Russia Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Russia Agribusiness Market Overview:

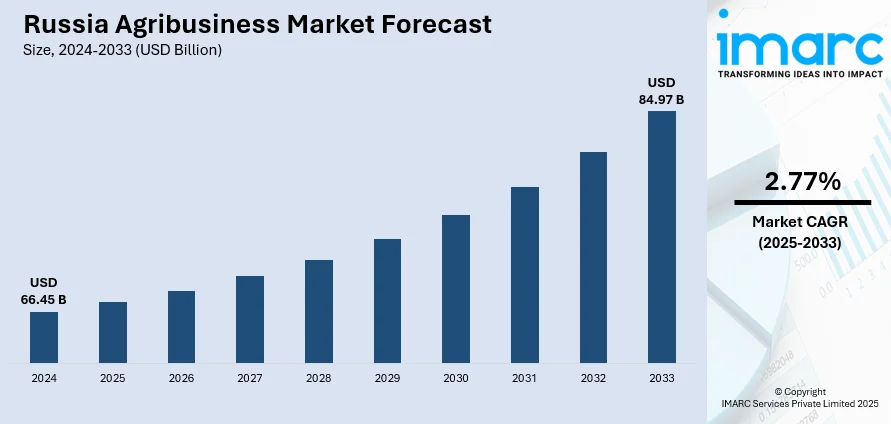

The Russia agribusiness market size reached USD 66.45 Billion in 2024. The market is projected to reach USD 84.97 Billion by 2033, exhibiting a growth rate (CAGR) of 2.77% during 2025-2033. Increasing export activities are encouraging farmers and agribusiness firms to invest in contemporary farming technologies, sophisticated processing plants, and enhanced storage facilities to comply with international standards. Besides this, rising integration of digital tracking and supply chain management tools is contributing to the expansion of the Russia agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 66.45 Billion |

| Market Forecast in 2033 | USD 84.97 Billion |

| Market Growth Rate 2025-2033 | 2.77% |

Russia Agribusiness Market Trends:

Increasing export demand for grains and dairy products

Rising exports of grains and dairy products are offering a favorable market outlook in Russia. Russia has become a leading exporter of wheat, sunflower oil, poultry, and dairy products, with international markets, especially in Asia, the Middle East, and Africa, showing strong demand due to competitive pricing and consistent quality. As per industry reports, as of May 21, 2025, Russia’s wheat export shipments from Black Sea ports reached 169,850 Tons. This growing export activity is motivating farmers and agribusiness companies to invest in modern farming technologies, advanced processing facilities, and improved storage infrastructure to meet international standards. Government policies that support agricultural subsidies, export incentives, and trade agreements are also fueling the market growth. Additionally, diversification of product offerings like high-protein grains, specialty dairy products, and premium meat cuts is helping Russia cater to niche markets abroad. Rising export revenues provide capital for reinvestment into research, sustainable farming practices, and capacity expansion, creating a cycle of growth. This robust export momentum is not only enhancing profitability for domestic producers but also increasing resilience against local market fluctuations, positioning Russia’s agribusiness sector for sustained long-term expansion.

To get more information on this market, Request Sample

Improved infrastructure and logistics

Improved infrastructure and logistics are significantly propelling the Russia agribusiness market growth by enhancing efficiency, reducing post-harvest losses, and enabling smoother domestic and international trade. As per the IMARC Group, the Russia logistics market size reached USD 110.42 Billion in 2024. The development of modern transportation networks, including upgraded highways, railways, and port facilities, ensures faster and more reliable movement of agricultural goods from farms to processing plants and export terminals. Investments in cold chain infrastructure are particularly important for preserving the quality of perishable products like dairy, meat, and fresh produce, allowing producers to tap into premium markets abroad. Storage facilities, such as grain silos and refrigerated warehouses, are expanding to accommodate the growing production volumes and prevent spoilage. Enhanced logistics systems also improve market accessibility for remote farming regions, encouraging greater participation in commercial agriculture. Integration of digital tracking and supply chain management tools is further streamlining operations, ensuring timely delivery. Government-backed projects to modernize rural infrastructure are creating stronger farm-to-market linkages, boosting competitiveness. Additionally, retail expansion is driving higher demand for well-distributed, high-quality agricultural products, stimulating spending on transport and storage capacity.

Russia Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

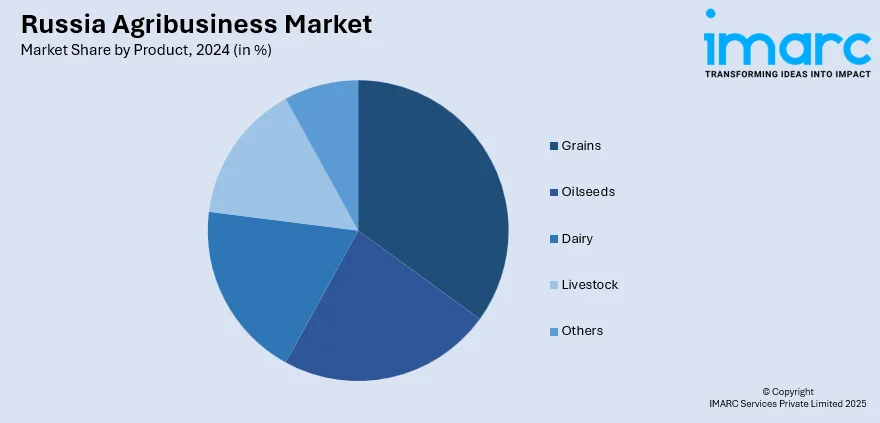

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Agribusiness Market News:

- In January 2025, the Tavros Group, a prominent diversified agribusiness entity in Russia, obtained a 33% share in Tosnensky Meat Processing Plant LLC (MPK Tosnensky) located in the Leningrad Region. The total valuation of the Tosnensky plant was approximately 300 Million rubles.

- In December 2024, VTB, Russia's second-biggest bank, purchased the prominent agribusiness firm, Agrocomplex Labinski, located in southern Russia. VTB announced its intention to enhance the company's efficiency and optimize its operations.

Russia Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia agribusiness market on the basis of product?

- What is the breakup of the Russia agribusiness market on the basis of region?

- What are the various stages in the value chain of the Russia agribusiness market?

- What are the key driving factors and challenges in the Russia agribusiness market?

- What is the structure of the Russia agribusiness market and who are the key players?

- What is the degree of competition in the Russia agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)