RF Front End Module Market Size, Share, Trends and Forecast by Component, Application, and Region, 2025-2033

RF Front End Module Market Size and Share:

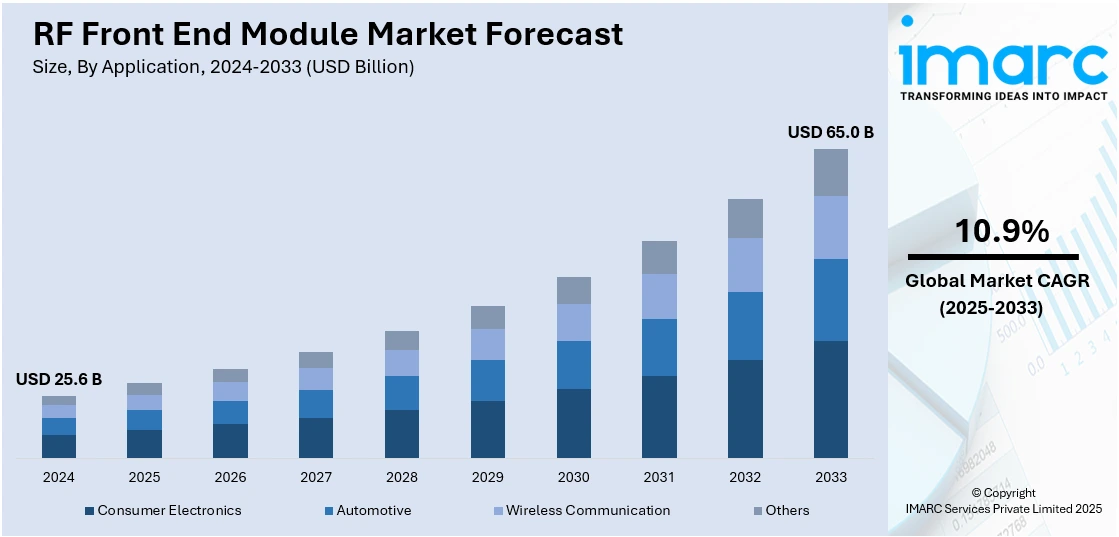

The global RF front end module market size was valued at USD 25.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 65.0 Billion by 2033, exhibiting a CAGR of 10.9% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.2% in 2024. Rapid digitalization, the rise in industrial automation, and the growing adoption of social networking platforms and IoT devices are key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 25.6 Billion |

|

Market Forecast in 2033

|

USD 65.0 Billion |

| Market Growth Rate 2025-2033 | 10.9% |

A key factor driving the expansion of the RF front-end module market is the growing use of the Internet of Things (IoT) devices in a variety of industries. Furthermore, the increasing reliance of IoT devices, including smart home devices, wearable technology, industrial sensors, and automated cars, on flawless wireless communication is driving the growth of the market. In this instance, RF front-end modules help these devices connect and communicate successfully over wireless networks by controlling signal amplification, filtering, and switching. This trend is accelerated by advances in wireless communication standards such as Wi-Fi 6 and Bluetooth Low Energy, which improve the performance of IoT applications. Along with this, the development of new RF front-end technologies that provide higher power efficiency, integration capabilities, and performance characteristics is enhancing the expansion of the market.

The United States stands out as a prominent market disruptor, owing to the extensive adoption of fifth-generation (5G) network infrastructure. Telecom companies are boosting their investment in 5G technology to meet consumer demand for faster data speeds and enhanced connection, which is driving the market growth. For example, over 300 million people (90%) live in areas served by all three tier-1 service providers' 5G low-band networks, whereas 210-300 million are covered by 5G mid-band. In this regard, RF front end modules play an important role in supporting various 5G devices and infrastructure by allowing for efficient transmission and reception of higher frequency signals.

