Ride Sharing Market Report by Service Type (E-Hailing, Car Sharing, Station-Based Mobility, Car Rental), Booking Mode (App-based, Web-based), Membership Type (Fixed Ridesharing, Dynamic Ridesharing, Corporate Ridesharing), Commute Type (ICE Vehicle, Electric Vehicle, CNG/LPG Vehicle, Micro Mobility Vehicle), and Region 2025-2033

Market Overview:

The global ride sharing market size reached USD 131.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 507.2 Billion by 2033, exhibiting a growth rate (CAGR) of 14.62% during 2025-2033. The market is propelled by technological advancements, economic efficiency, and a shift towards sustainable and shared transportation models, along with rising smartphone penetration and technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 131.3 Billion |

| Market Forecast in 2033 | USD 507.2 Billion |

| Market Growth Rate (2025-2033) | 14.62% |

Ride sharing refers to a transportation model where individuals share a vehicle trip, reducing travel costs, congestion, and environmental impact. This concept contrasts with traditional taxi services by enabling regular people to turn their private vehicles into part-time taxis through a digital platform. These platforms, typically smartphone applications, match passengers with drivers heading in the same direction. Ride sharing has gained significant traction due to its convenience, cost-effectiveness, and the rise of smartphones and mobile internet access. Market players offer a range of services from economical carpool options to more luxurious solo rides. The model's scalability has enabled rapid expansion into global markets, appealing to urban residents, commuters, and those without access to private or public transportation. The growth of ride sharing has been accompanied by regulatory challenges and concerns over safety, employment status of drivers, and its impact on traditional taxi services. Despite these issues, ride sharing remains an integral part of the evolving urban transportation landscape, offering a flexible alternative to conventional transport modes.

To get more information on this market, Request Sample

Ride Sharing Market Trends:

Technological advancements, particularly in smartphone technology and mobile internet connectivity, represent one of the key factors driving the global ride sharing market. The widespread adoption of smartphones has facilitated the growth of app-based ride sharing platforms, allowing for real-time matching of drivers and passengers. GPS technology ensures efficient route planning, while digital payment systems enable seamless financial transactions. Additionally, developments in data analytics has helped these platforms optimize pricing and logistics, enhancing user experience. Economically, ride sharing offers cost savings for users, as it typically undercuts traditional taxi fares and reduces the need for personal vehicle ownership, especially in urban areas where parking and maintenance costs are high. This economic efficiency is particularly appealing in the context of growing urbanization and the increasing economic pressure on urban residents.

Social and environmental factors are also significantly contributing to the growth of the ride sharing market. There is a rising awareness of environmental issues, and ride sharing is seen as a more sustainable transportation option. By maximizing vehicle occupancy, it reduces carbon emissions and traffic congestion, aligning with broader environmental goals. Furthermore, changing social attitudes, especially among younger populations, favor access over ownership, leading to a greater acceptance of shared services. This shift is part of a larger trend towards a 'sharing economy,' where assets and services are shared between individuals, often facilitated by technology. Ride sharing also addresses gaps in existing public transportation networks, providing a flexible solution for last-mile connectivity. However, the industry faces challenges, including regulatory hurdles, concerns over the safety and rights of both drivers and passengers, and the impact on traditional taxi services. These issues, alongside the potential disruption from autonomous vehicle technology, represent ongoing considerations for the future trajectory of the ride sharing market.

Key Market Segmentation:

