Qatar WealthTech Market Size, Share, Trends and Forecast by Technology, Investment Type, Distribution Channel, and Region, 2026-2034

Qatar WealthTech Market Summary:

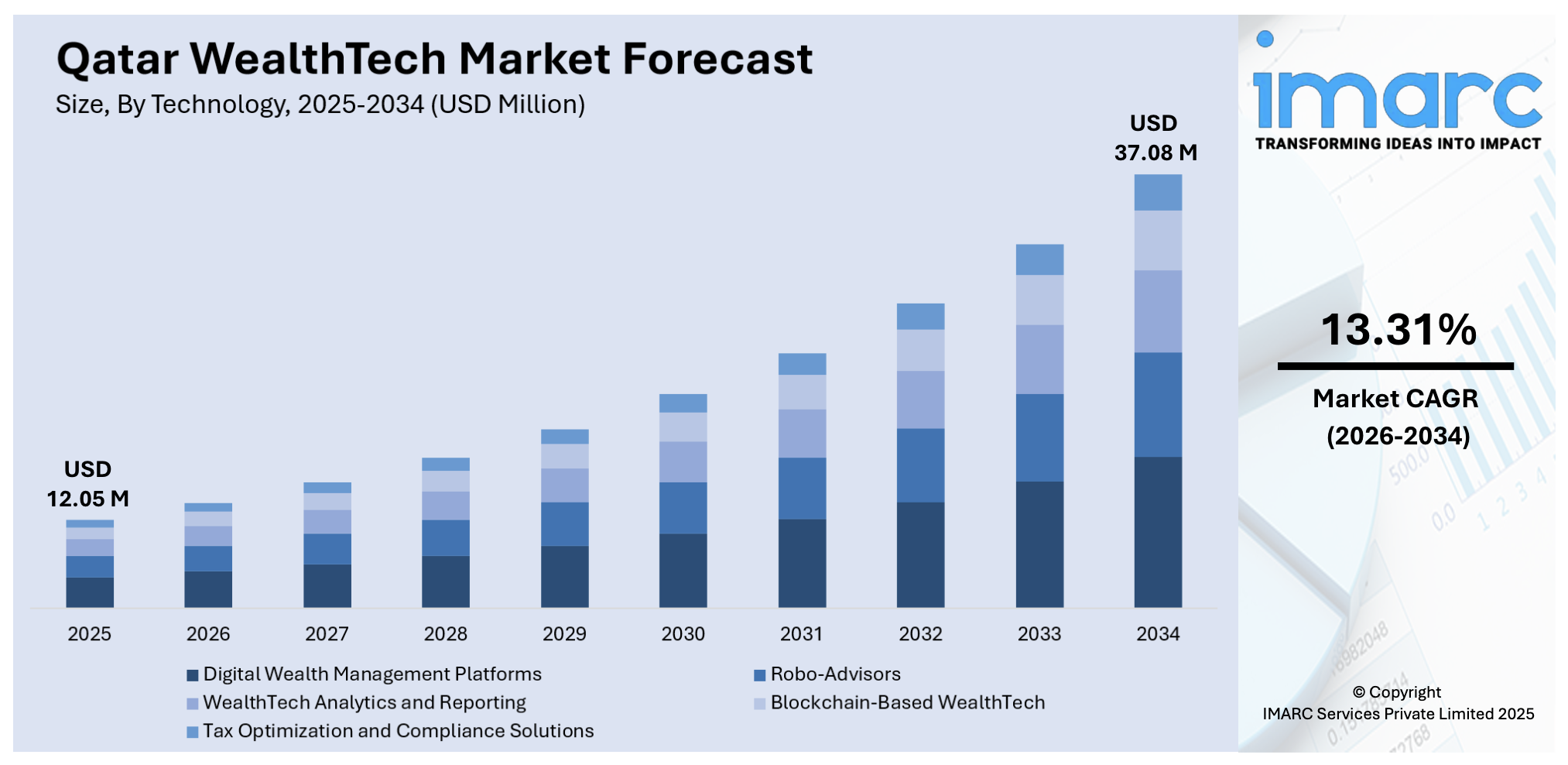

The Qatar WealthTech market size was valued at USD 12.05 Million in 2025 and is projected to reach USD 37.08 Million by 2034, growing at a compound annual growth rate of 13.31% from 2026-2034.

