Rolling Stock Market Size, Share, Trends and Forecast by Product Type, Locomotive Technology, Application, and Region, 2025-2033

Rolling Stock Market Size and Share:

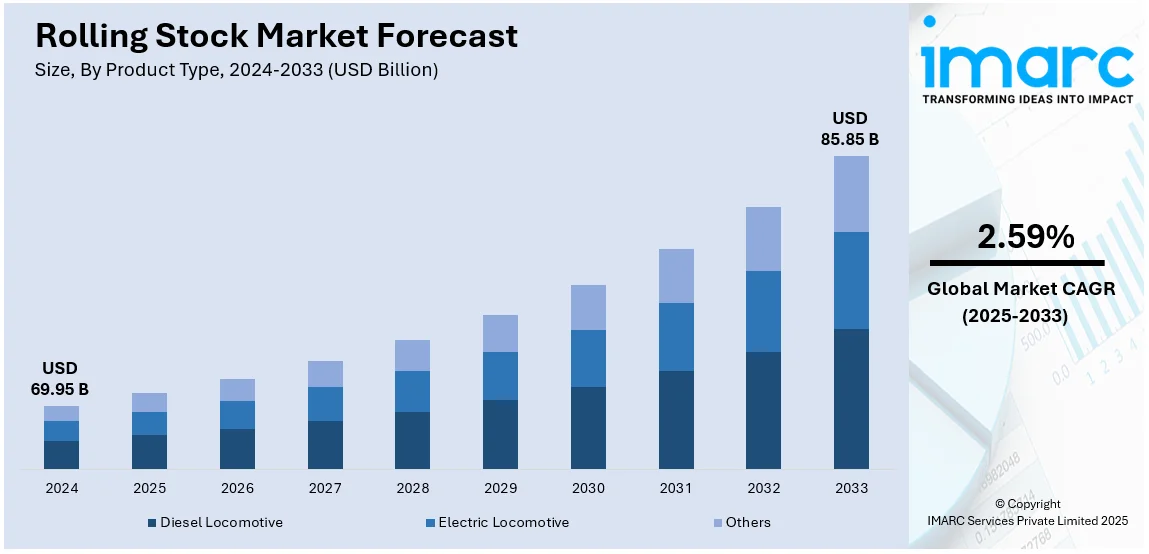

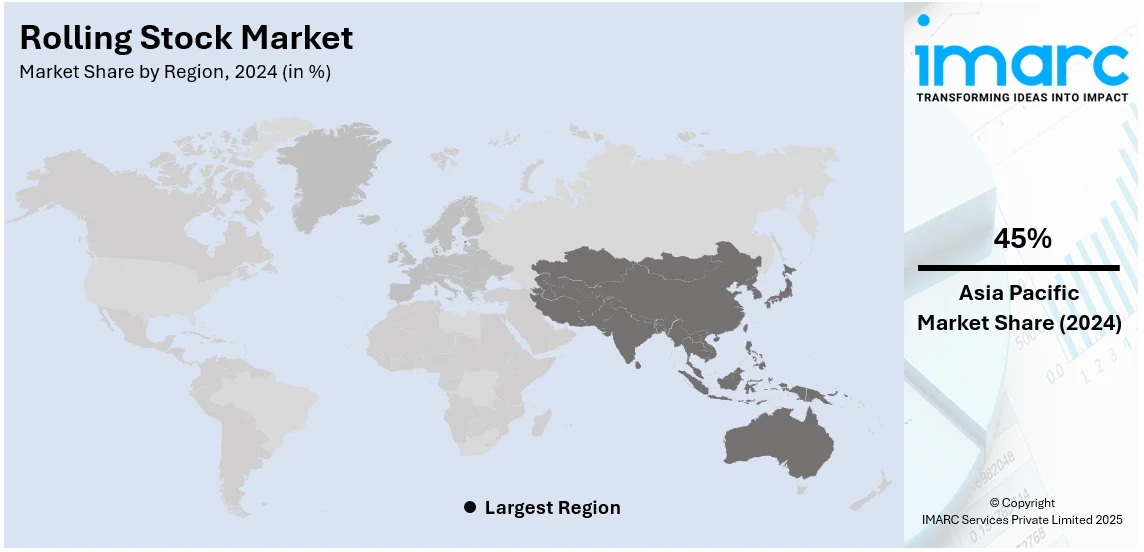

The global rolling stock market size was valued at USD 69.95 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 85.85 Billion by 2033, exhibiting a CAGR of 2.59% during 2025-2033. Asia Pacific currently dominates the market with a share of 45% due to rapid urbanization and infrastructure development, environmental sustainability, technological advancements, electrification, high-speed rail expansion, and a focus on efficiency and sustainability in freight logistics are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 69.95 Billion |

