Reverse Osmosis (RO) Membrane Market Size, Share, Trends and Forecast by Material Type, Filter Module, End-Use, and Region, 2025-2033

Reverse Osmosis (RO) Membrane Market Size and Share:

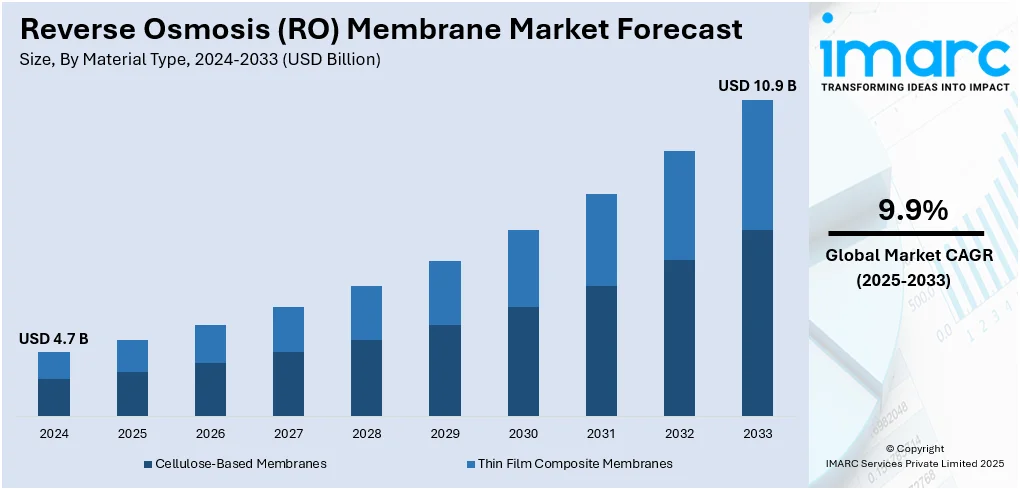

The global reverse osmosis (RO) membrane market size was valued at USD 4.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.9 Billion by 2033, exhibiting a CAGR of 9.9% from 2025-2033. The Middle East and Africa currently dominates the market in 2024. At present, water scarcity is rising and industries are adopting stricter wastewater regulations. Moreover, the continuous technological advancements are enhancing membrane performance, efficiency, and sustainability. Apart from this, investments in large-scale desalination projects and innovative materials are expanding the reverse osmosis (RO) membrane market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.7 Billion |

|

Market Forecast in 2033

|

USD 10.9 Billion |

| Market Growth Rate 2025-2033 | 9.9% |

The market is experiencing rapid growth, led by the rising need for pure and drinkable water in residential, commercial, and industrial processes. Industries are always looking for sustainable and effective water treatment technologies, which is leading to the uninterrupted growth of RO membrane uses. Governments and conservation authorities are imposing strict regulations on the discharge of wastewater, prompting industries to implement sophisticated filtration technology to abide by compliance criteria. Population growth and urbanization in emerging economies are also driving the demand for effective desalination and water treatment systems, in which RO membranes are taking the center stage. Advances in technology are improving membrane performance, increasing durability, and lowering operating costs, which is impelling the reverse osmosis (RO) membrane market growth.

To get more information on this market, Request Sample

The US market is experiencing steady growth as municipalities and industries are increasingly looking to future-proof advanced water treatment technologies. Tough environment regulations are compelling businesses to modernize their wastewater treatment plants, leading to consistent demand for high-performance RO membranes. Municipalities are increasing investments in water recycling and desalination projects to manage growing water scarcity issues, especially in drought-affected areas like the Southwest. Manufacturers are constantly working on new membrane materials that are providing increased flux rates and better fouling resistance, making water treatment plants more efficient. Various industries such as power generation, food and beverages, and pharmaceuticals are implementing RO systems to comply with stringent water quality regulations and lower environmental impacts. Residential adoption is increasing, with people becoming aware about drinking water quality and opting for home RO filtration systems. At CES 2025, VIOMI, a company listed on NASDAQ, presented its newest water purification technologies designed to transform household hydration. Driven by the company’s vision of “AI For Better Water,” VIOMI’s advancements aim to provide innovative, eco-friendly, and clean water to households globally. The Kunlun Water Purifier and Vortex 8 are two major products at VIOMI's CES exhibition. The Vortex 8 provides RO filtration with 0.0001 micron precision.

