Russia ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Russia ATM Market Overview:

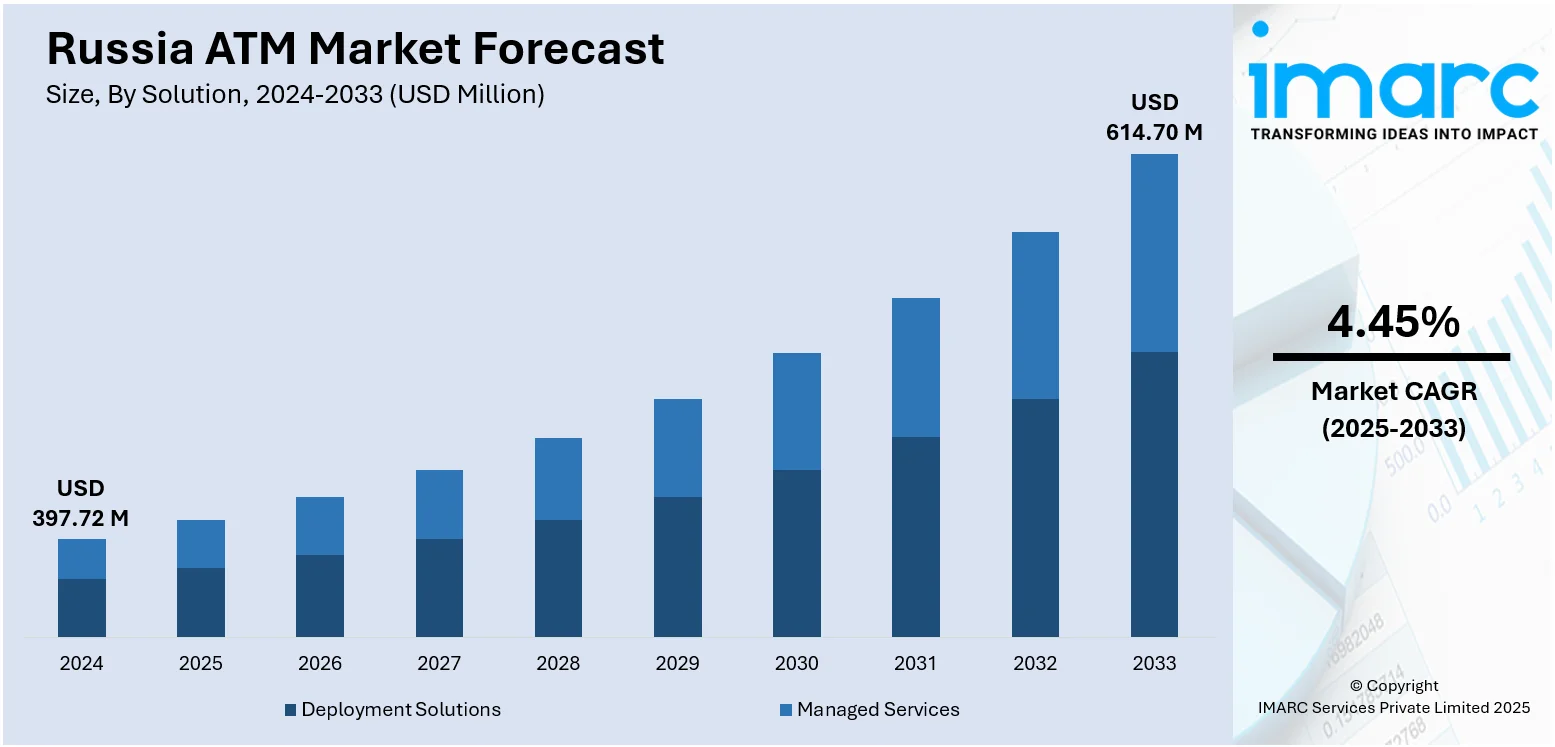

The Russia ATM market size reached USD 397.72 Million in 2024. The market is projected to reach USD 614.70 Million by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033. The market is witnessing steady growth driven by increasing demand for cashless transactions, banking automation, and the expansion of financial services. The adoption of advanced ATM technologies, including cash recycling and biometric authentication, is enhancing security and convenience for users. The growth of digital banking, coupled with supportive government regulations, is driving the development of the market, which is anticipated to further boost the Russia ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 397.72 Million |

| Market Forecast in 2033 | USD 614.70 Million |

| Market Growth Rate 2025-2033 | 4.45% |

Russia ATM Market Trends:

Adoption of Advanced Technologies

The Russian ATM market is gradually shifting toward technologies that foster customer convenience and security. Increased adoption of the new cash recycling type of ATMs is seen where users can deposit and withdraw cash at one go, thus ensuring smooth cash flow management for the banks. On the other hand, biometric authentication involving fingerprint and facial recognition are now considered convenient yet highly secure options for ensuring there is no element of fraud. Also, the use of contactless card payments is accelerating the speed of transactions and reducing physical contact making ATMs more efficient as well as more hygienic especially in a post-pandemic era. These technological innovations are enhancing the overall customer experience while providing avenues for banks to boost their operational efficiency and security to expedite the growth and modernization of the ATM industry in Russia.

To get more information on this market, Request Sample

Growing Focus on Security Enhancements

Security is the main concern for the ATM market in Russia, with more investments being made into high-tech security to prevent fraud and secure every user. Sophisticated encryption technologies are being used to secure ATM transactions so that client information is protected during withdrawals and lodgments. Anti-skimming solutions are increasingly being used to prevent unauthorized card data extraction, which is the greatest fear for banks and customers. Furthermore, the majority of ATMs are drilled with higher security systems comprising high-definition cameras and real-time monitoring, thus helping to prevent criminal activities and reduce response time in the case of an incident. Such security investments are important to ensure trust in ATM systems and are driving the Russia ATM market growth as consumers and financial institutions alike continue to seek safer and more secure banking services.