| Market Forecast in 2033 | USD 85.85 Billion |

| Market Growth Rate (2025-2033) | 2.59% |

The growing urban population across the globe has led to a heightened demand for effective and dependable public transportation networks. Cities are becoming denser, and with more people commuting daily, the existing infrastructure are struggling to keep up. Trains, metro systems, and light rail offer a sustainable solution by moving large numbers of passengers quickly and efficiently. Governments and local authorities are making significant investments to expand transit systems in order to alleviate congestion and lower emissions. For example, in the year 2023, around 1,760 kilometers of urban transit lines, including rail and bus projects, were inaugurated worldwide, adding 1,100 new stations. Additionally, travelers today value convenience, and modern rolling stock, with features like Wi-Fi, comfortable seating, and accessibility options, is designed to meet these expectations. This growing reliance on transit systems is a significant factor pushing the rolling stock market forward.

The United States stands out as a key market disruptor, driven by governments and private players investments into rail infrastructure projects. The U.S. Department of Transportation’s (USDOT) Federal Railroad Administration (FRA) has allocated over $2.4 billion in funding from the Bipartisan Infrastructure Law for 122 rail improvement initiatives across 41 states and Washington, D.C. These projects aim to enhance rail safety, reliability, and resilience, ensuring faster, more efficient movement of goods and people, while reducing disruptions, shipping costs, and pollution. These investments go beyond building tracks as they also involve upgrading stations, purchasing new rolling stock, and enhancing maintenance facilities. For manufacturers and suppliers, this translates into a steady demand for advanced trains, metro cars, and other vehicles.

Rolling Stock Market Trends:

Urbanization and Infrastructure Development

The increasing rate of urbanization across the globe is a significant driver for the rolling stock market. For instance, China’s high-speed rail network expansion saw a total length increase to 42,000 kilometers by 2022, as per reports. As more people move to urban areas, there is a growing need for efficient and sustainable transportation systems to alleviate road congestion and reduce environmental impact. Governments and private entities are investing heavily in the development and expansion of railway infrastructure, including the construction of new railway lines and the electrification of existing ones. This surge in infrastructure development directly stimulates demand for rolling stock, including locomotives and passenger coaches. In addition, urban transit systems are adopting modern rolling stock to enhance the quality of public transportation, further contributing to market growth.

Environmental Sustainability

Environmental concerns, particularly related to carbon emissions and air quality, are driving the transition towards cleaner and more sustainable transportation solutions. In response, the rolling stock market is witnessing a shift towards electric and hybrid locomotives, as well as energy-efficient passenger coaches. According to industrial reports, the European Green Deal aims to reduce transport emissions by 90% by 2050, significantly influencing investments in energy-efficient rolling stock technologies. Electrification of railway lines and the adoption of alternative fuels reduce the carbon footprint of rail transport, aligning with global efforts to combat climate change. This green focus not only attracts government support but also encourages private sector investment in environmentally friendly rolling stock technologies. Furthermore, stringent emissions regulations and sustainability targets in various regions are exerting additional pressure on the industry to accelerate the development and adoption of eco-friendly rolling stock.

Technological Advancements

The integration of advanced technologies into rolling stock is another key driver of market growth. Digitalization, automation, and predictive maintenance systems are revolutionizing the railway industry. Predictive maintenance, for instance, enables operators to proactively address maintenance needs, reducing downtime and improving the overall efficiency of rolling stock operations. Furthermore, the implementation of digital signaling and communication systems enhances safety and efficiency. High-speed trains, a growing segment in the industry, are pushing the envelope in terms of technology adoption, requiring advanced systems for passenger comfort, speed, and safety. Furthermore, magnetic levitation (Maglev) trains have reached commercial speeds of up to 600 km/h, with China launching the Shanghai Maglev in 2021, the fastest operational train globally. These technological advancements not only attract buyers looking for modern solutions but also stimulate innovation within the rolling stock industry.

Rolling Stock Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rolling stock market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, locomotive technology, and application.

