Refractories Market Size, Share, Trends and Forecast by Form, Alkalinity, Manufacturing Process, Composition, Refractory Mineral, Application, and Region, 2026-2034

Refractories Market Size and Share:

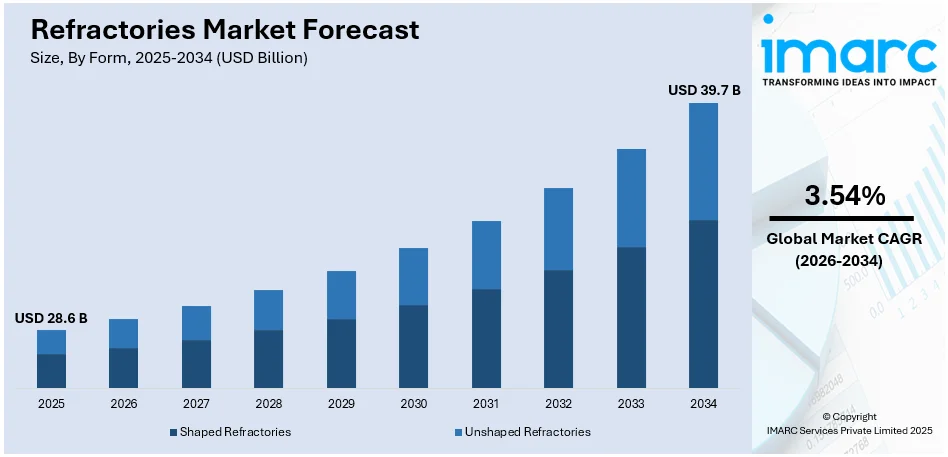

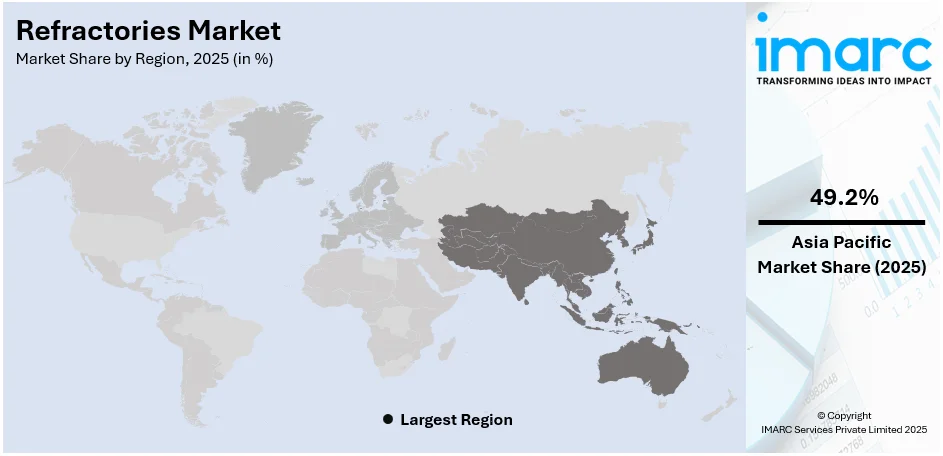

The global refractories market size was valued at USD 28.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 39.7 Billion by 2034, exhibiting a CAGR of 3.54% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 49.2% in 2025. The development of infrastructure, energy efficiency, industrial expansion, technical breakthroughs, and the special ability of refractory materials to survive high temperatures and challenging circumstances are major factors contributing to the refractories market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 28.6 Billion |

