Riot Control System Market Size, Share, Trends, and Forecast by Product, Technology, End User, and Region, 2025-2033

Riot Control System Market Size and Share:

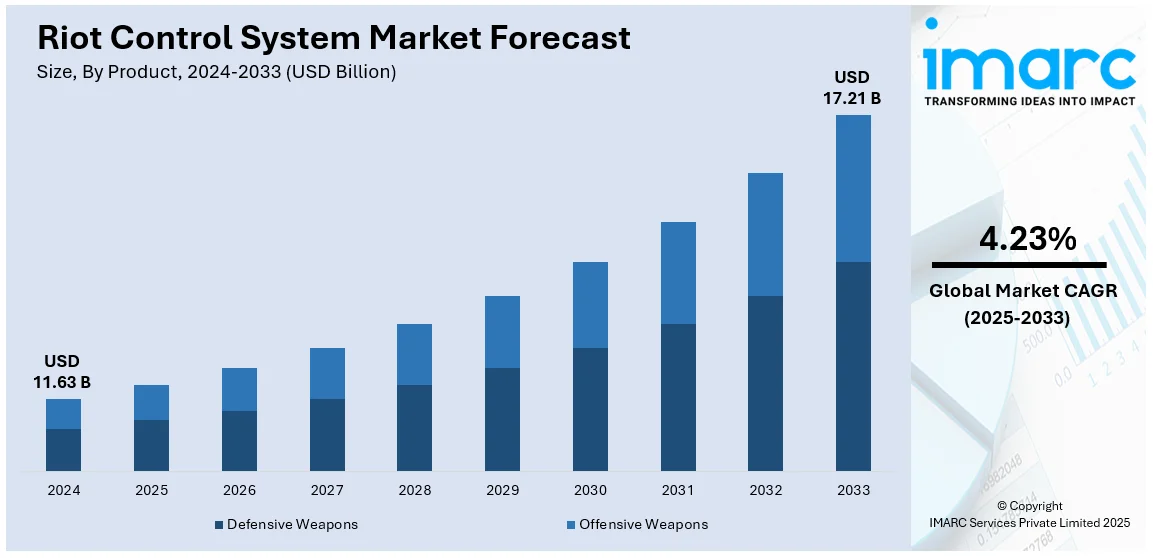

The global riot control system market size was valued at USD 11.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.21 Billion by 2033, exhibiting a CAGR of 4.23% from 2025-2033. North America currently dominates the market, holding a market share of over 34.8% in 2024. The riot control system market share is expanding, driven by the rising unrest and territorial conflicts, increasing law enforcement requirements in densely populated urban areas and large public events, and technological advancements in weapons and security solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.63 Billion |

|

Market Forecast in 2033

|

USD 17.21 Billion |

| Market Growth Rate (2025-2033) | 4.23% |

At present, the rising political unrest, protests, and civil disorders are impelling the market growth. Government agencies and law enforcement agencies invest in advanced non-lethal technologies to manage large crowds while minimizing injuries. These systems, including tear gas, water cannons, and rubber bullets, provide effective tools for maintaining order without excessive force. Besides this, the growing emphasis on public safety and security drives the demand for riot control systems. Apart from this, advancements in less-lethal weapon technology and the integration of surveillance systems with riot control equipment enhance efficiency and appeal. In addition, the requirement for rapid response systems in critical situations supports the market growth.

The United States has emerged as a major region in the riot control system market owing to many factors. The increasing incidents of civil unrest, protests, and demonstrations across the country are fueling the riot control system market growth. Law enforcement agencies prioritize non-lethal technologies like stun grenades to manage large crowds while lowering harm. Besides this, the high focus on public safety and the protection of critical infrastructure encourages the usage of advanced riot control equipment. According to the data provided on the official website of the US Department of Justice, in October 2024, The Justice Department declared that it would distribute USD 4 Billion to enhance public safety and community justice initiatives in the states, territories, and local and tribal communities. Government funding and policies aimed at strengthening domestic security further support the market growth.

