Rainwater Harvesting Market Size, Share, Trends and Forecast by Harvesting Method, End-User, and Region, 2026-2034

Rainwater Harvesting Market Size and Share:

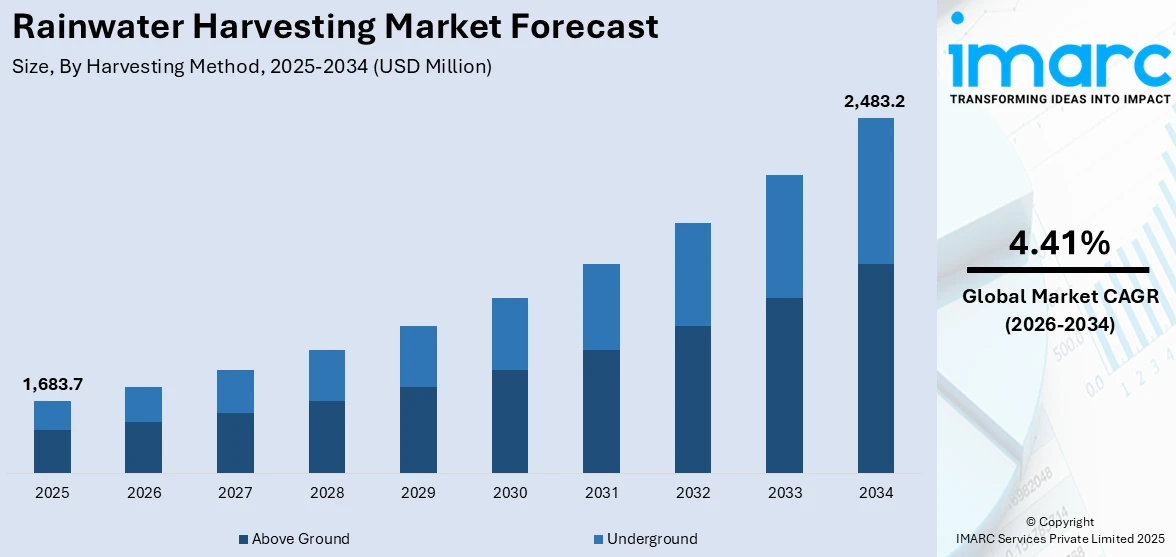

The global rainwater harvesting market size was valued at USD 1,683.7 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 2,483.2 Million by 2034, exhibiting a CAGR of 4.41% from 2026-2034. North America currently dominates the market, holding a market share of 43.2% in 2025. The market is witnessing significant growth due to increasing water scarcity, environmental concerns, and growing demand for sustainable water solutions. Governments are also offering incentives and regulations to promote rainwater harvesting in both urban and rural areas. Technological advancements and awareness regarding water conservation are further increasing the rainwater harvesting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,683.7 Million |

|

Market Forecast in 2034

|

USD 2,483.2 Million |

| Market Growth Rate 2026-2034 | 4.41% |

Key drivers in the rainwater harvesting market include increasing water scarcity, rising demand for sustainable water management solutions and growing awareness about environmental conservation. Urbanization and the need for efficient water supply systems also contribute to market growth. Governments are implementing regulations and incentives to promote rainwater harvesting as a means of reducing dependency on traditional water sources. For instance, in October 2023, in India, the Centre announced the launch of 'Jal Sanchay, Jan Bhagidari' to build one million rainwater harvesting structures nationwide by the next monsoon. This community-led initiative aims to improve groundwater replenishment and follows successful pilot efforts in Gujarat with other states like Rajasthan, Madhya Pradesh and Bihar expected to participate. Additionally, climate change-induced unpredictable rainfall patterns are pushing the need for reliable water storage solutions further driving market adoption across residential, commercial, and industrial sectors. These factors are collectively creating a positive rainwater harvesting market outlook across the world.