| Market Forecast in 2034 | USD 39.7 Billion |

| Market Growth Rate (2026-2034) | 3.54% |

The steel sector is the biggest user of refractories, and its steady expansion plays a key role in driving market growth. Steel manufacturing involves extreme heat, with temperatures exceeding 1,600°C, which demands materials that can withstand such conditions. Refractories are essential for safeguarding the equipment involved in steel production, including blast furnaces, converters, and ladles. During mid-January 2025, local raw steel production reached 1,659,000 net tons in the United States, operating at a capability utilization rate of 74.5%. This marked a 1.8% increase from the same period in 2024, which recorded 1,629,000 net tons and a 73.3% utilization rate. This continuous production highlights the persistent demand for top-quality refractories capable of enduring the intense temperatures in steel manufacturing processes. Furthermore, the shift towards electric arc furnaces (EAF) in steelmaking, which are more energy-efficient and environmentally friendly, has opened up opportunities for innovation in refractory materials. Companies are focusing on developing specialized refractories suited for EAF processes, further driving the refractories market growth.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by the rising energy efficiency need among industries to reduce operational costs and environmental impact. In 2023, the U.S. Department of Energy’s Industrial Efficiency and Decarbonization Office invested over $350 million in industrial innovation to promote cleaner and more efficient energy use. This investment has encouraged the adoption of advanced refractory materials that enhance thermal efficiency in high-temperature industrial processes, thereby driving demand in the market. Furthermore, urbanization trends in the U.S. continue to influence infrastructure development. The degree of urbanization increased from 75.3% in 1990 to 83.3% in 2023, reflecting a steady population shift toward urban areas. This urban growth drives the construction of residential and commercial buildings, roads, and bridges, subsequently increasing the demand for materials like steel and cement. The production of these materials relies heavily on refractories, thereby stimulating the expansion of the refractories market share in United States.

Refractories Market Trends:

Industrial expansion and modernization

The continuous expansion and modernization of various industries are significant drivers for the global refractories market demand. For instance, industrial production in India increased 5.20% in November of 2024 over the same month in the previous year. Industries such as steel, cement, glass, petrochemicals, and non-ferrous metals rely heavily on refractory materials. As these sectors grow and upgrade their facilities, there is a growing need for refractories to line and protect high-temperature equipment, such as blast furnaces, rotary kilns, and glass melt tanks. This demand is particularly evident in emerging economies where rapid industrialization and infrastructure development are ongoing. In developed nations, refurbishing and upgrading aging infrastructure also contribute to the sustained demand for refractories.

Technological advancements and energy efficiency

The growing use of cutting-edge and energy-efficient technologies in industrial operations is another important refractory market trends. Manufacturers are always looking for ways to decrease emissions, increase overall operational sustainability, and improve energy efficiency. Refractories, which can tolerate high temperatures and chemical reactions, are essential to these efforts. In order to endure the demands of contemporary industrial processes, new, high-performance refractory materials are being created, which helps to improve energy efficiency and lessen environmental effect. For instance, firebricks are refractory bricks that can, with one composition, store heat, and with another, insulate the firebricks that store the heat. A 31% reduction in annual hydrogen production for grid electricity indicates that firebricks could minimize reliance on hydrogen, which is often used for energy storage and grid balancing. These developments help industries achieve their objectives of lowering their carbon footprint and complying with strict environmental requirements.

Infrastructure development and urbanization

The growth in infrastructure development and urbanization, particularly in emerging economies, is boosting demand for refractories in the construction and housing sectors. The World Bank reports that Private Participation in Infrastructure (PPI) investment reached USD 86.0 billion in 2023. Refractory materials are necessary to keep facilities such as industrial incinerators, fireplaces, and chimneys structurally sound. The need for strong, heat-resistant buildings is growing as more metropolitan areas develop, and this is driving the refractories market's constant expansion. Refractory bricks and materials for insulation and fireproofing are also frequently used in the construction of residential and commercial structures, which fuels the market's growth. This pattern is strongly associated with improving living standards and more building in developing areas.

Refractories Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global refractories market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on form, alkalinity, manufacturing process, composition, refractory mineral, and application.