Riot Control System Market Trends:

Non-Lethal Weaponry Advancements

Advancements in non-lethal weaponry are positively influencing the market, mainly emphasizing safety and effectiveness. Technologies like advanced pepper sprays offer enhanced dispersion ranges, which improve the ability to control crowds from a distance while reducing direct confrontations. Tasers have evolved with long improved accuracy and integrated camera systems for accountability. Sound cannons or long-range acoustic devices can broadcast messages to produce disorienting sounds over vast areas facilitating large crowd management without physical interaction. These innovations reflect a strategic shift towards minimizing physical harm and psychological trauma during crowd control operations aligning with worldwide human rights standards and public expectations. As per a publication by The Air Force Security Forces Center in April 2024, it teamed up with the Joint Intermediate Force Capabilities Office and various military branches to improve non-lethal weapon choices for defenders. Reports indicate that the global market for non-lethal weapons reached USD 9.0 billion in 2024. They are also exploring advanced technologies like directed energy vehicle stopping systems and improved diversionary grenades to better protect personnel and resources. The goal is to provide non-lethal alternatives that effectively de-escalate situations and minimize harm in various operational scenarios.

Increasing Technological Integration

The integration of technology in riot control strategies is becoming increasingly sophisticated, significantly enhancing law enforcement and capabilities. Artificial intelligence (AI) is used to analyze real time data from surveillance and cameras and social media to predict crowd movements and potential flashpoints, which enables preemptive action. Drones provide aerial views, offering a strategic advantage in monitoring large gatherings from above often equipped with cameras and sometimes non-lethal payloads like tear gas. For instance, VCs invested a total of USD 1.5 Billion since 2012 in drone commercial startups that are shaping the industry. For example, in 2022, the Border Security Force (BSF) created a drone system for dropping tear gas shells to assist police in managing protesters and rioters. The “Drone Tear Smoke Launcher” can drop shells from an unmanned aerial vehicle or drone at designated spots enhancing the effectiveness of security forces in law-and-order management. Furthermore, real time surveillance technologies that include advanced facial recognition and thermal imaging help to identify agitators and track crowd dynamics, which ensure targeted and efficient law enforcement responses while aiming to maintain safety and order.

Rising Focus on Training

The increasing complexity and capabilities of riot control equipment have led to an increased focus on comprehensive training programs for law enforcement. These programs are mainly designed to ensure that officers are proficient in technical aspects of equipment like drones, tasers, and advanced surveillance tools while also understanding the strategic applications of these technologies in crowd management. According to the International Trade Administration, the market for surveillance systems in India is presently valued at approximately USD 2.5 Billion. Moreover, in 2022, the Kentucky Army National Guard's 1st Battalion, 149th Infantry Regiment carried out riot control training in Germany, focusing on how to handle riots and civil disturbances involving improvised incendiary devices and Molotov cocktails. The training hosted by the Slovenian military mainly aimed to prepare the soldiers for their upcoming deployment to the Balkan region. The soldiers gained valuable skills and confidence in maintaining order and carrying out their mission, focusing on the importance of proper care and defensive techniques. Training emphasizes not only operational skills but also situational awareness, decision making under pressure, and adherence to legal and ethical standards. This ensures that interventions are not only effective but also proportionate and respectful of civil liberties, thereby offering a favorable riot control system market outlook.

Riot Control System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global riot control system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technology, and end user.

Analysis by Product:

- Defensive Weapons

- Personal Protective Equipment

- Surveillance Systems

- Offensive Weapons

- Direct Contact Weapons

- Directed Energy Weapons

Defensive weapons (personal protective equipment and surveillance systems) are tools and equipment designed to protect law enforcement personnel and control crowds without inflicting serious harm. These also inculcate riot shields, body armor, helmets, barriers, and surveillance systems. Riot shields and barriers help to create safe distances between law enforcement and crowds while body armor and helmets provide protection from projectiles and physical attacks. Defensive systems are widely used during protests and demonstrations to maintain public safety and reduce risks for both officers and civilians. Their non-lethal nature makes them essential in modern crowd management strategies.

Offensive weapons (direct contact weapons and directed energy weapons) focus on dispersing crowds and neutralizing threats. These include tear gas, stun grenades, water cannons, rubber bullets, and acoustic devices. Tear gas and rubber bullets are commonly used to scatter large groups while stun grenades temporarily disorient individuals. Water cannons and acoustic devices are employed to deter aggressive behavior without causing lasting harm. Offensive weapons are highly effective in situations where escalations occur, providing law enforcement with tools to regain control efficiently and minimize risks.

Analysis by Technology:

- Electromagnetic

- Mechanical and Kinetic

- Chemical

- Others

Electromagnetic technology includes tools that use directed energy or electromagnetic waves to manage crowds or neutralize threats. Examples inculcate active denial systems (ADS) and directed-energy weapons. These systems cause temporary discomfort, such as heat sensation on the skin, to disperse crowds without causing lasting harm. Electromagnetic technology is favored for its non-lethal and precision capabilities, making it effective in high-pressure situations.

