Russia Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Component, Authentication, End-User, and Region, 2025-2033

Russia Biometrics Market Size and Share:

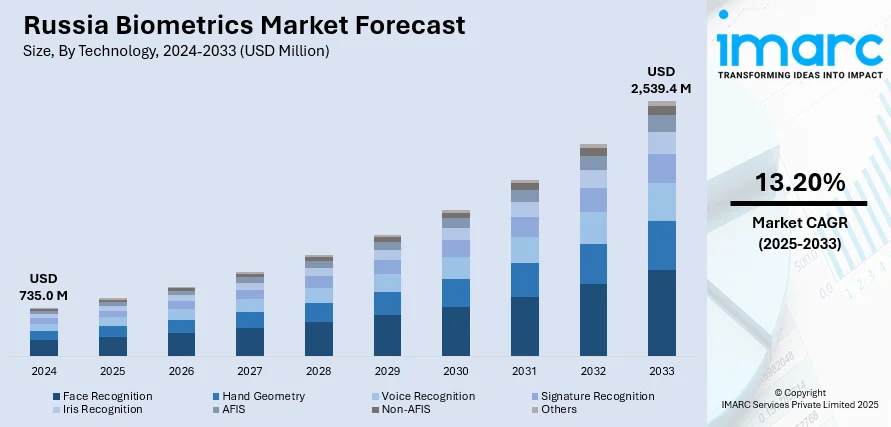

The Russia biometrics market size was valued at USD 735.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,539.4 Million by 2033, exhibiting a CAGR of 13.20% during 2025-2033. The market is witnessing steady growth, driven by increasing security concerns, digital transformation, and government-led identity verification initiatives. Expanding adoption in sectors such as banking, law enforcement, and enterprise security is further accelerating demand. Technological advancements in AI-powered biometric solutions are enhancing accuracy, efficiency, and widespread applicability, contributing to Russia biometrics market share expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 735.0 Million |

| Market Forecast in 2033 | USD 2,539.4 Million |

| Market Growth Rate (2025-2033) | 13.20% |

The market is being significantly driven by the increasing emphasis on national security and public safety. Government agencies are progressively adopting biometric technologies like facial recognition, iris detection, and fingerprint scanning to enhance identity verification systems and border control mechanisms. For instance, Russia plans to launch a nationwide facial recognition payment system by late 2025, expanding its Face Pay program through Sber and NSPK. Around 2 million biometric terminals will enable users to make payments via facial scans registered through any banking app. Integrated with the Unified Biometric System, the initiative includes features like age verification and hotel check-ins. Despite low adoption so far, it marks Russia’s largest biometric payment push, potentially supporting crypto payments and expanding biometric infrastructure across various sectors. The integration of biometric authentication in e-passports and national ID programs has reinforced trust in secure digital identification processes. Additionally, biometric solutions are increasingly being implemented in law enforcement operations to streamline criminal investigations and surveillance. These initiatives reflect the government’s commitment to modernizing its public security infrastructure while curbing identity fraud, unauthorized access, and terrorism-related threats, thereby accelerating demand for biometric solutions across public sector operations.

To get more information on this market, Request Sample

Another major driver of the Russia biometrics market is the rapid advancement and deployment of biometric applications across the private sector. Financial institutions are integrating biometric authentication to improve transaction security, reduce fraud, and streamline customer onboarding processes. Moreover, with the expansion of remote work and digital services, enterprises are adopting biometrics to safeguard sensitive data and ensure reliable user authentication in virtual environments. Biometric access control systems are also gaining traction in industrial and corporate settings to regulate entry to restricted areas. These developments are supported by increasing investments in artificial intelligence and machine learning, which enhance the accuracy, scalability, and speed of biometric technologies across diverse business environments.