Analysis by Product Type:

- Diesel Locomotive

- Electric Locomotive

- Others

In 2024, diesel locomotives represent the largest market share with 76.5%. Diesel locomotives remain relevant due to their versatility and ability to operate on non-electrified railway lines, especially in regions with less developed infrastructure. The demand for these locomotives persists, particularly in emerging economies where electrification projects are ongoing. On the other hand, electric locomotives are experiencing increased demand driven by their environmental benefits and efficiency. Electrification of railway networks is expanding globally, enhancing the appeal of electric locomotives as sustainable transportation options. Additionally, the broader adoption of high-speed rail and urban transit systems contributes to the growing demand for electric locomotives. Beyond diesel and electric locomotives, other specialized rolling stock, such as hybrid and hydrogen-powered trains, are gaining traction as innovative solutions for reducing emissions and improving rail transport sustainability, especially in regions with a strong focus on clean energy initiatives.

Analysis by Locomotive Technology:

- Conventional Locomotive

- Turbocharge Locomotive

- Maglev

Conventional locomotives lead the market share in 2024 with 42.5%. Conventional locomotives, though traditional, continue to see demand due to their reliability and cost-effectiveness, especially in freight transport and less developed rail networks, bolstering the market growth. Moreover, turbocharged locomotives are gaining popularity because of their enhanced power and fuel efficiency, making them well-suited for both freight and passenger rail services. The ability to deliver higher speeds and increased hauling capacity while minimizing emissions contributes to their appeal, aiding in market expansion. Meanwhile, magnetic levitation (maglev) technology is emerging as a futuristic and eco-friendly solution. Maglev trains, which float above the tracks using magnetic forces, offer unmatched speed and energy efficiency, attracting interest for high-speed intercity travel. As governments and private enterprises seek innovative transportation solutions, the demand for maglev technology is on the rise, particularly for cutting-edge passenger rail systems.

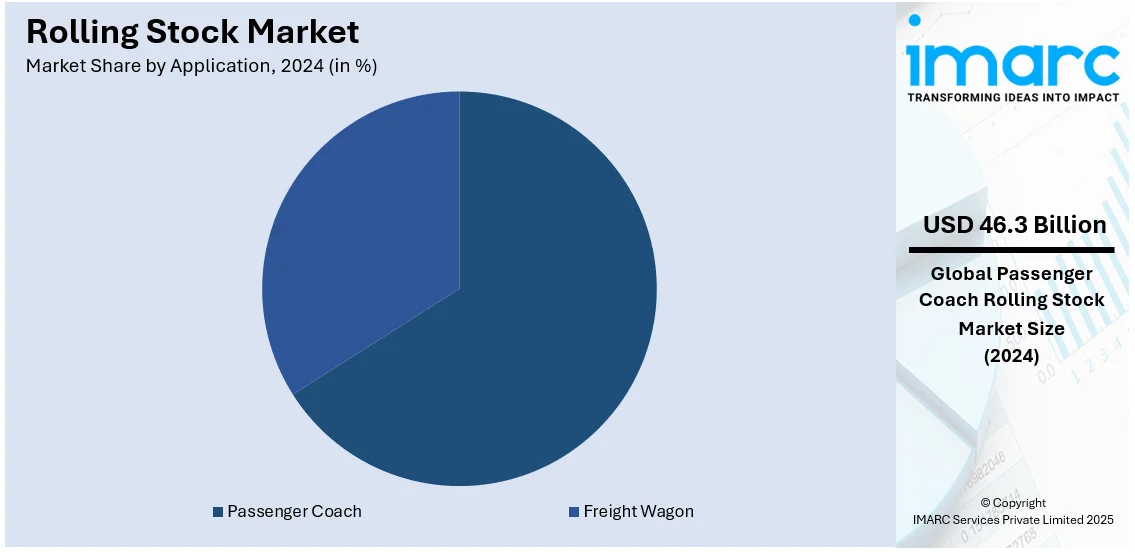

Analysis by Application:

- Passenger Coach

- Freight Wagon

Passenger coach represent the largest share of the market with 66.2% in 2024. In the passenger coach sector, the increasing focus on providing comfortable, efficient, and sustainable transportation options is spurring demand. Rapid urbanization is leading to higher passenger volumes on urban transit systems, necessitating the procurement of modern and technologically advanced passenger coaches, which is impelling the market growth. Furthermore, the expansion of high-speed rail networks and the demand for intercity travel are fueling the need for innovative and high-performance passenger rolling stock. In contrast, the freight wagon segment is experiencing growth due to the relentless demand for efficient and cost-effective freight transportation. Freight wagons play a pivotal role in logistics and supply chain operations, offering the flexibility to transport a wide array of goods. As e-commerce and global trade continue to expand, the demand for specialized freight wagons, capable of accommodating various cargo types and meeting stringent safety and efficiency standards, remains on an upward trajectory.