To get more information on this market Request Sample

Key drivers of the United States rainwater harvesting market are the rising water scarcity issues particularly in regions prone to drought and the rising demand for sustainable water solutions. Increased awareness regarding the environmental costs of water usage and the necessity for conservation further accelerates adoption. Government incentives, tax credits and regulations favoring green infrastructure drive investments in rainwater harvesting systems. For instance, in April 2025, the Texas Senate passed Senate Bill 7 addressing a critical water crisis by allocating billions for water infrastructure improvements. Key proposals include desalination, wastewater recycling and rainwater harvesting. Additionally, urbanization and the need for efficient water management in residential, commercial and industrial sectors are further driving market growth in the United States.

Rainwater Harvesting Market Trends:

Rise in water scarcity concerns across the globe

The global water crisis, exacerbated by factors such as population growth, rapid urbanization, and climate change, underlines the pressing need for sustainable water management solutions. According to recent reports by Worldometers, the global population is estimated to be growing at an annual rate of 0.85% in 2025, equating to an increase of approximately 70 million individuals every year. Rainwater harvesting emerges as a proactive approach to address water scarcity challenges. By capturing and utilizing rainwater, this practice reduces the reliance on conventional water sources, offering an alternative water supply for non-potable applications like irrigation, sanitation, and industrial processes. As regions face declining water reserves and increasing competition for water resources, rainwater harvesting provides a valuable means to augment available water supplies, promote efficient water use, and ultimately alleviate pressure on strained water networks.

Increase in regulatory support and incentives

Governments and municipalities worldwide are recognizing the significance of rainwater harvesting in achieving water conservation targets and promoting environmentally responsible practices. This recognition has led to the implementation of regulations that require or incentivize rainwater harvesting system integration in various sectors. Financial incentives, tax breaks and rebates for rainwater harvesting system installations encourage individuals and businesses to adopt this practice fostering rainwater harvesting market growth. For instance, in 2021, the Pune Municipal Corporation (PMC) in India offered a 5% tax rebate to properties that had an operational rainwater harvesting system. Moreover, the need for compliance with stricter water regulations and sustainability certifications further accelerates the adoption of rainwater harvesting systems, positioning them as integral components of a forward-thinking water management strategy.

Rapid urbanization and infrastructure development

With the elevating levels of urbanization and climate-related risks the concept of urban resilience has gained prominence globally. According to the United Nations (UN), 68% of the global population is expected to live in urban areas by 2050. Rainwater harvesting contributes to this resilience by enhancing a city's ability to withstand water-related challenges such as flooding, water quality issues, and supply disruptions. By integrating rainwater harvesting into green infrastructure designs, sustainable building projects, and flood management plans cities can effectively manage stormwater runoff, replenish local aquifers and reduce the strain on centralized drainage systems. This dual-purpose approach addresses water-related vulnerabilities and transforms rainwater from a potential problem into a valuable resource that strengthens urban sustainability and long-term resilience. According to the rainwater harvesting market forecast, the adoption of rainwater harvesting systems is expected to grow significantly in urban areas, driven by increasing urbanization, climate risks, and the need for sustainable water management solutions.

Rainwater Harvesting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rainwater harvesting market, along with forecast at the global and regional levels from 2026-2034. The market has been categorized based on harvesting method and end-user.

Analysis by Harvesting Method:

- Above Ground

- Underground

Above ground as the largest harvesting method in 2025, holding around 69.3% of the market. The above-ground rainwater harvesting method is gaining immense traction due to its simplicity, accessibility, and cost-effectiveness. This method involves the installation of catchment systems such as rooftop gutters, downspouts, and storage tanks that are situated above the ground surface. These systems are relatively easy to implement and require minimal modifications to existing infrastructure, making them attractive options for both residential and commercial properties. The visible nature of above-ground systems also fosters awareness and encourages higher product adoption rates among consumers.