Russia Biometrics Market Trends:

Increasing Adoption Across Government Sectors

The market is experiencing a significant increase in adoption across various government sectors, particularly in national security and public administration. This trend is primarily driven by the need for enhanced security measures, efficient identification processes, and improved citizen services. This shift is mainly caused by the necessity for increased security measures, streamlined identification procedures, and better citizen services. The government's push to incorporate biometric technologies imcluding fingerprint and facial recognition into important sectors like border control, law enforcement, and e-governance projects is driving the market expansion. For instance, in December 2024, the Russian Ministry of Transport launched an experimental program requiring biometric information from foreign nationals and stateless individuals entering the Russian Federation. There will be two stages to the experiment, which will end on June 30, 2026. In the first phase, biometric data will be collected at border points from foreign nationals traveling into or out of Russia via international airports. As part of the second phase, beginning June 30, 2025, visa-free foreign nationals can use a mobile app to pre-register in the unified identity and authentication system where they can upload biometric information. Furthermore, the usage of biometric technologies in government activities is quickly growing, confirming its importance as a vital element of Russia's security framework. These initiatives form part of a wider plan to enhance national security, make public services more efficient, and guarantee the precision and dependability of identification systems. Therefore, this is causing a rise in the need for more sophisticated biometric technologies.

Rising Demand in Financial Services

The rising demand for biometric technologies in financial services is a prominent trend in the market, primarily driven by the increasing need for secure and efficient customer verification methods. Several financial institutions in Russia are implementing biometric solutions, such as fingerprint and facial recognition systems, to prevent fraud and verify transactions. For instance, in January 2019, Russia’s Sberbank established a partnership with Azbuka Vkusa, a supermarket chain, to provide customers with fingerprint biometric payment solutions across 20 locations in Moscow. With this collaboration, customers will be able to use a fingerprint scan and a password to perform two-factor payments at checkout by enrolling their fingerprints and a linked payment card. This shift is motivated not just by the need to safeguard clients, but also by regulations requiring more robust authentication procedures in the financial industry. Furthermore, banks and financial platforms are being encouraged to incorporate biometric technologies into their mobile apps and ATMs due to the increasing demand for smooth, quick, and secure banking experiences from consumers. As digital banking and online financial services grow in Russia, the need for secure customer verification methods like biometrics is increasing in importance.

Expansion of Facial Recognition Technology

Facial recognition technology is becoming increasingly popular in the market, due to advances in artificial intelligence and machine learning. This technology is progressively being utilized in a variety of industries, including retail, transit, and public monitoring, demonstrating its growing importance in improving security and operating efficiency. According to reports, Russia has more than 1 Million video surveillance cameras. Among these, one in every three is linked to facial recognition software. In Moscow alone, there are approximately 230,000 in use. The government is particularly active in deploying facial recognition technology as part of a larger campaign to monitor and manage public spaces, with widespread installation in cities and transport hubs. Furthermore, the retail industry uses facial recognition to personalize client experiences and improve service delivery. The growing accuracy and dependability of facial recognition systems, combined with their ability to integrate seamlessly with existing infrastructures, further support this trend, positioning facial recognition as a critical tool in both public and private sector operations throughout the country.

Russia Biometrics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia biometrics market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on technology, functionality, component, authentication, and end-user.

Analysis by Technology:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris Recognition

- AFIS

- Non-AFIS

- Others

Face recognition is playing a pivotal role in the growth of the Russia biometrics market, driven by rising demand for seamless and contactless identification solutions across both public and private sectors. Government authorities are increasingly deploying facial recognition systems for surveillance and law enforcement, particularly in urban areas and transportation hubs. Moreover, the technology is being rapidly adopted by financial institutions and telecom companies for secure customer onboarding and authentication. Technological advancements, including AI integration and improved image analytics, are enhancing the accuracy and speed of face recognition systems. This is encouraging widespread use in retail, healthcare, and smart city infrastructure, reflecting overall Russia biometrics market growth.

Hand geometry recognition, although relatively less complex compared to newer technologies, continues to maintain a stable presence in Russia’s biometrics landscape due to its reliability in controlled environments. It is primarily utilized in industrial and corporate access control systems, where durability and user-friendliness are prioritized over high precision. Its ability to operate efficiently in harsh conditions and its lower susceptibility to fraud make it a preferred choice for manufacturing facilities and defense establishments. Continued adoption in sectors requiring robust physical security, along with integration into multi-modal biometric systems, is supporting consistent demand for hand geometry solutions and contributing to a positive Russia biometrics market outlook.