Mechanical and kinetic technologies possess rubber bullets, water cannons, riot shields, and batons, designed for physical engagement with crowds. These tools are used to disperse protesters, control aggressive individuals, or create barriers between law enforcement and demonstrators. Rubber bullets and water cannons are commonly employed for scattering large crowds while shields and batons provide close-range protection and defense. Mechanical and kinetic systems are reliable, cost-effective, and easy to deploy, making them widely beneficial for law enforcement agencies worldwide.

Chemical technology involves the use of tear gas, pepper spray, smoke grenades, and other chemical agents to manage crowds or neutralize threats. These substances cause temporary irritation to the eyes, skin, or respiratory system, forcing individuals to disperse. Tear gas is one of the most common chemical tools utilized in protests and riots, providing effective crowd control without permanent harm. Chemical technologies are sought-after due to their quick-action capabilities and effectiveness in managing large groups.

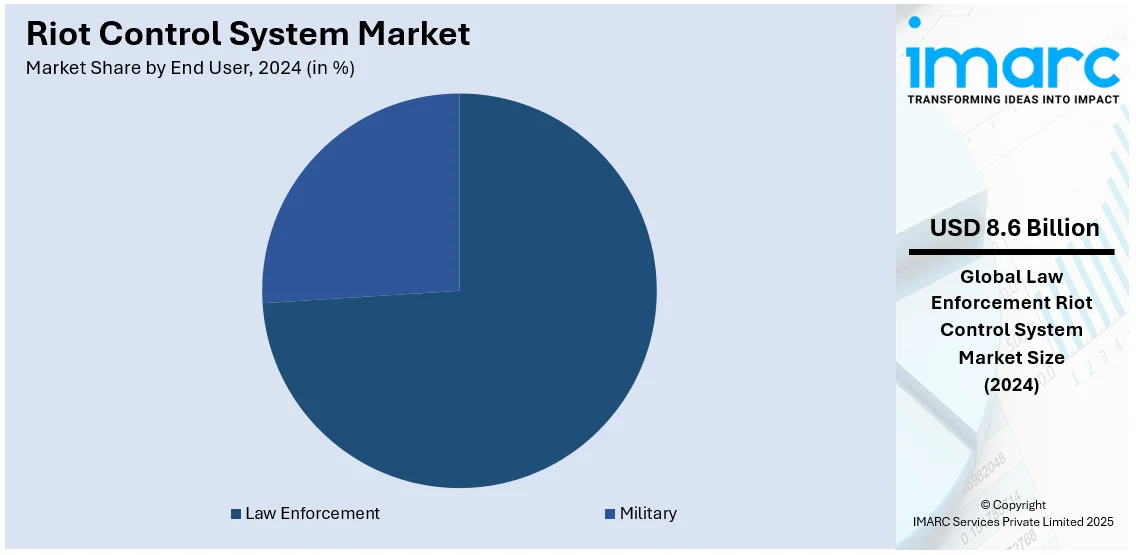

Analysis by End User:

- Law Enforcement

- Military

Law enforcement leads the market with 73.6% of the market share. Law enforcement is responsible for maintaining order during protests, civil unrest, and large public gatherings. As social, political, and economic tensions rise, law enforcement agencies depend on non-lethal riot control tools to manage crowds effectively without resorting to violence. Technologies like tear gas, rubber bullets, stun grenades, and water cannons help to disperse crowds while minimizing long-term harm, which is crucial in maintaining public safety. Additionally, law enforcement agencies wager on more advanced systems to improve their ability for responding efficiently and quickly to potential threats. These systems not only aid protect officers but also reduce the risk of injury to civilians. With urbanization increasing and large-scale events becoming more common, law enforcement agencies are continually updating their equipment to meet the riot control system market demand. This makes law enforcement the largest and most important end user in the riot control system market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is enjoying the leading position in the market, accounting for 34.8%. The region’s strong focus on public safety and law enforcement modernization is impelling the market growth. The region, especially the United States, faces frequent protests, demonstrations, and civil unrest, creating a constant need for enhancing defensive crowd management tools. In March 2024, the Biden-Harris Administration presented to Congress a proposed budget request of USD 849.8 Billion for the Department of Defense (DoD) for Fiscal Year (FY) 2025, in alignment with the limits set by Congress through the Financial Responsibility Act (FRA) of 2023. Government agencies and law enforcement agencies in North America prioritize the use of advanced non-lethal technologies to maintain order while minimizing harm and risks. There are also significant investments in security infrastructure and innovations in surveillance systems and less-lethal weapon technologies, enhancing the efficiency and precision of riot control systems. Strict regulations for public safety, coupled with the requirement to protect critical infrastructure. Additionally, the presence of leading manufacturers and defense contractors in the area ensures easy access to cutting-edge solutions.