Regional Analysis:

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, the Asia-Pacific region held the largest market share at 45%. This market growth is fueled by rapid urbanization, population expansion, and significant investments in rail infrastructure. Leading countries like China, India, and Japan are at the forefront of high-speed rail and metro system development, bolstered by government efforts to improve public transportation and reduce carbon emissions. As of 2023, China boasts the world's largest high-speed rail network, surpassing 40,000 kilometers, highlighting its dedication to modernizing transportation. India is investing heavily in metro and bullet train projects, such as the Mumbai-Ahmedabad high-speed rail corridor. Japan continues to lead the way with its Shinkansen network, setting high standards for efficiency and safety in rail transportation. Increasing demand for advanced rolling stock, including hybrid and electric trains, aligns with the region's focus on sustainable transport solutions. These factors, combined with growing cross-border trade facilitated by freight rail, establish Asia-Pacific as the leading market for rolling stock.

Key Regional Takeaways:

North America Rolling Stock Market Analysis

The continued steady growth in the North American rolling stock industry is due to the significant investments in rail infrastructure, demand for freight transportation, and upgradation of passenger rail systems. This expansion brings forth an extensive network of freight rail systems throughout the region, particularly in the most critical parts of the United States, which assure the immediate contribution of freight transport to the economy. The U.S. federal government has additionally committed $66 billion for improving the rail infrastructure through the Bipartisan Infrastructure Law to upgrade freight and passenger systems. Alongside the USA, Canada is also progressing in its rail projects such as the Ontario Line in Toronto, which aims to improve urban transit connectivity. Besides all these, the urgent requirement for sustainable solutions has driven the attention on hybrid and electric rolling stock and has encouraged manufacturers to invest in energy-efficient technologies to cope up with the changing environment standards. The integration of advanced digital technologies, such as predictive maintenance systems, is also driving further growth in the market.

United States Rolling Stock Market Analysis

Major traction of high growth rate at the level is being portrayed within the market across the rolling stocks in U.S. in connection with rail investments and upgrades. The Department of Transportation approved USD 2.4 billion toward implementing 122 Rail Improvement programs and projects with key objectives directed for safety and higher reliability through modernization 2023 end. This focus on modernization is critical in keeping passenger and freight movement in the rail system competitive, where private rail corporations spend an average of USD 23 billion to ensure the upgrade and maintenance of their vast networks. Passenger rail also remains strong, with Amtrak recording record ridership of 32.8 million trips in FY2024, or a 15% increase over FY2023. Ticket revenues reached USD 2.5 billion, symbolizing the fast-growing trend by the public for sustainable and efficient movement, an industrial report stated. High-speed rail technologies are developing. Green transportation and support from governments push the market forward. In doing so, it places the U.S. rolling stock market as one of the leading in rail innovation and infrastructure around the world.

Europe Rolling Stock Market Analysis

The European rolling stock market is moving at fast pace. According to an industrial report, the EU's record investment of Euro 7 billion (USD 7.2 billion) into sustainable, safe, and smart transport infrastructure stands at its back. Such funding, under the CEF, underlines initiatives focused on railway projects closely related to climate objectives, modernizing waterways, ports, and railways. Funding for projects amounts to 80%, and important initiatives include rail linkages such as Rail Baltica, the Lyon-Turin connection, and the Fehmarnbelt tunnel. These projects seek to improve trans-European rail connections on the TEN-T network, strengthening Europe's leadership in sustainable rail transport. Ireland, Spain, and other countries will also improve their maritime ports to upgrade the infrastructure that will support renewable energy and shore-side electricity for ships. The inland waterways such as the Seine-Scheldt basin and Danube are also being upgraded to enhance cross-border connections. These initiatives, combined with the development of cooperative Intelligent Transport Systems, position Europe as a pioneer in modern, sustainable, and efficient rolling stock solutions.

Asia Pacific Rolling Stock Market Analysis

Asia Pacific rolling stock market is experiencing tremendous growth with vast infrastructure investments and urbanization. China Railway has projected that the fixed-asset investment in the railway sector would reach 590 billion yuan (around USD 82.08 billion) in 2025, and 2,600 km of new rail tracks are scheduled to be completed and become operational. This heavy investment reflects the fact that China will increase its rail network, improving freight and passenger services. India's plans for rail electrification and modernization are another example of the region's focus on sustainable growth; by 2030, India hopes to achieve a zero-emission network. Japan remains a leader in high-speed rail technology with improvements to its Shinkansen network. Collaboration, as in the case of Bharat Dynamics' collaboration with global players, facilitates the transfer of technology and innovation in the region. Asia Pacific continues to be a strong driving force for the global rolling stock market with its growing emphasis on urban transit systems and freight rail development.