Voice recognition technology is gaining prominence in Russia due to the increasing emphasis on remote authentication and user convenience, especially in sectors such as banking, telecommunications, and customer service. Voice biometrics offer a non-invasive, software-based solution that fits well into digital transformation strategies and mobile-centric services. Its growing use in call centers and virtual assistant platforms is enhancing both security and customer experience. Moreover, advancements in natural language processing (NLP) and machine learning are improving recognition accuracy across diverse languages and dialects, further boosting adoption in Russia’s linguistically varied landscape. Regulatory support for secure digital identity verification is also accelerating growth.

Analysis by Functionality:

- Contact

- Non-contact

- Combined

In the Russia biometrics market, the contact segment holds significant importance, especially in secure identity verification processes across government and banking sectors. Contact biometrics, such as fingerprint and palm print recognition, are widely trusted for their accuracy and cost-effectiveness. Their long-standing integration in border control, law enforcement, and civil ID programs continues to drive demand. The growth of digital banking and government e-services further fuels this segment as these applications often require high-assurance identification methods. While hygiene concerns have slightly reduced enthusiasm post-COVID-19, upgrades in touch-based technologies with faster sensors and improved user experiences are reviving growth in both public and private sectors.

The non-contact biometrics segment is witnessing rapid expansion in Russia, driven by hygiene preferences and technological advances. Modalities like facial recognition, iris scanning, and voice biometrics are gaining traction across airports, smart cities, and mobile banking due to their convenience and low physical interaction. The proliferation of AI-powered surveillance, particularly for public safety and counter-terrorism, is a key catalyst. Russia's investment in smart infrastructure and surveillance in public transport and critical facilities is boosting adoption. Furthermore, the integration of non-contact biometrics into smartphones and wearable devices is encouraging broader usage, making it a pivotal area in Russia biometrics market trends.

The combined biometrics segment, which integrates multiple modalities such as fingerprint and facial recognition, is growing in prominence due to its enhanced security and reduced risk of spoofing. This segment is especially critical in high-security environments like military, border control, and secure financial transactions. In Russia, the increasing need for layered authentication in sectors prone to fraud or identity theft is accelerating combined biometrics adoption. Growth is also supported by government-led projects involving digital identity frameworks and national security. The synergy of multiple identification factors ensures higher accuracy, and as AI continues to refine multimodal algorithms, this segment is projected to lead innovation in the biometrics space.

Analysis by Component:

- Hardware

- Software and Services

In the Russia biometrics market, the hardware segment forms the foundation of biometric systems, encompassing devices such as fingerprint scanners, iris recognition systems, facial recognition cameras, and biometric sensors. The demand for advanced biometric hardware is rising due to increased adoption in national ID programs, border control systems, and secure access points in banking and government facilities. Russia's growing focus on surveillance, public safety, and modernization of law enforcement tools has significantly boosted demand for robust and tamper-proof biometric hardware. Additionally, innovations in compact and high-speed sensors, particularly for mobile and remote applications, are driving further penetration of biometric hardware solutions.

The software and services segment is experiencing strong growth in Russia, propelled by the shift toward integrated biometric solutions and analytics-driven identity management. Software enables the processing, matching, and analysis of biometric data, with AI and machine learning playing crucial roles in enhancing system accuracy and adaptability. Services such as deployment, maintenance, and system integration are increasingly in demand as organizations seek seamless and scalable biometric implementations. Russia’s investments in digital transformation across public services, healthcare, and fintech are major growth drivers. Moreover, rising cybersecurity concerns are leading to higher adoption of customizable biometric authentication platforms tailored to specific institutional needs.

Analysis by Authentication:

- Single-Factor Authentication

- Multifactor Authentication

Single-factor authentication (SFA) remains a foundational component of the Russia biometrics market, particularly in applications requiring quick and straightforward identity verification. Fingerprint or facial recognition used alone is still prevalent in public access systems, time and attendance tracking, and basic banking services due to its low implementation cost and ease of use. Government-backed identity programs and law enforcement databases continue to rely heavily on SFA for mass population enrollment and routine checks. Additionally, the widespread use of smartphones with built-in biometric features supports the adoption of single-factor solutions, especially in rural and semi-urban areas where cost constraints limit the use of more complex systems.