Key Regional Takeaways:

United States Riot Control System Market Analysis

United states presently accounts for a share of 89.50%. The increasing adoption of riot control systems is closely tied to heightened investments in the chemical sector, particularly in the development and deployment of specialized deterrents. Tools, such as tear gas, smoke grenades, and pepper spray are receiving substantial attention since they offer effective crowd control mechanisms. These tools cater to scenarios demanding non-lethal solutions to disperse crowds or prevent escalations. For example, in 2016, Safariland secured a contract worth USD 7.3 Million with the New York City Police Department for ballistic gear. The focus on research and refinement has resulted in innovations that ensure improved safety standards and precision targeting, minimizing collateral impact. Law enforcement agencies and private security firms are integrating such equipment into their operational arsenals, driven by an emphasis on preparedness and situational versatility. The versatility of chemical deterrents has made them a pivotal component in diverse applications, ranging from public event management to critical infrastructure security, reflecting their high prominence in modern riot control strategies.

Europe Riot Control System Market Analysis

The growing focus on military advancements has enabled the adoption of riot control systems tailored to high-stakes scenarios. According to the European Defense Agency (EDA), EU Member States' defense spending reached approximately USD 302 Billion in 2023, a 10% increase from 2022. Advanced protective gear, acoustic devices, and specialized barricades are utilized to fortify capabilities in managing hostile crowds. These systems are designed to align with broader defense strategies, emphasizing rapid deployment and precision application. Investments in training programs and modular solutions have further streamlined their integration into diverse security protocols. Enhanced collaboration between defense agencies and private-sector innovators has yielded solutions that address both tactical and logistical challenges. The growing reliance on such systems reflects a commitment to safeguarding personnel while maintaining order in sensitive operational environments, highlighting their expanding role in the evolving landscape of military preparedness.

Asia-Pacific Riot Control System Market Analysis

The incorporation of drones is revolutionizing the adoption of riot control systems, with heightened interest in their capabilities for aerial surveillance and response. For instance, India boasted around 398 drone startups throughout the country, more than twice the 157 startups that were present three years prior. Drones equipped with advanced cameras and non-lethal payloads provide unparalleled situational awareness among the masses, enabling proactive crowd management and tactical response. Investments in this area have facilitated the development of lightweight and long-endurance platforms that can operate across various terrains and environments. The ability to gather real-time intelligence and deploy deterrents from the air reduces risks to on-ground personnel while enhancing operational effectiveness. Moreover, the integration of automated navigation systems and thermal imaging extends the functionality of drones, making them invaluable in complex riot scenarios. These advancements market a considerable shift towards more dynamic and technology-driven approaches in the realm of crowd control and security enforcement.

Latin America Riot Control System Market Analysis

Riot control systems are witnessing enhanced adoption owing to increased defense investments aimed at bolstering public safety and infrastructure security. For instance, in 2023, military expenditure in Central America and the Caribbean increased by 54% compared to 2014. Emphasis on protective equipment and rapid deployment tools ensures that forces can respond effectively to emergent threats. Specialized training and the incorporation of modular systems have facilitated their use across diverse operational scenarios. The strategic focus on ensuring readiness for unpredictable contingencies has driven the demand for adaptable and scalable solutions. As defense priorities expand, riot control systems are emerging as essential tools in maintaining order during challenging situations, demonstrating their evolving relevance in safeguarding stability.

Middle East and Africa Riot Control System Market Analysis

The growing emphasis on surveillance technology encourages the adoption of advanced riot control systems. For instance, Dubai Police commits to a significant investment of approximately USD 545 Million to enhance security and public safety. High-resolution monitoring tools and integrated communication networks are enhancing the ability to predict and manage crowd dynamics effectively. These systems employ cutting-edge imaging and data analytics to enable proactive decision-making and coordinated responses. The focus on technological upgrades ensures better situational consciousness and resource optimization, particularly in regions prioritizing security enhancement. Such investments reflect a broader trend towards leveraging surveillance advancements to reinforce public safety measures and improve riot control capabilities, underlining their critical role in modern security frameworks.