Analysis by Form:

- Shaped Refractories

- Unshaped Refractories

As per the refractories market outlook, unshaped refractories stand as the largest component in 2025. The primary factors driving the need for unshaped refractories are their adaptability and versatility in intricate industrial applications. Castables, polymers, and ramming mixtures are examples of unshaped refractories. They have the advantage of being able to be applied and shaped into irregular forms and voids, giving them the best possible protection and insulation in a variety of industrial situations. Consequently, unshaped refractories are becoming increasingly common among industries looking for cost-effective solutions for boiler insulation, ladle linings, and furnace linings due to their capacity to fit into certain configurations, saving installation time and labor costs while guaranteeing dependable thermal performance and creating new opportunities for market expansion.

Analysis by Alkalinity:

- Acidic and Neutral

- Basic

Based on the refractories market forecast, acidic and neutral lead the industry share in 2025. The increasing demand for acidic and neutral refractories due to their suitability for industries and processes that involve corrosive environments and acidic materials is contributing to the market’s growth. These refractories excel in applications where resistance to acidic slags or gases is critical, such as in the production of non-ferrous metals, petrochemical refining, and waste incineration, which is aiding in market expansion. Apart from this, acidic refractories, such as silica bricks, and neutral refractories, such as chromite or alumina-silica materials, offer robust protection against chemical erosion and high-temperature corrosion, making them indispensable in these specialized industries, which require durability and reliability even in harsh conditions.

Analysis by Manufacturing Process:

- Dry Press Process

- Fused Cast

- Hand Molded

- Formed

- Unformed

Fused cast leads the market share in 2025. The demand for refractories produced through the fused cast manufacturing process is primarily driven by their exceptional resistance to extreme temperatures and chemical corrosion. Fused cast refractories are manufactured by melting high-purity raw materials, including alumina and zirconia, and then cooling them to form dense, crystalline structures. This unique production method results in refractory materials with outstanding thermal stability and minimal porosity, making them ideal for applications in glass manufacturing, particularly in the construction of glass furnace sidewalls and tank blocks. The ability of fused cast refractories to withstand the severe conditions of molten glass and other corrosive substances has led to their increased adoption in the glass industry, thereby fuelling demand for these specialized refractory products.

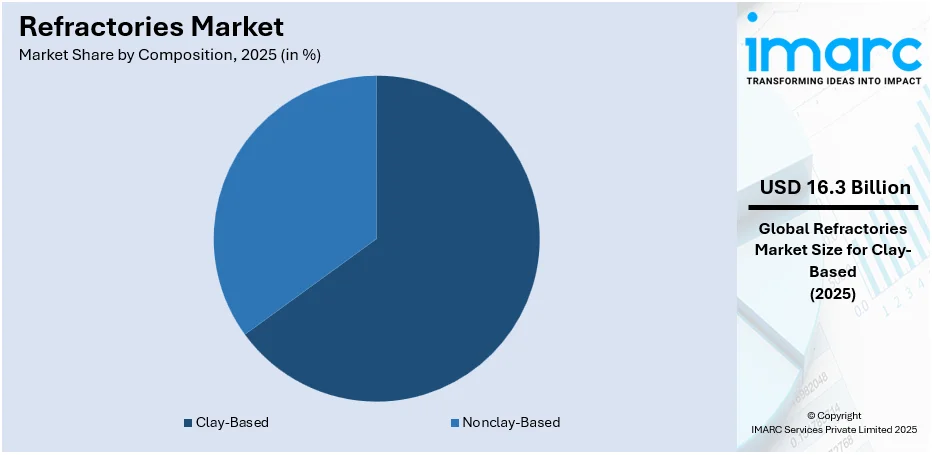

Analysis by Composition:

Access the comprehensive market breakdown Request Sample

- Clay-Based

- Nonclay-Based

Clay-based leads the market with around 59.0% of market share in 2025. The cost-effectiveness and versatility of clay-based refractories across a range of industries is presenting lucrative opportunities for market growth. Clay-based refractories, such as fire clay bricks and high-alumina bricks, offer a cost-efficient solution for applications where extreme resistance to temperature and chemical attack isn't as critical. They find extensive use in less severe environments, including foundries, boiler linings, and cement kilns. Their relative affordability, ease of production, and adaptability to various shapes and sizes make them a preferred choice for industries that require reliable thermal insulation and moderate resistance to wear and tear, which is sustaining the demand for these refractory materials.