Latin America Rolling Stock Market Analysis

Latin America is expanding its market for rolling stock as countries take the plunge and invest in transformational rail infrastructure projects to strengthen connectivity and enhance economic growth. According to industrial reports, in Mexico, a high-speed train connecting Mexico City and Querétaro at an investment of USD 4.5 billion will build a 583 km rail line, increasing regional mobility. Some other strategic projects are Mexico City-Toluca train, and the connection of 30 km that directly links Matamoros and Brownsville for access to the U.S. These initiatives depict Mexico's continued efforts towards its modern rail systems for passengers as well as cargo transport. In Brazil, a USD 2.74 billion deal with mining giant Vale will renew concessions for the Carajás and Vitória a Minas railways until 2057, as per reports. That money will update infrastructure and expand freight rail capacity to bolster Brazil's logistics capabilities. Taken together, these deals underscore efforts by Latin America to modernize its rail networks, making it an emerging market in the world of rolling stock.

Middle East and Africa Rolling Stock Market Analysis

Ambitious rail projects that improve connectivity, ease traffic, and make sustainable transportation an effective option is driving the Middle East rolling stock market's revolutionary expansion. The Dubai Sky Pod Network is expected to open with 21 stations by 2030, transporting around 8,400 passengers per hour at a speed of 50 km/h, according to industry projections. This will undoubtedly be a significant advancement in the evolution of urban mobility. Furthermore, the UAE's 1,200-kilometer Etihad Rail network, which has been invested USD 13.6 billion, aims to cut carbon emissions by up to 80% while also expanding the country's GDP to about USD 54 billion. According to an industry report, Saudi Arabia's railway projects include the USD 60 billion Jeddah Metro project and the Saudi Landbridge, a 2,400 km rail line connecting Jeddah and Dammam, which is expected to be completed by 2027 with a capacity of 2 million containers per year. The Haramain High-Speed Rail, which carries over 60 million passengers annually, is also changing the face of transport infrastructure in the region and driving economic growth.

Competitive Landscape:

The competitive landscape of the global rolling stock market is characterized by a mix of established industry leaders and emerging players vying for market share. Key incumbents dominate the market with extensive product portfolios and global reach, often securing large-scale contracts for high-speed trains, electric locomotives, and passenger coaches. These companies leverage their experience and technological prowess to maintain their stronghold. However, the market also witnesses the emergence of innovative startups and regional players, particularly in electric and maglev technology segments, challenging traditional leaders with niche solutions and localized expertise. Additionally, collaborations and strategic partnerships are becoming prevalent, fostering technology-sharing and global expansion. Regulatory compliance, environmental sustainability, and digitalization are increasingly shaping competition, prompting companies to invest in R&D to develop energy-efficient, eco-friendly, and technologically advanced rolling stock.

The report provides a comprehensive analysis of the competitive landscape in the rolling stock market with detailed profiles of all major companies, including:

- China Railway Construction Corporation Limited (CRCC)

- Alstom SA

- Siemens AG

- Wabtec Corporation

- Kawasaki Heavy Industries Ltd

- CJSC Transmashholding, Stadler Rail

- Hyundai Rotem

- Mitsubishi Heavy Industries Ltd

- Hitachi Rail Systems

Rolling Stock Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Diesel Locomotive, Electric Locomotive, Others |

| Locomotive Technologies Covered | Conventional Locomotive, Turbocharge Locomotive, Maglev |

| Applications Covered | Passenger Coach, Freight Wagon |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | China Railway Construction Corporation Limited (CRCC), Alstom SA, Siemens AG, Wabtec Corporation, Kawasaki Heavy Industries Ltd, CJSC Transmashholding, Stadler Rail, Hyundai Rotem, Mitsubishi Heavy Industries Ltd, Hitachi Rail Systems, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rolling stock market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global rolling stock market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rolling stock industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global rolling stock market was valued at USD 69.95 Billion in 2024.

IMARC Group estimates the market to reach USD 85.85 Billion by 2033, exhibiting a CAGR of 2.59% during 2025-2033.

The key factors driving the global rolling stock market include increasing urbanization and demand for efficient transit systems, rising investments in rail infrastructure, advancements in train technologies, growing freight transport needs, government policies supporting rail development, a shift toward sustainable transportation, and expanding high-speed rail networks globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the rolling stock market include China Railway Construction Corporation Limited (CRCC), Alstom SA, Siemens AG, Wabtec Corporation, Kawasaki Heavy Industries Ltd, CJSC Transmashholding, Stadler Rail, Hyundai Rotem, Mitsubishi Heavy Industries Ltd, Hitachi Rail Systems, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)