Reverse Osmosis (RO) Membrane Market Trends:

Growing International Water Scarcity and Need for Desalination

Increased freshwater shortage is motivating the large-scale use of RO membranes as communities and industries are searching for consistent measures to tackle increasing water demands. Substantially, many regions are facing declining groundwater levels and contamination of available sources of water, and this is encouraging local authorities and private organizations to invest in desalination schemes. The United Nations estimated that around 40% of the global population could be at risk of significant water shortages by 2040. In areas like the Middle East, Africa, and South Asia, where water scarcity is significant, negative consequences such as reduced agricultural production, rising food costs, and economic instability may arise. RO membranes are at the forefront of converting seawater and brackish water into drinking water, facilitating urban growth and agricultural use. Urban cities are expanding desalination capacities continuously to provide safe and clean drinking water to the increasing urban population. Industries, too, are relying on desalinated water to ensure secure operations in water-scarce areas. This growing dependence on RO technology for industrial-scale desalination is driving innovation and development in membrane materials and system efficiency.

Strict Environmental Regulations and Industrial Wastewater Treatment

One of the major reverse osmosis (RO) membrane market trends comprises the heightened implementation of tighter environmental laws by governments. This is encouraging industries to implement sophisticated wastewater treatment technologies, driving the demand for RO membranes. The manufacturing, energy, and chemical sectors are constantly producing vast amounts of wastewater that need to comply with rigorous discharge and recycling requirements. RO membrane systems are installed by companies to comply with regulations while reusing and recovering water in production processes at the same time. This trend is serving to reduce freshwater intake and lower operational expenses associated with water procurement and waste management. Environmental authorities are enforcing more stringent effluent quality monitoring, which is making industries to replace older treatment technologies with state-of-the-art RO membrane systems. For instance, in 2024, Toray Industries, Inc., created a robust RO membrane. This groundbreaking service ensured the sustained delivery of superior-quality water. It also preserved the excellent removal capabilities of Toray's membranes, which are essential for recycling industrial wastewater and processing sewage. The new membrane exhibited twice the durability against cleaning chemicals compared to traditional alternatives. This minimized performance declines due to membrane deterioration and streamlines operational management, cutting replacement rates in half and decreasing the product's carbon footprint.

Technological Advancements and Performance Innovation

Ongoing innovation in membrane technology is playing a major role in offering a favorable reverse osmosis (RO) membrane market outlook, as manufacturers are creating next-generation products that are offering more efficiency and less energy usage. Technology providers and research institutions are working in tandem to design membranes with better permeability, selectivity, and fouling resistance, which is improving operational lifetimes and lowering maintenance expenses for end customers. Firms are adopting cutting-edge materials like nanocomposites and graphene-based membranes that are improving filtration efficiency without sacrificing high throughput. RO units are being embedded with automation and smart monitoring systems, which allow real-time monitoring of performance and predictive maintenance. These advances are rendering RO systems cost-effective and environment friendly for use in applications from municipal water supply to industrial process water treatment. Therefore, utilities and industries are rapidly embracing new RO membrane technologies to meet tight water quality requirements while improving operational efficiency and helping to meet worldwide sustainability objectives. In 2025, Active Membranes, a California-based company, developed a new technology that equips membranes employed in the reverse-osmosis desalination process with electrical conductivity, to improve their ability to separate salts and various other contaminants from hard-to-treat water.

Reverse Osmosis (RO) Membrane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global reverse osmosis (RO) membrane market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type, filter module, and end-use.

Analysis by Material Type:

- Cellulose-Based Membranes

- Cellulose Acetate (CA) Membranes

- Nitrocellulose Membranes

- Thin Film Composite Membranes

- Polyamide (PA) Composite Membranes

- GO-Based Polyacrylonitrile Membrane

Thin film composite membranes stand as the largest component in 2024, holding 57.2% of the market. These membranes are providing enormous advantages that are making them popular across the globe for use in contemporary water treatment systems. They are providing high salt rejection rates while having great water permeability, which is making sure effective purification processes in residential and industrial settings. The manufacturers are creating thin film composite membranes with multiple layers that are making them stronger and more resistant to fouling, decreasing maintenance requirements and downtime. Companies are using these membranes to treat difficult feedwater sources, as these membranes are performing well under high pressures and changing water qualities. Thin film composite membranes are being taken up by water treatment plants at all times since they are facilitating reduced energy use as opposed to the established technologies, which is aiding in achieving sustainability goals by operators. Research and development (R&D) centers are also enhancing membrane materials to increase chemical resistance and durability.