Analysis by Refractory Mineral:

- Graphite

- Magnesite

- Chromite

- Silica

- High Alumina

- Zirconia

- Others

Graphite leads the market share in 2025. Graphite refractories’ exceptional thermal conductivity and resistance to high temperatures, making them indispensable in specific industrial applications, are acting as significant growth-inducing factors. Graphite refractories, composed primarily of graphite and clay, excel in environments with extreme heat, such as in electric arc furnaces and steelmaking processes. Their ability to efficiently conduct heat, maintain stability at high temperatures, and resist chemical corrosion by molten metals positions them as a critical choice in the metallurgical and steel industries. Additionally, their low thermal expansion and high mechanical strength contribute to their longevity and reliability in demanding thermal processes, thereby sustaining the demand for graphite refractories in these sectors.

Analysis by Application:

- Iron and Steel

- Cement

- Non-Ferrous Metals

- Glass

- Others

Iron and steel lead the market with around 65.4% of market share in 2025. The iron and steel sector's relentless pursuit of efficiency and cost-effectiveness is providing impetus to the market growth. Refractories play a vital role in maintaining the integrity of high-temperature equipment including blast furnaces, converters, and ladles. As the iron and steel industry continuously seeks to optimize production processes and reduce energy consumption, the need for advanced refractories becomes paramount. These materials enable higher productivity, prolonged equipment lifespan, and reduced downtime, translating into substantial cost savings. Apart from this, refractories that can withstand extreme temperatures and chemical interactions are essential for ensuring product quality and safety in this critical sector, highlighting the persistent demand for refractories in iron and steel production.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific has assumed a leading position in the global refractories market in 2025 with 49.2% share for several compelling reasons. The region's dominance can be attributed to its rapidly expanding steel, cement, and glass industries, which are among the primary consumers of refractory products. Rapid industrialization and urbanization in countries such as China and India have driven substantial demand for steel and cement, augmenting the need for refractories in their production processes. Additionally, Asia Pacific's vast manufacturing base and robust infrastructure development contribute significantly to refractory consumption. The region benefits from a competitive advantage in terms of cost-effective production and a skilled labor force, making it an attractive hub for refractory manufacturing. Furthermore, the presence of abundant raw materials and a proactive approach toward research and development in refractories are further solidifying Asia Pacific's leadership in the global market.

Key Regional Takeaways:

North America Refractories Market Analysis

The steady demand from the industries of steel, cement, and glass manufacturing is majorly driving the North American refractories market. As the region shifts focus towards energy efficiency and sustainability, the use of advanced refractory solutions has increased, aiming to improve thermal efficiency and minimize environmental impact. In the United States, growth in steel production and investments in infrastructure projects consistently contribute to the demand in the market. The improvements in technology, like refractory material, which offers lightweight and durable products, also supports the industrial modernization process. Also, manufacturers are focusing on developing eco-friendly and recyclable refractory, pushing compliance towards a more sustainable and green North American market.

United States Refractories Market Analysis

The growing adoption of refractories is being significantly influenced by the expansion of the chemical industries, particularly driven by increasing production activities. According to International Trade Administration, the U.S. chemical manufacturing industry total FDI in the industry was USD 766.7 Billion in 2023. As manufacturing processes in industries like petrochemicals, fertilizers, and plastics see heightened demand, refractories are becoming essential for ensuring high efficiency and safety. These materials are crucial for withstanding extreme temperatures, abrasions, and chemical reactions during production. The robust development of chemical plants and refineries, especially in regions with booming industrial capacities, is stimulating the market for advanced refractory products. Refractories, offering superior performance and longevity, are increasingly favored for their resistance to thermal shock and chemical corrosion. The continued rise in industrial outputs necessitates refractories to maintain system integrity, ensuring streamlined production in high-demand markets.