The Qatar WealthTech market is experiencing rapid expansion driven by the nation's comprehensive digital transformation initiatives and supportive regulatory environment. The country's commitment to financial innovation, anchored in Qatar National Vision 2030, has created a fertile ecosystem for digital wealth management solutions that cater to both individual investors and institutional clients. Rising demand for personalized investment services, coupled with increasing smartphone penetration and advanced technological infrastructure, continues to fuel market momentum. The growing population of high-net-worth individuals seeking sophisticated portfolio management tools and the expansion of Islamic fintech solutions addressing Sharia-compliant investment needs further strengthen market dynamics.

Key Takeaways and Insights:

- By Technology: Digital wealth management platforms dominate the market with a share of 28% in 2025, driven by increasing demand for integrated investment solutions that combine portfolio management, analytics, and automated advisory services, enabling seamless digital access for both retail and institutional investors.

- By Investment Type: Equities lead the market with a share of 30% in 2025, reflecting strong investor preference for stock market participation through digital platforms that offer real-time trading, portfolio tracking, and access to local and international equity markets.

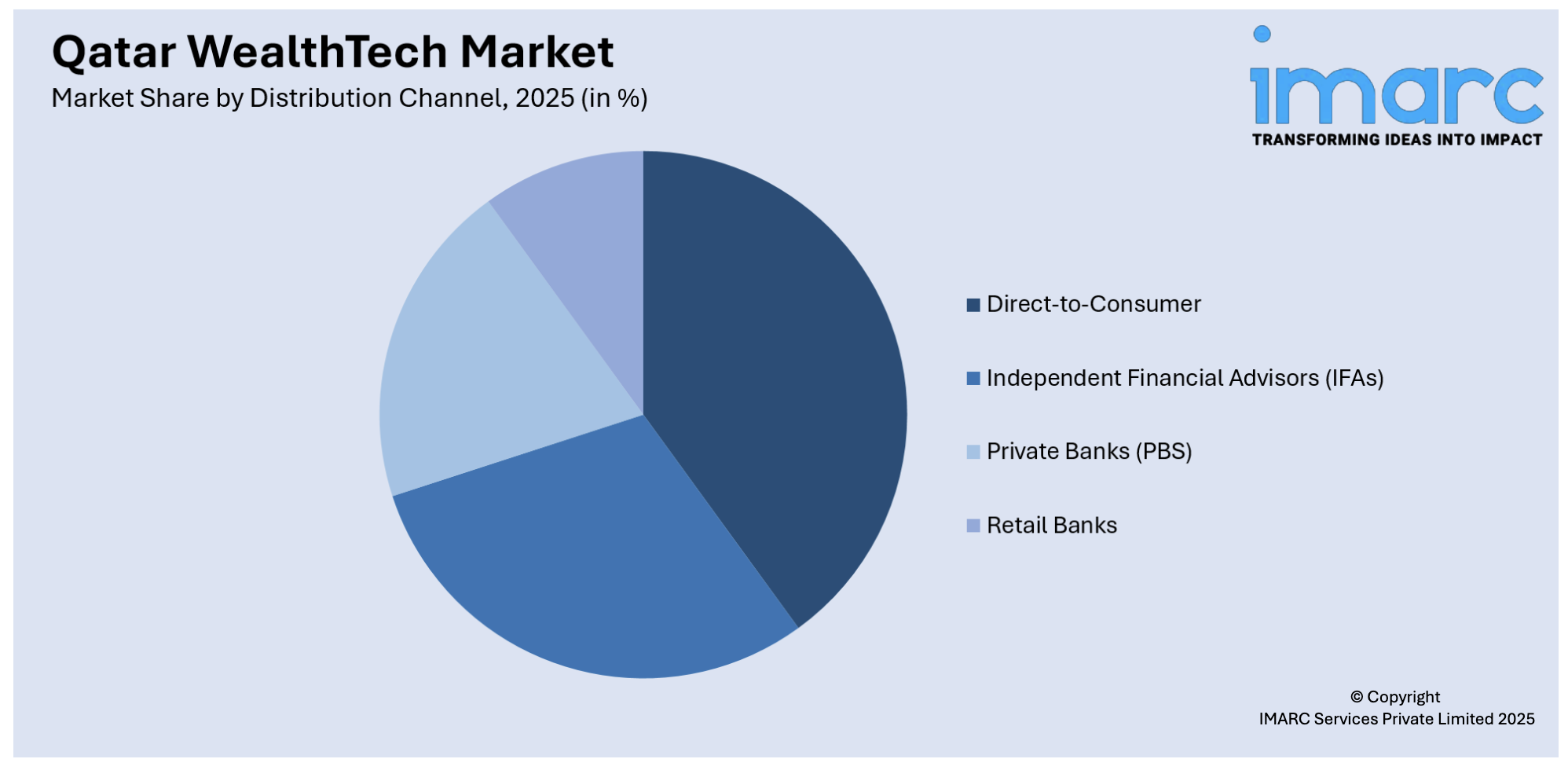

- By Distribution Channel: Direct-to-consumer represents the largest segment with a market share of 36% in 2025, driven by high digital literacy, widespread smartphone adoption, and consumer preference for self-directed investment platforms offering convenience, lower fees, and personalized experiences.

- By Region: Ad Dawhah comprises the largest region with 40% share in 2025, owing to its status as Qatar's financial hub housing major banks, fintech startups, regulatory bodies, and concentration of high-net-worth individuals seeking advanced wealth management services.

- Key Players: Key players drive the Qatar WealthTech market by developing innovative digital platforms, enhancing user experience through artificial intelligence integration, expanding Sharia-compliant investment options, and forming strategic partnerships with traditional financial institutions to broaden market reach and accelerate technology adoption.

To get more information on this market Request Sample

Qatar’s WealthTech market is witnessing a transformative surge, underpinned by the nation's high concentration of High-Net-Worth Individuals (HNWIs) and the ambitious Qatar National Vision 2030, which prioritizes digital transformation and economic diversification. The ecosystem has matured under the Qatar Central Bank’s updated National FinTech Strategy and the Qatar Financial Centre’s (QFC) rigorous yet supportive regulatory frameworks. These entities provide "sandbox" environments that have successfully accelerated the adoption of AI-driven robo-advisory and automated asset management. A defining characteristic of the local market is its global leadership in Sharia-compliant WealthTech, integrating Islamic financial ethics with cutting-edge portfolio algorithms. As we progress through 2026, the market is shifting toward holistic, hyper-personalized digital ecosystems, positioning Doha as a premier regional hub for sophisticated and secure wealth preservation solutions.

