Russia Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Russia Advertising Market Overview:

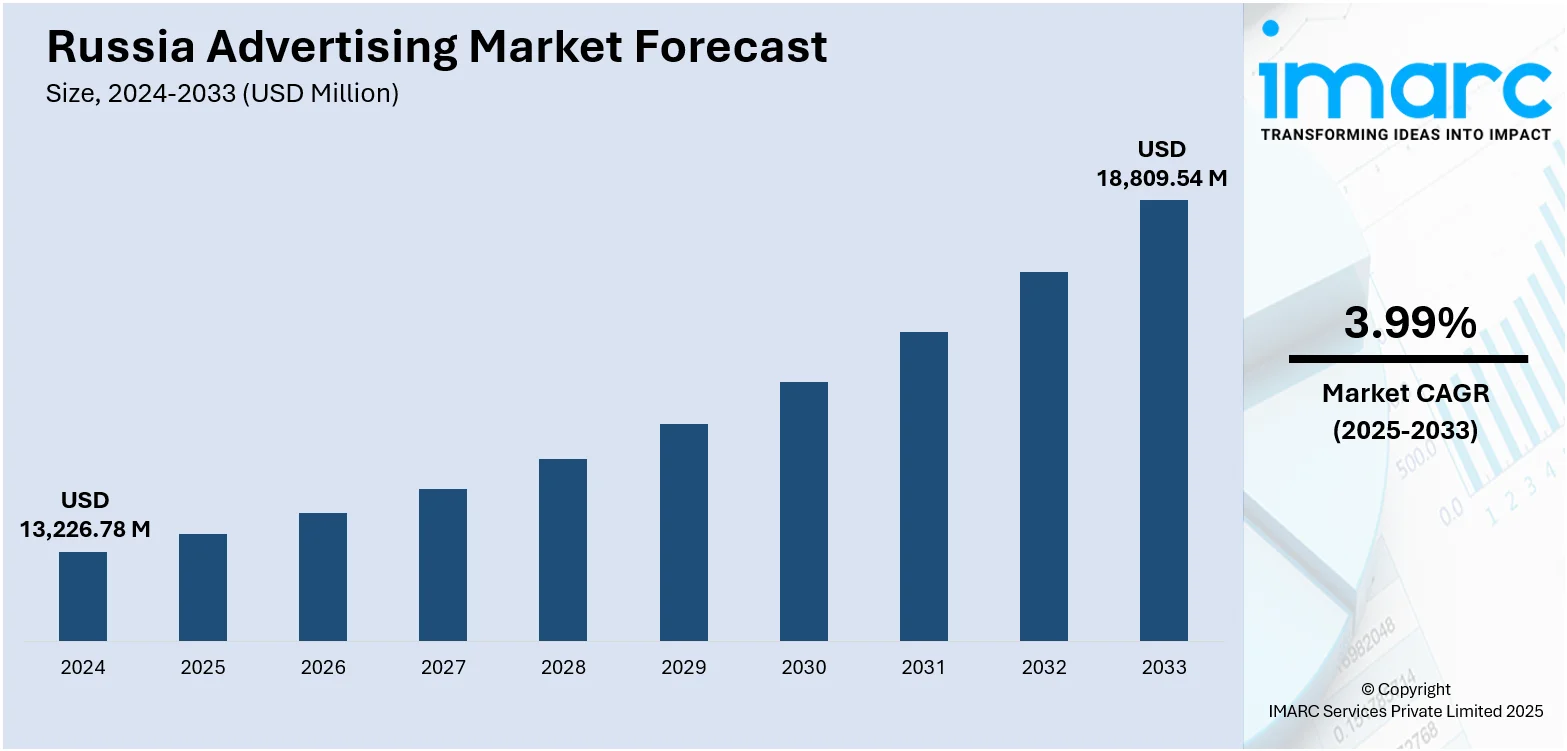

The Russia advertising market size reached USD 13,226.78 Million in 2024. The market is projected to reach USD 18,809.54 Million by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033. The market is evolving amid shifts in consumer behavior and the growing influence of digital media. Traditional media like television and print still have some relevance, but new media are increasingly making their presence felt. Marketers are adjusting by prioritizing digital channels, social networking, mobile, and video marketing. The regional strategy is also getting stronger as brands approach targeted consumers more easily. These persistent trends continue to influence the Russia advertising market share competitive environment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13,226.78 Million |

| Market Forecast in 2033 | USD 18,809.54 Million |

| Market Growth Rate 2025-2033 | 3.99% |

Russia Advertising Market Trends:

Surge in Retail and Marketplace Advertising

Russia’s retail media segment is showing striking momentum, with the share of retail‑based advertising rising sharply in 2024. This success stems from major retailers and e‑commerce platforms integrating their own ad tools and leveraging shopper data to target consumers directly on their platforms. As a result, this form of advertising combining product visibility and performance marketing has grown account of the total advertising market in Russia. The rapid adoption of these formats has led traditional retailers and online marketplaces alike to invest heavily in platforms that allow brands to promote within shopping environments. This approach benefits from first‑party data, AI‑driven analytics, and high levels of consumer intent, which make campaigns more measurable and actionable. The development of retail‑media ecosystems is fostering deeper collaboration between brands and retail platforms. Consequently, this shift is driving a strategic pivot in how ad budgets are allocated, moving increasingly toward results‑oriented, data‑rich placements in commerce‑adjacent channels. This momentum is a clear indicator of Russia advertising market trends, highlighting retail media’s role in shaping future investment strategies.

To get more information on this market, Request Sample

Digital Expansion Across Advertising Channels

In March 2024, the Russian ad market achieved a key milestone in total volume, heralding sustained momentum in both digital and traditional media. This shift is being fueled by more profound changes in consumer behavior, in which online channels now occupy the prime position in daily content consumption. Advertisers are increasingly diversifying their efforts, combining internet-based formats with more traditional media such as outdoor boards and broadcast to drive reach. Among online formats, video, search, and programmatic channels are witnessing increased investment, driven by rising mobile adoption and platform integration. At the same time, conventional media, although shrinking in some aspects, remains relevant for national reach and event-triggered campaigns. Campaign effectiveness today is heavily dependent on how well they perform across various touchpoints, particularly where digital and physical touchpoints meet. This integrated strategy is assisting brands to further align with fractured audiences and changing media environments. The steady move towards unified, multi-platform planning is not merely a fashion, it's transforming the entire promotional landscape. This cross-channel flexibility is a major driver of continued Russia advertising market growth.

Expansion of Programmatic and Contextual Advertising

In April 2024, programmatic ad spending in Russia saw a notable rise, reflecting a major shift in how brands purchase and place ads. As access to some international ad-tech platforms became limited, local DSPs and contextual ad tools gained traction, enabling advertisers to buy inventory directly on domestic platforms. This shift supports more precise targeting and better brand safety through context-driven placements ads embedded within relevant content such as news, search, or lifestyle sites. Native video and in-text ads are increasingly favored, blending with editorial environments to reach attentive audiences in a seamless way. Advertisers are leveraging AI and first-party data to optimize placements through automated auctions, reducing dependency on international systems. With these tools, campaigns can be managed efficiently across multiple channels display, in-app, OTT video, while maintaining greater transparency and control. The evolution toward context-rich, automated buying reflects a growing preference for relevance over volume, and credibility over scale. As this approach becomes more ingrained across campaigns, it underscores the central role of programmatic and contextual planning in modern advertising.