Asia Pacific Refractories Market Analysis

Growth in the adoption of refractories is seen in the Asia-Pacific region, driven by its booming electronics production. As per the India Brand Equity Foundation, India's domestic electronics production increased from USD 29 billion in 2014-15 to USD 101 billion in 2022-23. As the demand for electronics grows exponentially, so does the requirement for performance materials that can tolerate the rigors of semiconductor manufacturing environments and other high-tech manufacturing processes. Refractories are critical in maintaining the dependability and productivity of machinery used in these areas because of their superior heat and wear resistance. As countries in the region build up their manufacturing capabilities to fulfil the growing world demand for electronics, refractories are becoming critical to the continued operation and stability of equipment in the manufacturing process, meeting production standards.

Europe Refractories Market Analysis

The growing adoption of refractories in Europe is tied closely to the expansion and modernization of industrial production, particularly in the banking sector. The EU's industrial production in 2021 increased by 8.5% compared with 2020, as reported. It continued to rise in 2022 by 0.4% compared with 2021. As the industrial facilities expand, upgrade, and modernize their operations, there is an increased demand for durable and efficient refractory materials to support new production technologies. These materials are especially essential to energy-intensive industries; ensuring operational continuity and constant performance level is vital. Advanced developments in machinery and equipment have made refractories a vital component in maintaining the stability and resiliency of the infrastructure and helping drive higher productivity in industrial operations. This trend is further propelled by increasing demands for better-performing materials to maintain competitiveness.

Latin America Refractories Market Analysis

The automotive industry in Latin America is consistently growing and with that, the demand for refractory also rises. For example, Stellantis announces USD 6.03 Billion in new investment in South America, its biggest investment ever into the region's automotive sector. The production increase of automobiles as well as vehicle parts pushes the development within the industry where high temperature is required. Automotive manufacturing processes like casting, heat treatment, and welding require refractories, as the temperatures at which they are conducted are extreme. Hence, in Latin America, with the continuous growth of the industry, the demand for refractories that resist such conditions without performance degradation is increased considerably. The rising automotive production in the region is therefore directly contributing to the increased adoption of refractories, making them an integral part of the sector’s technological advancements and production efficiency.

Middle East and Africa Refractories Market Analysis

In the Middle East and Africa, the refractory industry is registering growing adoption through the cement sector, which in turn is propelled by construction activities that have witnessed increasing momentum. Reportedly, construction in Saudi Arabia is experiencing massive growth with more than 5,200 projects underway valued at USD 819 Billion. As urbanization is gaining faster pace and infrastructure development becoming a top priority, the demand for cement increases and hence requires the utilization of refractories in cement manufacturing plants. These materials are necessary for maintaining the high temperatures and abrasive conditions of cement kilns and other heavy-duty machinery. The growth in construction activities is creating an environment where refractories are critical to maintaining continuous and efficient operations, meeting the growing demands for infrastructure development across the region.

Competitive Landscape:

The key players in this market are dynamically focusing on developing strategies to build their market stronghold and cater to the changing industrial demands. These companies are entering new markets with acquisitions and joint ventures, emerging as well as established, diversifying their customers and product base. Innovation continues to be a key driver, with significant investments in the research and development of environmentally friendly, energy-efficient refractory solutions. The technological development is aimed to meet the standards of environmental legislation and to achieve the requirement for sustainable manufacturing across industries. On the other hand, market leaders are using digital monitoring systems along with other high technologies to upgrade the performance as well as lifespan of refractory materials. The high-performance product development is also achieved to withstand high temperatures and chemical stresses, critical for steel, cement, and glass industries.