Qatar WealthTech Market Trends:

Rise of Digital Investment Platforms and Mobile-First Solutions

The proliferation of digital investment platforms is fundamentally reshaping Qatar's financial landscape, with mobile-first solutions becoming the preferred choice among tech-savvy investors. These platforms offer seamless access to diverse investment opportunities, real-time portfolio monitoring, and automated rebalancing features that appeal to both novice and experienced investors. The shift toward paperless transactions and instant account opening processes continues to accelerate adoption across demographic segments, particularly among younger investors seeking convenient wealth accumulation tools. According to the Qatar Central Bank (QCB) Payment Systems Statistics for May 2025, Qatar's payment system recorded 54.019 million transactions valued at QR 15.28 billion, with the instant payment system Fawran processing 1.645 million transactions worth QR 2.586 billion through 3.095 million registered accounts.

Growing Adoption of Artificial Intelligence in Wealth Management

Artificial intelligence and machine learning technologies are increasingly integrated into Qatar's wealth management ecosystem, enhancing data analytics capabilities and enabling personalized investment recommendations. These advanced technologies facilitate predictive insights, risk assessment automation, and portfolio optimization strategies that were previously accessible only to institutional investors. The integration of AI-driven chatbots and virtual assistants further improves customer engagement while reducing operational costs for service providers. In September 2024, the Qatar Central Bank issued the Artificial Intelligence (AI) Guideline to regulate AI use within the financial sector, aligning with the Third Financial Sector Strategy and the FinTech Strategy, enabling financial institutions to develop innovative AI-powered products and services while ensuring safe, efficient, and transparent use of AI technologies.

Expansion of Islamic FinTech and Sharia-Compliant Investment Solutions

Islamic fintech solutions are experiencing rapid adoption in Qatar, offering Sharia-compliant and interest-free investment products that cater to the growing demand for ethical financial services. These platforms combine traditional Islamic finance principles with modern technology to deliver accessible wealth management tools aligned with religious values. The development of halal investment screening algorithms and compliant robo-advisory services continues to attract both local and regional investors seeking faith-based portfolio management.