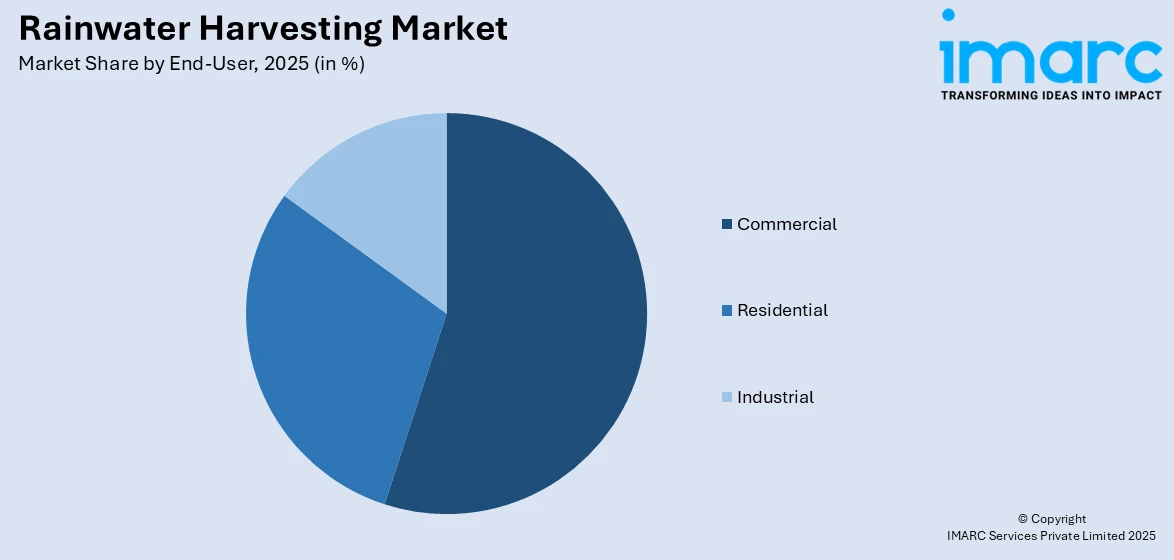

Analysis by End-User:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

Commercial leads the market with around 50.5% of market share in 2025. The main factors that are driving the growth of the commercial segment include its potential for impactful water savings and sustainability initiatives. Businesses across numerous industries, including hospitality, manufacturing, and offices, are increasingly recognizing the economic and environmental benefits of rainwater harvesting. Commercial properties often have substantial roof areas and water demands, making them ideal candidates for large-scale rainwater collection. By integrating rainwater harvesting systems, commercial establishments can reduce reliance on municipal water supplies, thereby lowering water bills and operating costs.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2025, North America accounted for the largest market share of over 43.2%. North America held the biggest share in the market since the region has diverse climate patterns, including water scarcity concerns in arid areas and higher instances of intense rainfall events, which have accelerated the adoption of rainwater harvesting. Additionally, the rising environmental awareness and sustainable practices in North America prompt the residential, commercial, and industrial sectors to seek alternative water solutions, thereby propelling the market growth. Government incentives and regulations further stimulate the market growth, as various states and municipalities across the region offer rebates and mandates for rainwater harvesting system installations. Moreover, the rapid growth of the construction industry and the shifting trend toward green building standards encourage the incorporation of rainwater harvesting into new projects, thus contributing to market growth. North America's proactive approach to water conservation, coupled with its robust market infrastructure, fosters innovation and expansion in the rainwater harvesting market, fueling its growth in the region.

Key Regional Takeaways:

United States Rainwater Harvesting Market Analysis

In 2025, the United States accounted for 89% of the rainwater harvesting market in North America. The United States rainwater harvesting market is driven by a combination of environmental, economic, and policy factors. Frequent droughts and declining groundwater levels, particularly in states such as California, Arizona, and Texas, have heightened interest in alternative water sources. For instance, in California, 22.7 million residents live in areas affected by drought, according to the National Integrated Drought Information System. Rising municipal water costs also make rainwater collection an appealing option for homeowners and businesses aiming to reduce expenses. Moreover, advancements in technology have led to more efficient and user-friendly systems, featuring real-time monitoring and integration with weather forecasts. Additionally, the commercial sector, including hotels and office buildings, is increasingly implementing these systems to manage water resources efficiently and meet sustainability goals. The construction industry is also integrating rainwater harvesting systems into new developments to meet green building standards and reduce environmental impact. Overall, expenditure on construction in the United States reached USD 2,195.8 Billion in February 2025 at a seasonally adjusted annual rate, according to the Census Bureau. Agricultural users are also turning to rainwater harvesting to maintain crop yields during periods of water scarcity. Other than this, government incentives, including tax breaks and rebates, are encouraging widespread adoption, with cities such as Tucson offering grants and loans for system installations and promoting market growth.