Russia Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

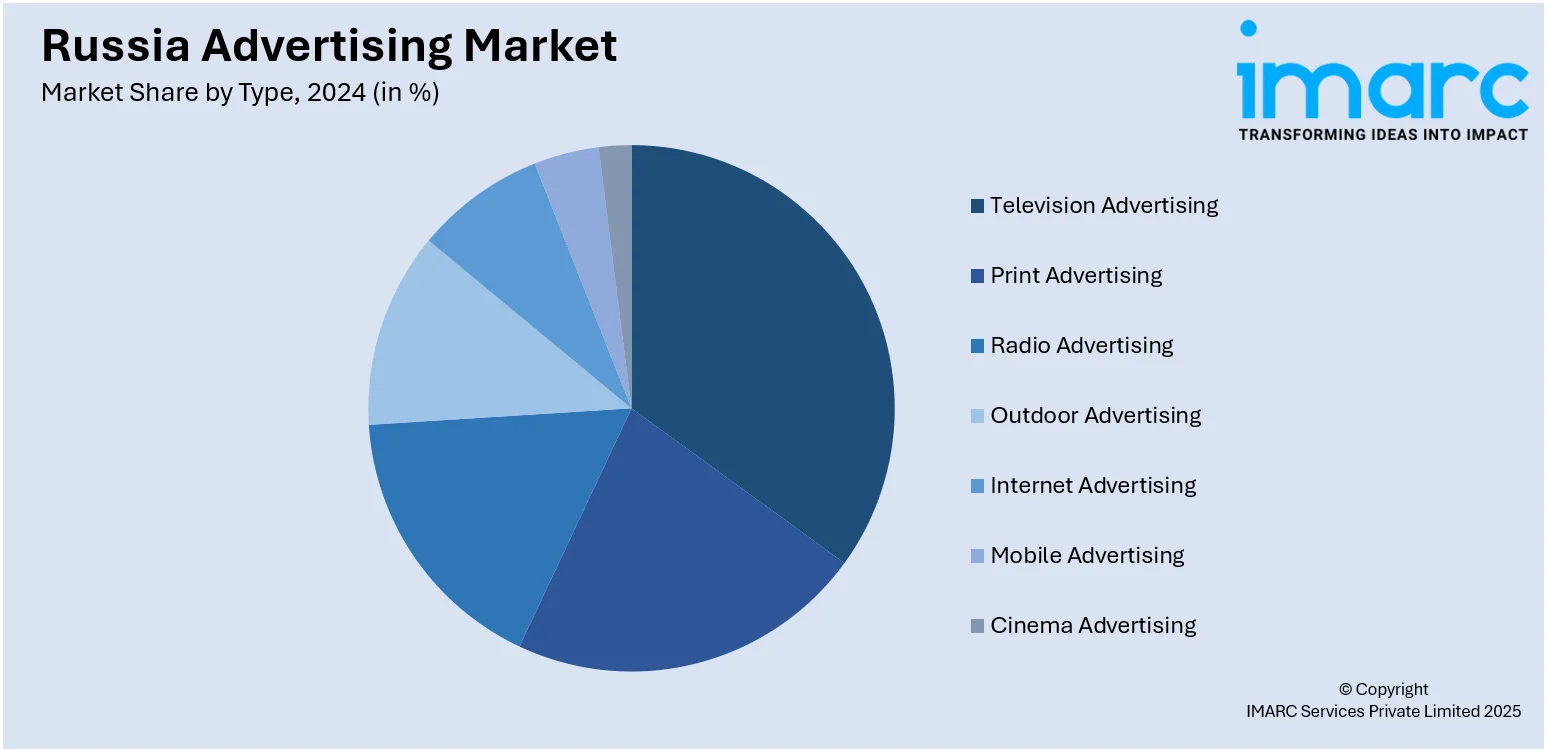

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Advertising Market News:

- June 2024: Wildberries, Russia’s leading e-commerce platform, is set to acquire Russ Group, the nation's top outdoor advertising operator, to build a comprehensive digital trading platform. This merger combines Wildberries’ online retail infrastructure with Russ's outdoor ad network, logistics hubs, and media assets, aiming to support small and medium-sized enterprises across Russia and beyond. The newly formed entity, RVB LLC, is led by Wildberries founder Tatyana Bakalchuk as general director and Russ CEO Robert Mirzoyan as executive director.

Russia Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia advertising market on the basis of type?

- What is the breakup of the Russia advertising market on the basis of region?

- What are the various stages in the value chain of the Russia advertising market?

- What are the key driving factors and challenges in the Russia advertising market?

- What is the structure of the Russia advertising market and who are the key players?

- What is the degree of competition in the Russia advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)