Qatar Wealth Management Market Size, Share, Trends and Forecast by Business Model, Provider, End User, and Region, 2026-2034

Qatar Wealth Management Market Summary:

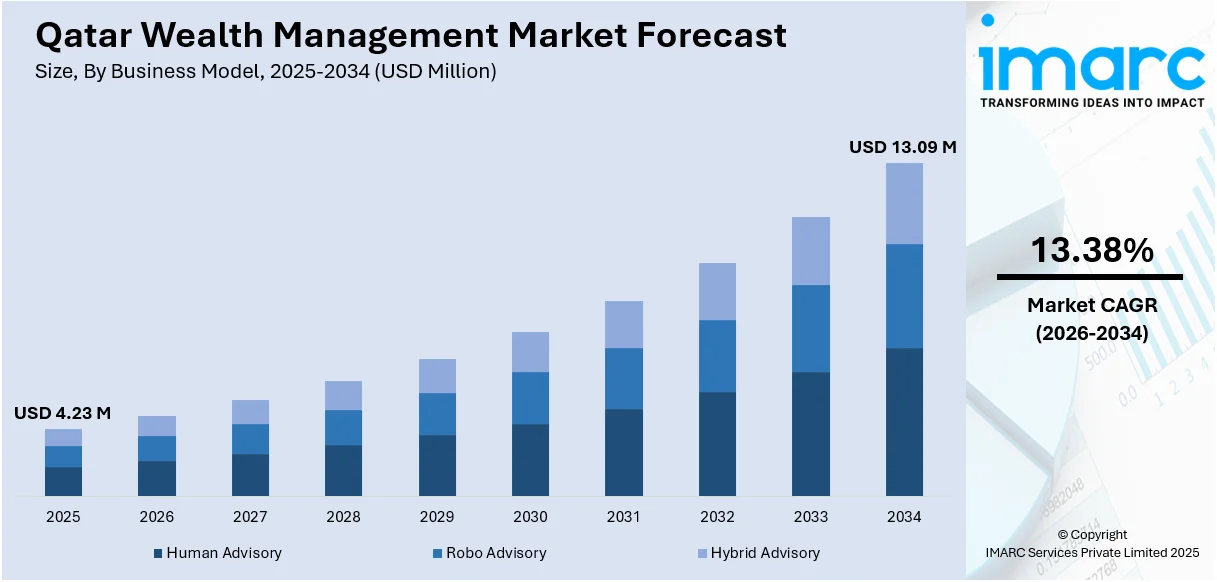

The Qatar wealth management market size reached USD 4.23 Million in 2025 and is projected to reach USD 13.09 Million by 2034, growing at a compound annual growth rate of 13.38% from 2026-2034.

The market is driven by the rapid expansion of family offices supporting intergenerational wealth transfer, accelerated digital transformation enabling fintech-powered wealth services, and growing adoption of Sharia-compliant investment solutions aligned with Islamic finance principles. Additionally, favorable regulatory frameworks established by the Qatar Financial Centre and strategic partnerships between traditional banks and technology providers are propelling the Qatar wealth management market share.

Key Takeaways and Insights:

- By Business Model: Human advisory dominates the market with a share of 45% in 2025, driven by high-net-worth clients who value personalized financial guidance. These clients prefer relationship-focused wealth management services that provide customized investment strategies, detailed portfolio oversight, and tailored solutions to meet their unique financial goals.

- By Provider: Banks lead the market with a share of 38% in 2025, owing to their established trust, comprehensive service offerings, extensive branch networks, and ability to integrate wealth management with traditional banking products and cross-border financial solutions.