Analysis by Filter Module:

- Plate and Frame (PF)

- Spiral

- Pillow-Shaped

- Tubular-Shaped

- Spiral-Wound

- Hollow-Fiber

Spiral-wound leads the market with 55.1% of market share in 2024. They are offering substantial benefits that are sustaining their leading role in reverse osmosis and other filtration processes. They are presenting a space-efficient and compact design, which optimizes surface area within a small space and enables higher flow rates with limited space. Industries and municipalities are favoring spiral-wound arrangements more and more because they are providing consistent filtration efficiency while being simple to install and replace. Operators are taking advantage of the modularity of spiral-wound elements, which is facilitating flexible system design and easy scaling for changing capacity requirements. The configuration is also facilitating good cleaning and maintenance, which is minimizing fouling and prolonging operational life. Manufacturers are equipping spiral-wound membranes with advanced materials that are enhancing durability and chemical resistance, which guarantees reliable operation in difficult conditions. While water treatment requirements continue to escalate, spiral-wound membranes are taking center stage in offering affordable, high-efficiency solutions for varied purification needs.

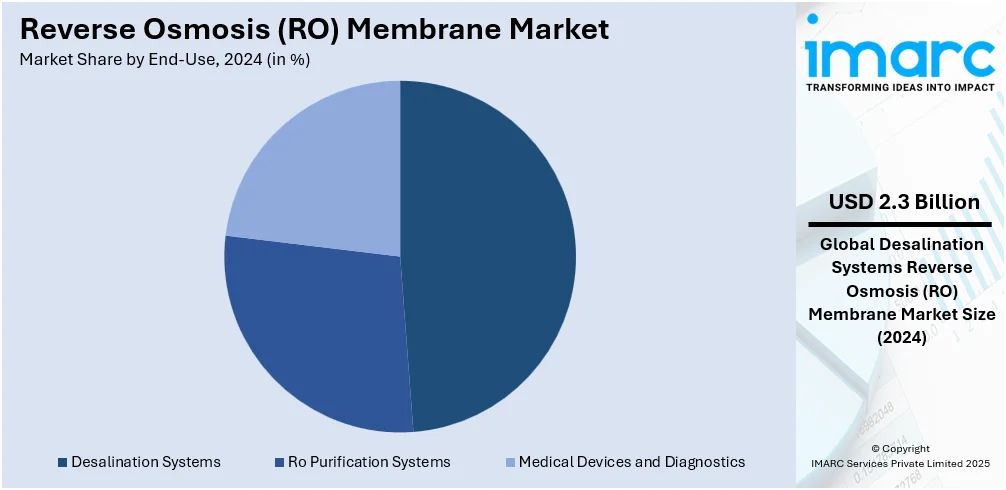

Analysis by End-Use:

- Desalination Systems

- Seawater

- Brackish Water

- Ro Purification Systems

- Residential and Commercial

- Municipal

- Industrial

- Medical Devices and Diagnostics

Desalination systems lead the market with 48.6% of market share in 2024. They are offering vital advantages as communities and industries are increasingly experiencing a freshwater shortage and looking for alternative sources of water. These technologies are facilitating the production of seawater and brackish water into drinking and process-grade water, which is sustaining increasing urban populations as well as industrial processes in water-scarce areas. Municipalities are making big investments in large-scale desalination plants to provide a stable and secure water supply, particularly in coastal and desert regions where conventional water resources are inadequate. Industries are embracing desalination systems to achieve reliable water quality for production operations, which is enabling the continuity of operation and compliance with strict regulatory requirements. Advances in technology are enhancing the energy efficiency and economic viability of desalination systems, paving the way for wide-scale applications.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Middle East and Africa lead the market in 2024. The market is experiencing robust growth as countries across the region are addressing acute water scarcity and increasing urbanization. Governments are investing heavily in large-scale desalination projects to secure potable water supplies for expanding populations and industrial zones. Gulf Cooperation Council (GCC) countries are continuously constructing new desalination plants that are relying on advanced RO membranes to convert seawater into drinking water efficiently. In Africa, nations are adopting RO technologies to treat brackish groundwater and contaminated surface water to support agricultural activities and provide safe drinking water in rural communities. Private sector players are forming strategic partnerships with governments to develop sustainable water infrastructure, which is driving the demand for high-performance RO membranes. Technological advancements are enabling operators to deploy energy-efficient RO systems that are reducing operational costs and minimizing environmental impacts. As per the reverse osmosis (RO) membrane market forecasts, research institutions and regional companies are expected to focus on localized solutions that can address unique water challenges, such as high salinity and poor feedwater quality.