RF Front End Module Market Trends:

Rise in 5G deployments

The rapid implementation of fifth-generation (5G) networks worldwide is driving the demand for RF front end modules, which are critical for allowing access to higher frequencies and increased bandwidths required for 5G communication. Furthermore, the increasing demand for faster data transmission, ultra-low latency, and seamless communication across different devices is driving the market expansion. According to industry sources, over 1.5 billion 5G connections were reported worldwide in 2023, and this figure is predicted to rise to 4.5 billion by 2030, showing the technology's fast adoption. Along with this, there is a greater requirement for advanced RF components, such as filters, amplifiers, power management systems, and switches, which play an important role in maintaining signal quality and reducing interference throughout the numerous frequency bands, thereby favoring the expansion of the market.

The increased adoption of the Internet of Things (IoT)

The heightened adoption of IoT devices is propelling the demand for RF front-end modules. According to recent estimates, connected IoT devices will total 16.6 billion by the end of 2023, with a predicted 13% increase to 18.8 billion by 2024. These devices, which include smart home gadgets, healthcare monitoring, and industrial systems, require small, energy-efficient RF modules to provide dependable wireless connection. In this context, RF modules enable essential protocols such as Wi-Fi, Zigbee, and Bluetooth, offering reliable communication for IoT applications. Aside from this, the growing reliance on linked devices across many industries that can handle increased data traffic while consuming minimal power is driving the demand for improved RF front-end solutions.

Surge in smartphone penetration

The surging penetration of smartphones and the increasing need for high-speed wireless connectivity are boosting the demand for RF front-end modules. As of 2023, the global smartphone penetration rate was predicted to be 69%, implying that roughly 69% of the world's population uses smartphones. Effective RF modules are necessary for modern smartphones to handle features like carrier aggregation, multi-band support, and seamless 5G integration. Furthermore, the development of lightweight RF modules that can manage complex processes while using less energy has increased due to the popularity of foldable smartphones and high-performance devices. Manufacturers are concentrating on combining many functions, including filters, switches, and power amplifiers, onto a single chip in order to meet these demands. By improving performance and enabling elegant and lightweight designs without compromising connectivity quality, this trend is helping to propel market expansion.

RF Front End Module Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global RF front-end module market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, and application.

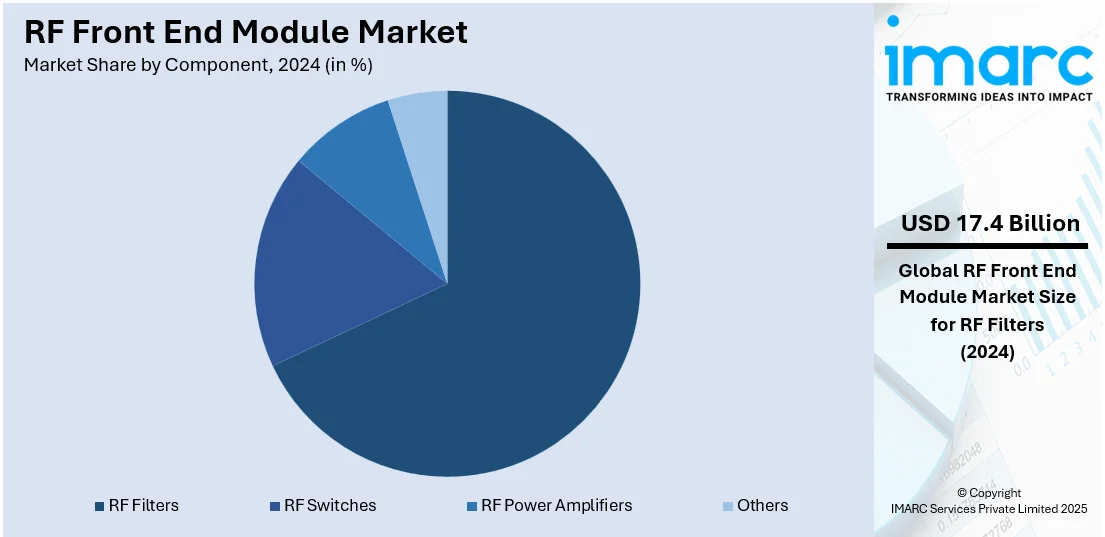

Analysis by Component:

- RF Filters

- RF Switches

- RF Power Amplifiers

- Others

RF filters stand as the largest component in 2024, holding around 68% of the market. The increased demand for advanced communication technologies such as fifth-generation (5G), the Internet of Things (IoT), and Wi-Fi 6 is driving the market growth. Furthermore, RF filters are important components in wireless communication systems as they selectively allow specific frequency bands while blocking unwanted signals, resulting in high-quality signal transmission and reception. Along with this, the emergence of devices that operate across many frequency bands, necessitating efficient filtering solutions, is fueling the market expansion. Aside from that, the increasing deployment of 5G technology, which amplifies this demand by requiring filters that are capable of handling higher frequencies and bigger bandwidth, is contributing to the market growth.

Analysis by Application:

- Consumer Electronics

- Automotive

- Wireless Communication

- Others

The consumer electronics segment is a significant contributor to the RF front-end module market, driven by the growing popularity of smartphones, smartwatches, tablets, and IoT devices. These modules are crucial to improving wireless communication performance and guaranteeing dependable connectivity in Wi-Fi, Bluetooth, and 5G networks. Moreover, the market is expanding because of the rising need for devices that are more compact and energy-efficient, which propels advancements in radio frequency technology and enables producers to incorporate high-performance front-end modules.

Because they facilitate sophisticated connectivity features like infotainment systems, global positioning system (GPS) navigation, and vehicle-to-everything (V2X) communication, RF front-end modules are becoming more and more prevalent in the automobile industry. Furthermore, the growing trend toward autonomous and electric vehicles (EVs), which requires the integration of sophisticated RF modules to provide flawless communication between vehicles, infrastructure, and gadgets, is driving the market expansion.

Wireless communication is a key segment for RF front-end modules, owing to the rapid implementation of 5G networks and the development of IoT applications. These modules are critical for improving signal transmission, increasing network coverage, and supporting larger data speeds on a variety of devices. Furthermore, the increasing demand for robust and dependable communication systems in industries such as industrial automation, smart cities, and healthcare is propelling the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.2%. Based on the recent RF front end module market forecast, Asia-Pacific is the dominant region, driven by its rapid technological advancements and robust consumer electronics industry. Moreover, countries like China, Japan, South Korea, and India are major contributors due to their thriving smartphone and IoT device manufacturing sectors. Besides this, the widespread adoption of 5G technology across the Asia Pacific that boosts the demand for RF front-end modules, as they are essential for enabling high-speed data transfer and multi-band support, is catalyzing the market growth. Additionally, the large population and increasing penetration of connected devices, including wearables and smart home systems, are fueling the market growth.

Key Regional Takeaways:

North America RF Front End Module Market Analysis

The increasing development of 5G networks, as well as the strong presence of major technological companies, are driving the North American RF front-end module market. Furthermore, the region's advanced telecommunications infrastructure, which allows for widespread adoption of high-speed wireless technologies, is contributing to the market expansion. Aside from that, the increased demand for RF modules in smartphones, consumer electronics, and IoT devices is promoting the growth of this industry. Furthermore, the heightened use of linked devices, such as smart home systems and automotive telematics, is propelling the market expansion. Besides this, the growing adoption of RF modules in North America's defence and aerospace industries for satellite communication, radar systems, and advanced military applications is encouraging the market growth.