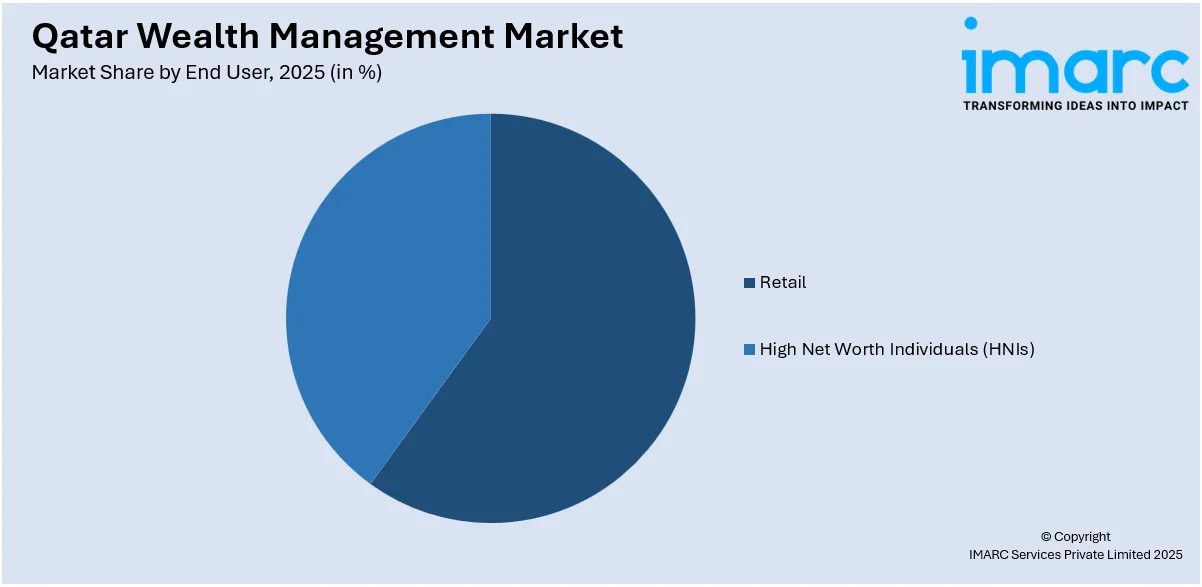

- By End User: High net worth individuals (HNIs) represent the largest segment with a market share of 63% in 2025, attributed to Qatar's position as one of the wealthiest nations globally with substantial investable assets requiring sophisticated wealth preservation strategies.

- By Region: Ad Dawhah lead the market with a share of 49% in 2025, driven by a high concentration of affluent residents, expanding financial services infrastructure, growing demand for diversified and Shariah-compliant investments, and increasing adoption of digital wealth management solutions.

- Key Players: The Qatar wealth management market exhibits moderate competitive intensity, with established banking institutions competing alongside specialized wealth managers and emerging fintech advisors. Market participants are differentiating through digital innovation, Sharia-compliant product offerings, and enhanced client engagement strategies.

To get more information on this market Request Sample

Qatar's wealth management landscape is experiencing transformative growth underpinned by the country's remarkable economic prosperity and strategic financial sector development. The nation's investable wealth is projected to expand from USD 324 billion in 2024 to USD 409 billion by 2029, reflecting a compound annual growth rate of 4.8 percent. This expansion is supported by robust government initiatives through the Third Financial Sector Strategy for 2024-2030, which specifically targets wealth management innovation and Islamic finance development. For instance, in December 2024, the Qatar Financial Centre hosted its Family Office Forum, bringing together key stakeholders and wealth management experts to discuss evolving dynamics and strategies crucial for sustaining the growth of family enterprises and intergenerational wealth preservation.

Qatar Wealth Management Market Trends:

Rapid Expansion of Family Offices and Intergenerational Wealth Management Infrastructure

The market is witnessing substantial growth driven by the establishment and expansion of family office structures designed to preserve and transfer wealth across generations. High-net-worth individuals and ultra-high-net-worth families are increasingly recognizing the need for sophisticated governance frameworks to manage expanding portfolios. In May 2025, the Qatar Financial Centre partnered with Campden Wealth to host the Qatar Family Office Showcase, bringing together family offices and prominent families to explore wealth management opportunities and succession planning strategies.

Growth of Islamic Finance and Sharia-Compliant Wealth Management Solutions

The expansion of Islamic finance and Sharia-compliant wealth management products represents a fundamental driver of market growth. Islamic banks are developing comprehensive portfolios including Islamic funds, sukuk, and ethical investment vehicles that align with religious values while delivering competitive returns. Qatar's Islamic finance sector recorded total assets of QR 683 billion in 2024, with Islamic banks issuing QR 9.5 billion in sukuk representing a significant increase from previous years, demonstrating strong market confidence in Sharia-compliant investment instruments.

Digital Transformation and AI-Powered Wealth Services Integration

Rapid digital transformation is redefining how wealth management services are delivered, driven by fintech innovation and the growing use of artificial intelligence. Firms are adopting advanced technologies to improve client engagement, streamline operations, and deliver more tailored investment insights. Regulatory progress has provided greater clarity for digital and virtual asset offerings, encouraging innovation within a structured environment. At the same time, robo-advisory and digital-first platforms are gaining acceptance for their affordability and ease of access, enabling wealth managers to reach a wider range of investors beyond traditional high-net-worth segments.

Market Outlook 2026-2034:

The Qatar wealth management market is positioned for sustained expansion driven by the country's economic diversification initiatives and growing affluent population. Strategic investments in financial infrastructure and regulatory modernization are creating favorable conditions for market participants. The Qatar Financial Centre recorded a 64 percent year-on-year growth in firm registrations during the first half of 2025, signaling strong investor confidence in the jurisdiction's wealth management ecosystem. The market generated a revenue of USD 4.23 Million in 2025 and is projected to reach a revenue of USD 13.09 Million by 2034, growing at a compound annual growth rate of 13.38% from 2026-2034.

