two-Wheeler, Passenger Car |

|

Booking Types Covered |

Online, Offline |

|

End Uses Covered |

Personal, Commercial |

|

Regions Covered |

Ad Dawhah, Al Rayyan, Al Wakrah, Others |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Qatar ride-hailing market performed so far and how will it perform in the coming years?

- What is the breakup of the Qatar ride-hailing market on the basis of vehicle type?

- What is the breakup of the Qatar ride-hailing market on the basis of booking type?

- What is the breakup of the Qatar ride-hailing market on the basis of end use?

- What is the breakup of the Qatar ride-hailing market on the basis of region?

- What are the various stages in the value chain of the Qatar ride-hailing market?

- What are the key driving factors and challenges in the Qatar ride-hailing market?

- What is the structure of the Qatar ride-hailing market and who are the key players?

- What is the degree of competition in the Qatar ride-hailing market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Qatar ride-hailing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Qatar ride-hailing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Qatar ride-hailing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)