United States RF Front End Module Market Analysis

The United States accounts for 92.3% of the market share in North America. The country is at the vanguard of 5G implementation, with telecom companies aggressively expanding their networks throughout the region. This rapid deployment is increasing the demand for RF Front End Modules (RF FEMs) to enable higher frequency bands and advanced 5G technology capabilities such as mmWave connectivity and massive MIMO (Multiple Input Multiple Output) systems. For instance, Qorvo introduced the first dual-band front-end module (FEM) for Wi-Fi 6, the SKY85334-11 and SKY85750-11. It is designed ideally for customer premise equipment (CPE), combining the performance required to deliver HD/4K video with the efficiency needed for IoT. Also, by featuring linearity, power dissipation, and efficiency for access points, routers, and gateways, where regulatory, thermals, or Power-over-Ethernet (PoE) limitations demand low current consumption, the modules overlook integration at switching, low-noise amplifier (LNA) with bypass and power amplifier (PA) as applications.

Technological innovations in semiconductor manufacturing processes, packaging technologies, and RF circuit design are driving advancements in performance, power efficiency, and integration of RF FEMs. Additionally, the proliferation of IoT devices and applications in North America is fueling demand for RF FEMs to enable wireless connectivity in smart home devices, industrial sensors, healthcare wearables, and other IoT applications. RF FEMs play a critical role in ensuring reliable communication and connectivity in IoT ecosystems.

Asia Pacific RF Front End Module Market Analysis

The Asia-Pacific is expected to witness significant growth. The advancement in consumer electronics and growing defense equipment requirements with the considerable growth of major emerging economies, such as China, India, and South Korea, will further boost the demand for the RF component market. Additionally, the RF Front End Module (RFFE) benefits from a thriving Integrated Circuit (IC) sector, the expansion of the SOI ecosystem in Asia-Pacific, and the increased usage of SOI in IoT applications. According to Forbes, the number of IoT devices will approach 3.5 billion by 2023, and Northeast Asia will be a market for more than 2.2 billion devices by 2023. Furthermore, the data transmission over 2G, 3G, and 4G/ Long-term Evolution (LTE), mobile devices require dedicated front-end modules (FEMs). FEMs use RF-SOI chips, which integrate switches, power amplifiers, antenna tuning components, power management units, and filters on a single platform for IoT applications. Hence, this caters to the market growth in the region.

Europe RF Front End Module Market Analysis

The market for RF front-end modules in Europe is driven by the region's emphasis on developing 5G infrastructure and the growing adoption of smart home technologies. Major economies like Germany, the UK, and France are leading the way in network expansions as European Union nations make significant investments in 5G rollouts. The requirement for sophisticated RF modules that can manage higher frequencies and guarantee flawless communication is fueled by this expansion. One of the main drivers of the European economy, the automobile sector, also makes a substantial contribution to market expansion. RF modules are in great demand for V2X communication and advanced driver assistance systems (ADAS) as major manufacturers like BMW, Volkswagen, and Daimler push for the adoption of connected and driverless vehicles. Other potential factors include government programs to improve connection in rural regions and the expanding use of IoT devices in sectors like manufacturing and healthcare.

Latin America RF Front End Module Market Analysis

The increasing need for improved wireless connectivity and the slow rollout of 5G technologies are driving the market for RF front-end modules in Latin America. With the help of corporate investments in telecommunications infrastructure and government initiatives, nations like Brazil and Mexico are spearheading the rollout of 5G networks. The need for effective RF components is also fueled by the growing use of smartphones and other connected devices. Additionally, the expansion of IoT applications and smart cities in the area supports the use of RF front-end modules in a number of industries, such as healthcare and energy.

Middle East and Africa RF Front End Module Market Analysis

The deployment of 5G networks and investments in telecommunications infrastructure are the main factors propelling the RF front-end module market in the Middle East and Africa. Leading the way are nations like the United Arab Emirates and Saudi Arabia, which have made significant investments in digital transformation projects like Saudi Arabia's Vision 2030. The rise of IoT applications in industries including healthcare, smart cities, and oil & gas, as well as the rising demand for smartphones, are driving the market growth. The region's growing emphasis on industrial automation and linked cars has also increased the use of RF front-end modules.