Market Outlook 2026-2034:

The Qatar WealthTech market is poised for substantial growth as digital transformation initiatives accelerate and regulatory frameworks mature to support financial innovation. Increasing investor sophistication, coupled with expanding access to global markets through digital platforms, will drive sustained demand for advanced wealth management solutions. Strategic government investments in fintech infrastructure, enhanced cybersecurity frameworks, and the integration of emerging technologies like blockchain and artificial intelligence will further strengthen market foundations. Rising financial literacy, growing expatriate population, and increasing affluence among Qatari households position the market for continued expansion throughout the forecast period. The market generated a revenue of USD 12.05 Million in 2025 and is projected to reach a revenue of USD 37.08 Million by 2034, growing at a compound annual growth rate of 13.31% from 2026-2034.

Qatar WealthTech Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

Digital Wealth Management Platforms |

28% |

|

Investment Type |

Equities |

30% |

|

Distribution Channel |

Direct-to-Consumer |

36% |

|

Region |

Ad Dawhah |

40% |

Technology Insights:

- Digital Wealth Management Platforms

- Robo-Advisors

- WealthTech Analytics and Reporting

- Blockchain-Based WealthTech

- Tax Optimization and Compliance Solutions

Digital wealth management platforms dominate with a market share of 28% of the total Qatar WealthTech market in 2025.

Digital wealth management platforms have emerged as the cornerstone of Qatar's WealthTech ecosystem, offering comprehensive solutions that integrate portfolio management, investment analytics, and client relationship tools within unified interfaces. These platforms enable financial institutions and independent advisors to deliver personalized services at scale while maintaining regulatory compliance. The Qatar Financial Centre's Digital Assets Lab has onboarded a number of participants developing innovative digital solutions based on distributed ledger technology, demonstrating the robust infrastructure supporting platform development and commercialization in the country.

The growing sophistication of these platforms, incorporating artificial intelligence for predictive analytics and automated portfolio rebalancing, continues to attract both retail investors and wealth management professionals. Enhanced security features, including biometric authentication and multi-factor verification, address cybersecurity concerns while improving user experience. The integration of real-time market data, research insights, and educational resources within these platforms fosters investor confidence and engagement, driving sustained adoption across diverse customer segments seeking comprehensive digital wealth management solutions.

Investment Type Insights:

- Equities

- Fixed Income

- Alternative Investments

- Real-estate

- Commodities

Equities lead with a share of 30% of the total Qatar WealthTech market in 2025.

Equities represent the dominant investment category within Qatar's WealthTech landscape, reflecting strong investor appetite for stock market participation through digital platforms. The Qatar Stock Exchange provides a robust foundation for equity-focused WealthTech solutions that offer real-time trading capabilities, portfolio tracking, and research tools. Digital platforms have democratized access to equity investments, enabling retail investors to participate in both local and international markets with lower barriers to entry and reduced transaction costs.

The proliferation of mobile trading applications and fractional share investing features has expanded equity market participation among younger demographics and first-time investors. Advanced charting tools, algorithmic trading options, and social trading features enhance the equity investment experience while educational resources integrated within platforms improve financial literacy. The availability of diversified equity products, including exchange-traded funds tracking local and regional indices, provides investors with flexible portfolio construction options aligned with their risk tolerance and investment objectives.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct-to-Consumer

- Independent Financial Advisors (IFAs)

- Private Banks (PBS)

- Retail Banks

The direct-to-consumer exhibits a clear dominance with a 36% share of the total Qatar WealthTech market in 2025.

Direct-to-consumer distribution channels have gained significant traction in Qatar's WealthTech market, driven by high digital literacy, widespread smartphone adoption exceeding ninety-two percent, and consumer preference for self-directed investment platforms. Qatar's internet penetration rate of 99.7% and advanced digital infrastructure, including nationwide 5G coverage, have created optimal conditions for direct digital engagement between WealthTech providers and end-users. The convenience of twenty-four-hour access, competitive fee structures, and personalized user experiences continue to attract investors away from traditional intermediated channels.

The increasing shift towards contactless and digital payments, with the majority of in-store payments being made through contactless means, is indicative of consumer acceptance of digital financial services. Direct consumer-focused WealthTech platforms have made significant investments in user interface design, simplification of onboarding, and mobile optimization to tap into this emerging segment. The inclusion of goal-based investment solutions, savings automation, and educational content in these platforms improves customer acquisition and retention and promotes wealth-building behavior.