Remote Management and Monitoring

The increase in remote management of ATM is hugely changing the Russia ATM market with enhanced operational efficiency and faster resolution of issues. Remote maintenance systems are being used more and more by bankers for monitoring an ATM network remotely from a level central to them. Such systems provide real-time updates regarding ATM performance, cash status, and potential technical faults allowing that operator to promptly identify and rectify a fault minimizing downtime in the system. Remote maintenance also allows planning and tracking of maintenance work such as cash replenishment or technical maintenance, thereby contributing to the optimal functioning of the ATMs. Remote management also improves security, as it provides the ability to react immediately to possible threats or suspicious activities. Thus, the trend improves customer satisfaction while facilitating the growth of the ATM market across Russia.

Russia ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15.

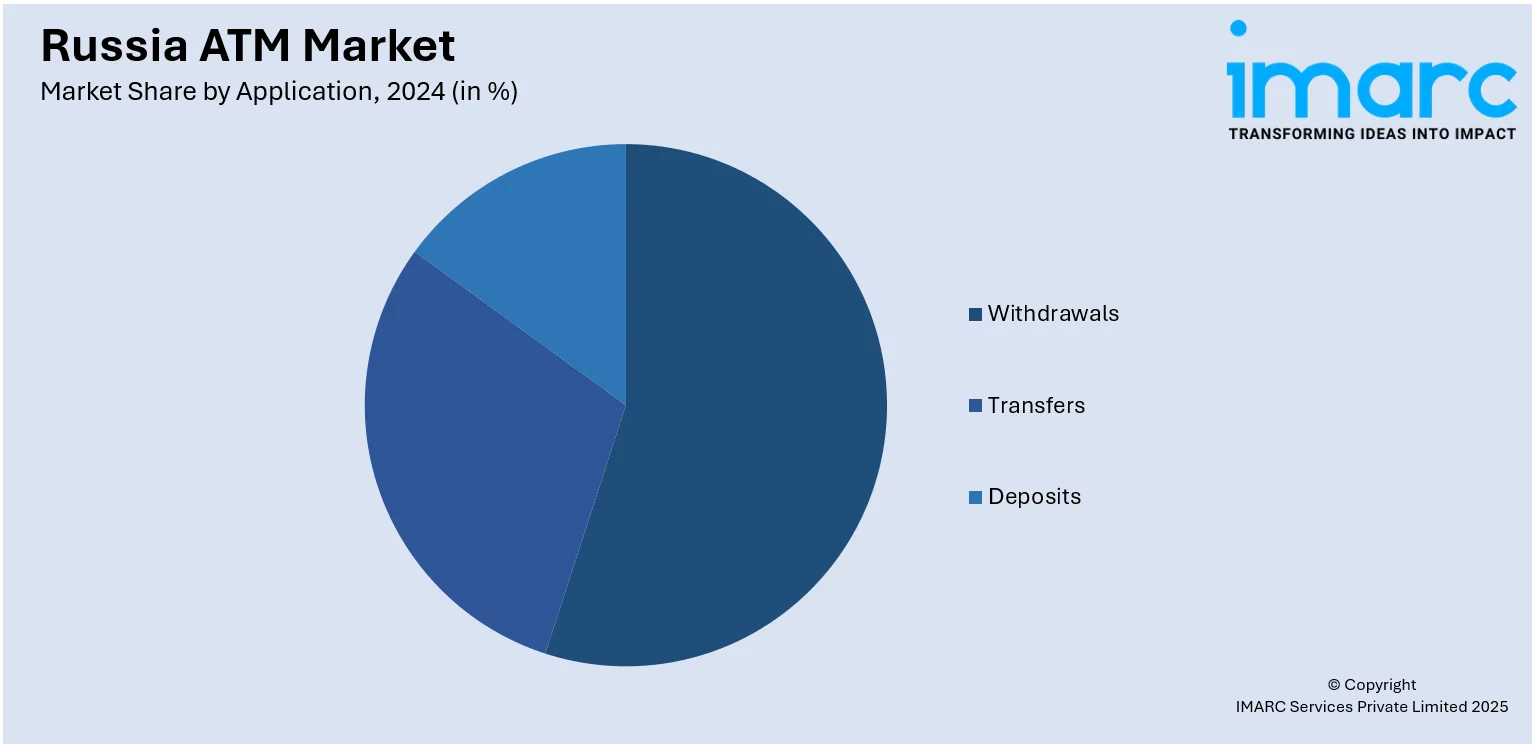

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant have been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia ATM Market News:

- In July 2024, Iran and Russia agreed to connect their ATM networks and trade in national currencies by August as announced by Central Bank of Iran. This agreement aims to strengthen banking ties, eliminate dollar dependence, and facilitate transactions amid ongoing sanctions affecting both nations.

- In November 2023, a Moscow manufacturer begun supplying domestically developed bank machines with three banks having received initial units. Featuring 80% local components and proprietary software, the ATMs include touch screens and biometric cameras. The plant aims to double production capacity by 2026, producing up to 15,000 machines annually.

Russia ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia ATM market on the basis of solution?

- What is the breakup of the Russia ATM market on the basis of screen size?

- What is the breakup of the Russia ATM market on the basis of application?

- What is the breakup of the Russia ATM market on the basis of ATM type?

- What is the breakup of the Russia ATM market on the basis of region?

- What are the various stages in the value chain of the Russia ATM market?

- What are the key driving factors and challenges in the Russia ATM market?

- What is the structure of the Russia ATM market and who are the key players?

- What is the degree of competition in the Russia ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia ATM market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)