Key Regional Takeaways:

United States Reverse Osmosis (RO) Membrane Market Analysis

The United States holds 84.70% share in North America. The United States market is primarily driven by a confluence of environmental, regulatory, and technological drivers reshaping the water treatment landscape. Increasing concerns around water scarcity, drought-prone regions, and aging municipal water infrastructure are prompting utilities and municipalities to adopt RO systems for both potable water production and industrial use. According to a recent report by the CDC Foundation, water scarcity costs the United States economy nearly USD 8.58 Billion a year in missed productivity and labor, lower household incomes, and increased medical expenses. Stricter regulations on water quality and discharge standards have elevated the need for advanced purification technologies, making RO a preferred choice for removing contaminants such as PFAS, nitrates, and heavy metals. Industries such as power generation, food and beverage, pharmaceuticals, and microelectronics are also expanding rapidly and require ultra-pure water, further driving the demand. Moreover, technological advancements, such as nano-enhanced membranes, energy recovery devices, and improved anti-fouling coatings, have increased membrane lifespan and reduced operating costs. Other than this, sustainability goals and ESG commitments are encouraging businesses and municipalities to invest in high-efficiency RO systems that minimize waste and energy use. The expansion of decentralized and point-of-use water treatment for homes, agriculture, and remote facilities is also creating new market segments.

Asia Pacific Reverse Osmosis (RO) Membrane Market Analysis

The Asia Pacific market is expanding due to industrialization and environmental pressures reshaping regional water management strategies. Urban expansion in countries such as India, China, and Southeast Asia has intensified the demand for safe drinking water, prompting municipalities to adopt RO systems for potable supply. Droughts and erratic rainfall patterns in the region are also increasing investment in seawater desalination and water reuse plants. For instance, in September 2024, 30% of the land in India was experiencing some degree of drought, as per industry reports. Approximately 11.5% of the land was experiencing severe drought, while 18.9% was experiencing moderate drought. Additionally, ongoing innovations, such as anti-fouling coatings, energy-efficient modules, and compact designs, are reducing operational costs and making RO systems more accessible for small towns and decentralized applications. National sustainability agendas and funding support for water infrastructure upgrades are also encouraging public–private partnerships in the sector, supporting industry expansion.

Europe Reverse Osmosis (RO) Membrane Market Analysis

The growth of the Europe market is largely driven by increasing regulatory pressure on effluent quality and water reuse targets, which is prompting utilities and industries to upgrade water purification systems. This is making RO membranes essential for compliance with stringent standards around salinity, heavy metals, and micropollutants. Climate-induced water scarcity events and droughts in southern Europe are further driving investments in desalination and wastewater recycling facilities that rely heavily on RO technology. According to the European Environment Agency, in 2022, water scarcity impacted nearly 34% of the EU region during at least one season, affecting approximately 41% of the population of the European Union. Additionally, industrial sectors, including pharmaceuticals, food and beverage, chemicals, and microelectronics, are experiencing rising demand for ultra-pure water, which is propelling membrane deployment in onsite and centralized applications. Technological breakthroughs, such as graphene-enhanced membranes, optimized spiral-wound modules, and improved cleaning protocols, are also boosting process efficiency, lowering energy and maintenance costs, and extending membrane lifespan. Other than this, the growth of public–private partnerships and cross-border collaboration on transnational water infrastructure is facilitating the scale-up of RO installations, creating a robust environment for market growth, advanced product development, and regional deployment.

Latin America Reverse Osmosis (RO) Membrane Market Analysis

The Latin America market is experiencing robust growth due to growing water stress, rapid urbanization, and a rising demand for clean drinking water across the region. Recurring droughts, groundwater depletion, and contamination of freshwater sources are driving municipalities and industries to invest in RO-based desalination and water treatment plants. For instance, as per an industry report, 80% of the land in Brazil is impacted by drought, affecting nearly 1,400 cities across the country. Additionally, government initiatives and investment programs aimed at improving water infrastructure and meeting sustainability targets are also encouraging uptake. The rise in residential and point-of-use RO systems, driven by growing public concerns over tap water quality, is also creating a new consumer-driven market segment, further strengthening regional growth.

Middle East and Africa Reverse Osmosis (RO) Membrane Market Analysis

The Middle East and Africa market is significantly influenced by the rising need to diversify water sources in response to climate variability and limited freshwater availability. Countries in the region are increasingly integrating RO systems into national water strategies to ensure long-term supply security. In addition to this, increasing investments from international development organizations and private stakeholders are supporting the deployment of advanced RO technologies. The emergence of smart water management systems and digital monitoring is also enhancing the operational control and efficiency of RO plants. For instance, the smart water management market in Saudi Arabia reached USD 0.18 Billion in 2024 and is projected to grow at a CAGR of 9.72% during 2025-2033, according to the IMARC Group. Educational and awareness campaigns promoting efficient water usage and improved sanitation are also encouraging the adoption of RO systems across the region, facilitating market growth.