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

Ad Dawhah represents the leading region with a 40% share of the total Qatar WealthTech market in 2025.

Ad Dawhah, Qatar's capital and primary financial hub, commands the dominant position in the WealthTech market due to its concentration of major banks, financial institutions, and fintech startups. The presence of the Qatar Financial Centre, which registered 836 new firms in 2024 representing a 156% growth compared to 2023 and managing combined assets exceeding USD 33 Billion, establishes Doha as the epicenter of financial innovation. The city's strategic location, robust digital infrastructure, and concentration of high-net-worth individuals create a conducive ecosystem for advanced wealth management services and technology development.

The capital city is home to major regulatory institutions such as the Qatar Central Bank and Qatar Financial Centre Regulatory Authority, giving WealthTech firms direct access to policymakers and regulatory advice. International wealth management companies such as major global banks have established and expanded their operations in Doha in a bid to tap into the region's wealthy population. The fact that the city is a venue for major events and an alternative financial hub in the region continues to attract investment in WealthTech.

Market Dynamics:

Growth Drivers:

Why is the Qatar WealthTech Market Growing?

Supportive Regulatory Framework and Government Initiatives

The Qatar Central Bank’s overall fintech strategy, which includes a five-year plan for innovation in blockchain, artificial intelligence, and open banking, has created a conducive environment for the development of WealthTech. The setting up of sandboxes by regulatory bodies provides a controlled environment for new entrants to test innovative products while ensuring consumer protection and financial stability. The Third National Development Strategy, announced in early 2024 as the final stage of Qatar National Vision 2030, focuses on developing business competitiveness and foreign direct investment in specialized economic zones such as financial services and information technology. These plans have multiplier effects that accelerate the adoption of WealthTech. The Qatar Financial Centre’s launch of the Digital Assets Framework in September 2024 has provided overall guidelines on tokenization, custody, and smart contract recognition, which provides regulatory certainty that attracts both local and international players in the WealthTech space.

Advanced Digital Infrastructure and High Technology Adoption

The superior digital infrastructure in Qatar creates a solid basis for the development of WealthTech, with internet penetration almost at complete coverage and the nationwide implementation of fifth-generation mobile networks. The country provides one of the fastest and most stable mobile internet experiences in the Middle East, thanks to widespread fiber-optic infrastructure that enables real-time financial applications and data-heavy investment platforms. High smartphone penetration rates among the population create ideal conditions for mobile-centric WealthTech solutions that focus on convenience and ease of use. The trend towards cashless payments, with the overwhelming majority of in-store digital payments made through contactless technologies, indicates overall consumer readiness for digital financial services. This technological infrastructure allows WealthTech firms to efficiently develop, test, and launch complex solutions, compared to markets with less developed infrastructure. The adoption of advanced authentication tools, such as biometric authentication and secure digital identity infrastructure, mitigates security risks while improving user experience. The leadership role of Qatar in digital connectivity provides a competitive advantage for WealthTech firms targeting tech-savvy investors who demand convenient digital experiences.

Growing Affluent Population and Increasing Demand for Personalized Services

Qatar's growing population of high-net-worth individuals and expanding middle class creates substantial demand for sophisticated wealth management solutions that cater to diverse investment preferences and financial goals. The country's record net wealth reaching significant milestones, with financial wealth growing steadily year over year, reflects sustained economic prosperity that fuels WealthTech market expansion. Rising disposable incomes enable broader segments of the population to participate in wealth accumulation activities previously accessible only to affluent investors. The increasing sophistication of Qatari investors, who seek tailored investment solutions aligned with their unique financial objectives and risk tolerances, drives demand for AI-powered personalization features within WealthTech platforms. Family businesses and high-net-worth individuals increasingly require comprehensive wealth structuring, succession planning, and multi-generational wealth transfer solutions that modern WealthTech platforms can deliver. The growing expatriate population, representing diverse nationalities with varying financial needs and international investment requirements, expands the addressable market for WealthTech providers. Strategic initiatives by international wealth management firms establishing and expanding their presence in Qatar further validate the market's growth potential and attract additional investment in WealthTech capabilities.

Market Restraints:

What Challenges the Qatar WealthTech Market is Facing?