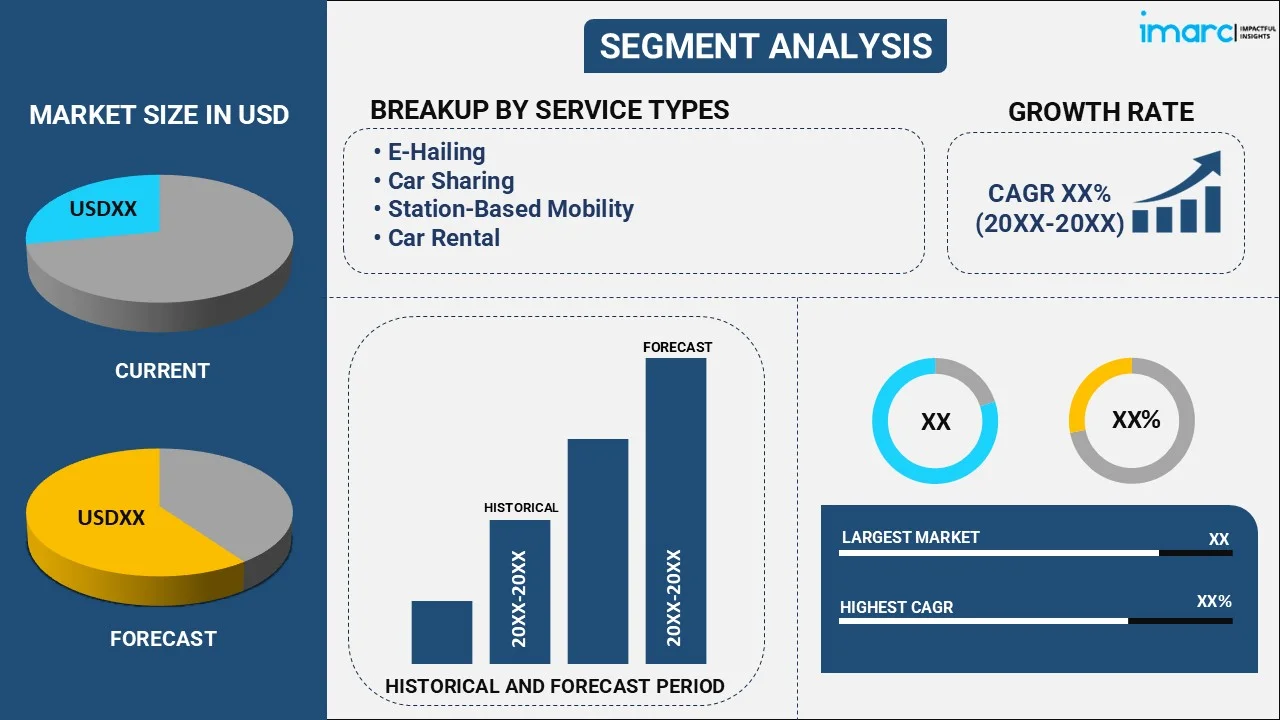

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on service type, booking mode, membership type, and commute type.

Service Type Insights:

- E-Hailing

- Car Sharing

- Station-Based Mobility

- Car Rental

The report has provided a detailed breakup and analysis of the market based on the service type. This includes e-hailing, car sharing, station-based mobility, and car rental. According to the report, e-hailing represented the largest segment.

Booking Mode Insights:

- App-based

- Web-based

A detailed breakup and analysis of the market based on the booking mode has also been provided in the report. This includes app-based and web-based. According to the report, app-based represented the largest segment.

Membership Type Insights:

- Fixed Ridesharing

- Dynamic Ridesharing

- Corporate Ridesharing

The report has provided a detailed breakup and analysis of the market based on the membership type. This includes fixed, dynamic, and corporate ridesharing. According to the report, corporate ridesharing represented the largest segment.

Commute Type Insights:

- ICE Vehicle

- Electric Vehicle

- CNG/LPG Vehicle

- Micro Mobility Vehicle

A detailed breakup and analysis of the market based on the commute type has also been provided in the report. This includes ICE vehicle, electric vehicle, CNG/LPG vehicle, and micro mobility vehicle. According to the report, electric vehicle represented the largest segment.

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for ride sharing. Some of the factors driving the North America ride sharing market included high smartphone penetration, urban traffic congestion, environmental concerns, and a cultural shift towards shared economy models, alongside significant investments in technology-driven transport solutions.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global ride sharing market. The detailed profiles of all major companies have been provided. Some of the companies covered include ANI Technologies Pvt. Ltd. (OLA), BlaBlaCar, Bolt Technology OU, Cabify, Curb Mobility LLC, Gett, Grab Holdings Inc, HyreCar Inc, Lyft, Inc., Tomtom International B.V., and Uber Technologies Inc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | E-Hailing, Car Sharing, Station-Based Mobility, Car Rental |

| Booking Modes Covered | App-based, Web-based |

| Membership Types Covered | Fixed Ridesharing, Dynamic Ridesharing, Corporate Ridesharing |

| Commute Types Covered | ICE Vehicle, Electric Vehicle, CNG/LPG Vehicle, Micro Mobility Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ANI Technologies Pvt. Ltd. (OLA), BlaBlaCar, Bolt Technology OU, Cabify, Curb Mobility LLC, Gett, Grab Holdings Inc, HyreCar Inc, Lyft, Inc., Tomtom International B.V., and Uber Technologies Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ride sharing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ride sharing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ride sharing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ride sharing market was valued at USD 131.3 Billion in 2024.

The ride sharing market is projected to exhibit a CAGR of 14.62% during 2025-2033, reaching a value of USD 507.2 Billion by 2033.

The market is driven by increasing urbanization, rising fuel and vehicle ownership costs, growing smartphone penetration, and expanding internet connectivity. Environmental concerns, government support for shared mobility, and convenience of app-based booking further fuel adoption. Integration of electric and autonomous vehicles also boosts the long-term potential for ride sharing services.

North America dominates the ride sharing market in 2024. The dominance is fueled by a well-established digital infrastructure, high consumer acceptance of shared mobility, strong presence of major ride sharing companies, and rising demand for cost-effective and flexible transportation. Urban congestion and sustainability efforts further drive the region’s leadership.

Some of the major players in the ride sharing market include ANI Technologies Pvt. Ltd. (OLA), BlaBlaCar, Bolt Technology OU, Cabify, Curb Mobility LLC, Gett, Grab Holdings Inc, HyreCar Inc, Lyft, Inc., Tomtom International B.V., and Uber Technologies Inc.,among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)