Competitive Landscape:

Key players in the market work on developing innovative solutions and meeting the high demand for non-lethal technologies. Leading manufacturers invest heavily in research and development (R&D) to create advanced products like tear gas, stun grenades, water cannons, and electromagnetic systems that ensure effective crowd management with minimal harm. These companies team up with government agencies and law enforcement to provide customized solutions tailored to specific security needs. They also focus on improving the safety and efficiency of existing riot control tools through advancements in design and materials. Additionally, they expand their global presence by forming partnerships and securing large contracts, ensuring the availability of cutting-edge systems. For instance, in May 2024, Axon, a worldwide leader in public safety technology, revealed its acquisition of Dedrone, a pioneer in airspace security, to expedite the creation of cutting-edge drone solutions that safeguard communities and permit the secure deployment of drones for first responders. The merger merges Axon's 30-year heritage of innovations with Dedrone's advanced counter-drone technologies to transform public safety.

The report provides a comprehensive analysis of the competitive landscape in the riot control system market with detailed profiles of all major companies, including:

- Amtec Less Lethal Systems Inc.

- Byrna Technologies, Inc.

- Combined Systems Inc.

- Condor Non-lethal Technologies (EDGE Group PJSC)

- FN Herstal

- Milkor Pty Ltd.

- NonLethal Technologies Inc.

Latest News and Developments:

- August 2024: Moscow Metro law enforcement broadened their armored vehicle collection by incorporating the Chinese-produced Dongfeng EQ2091XFB riot control unit, according to Avtobusy y Vobbechle. This inclusion corresponds with a wider trend of rising armored vehicle purchases, encompassing 15 local models, such as the Buran and Z-STS Akhmat. The action indicates increased security protocols in Moscow's transportation network.

- May 2024: BAE Systems entered into a contract with Sweden to supply newly manufactured CV90 combat vehicles, upgrading the Swedish Army's fleet with modern capabilities and substituting older vehicle models, including those sent to Ukraine. This agreement also creates possibilities for additional countries to participate in the acquisition of CV90MkIIICs, thereby broadening the influence and presence of these combat-tested infantry fighting vehicles.

- February 2024: AARDVARK teamed up with Combined Systems, Inc. to distribute less-lethal products from Combined Tactical Systems and Penn Arms Launchers, enhancing riot management solutions. This signifies a strategic change following AARDVARK's 25-year exclusive alliance with a different manufacturer. CEO Jon Becker shared excitement about partnering with CSI to improve less-lethal initiatives. The collaboration strengthens AARDVARK's dedication to safeguarding tactical operators.

- February 2024: The Haryana Police emerged as the first police force in India to utilize drones for deploying tear gas canisters. At a demonstration at the Shambhu Barrier along the Punjab-Haryana border, drones were deployed to release tear gas canisters on the farmers. This groundbreaking approach to riot management signifies an important change in addressing extensive demonstrations. The event emphasizes the incorporation of cutting-edge technology into law enforcement strategies.

Riot Control System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Technologies Covered | Electromagnetic, Mechanical and Kinetic, Chemical, Others |

| End Users Covered | Law Enforcement, Military |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Germany, France, United Kingdom, Italy, Spain, Russia, Indonesia, Brazil, Mexico |

| Companies Covered | Amtec Less Lethal Systems Inc., Byrna Technologies, Inc., Combined Systems Inc., Condor Non-lethal Technologies (EDGE Group PJSC), FN Herstal, Milkor Pty Ltd., NonLethal Technologies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the riot control system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global riot control system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the riot control system industry and its attractiveness.

Key Questions Answered in This Report

The riot control system market was valued at USD 11.63 Billion in 2024.

IMARC estimates the riot control system market to exhibit a CAGR of 4.23% during 2025-2033, reaching a value of USD 17.21 Billion by 2033.

The rising incidents of protests, demonstrations, and riots worldwide are creating the need for effective riot control tools. Besides this, the increasing focus on public safety, with government agencies prioritizing non-lethal solutions to ensure public safety while minimizing harm during crowd control, is impelling the market growth. Moreover, innovations in less-lethal weapons, surveillance systems, and electromagnetic technologies are enhancing efficiency, thereby catalyzing the demand for riot control systems.

North America currently dominates the riot control system market, accounting for a share of 34.8%, driven by its frequent incidents of civil unrest, significant government investments in public safety, and widespread adoption of advanced non-lethal technologies.

Some of the major players in the riot control system market include Amtec Less Lethal Systems Inc., Byrna Technologies, Inc., Combined Systems Inc., Condor Non-lethal Technologies (EDGE Group PJSC), FN Herstal, Milkor Pty Ltd., NonLethal Technologies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)