Multifactor authentication (MFA) is gaining prominence in Russia due to rising cybersecurity threats and the need for robust identity protection in sensitive sectors such as finance, defense, and critical infrastructure. MFA combines biometric verification with other factors like PINs or smart cards, providing layered security that is difficult to breach. Government initiatives promoting digital governance and secure citizen services are pushing the adoption of multifactor systems. Additionally, the rise of remote work, digital banking, and cloud services has heightened the demand for stronger authentication frameworks. As AI enhances real-time threat detection, MFA is emerging as a critical growth driver in Russia’s biometric landscape.

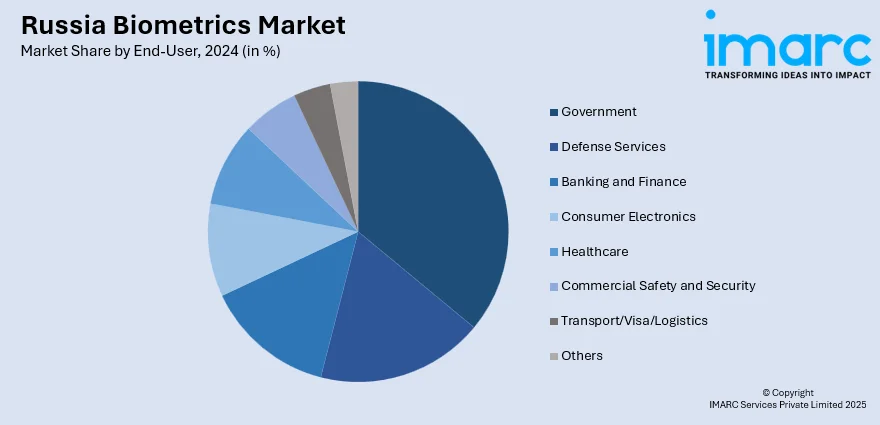

Analysis by End-User:

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

The government segment is one of the most dominant end users in the Russia biometrics market, driven by large-scale national ID programs, voter registration, and digital governance initiatives. Biometric systems are widely used for citizen identification, e-passports, and law enforcement databases. The Russian government’s focus on enhancing public safety, improving administrative efficiency, and modernizing civil services is accelerating the adoption of biometric technologies. Programs involving biometric registration for social benefits and border security further bolster demand. Continued investment in smart city infrastructure and surveillance, alongside efforts to prevent identity fraud and enhance public sector service delivery, are key drivers in this segment.

The defense services segment relies heavily on biometrics for secure access, personnel authentication, and surveillance. In Russia, heightened national security priorities and ongoing modernization of military infrastructure are fueling demand for advanced biometric technologies. These systems are used to control access to sensitive areas, verify identities in combat and intelligence operations, and ensure secure communications. Biometric data is also integrated into defense databases for rapid identification in both domestic and international missions. As threats related to espionage, cyberattacks, and terrorism evolve, the Russian military increasingly views biometrics as a critical tool for operational security and strategic advantage.

The banking and finance sector in Russia is experiencing rapid biometric adoption as institutions prioritize secure, seamless customer experiences and fraud prevention. Fingerprint, facial, and voice recognition are being integrated into ATMs, mobile banking apps, and secure transaction platforms. Regulatory pressure to enhance digital security, coupled with the rise of fintech solutions, is driving banks to invest in biometric systems for Know Your Customer (KYC) compliance and multi-factor authentication. As online banking usage increases, so does the need for biometric measures that balance user convenience with high-level data protection. This sector's growth is reinforced by increasing consumer trust in biometric-enabled financial services.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District plays a leading role in Russia’s biometrics market, largely due to the presence of Moscow, the country's political, financial, and technological hub. Government projects, smart city initiatives, and financial institutions headquartered in this region drive robust demand for biometric solutions. Central District is also home to major IT companies and system integrators, fostering innovation in biometric technology. The concentration of federal agencies and administrative offices has accelerated the implementation of biometric-based identity management, surveillance, and secure access systems. Furthermore, high population density and widespread adoption of digital services contribute significantly to this region’s prominence in the market.