Data Privacy and Cybersecurity Concerns

Data privacy remains a significant challenge in Qatar's digital wealth management landscape, with many consumers expressing concerns about data security that lead to hesitance in adopting technology-driven solutions. The rise of digital banking and investment applications has correspondingly increased cybersecurity threats, with financial institutions becoming prime targets for sophisticated cybercriminals. While the Qatar National Cyber Security Strategy aims to address these issues, rebuilding consumer trust requires sustained investment in robust security measures and transparent data handling practices that can slow market adoption rates.

Intense Competition and Market Saturation

The competitive landscape in Qatar's WealthTech market is intensifying as numerous fintech companies vie for market share, leading to aggressive pricing strategies and innovation races that can strain resources. Many startups struggle to differentiate their offerings in an increasingly crowded marketplace, making it challenging for new entrants to establish sustainable competitive positions. The need for unique value propositions and substantial marketing investments to capture customer attention creates barriers that can stifle innovation and limit overall market growth potential for smaller players.

Regulatory Compliance Complexities

Navigating the regulatory landscape in Qatar poses significant challenges for WealthTech providers, with stringent anti-money laundering, data protection, and consumer protection requirements demanding substantial compliance efforts. The costs associated with meeting multiple regulatory obligations can strain resources, particularly for smaller companies and startups with limited capital. While regulatory frameworks protect consumers and ensure financial stability, the complexity of compliance requirements can potentially hinder innovation as institutions divert focus from product development to regulatory adherence.

Competitive Landscape:

The Qatar WealthTech market is known to have a highly competitive landscape that is marked by the entry of traditional financial institutions looking to expand their technology offerings, as well as new fintech companies that are bringing innovative solutions to the market. The major financial institutions are actively looking to partner with technology companies to improve their digital offerings and capitalize on the existing trust that these institutions have with their customers, while also providing innovative services. The market is fueled by the adoption of artificial intelligence, user experience optimization, and product diversification as the major players look to capitalize on the growing interest of investors in digital wealth management solutions. Partnerships between traditional financial institutions and fintech companies are promoting innovation and time-to-market for new products.

Recent Developments:

- In November 2024, Qatar Development Bank announced a strategic investment in Wahed, a global Islamic FinTech managing over USD 1 Billion in assets with more than 400,000 clients worldwide. The investment supports Wahed's mission to democratize access to Sharia-compliant investment services and aligns with Qatar National Vision 2030's goal of becoming a leading knowledge-based economy.

- In September 2024, the Qatar Financial Centre Authority and Qatar Financial Centre Regulatory Authority launched the QFC Digital Assets Framework, establishing comprehensive legal and regulatory foundations for digital assets including tokenization processes, property rights recognition, and smart contract enforcement. The framework followed extensive consultation with thirty-seven domestic and international organizations and supports over twenty startups in the Digital Assets Lab.

Qatar WealthTech Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Technologies Covered |

Digital Wealth Management Platforms, Robo-Advisors, WealthTech Analytics and Reporting, Blockchain-Based WealthTech, Tax Optimization and Compliance Solutions |

|

Investment Types Covered |

Equities, Fixed Income, Alternative Investments, Real-estate, Commodities |

|

Distribution Channels Covered |

Direct-to-Consumer, Independent Financial Advisors (IFAs), Private Banks (PBS), Retail Banks |

|

Regions Covered |

Ad Dawhah, Al Rayyan, Al Wakrah, Others |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Qatar WealthTech market size was valued at USD 12.05 Million in 2025.

The Qatar WealthTech market is expected to grow at a compound annual growth rate of 13.31% from 2026-2034 to reach USD 37.08 Million by 2034.

Digital wealth management platforms dominated the market with a share of 28%, driven by increasing demand for integrated investment solutions that combine portfolio management, analytics, and automated advisory services within unified digital interfaces.

Key factors driving the Qatar WealthTech market include supportive government regulatory frameworks, advanced digital infrastructure with high internet and smartphone penetration, growing affluent population seeking personalized investment services, and strategic initiatives aligned with Qatar National Vision 2030.

Major challenges include data privacy and cybersecurity concerns affecting consumer trust, intense competition among numerous fintech players creating market saturation, regulatory compliance complexities requiring substantial investment, and the need for continuous technological innovation to maintain competitive positioning.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)