Qatar Wealth Management Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Business Model | Human Advisory | 45% |

| Provider | Banks | 38% |

| End User | High Net Worth Individuals (HNIs) | 63% |

| Region | Ad Dawhah | 49% |

Business Model Insights:

- Human Advisory

- Robo Advisory

- Direct Plan-Based/Goal-Based

- Comprehensive Wealth Advisory

- Hybrid Advisory

Human advisory dominates with a market share of 45% of the total Qatar wealth management market in 2025.

Human advisory services maintain dominance in Qatar's wealth management landscape due to the cultural emphasis on relationship-based financial guidance and personalized service delivery. High-net-worth clients in the region demonstrate strong preference for direct engagement with experienced wealth advisors who understand local market dynamics and family business complexities. This segment benefits from the ability to provide comprehensive portfolio oversight, succession planning guidance, and tailored investment strategies that address unique client circumstances.

The segment's strength is further reinforced by the growing sophistication of wealth management needs among Qatari families navigating intergenerational wealth transfers. Leading institutions are investing in advisor development programs and enhanced client acquisition strategies to capture this expanding opportunity. Technology integration is augmenting rather than replacing human advisors, with firms deploying digital tools to enhance service delivery while maintaining the personal engagement that clients value.

Provider Insights:

- FinTech Advisors

- Banks

- Traditional Wealth Managers

- Others

Banks leads with a share of 38% of the total Qatar wealth management market in 2025.

Banks maintain leadership in wealth management provision through their established trust, comprehensive service capabilities, and extensive client relationships developed over decades of operation in the Qatari market. Major banking institutions offer integrated solutions spanning investment advisory, portfolio management, succession planning, and cross-border wealth structuring that appeal to both local and expatriate high-net-worth clients. The competitive advantage stems from regulatory credibility and the ability to combine wealth management with traditional banking products.

Leading banks are strengthening their private banking propositions through digital innovation and advanced technology investment to enhance efficiency while preserving relationship-based service. Strategic partnerships with government entities are expanding service reach, as demonstrated by recent collaborations between major banks and investment promotion agencies to facilitate foreign investor services through dedicated account management and specialized financial programs.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- High Net Worth Individuals (HNIs)

High net worth individuals (HNIs) exhibit clear dominance with a 63% share of the total Qatar wealth management market in 2025.

High-net-worth individuals represent the primary client base for wealth management services given Qatar's exceptional concentration of affluent households and one of the highest GDP per capita levels globally. This segment demands sophisticated wealth preservation strategies, multi-generational planning services, and diversified investment portfolios spanning domestic and international markets. The increasing sophistication of Qatari investors is driving demand for advisory services covering equities, fixed income, private equity, and alternative investments.

Wealth accumulation from hydrocarbons, real estate ventures, and business enterprises continues driving demand for personalized asset management solutions. The segment benefits from growing awareness of structured wealth transfer mechanisms and family office services that preserve legacies across generations. Cross-border wealth deployment capabilities are increasingly important as HNI clients seek global diversification and international market access through trusted advisory relationships.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

Ad Dawhah represents the largest share with 49% of the total Qatar wealth management market in 2025.

Ad Dawhah’s wealth management market is strongly driven by its position as Qatar’s financial and administrative hub, concentrating high-net-worth individuals, multinational corporations, and sovereign-linked entities. The city benefits from a mature banking ecosystem, international financial services presence, and a stable regulatory environment that supports sophisticated investment products. Rising demand for portfolio diversification, succession planning, and Shariah-compliant solutions is encouraging banks and asset managers to expand advisory capabilities. Cross-border investment activity and access to global markets further strengthen Ad Dawhah’s appeal as a regional wealth management center.

Another key driver is rapid digital and institutional modernization within the financial sector. Wealth managers in Ad Dawhah are increasingly adopting digital platforms, data analytics, and hybrid advisory models to enhance personalization and service efficiency. Regulatory clarity for fintech, digital assets, and alternative investments supports innovation while maintaining investor confidence. Growing financial literacy, a younger affluent population, and demand for discretionary and goal-based investing are also reshaping client expectations, prompting firms to offer more customized, technology-enabled wealth management solutions.

Market Dynamics:

Growth Drivers:

Why is the Qatar Wealth Management Market Growing?

Rising High-Net-Worth Population and Wealth Accumulation

Qatar's expanding base of high-net-worth individuals and wealthy family offices represents a fundamental driver of wealth management market growth. The country maintains one of the highest gross domestic product per capita levels globally, resulting in a substantial population segment possessing significant investable assets requiring professional management. Qatar's net wealth reached a record USD 765 billion in 2024, with financial wealth growing by 4.1 percent to USD 424 billion. Investable wealth is expected to grow steadily over the coming years, driving sustained demand for advanced strategies focused on wealth preservation, capital growth, and long-term financial planning across diverse investor segments.