The Volga District is emerging as a strong contributor to the biometrics market in Russia due to its industrial development, growing urban centers, and rising investment in infrastructure. Key cities like Nizhny Novgorod and Kazan are expanding their use of biometric technologies in public safety, transport, and local governance. The region's growing financial and educational institutions are also adopting biometric authentication to enhance security and streamline operations. Additionally, regional government programs promoting e-services and smart city projects are fueling the integration of biometric systems. Improved connectivity and digital awareness are further encouraging widespread adoption across commercial and public sectors.

The Urals District is gaining traction in the biometrics market due to its strategic importance in defense, industry, and logistics. Yekaterinburg, the administrative center, is a growing hub for technological advancement and innovation, contributing to the region’s increasing use of biometric systems. Defense-related installations and industrial enterprises are implementing biometrics for access control, personnel verification, and asset protection. Moreover, with heightened security requirements in mining and manufacturing zones, there is a growing need for robust identity solutions. Investment in digital transformation and regional development initiatives is also supporting the deployment of biometric technologies in public administration and commercial infrastructure.

Competitive Landscape:

The competitive landscape of the Russian biometrics market is characterized by a mix of domestic innovation and international technological influence. Competition is intensifying due to rising demand across government, defense, and commercial sectors. Key players focus on enhancing product portfolios with AI-driven biometric solutions, including facial recognition, fingerprint scanning, and multimodal authentication systems. Strategic collaborations, R&D investments, and government contracts play critical roles in market positioning. Companies are also expanding into cloud-based and mobile biometric platforms to meet evolving user needs. Regulatory compliance, data protection mandates, and the shift toward digital identity infrastructure are shaping competitive strategies. Customization, speed, and accuracy of biometric systems remain crucial differentiators in securing market share within Russia's security-driven digital landscape. Russia biometrics market forecast projects continued growth, driven by technological innovation and expanding application across high-security environments. For instance, starting July 1, Russia will begin disconnecting mobile services for foreigners who have not submitted biometric data to the Unified Biometric System (UBS), according to the Digital Development Ministry. Foreigners with SIM cards issued before 2024 must verify their identity at a mobile operator's office. The process includes submitting biometric data, a SNILS number, IMEI, and registering on the Gosuslugi portal. Services will be limited gradually—first blocking calls, then slowing internet, and finally full disconnection after 30 days. Over 2 million foreigners have already complied. The government claims the move aims to curb SIM card fraud and improve telecom security nationwide.

The report provides a comprehensive analysis of the competitive landscape in the Russia biometrics market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Russian authorities announced plans for the construction of the first completely biometric terminal at Sochi International Airport. The initiative will be carried out in collaboration with Mile on Air, a prominent provider of aviation services in the areas of biometrics and IT, and the local Aerodinamika holding, which is in charge of administering Sochi airport.

- January 2025: The Government of Russia announced plans to enhance its current Face Pay system by introducing a statewide facial recognition payment system in 2025 through a partnership between the National Payment Card System (NSPK) and Sber. As part of this project, approximately 2 Million biometric terminals will be deployed nationwide, leading to a substantial increase in Russia's biometric infrastructure.

- December 2024: Government-owned Sberbank announced plans to launch a number of new financial services based on biometrics in order to strengthen its position in the Russian Biometrics industry. Under this initiative, one of the most significant initiatives is the development of the bank's exclusive biometric payment system, ‘Pay with a smile.’

- October 2024: The Kazan City Government introduced a biometric facial payment system through the Russian National Payment Card System (NSPK) in the city. This marks the initial phase of the full-scale implementation of biometric acquisition in the Russian transportation industry. The technology is expected to be extended to restaurants and retail establishments by the end of the year.

Russia Biometrics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, Others |

| Functionalities Covered | Contact, Non-contact, Combined |

| Components Covered | Hardware, Software and Services |

| Authentications Covered | Single-Factor Authentication, Multifactor Authentication |

| End-Users Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia biometrics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia biometrics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia biometrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biometrics market in Russia was valued at USD 735.0 Million in 2024.

The Russia biometrics market size is projected to exhibit a CAGR of 13.20% during 2025-2033, reaching a value of USD 2,539.4 Million by 2033.

Key drivers of Russia's biometrics market include government mandates for biometric registration, expansion of facial recognition payment systems, integration with public services, growing demand for digital identity verification, and increased security needs. Collaborations between major banks and tech firms also accelerate infrastructure development and support broader biometric adoption nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)