Competitive Landscape:

The major players in the market are focusing on enhancing performance and expanding their product portfolios to meet the rising demand for advanced wireless communication technologies. They are working on developing highly integrated modules that support 5G, Wi-Fi 6, and IoT applications. Moreover, these players are leveraging advanced materials and technologies to improve signal efficiency, reduce power consumption, and enable compact designs suitable for modern smartphones and connected devices. Besides this, several key companies are forming partnerships with device manufacturers and investments in research and development (R&D) to stay competitive. Additionally, market leaders are targeting regional expansion to cater to growing markets, driven by the adoption of 5G and smart home technologies.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Broadcom Inc

- Infineon Technologies AG

- Murata Manufacturing Co

- NXP Semiconductors N.V

- Qorvo Inc

- Skyworks Solutions

- STMicroelectronics N.V

- Taiyo Yuden Co. Ltd

- TDK Corporation

- Teradyne Inc

- Texas Instruments Incorporated

Latest News and Developments:

- June 2023: Qorvo introduced the “QPQ3509,” BAW 280 MHz band pass filter for the 5G C-band in North America, and the “QPB9850,” a compact front-end switch/LNA module for 5G base station RF front-ends. The QPQ3509 offers C-band coverage, while the QPB9850 combines high integration and compact design, making both devices well-suited for 5G small cell applications where size and weight are critical.

- June 2022: Qualcomm Technologies, Inc., introduced a range of RFFE modules aimed at enhancing Wi-Fi and Bluetooth performance. This expanded portfolio supports Bluetooth, Wi-Fi 6E, and the upcoming Wi-Fi 7 standard. The modules are tailored for a diverse set of device categories beyond smartphones, including automotive, extended reality (XR), PCs, wearables, mobile broadband, and IoT applications.

- February 2022: pSemi Corporation, a Murata company, expanded its mmWave RF front-end portfolio for 5G infrastructure. The products, including beamforming ICs and up-down converters, offer flexibility across n257, n258, and n260 bands. This modular approach with on-chip calibration simplifies design and adapts to various antenna configurations. The portfolio is available as discrete RFICs or as part of Murata's 28 GHz antenna-integrated module, delivering high performance and reliability in a compact form factor.

RF Front End Module Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | RF Filters, RF Switches, RF Power Amplifiers, Others |

| Applications Covered | Consumer Electronics, Automotive, Wireless Communication, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom Inc., Infineon Technologies AG, Murata Manufacturing Co. Ltd., NXP Semiconductors N.V., Qorvo Inc., Skyworks Solutions Inc., STMicroelectronics N.V., Taiyo Yuden Co. Ltd., TDK Corporation, Teradyne Inc. and Texas Instruments Incorporated |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the RF Front End Module market from 2019-2033.

- The RF Front End Module market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the RF front end module industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

RF front end module is a critical component in wireless communication systems that manages signal transmission and reception. It integrates devices like filters, amplifiers, and switches to enhance performance, reduce interference, and support multi-band frequencies. These modules are essential in smartphones, IoT devices, automotive systems, and 5G networks.

The global RF front end module market was valued at USD 25.6 Billion in 2024.

IMARC estimates the global RF front end module market to exhibit a CAGR of 10.9% during 2025-2033.

The rapid adoption of 5G networks is a key market driver, as it requires advanced RF front end modules to handle higher frequencies, faster data rates, and multi-band operations, ensuring seamless connectivity for smartphones, IoT devices, and telecommunications infrastructure.

According to the report, RF filters represented the largest segment by component, driven by the growing demand for advanced communication technologies such as fifth-generation (5G) and the Internet of Things (IoT).

Consumer electronics leads the market by application as these devices rely on RF front end modules to support seamless wireless communication across various standards.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global RF front end module market include Broadcom Inc., Infineon Technologies AG, Murata Manufacturing Co. Ltd., NXP Semiconductors N.V., Qorvo Inc., Skyworks Solutions Inc., STMicroelectronics N.V., Taiyo Yuden Co. Ltd., TDK Corporation, Teradyne Inc., Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)