Asia Pacific Rainwater Harvesting Market Analysis

The Asia Pacific rainwater harvesting market is expanding due to several interrelated factors. Rapid urbanization and industrialization in countries, such as India, China, Indonesia, etc., are intensifying the demand for sustainable water management solutions as traditional water sources become increasingly strained. For instance, in India, the State Government of Odisha introduced a five-year rooftop rainwater harvesting initiative called ‘Community Harnessing and Harvesting Rainwater Artificially from Terrace to Aquifer (CHHATA) in 2022. As part of this project, rainwater harvesting systems were built on the rooftops of 29,500 private buildings, 1,925 government buildings, and 52 water-stressed blocks. Additionally, the increasing emphasis on rural water security and community-based water management programs is contributing substantially to industry expansion. In numerous remote and underserved areas across countries such as Indonesia, the Philippines, and parts of India, rainwater harvesting provides an essential and often the only reliable source of clean water, particularly during dry seasons. Smart water management technologies, such as IoT-enabled rainwater tanks and real-time monitoring systems, are also gaining popularity, enabling efficient maintenance and usage, which in turn bolsters long-term adoption and market growth.

Europe Rainwater Harvesting Market Analysis

The Europe rainwater harvesting market is experiencing robust growth, fueled by rising water scarcity concerns and regulatory efforts promoting sustainable water management. According to the European Environment Agency, in 2022, 34% of EU territory experienced water scarcity for at least one season. Several European countries, particularly in Southern and Eastern Europe, are experiencing increasingly frequent droughts and declining freshwater availability, compelling governments and municipalities to encourage alternative water sourcing. Rainwater harvesting systems help reduce dependency on municipal supplies, particularly in urban areas where groundwater levels are under pressure. Stricter EU directives on water conservation and wastewater reuse, such as the Water Framework Directive, have also prompted the integration of rainwater harvesting in new construction standards and retrofitting projects. Additionally, financial incentives and tax rebates in countries such as Germany, the UK, and France are propelling widespread adoption in residential, commercial, and industrial segments. Growing environmental awareness among consumers and businesses is also contributing to market expansion, as these systems offer a low-carbon, cost-efficient solution for non-potable uses such as irrigation, toilet flushing, and cooling systems. Besides this, public sector initiatives supporting green infrastructure in schools, public buildings, and transport hubs are also bolstering industry growth, positioning rainwater harvesting as a key element of climate-resilient infrastructure across Europe.

Latin America Rainwater Harvesting Market Analysis

The Latin America rainwater harvesting market is significantly influenced by the increasing need for decentralized water systems in rapidly growing urban peripheries, where municipal infrastructure often lags behind population growth. Informal settlements in countries such as Colombia, Peru, and Bolivia are turning to rainwater collection as a practical solution to meet basic water needs. Moreover, increasing climate variability and frequent droughts in countries such as Brazil and Mexico have also heightened water stress, prompting the adoption of alternative water sources such as rainwater harvesting systems. For instance, in 2023-2024, 59% of Brazil was affected by droughts, leading to severe water shortages. As a result, climate resilience planning by local governments is also incorporating rainwater systems to mitigate flood risks and ensure water availability during dry spells, reinforcing their value as a multifunctional water management tool across Latin America.

Middle East and Africa Rainwater Harvesting Market Analysis

The Middle East and Africa (MEA) rainwater harvesting market is expanding due to several critical factors. Water scarcity, exacerbated by arid climates and limited freshwater resources, drives the adoption of alternative water sources. For instance, in Saudi Arabia, the absolute water scarcity levels reached 500 cubic meters per capita per year, according to a 2020 report. Countries such as Saudi Arabia, Egypt, and South Africa are implementing rainwater harvesting systems to ensure water availability for agriculture and urban areas. Government initiatives and regulations that support water conservation and sustainable practices enhance the implementation of rainwater harvesting systems. The International Trade Administration (ITA) reported that the Saudi Arabian Ministry of Environment, Water, and Agriculture has designated USD 80 billion in 2024 for projects related to water, which will be utilized in the coming years. Besides this, the integration of rainwater harvesting into smart city projects and infrastructure development also supports market growth.