Competitive Landscape:

Key market players are actively expanding production capacities, investing in advanced research, and forming strategic partnerships to strengthen their market presence. Companies are continuously developing high-performance membranes that are offering improved efficiency, durability, and fouling resistance to meet diverse water treatment needs. Leading manufacturers are collaborating with governments and industries to implement large-scale desalination and wastewater recycling projects, addressing rising global water scarcity. Firms are also focusing on sustainable solutions by designing energy-efficient membranes that are supporting lower operational costs. By expanding distribution networks and entering emerging markets, key players are ensuring wider access to modern RO technologies. These activities are driving innovation and shaping the competitive landscape of the global RO membrane market.

The report provides a comprehensive analysis of the competitive landscape in the reverse osmosis (RO) membrane market with detailed profiles of all major companies, including:

- Alfa Laval AB

- AXEON Water

- DuPont de Nemours, Inc.

- Hunan Keensen Technology Co., Ltd

- Hydranautics (A Nitto Denko Group Company)

- Kovalus Separation Solutions

- LG Chem

- MANN+HUMMEL Water & Fluid Solutions GmbH

- Pentair

- Toray Industries Inc.

- TOYOBO MC Corporation

- Vontron Technology Co., Ltd.

Latest News and Developments:

- June 2025: DuPont introduced the FilmTec Hypershell XP RO-8038 element, a cutting-edge reverse osmosis (RO) solution designed to fulfill the changing demands of the dairy processing sector. The FilmTec Hypershell XP RO-8038 element will support the manufacturing of premium dairy products that satisfy customer expectations for both nutritional content and performance.

- May 2025: The Florida Keys Aqueduct Authority (FKAA) officially launched the USD 47 Million Kermit H. Lewin Stock Island Reverse Osmosis (RO) Facility. Featuring cutting-edge RO technology, including the newest membrane system design and materials, the upgraded plant will double the capacity of the existing facility from 2 to 4 Million Gallons per day.

- April 2025: Aqua Membranes, a renowned provider of innovative reverse osmosis membrane elements, announced the launch of the ROI Clarity Calculator, a cutting-edge new tool that provides highly precise cost-savings analysis. By utilizing actual operational data, the calculator enables users to reliably illustrate the benefits of Aqua Membranes' cutting-edge reverse osmosis technologies with verifiable savings figures.

- April 2025: Oman's first locally produced reverse osmosis (RO) membrane was successfully developed by local start-up Tasnee, marking a major step toward industrial self-reliance and water sustainability in the country. In line with Oman Vision 2040's objectives of economic diversification, technological advancement, and less reliance on imports, this accomplishment is a significant milestone in the Sultanate of Oman's water treatment industry.

- February 2025: LG Chem, in partnership with AlKhorayef Group, announced the launch of a reverse osmosis (RO) membrane manufacturing plant in Saudi Arabia. By offering a legislative framework and an integrated infrastructure centered on innovation, collaborative research, and development, the effort seeks to improve local content, assist sustainability enablers, and localize desalination technology.

Reverse Osmosis (RO) Membrane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered |

|

| Filter Modules Covered |

|

| End-Uses Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alfa Laval AB, AXEON Water, DuPont de Nemours, Inc., Hunan Keensen Technology Co., Ltd, Hydranautics (A Nitto Denko Group Company), Kovalus Separation Solutions, LG Chem, MANN+HUMMEL Water & Fluid Solutions GmbH, Pentair, Toray Industries Inc., TOYOBO MC Corporation, Vontron Technology Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the reverse osmosis (RO) membrane market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global reverse osmosis (RO) membrane market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the reverse osmosis (RO) membrane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The reverse osmosis (RO) membrane market was valued at USD 4.7 Billion in 2024.

The reverse osmosis (RO) membrane market is projected to exhibit a CAGR of 9.9% during 2025-2033, reaching a value of USD 10.9 Billion by 2033.

The rising global water scarcity, stricter environmental regulations for industrial wastewater, technological advancements in membrane efficiency, and large-scale investments in desalination projects are driving robust demand for high-performance RO membranes worldwide.

The Middle East and Africa currently dominate the reverse osmosis (RO) membrane market. The regional industry is supported by significant investments in desalination infrastructure to combat severe water scarcity and ensure long-term water security.

Some of the major players in the reverse osmosis (RO) membrane market include Alfa Laval AB, AXEON Water, DuPont de Nemours, Inc., Hunan Keensen Technology Co., Ltd, Hydranautics (A Nitto Denko Group Company), Kovalus Separation Solutions, LG Chem, MANN+HUMMEL Water & Fluid Solutions GmbH, Pentair, Toray Industries Inc., TOYOBO MC Corporation, Vontron Technology Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)