The report provides a comprehensive analysis of the competitive landscape in the refractories market with detailed profiles of all major companies, including:

- Chosun Refractories Eng Co. Ltd.

- Compagnie de Saint-Gobain S.A.

- Coorstek Inc.

- Imerys Usa Inc.

- Krosaki Harima Corporation

- Morgan Advanced Materials Plc

- Refratechnik Holding GmbH

- RHI Magnesita GmbH

- Vesuvius Plc

Latest News and Developments:

- October 2024, IFGL Refractories Ltd. has revealed a joint venture with Marvels International Group Co. Ltd. of Seychelles and Marvel Refractories (Anshan) Company Limited of China. The partnership plans to set up a greenfield facility in India, investing around INR 300 million to produce products for the cement, glass, non-ferrous, and gasification sectors.

- October 2024, Shinagawa Refractories Co., Ltd. has acquired Gouda Refractories Group B.V., a Dutch company specializing in high-alumina refractories and offering refractory services. This strategic move aims to enhance Shinagawa's presence in Europe, the Middle East, and Africa, aligning with its Vision 2030 for global expansion.

- April 2024, RHI Magnesita revealed plans to acquire U.S.-based Resco Products, a producer of alumina monolithics and various refractories, for up to USD 430 Million. This acquisition is intended to boost RHI Magnesita's North American production capabilities.

- April 2024, Thorpe Specialty Services has finalized the acquisition of Walburn Industrial Services LLC, a company offering specialized refractory services to industries including lime & mineral, cement, and steel. This acquisition aims to expand Thorpe's geographic reach and diversify its customer base.

- April 2024, Thyssenkrupp AG and EP Corporate Group A.S. have announced that EPCG will acquire a 20% stake in thyssenkrupp's steel business. This strategic partnership aims to enhance thyssenkrupp's competitiveness in the steel industry, with a focus on growth and innovation. The deal will also involve collaboration in refractories, supporting advancements in steel production processes. The acquisition is expected to solidify thyssenkrupp’s position in the global steel market.

Refractories Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Shaped Refractories, Unshaped Refractories |

| Alkalinities Covered | Acidic and Neutral, Basic |

| Manufacturing Processes Covered | Dry Press Process, Fused Cast, Hand Molded, Formed, Unformed |

| Compositions Covered | Clay-Based, Nonclay-Based |

| Refractory Minerals Covered | Graphite, Magnesite, Chromite, Silica, High Alumina, Zirconia, Others |

| Applications Covered | Iron and Steel, Cement, Non-Ferrous Metals, Glass, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Chosun Refractories Eng Co. Ltd., Compagnie de Saint-Gobain S.A., Coorstek Inc., Imerys Usa Inc., Krosaki Harima Corporation, Morgan Advanced Materials Plc, Refratechnik Holding GmbH, RHI Magnesita GmbH, Vesuvius Plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the refractories market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global refractories market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the refractories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global Refractories market was valued at USD 28.6 Billion in 2025.

IMARC Group estimates the market to reach USD 39.7 Billion by 2034, exhibiting a CAGR of 3.54% during 2026-2034.

The refractories market is driven by the rising demand in steel and cement industries, rapid advancements in technology, increased focus on energy efficiency, imposition of stringent environmental regulations, and rapid urbanization. Expanding glass manufacturing, growing industrialization, and the shift toward sustainable and high-performance materials also significantly boost market growth.

Asia Pacific currently dominates the market, driven by rapid industrialization, significant steel and cement production, and large-scale infrastructure development in several countries.

Some of the major players in the refractories market include Chosun Refractories Eng Co. Ltd., Compagnie de Saint-Gobain S.A., Coorstek Inc., Imerys Usa Inc., Krosaki Harima Corporation, Morgan Advanced Materials Plc, Refratechnik Holding GmbH, RHI Magnesita GmbH, Vesuvius Plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)