Favorable Regulatory Framework and Qatar Financial Centre Development

The regulatory environment actively supports wealth management sector expansion through supportive frameworks established by the Qatar Central Bank and Qatar Financial Centre. The QFC provides a business-friendly regulatory framework featuring streamlined processes, competitive tax incentives, and legal structures based on English Common Law that appeal to international wealth managers and family offices. The Third Financial Sector Strategy for 2024-2030 specifically targets wealth management innovation, Islamic finance development, and digital transformation. In the first half of 2025, the QFC recorded a 64 percent year-on-year increase in firm registrations, demonstrating strong momentum in attracting financial services providers to the jurisdiction.

Expanding Islamic Banking and Sharia-Compliant Investment Products

The growth of Islamic finance and Sharia-compliant wealth management products drives market expansion as Qatar positions itself as a global leader in ethical finance. Islamic financial institutions are developing comprehensive portfolios of investment options that align with religious values while delivering competitive returns. Qatar's Islamic finance sector recorded total assets of QR 683 billion in 2024, representing 4.1 percent year-on-year growth, with Islamic banks commanding approximately 27 percent of the total financial system. Islamic banks have significantly expanded sukuk issuance, reflecting growing market maturity and rising investor demand for Sharia-compliant financial instruments.

Market Restraints:

What Challenges the Qatar Wealth Management Market is Facing?

Hydrocarbon Dependency and Economic Volatility Exposure

While economic diversification is progressing, hydrocarbons still account for a large share of public revenue, linking overall economic performance and wealth accumulation to energy price cycles. Fluctuations in global oil and gas markets can influence fiscal stability, investor sentiment, and asset performance, introducing uncertainty into long-term portfolio strategies and complicating wealth planning and risk management decisions.

Competition from Regional Financial Hubs

Qatar’s wealth management sector faces intensifying competition from neighboring financial hubs such as the UAE and Saudi Arabia, which are rapidly expanding their financial services ecosystems. These markets are introducing attractive regulatory regimes, tax incentives, and investor-friendly policies that may draw global wealth managers and affluent clients seeking broader diversification and alternative regional platforms.

Data Security and Regulatory Compliance Challenges

The growing dependence on digital channels heightens concerns around data protection and cybersecurity, potentially slowing the adoption of technology-driven wealth management services. At the same time, strict regulatory obligations such as anti-money laundering and know-your-customer requirements increase operational complexity, while constantly evolving international compliance standards require firms to invest continuously in systems, controls, and governance capabilities.

Competitive Landscape:

The Qatar wealth management market exhibits a competitive structure characterized by established banking institutions competing alongside specialized wealth managers and emerging fintech advisors. Market participants are differentiating through digital innovation, Sharia-compliant product development, and enhanced client engagement strategies. Local banks maintain competitive advantages through cultural affinity, deep client relationships, and understanding of Islamic finance principles, while international entrants bring global investment capabilities and cross-border wealth structuring expertise. The competitive landscape is evolving as traditional players invest in technology platforms and fintech firms establish partnerships to access established client bases.

Recent Developments:

- April 2025: Invest Qatar and QNB announced a strategic partnership aimed at enhancing the ease of doing business for foreign investors entering the Qatari market. This collaboration provides a comprehensive suite of services to foreign investors via the Invest Qatar Gateway, including onboarding packages for incoming staff, dedicated account management teams, and access to QNB's specialized financial programs tailored for key sectors in Qatar.

- October 2024: QNB reaffirmed its leadership in private banking by being named Best Private Bank in Qatar at MEED's MENA Banking Awards for Wealth and Private Banking 2025, and Best Private Bank in the Middle East and Qatar 2025 by Global Finance magazine. This recognition highlights QNB's continued excellence in serving high-net-worth clients through innovative solutions, personalized advisory services, and commitment to delivering exceptional value.

Qatar Wealth Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered |

|

| Providers Covered | FinTech Advisors, Banks, Traditional Wealth Managers, Others |

| End Users Covered | Retail, High Net Worth Individuals (HNIs) |

| Regions Covered | Ad Dawhah, Al Rayyan, Al Wakrah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Qatar wealth management market size was valued at USD 4.23 Million in 2025.

The Qatar wealth management market is expected to grow at a compound annual growth rate of 13.38% from 2026-2034 to reach USD 13.09 Million by 2034.

Human advisory dominates the market with a 45% share in 2025, driven by high-net-worth clients' preference for personalized financial guidance and relationship-based wealth management services.

Key factors driving the Qatar wealth management market include rising high-net-worth population and wealth accumulation, favorable regulatory frameworks through the Qatar Financial Centre, expanding Islamic banking and Sharia-compliant investment products, and accelerating digital transformation.

Major challenges include hydrocarbon dependency and economic volatility exposure, increasing competition from regional financial hubs, data security concerns with digital platforms, and regulatory compliance requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)