Competitive Landscape:

Key players in the rainwater harvesting market are driving innovation through advanced technologies and solutions. Recent innovations include the integration of Internet of Things (IoT) sensors and smart monitoring systems into rainwater harvesting setups, enabling real-time data collection on water quality, storage levels, and system performance. Additionally, some players are developing modular and scalable rainwater harvesting systems tailored to diverse applications, from residential to industrial, providing flexibility and ease of installation. Furthermore, the rising collaborative efforts between rainwater harvesting providers and digital platforms offer online tools for system design, estimating water savings, and facilitating informed decision-making. Such innovations collectively enhance the efficiency, accessibility, and appeal of rainwater harvesting solutions in the market. We also expect the market to witness new entrants, consolidation of product portfolios, and a rise in strategic partnerships and collaborations among key players to drive healthy competition within the rainwater harvesting domain during the forecast period.

The report provides a comprehensive analysis of the competitive landscape in the rainwater harvesting market with detailed profiles of all major companies, including:

- Kingspan Group

- Watts Water Technologies Inc.

- Graf Group

- WISY AG

- Innovative Water Solutions LLC

- D&D Ecotech Services

- Rain Harvesting Supplies Inc.

- Water Field Technologies Pvt. Ltd.

- Stormsaver

- Climate Inc

- Water Harvesters

- Heritage Tanks

Latest News and Developments:

- April 2025: The Coimbatore district administration in Tamil Nadu, India, launched a campaign to install rainwater harvesting devices in all large buildings by May 2025. The project sought to guarantee that these systems are installed in government buildings, private institutions, malls, residential communities, hospitals, businesses, and other sizable.

- March 2025: Hitachi Energy’s Halol factory in western India launched a rainwater harvesting project, aligning with the factory’s overarching sustainability objectives and also assisting in replenishing groundwater reserves in the area. This initiative allowed the Halol plant to collect more water than it utilized, reportedly making it the first Hitachi Energy facility to become water-positive.

- December 2024: The Zambia Ministry of Water Development and Sanitation (MWDS), in collaboration with the European Union’s Green Nexus Programme, unveiled the very first National Rainwater Harvesting Strategy in the country, reaching a significant milestone toward achieving more water security in Zambia.

- August 2024: The Water and Sanitation Agency (WASA) in Rawalpindi, Pakistan, announced plans to construct rainwater harvesting systems at 30 buildings throughout the city in partnership with UN-HABITAT. As part of this initiative, rainwater from rooftops would be directed into subterranean tanks for various non-potable uses.

Rainwater Harvesting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Harvesting Methods Covered | Above Ground, Underground |

| End-Users Covered | Commercial, Residential, Industrial |

| Regions Covered | North America, Asia Pacific, Europe, Middle East and Africa, Latin America |

| Companies Covered | Kingspan Group, Watts Water Technologies Inc., Graf Group, WISY AG, Innovative Water Solutions LLC, D&D Ecotech Services, Rain Harvesting Supplies Inc., Water Field Technologies Pvt. Ltd., Stormsaver, Climate Inc, Water Harvesters, Heritage Tanks |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rainwater harvesting market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global rainwater harvesting market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rainwater harvesting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rainwater harvesting market was valued at USD 1,683.7 Million in 2025.

The rainwater harvesting market is projected to reach USD 2,483.2 Million by 2034, exhibiting a CAGR of 4.41% from 2026-2034.

Key factors driving the rainwater harvesting market include increasing water scarcity, rising awareness about environmental sustainability, urbanization, and the need for efficient water management systems. Government regulations, incentives, and policies promoting green infrastructure and water conservation also play a crucial role in boosting market growth.

North America currently dominates the rainwater harvesting market due to increased water scarcity, government incentives, and widespread adoption of sustainable water management practices.

Some of the major players in the rainwater harvesting market include Kingspan Group, Watts Water Technologies, Inc., Graf Group, WISY AG, Innovative Water Solutions LLC, D&D Ecotech Services, Rain Harvesting Supplies, Inc., Water Field Technologies Pvt. Ltd., Stormsaver, Climate Inc, Water Harvesters, Heritage Tanks, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)