Russia Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

Russia Bottled Water Market Overview:

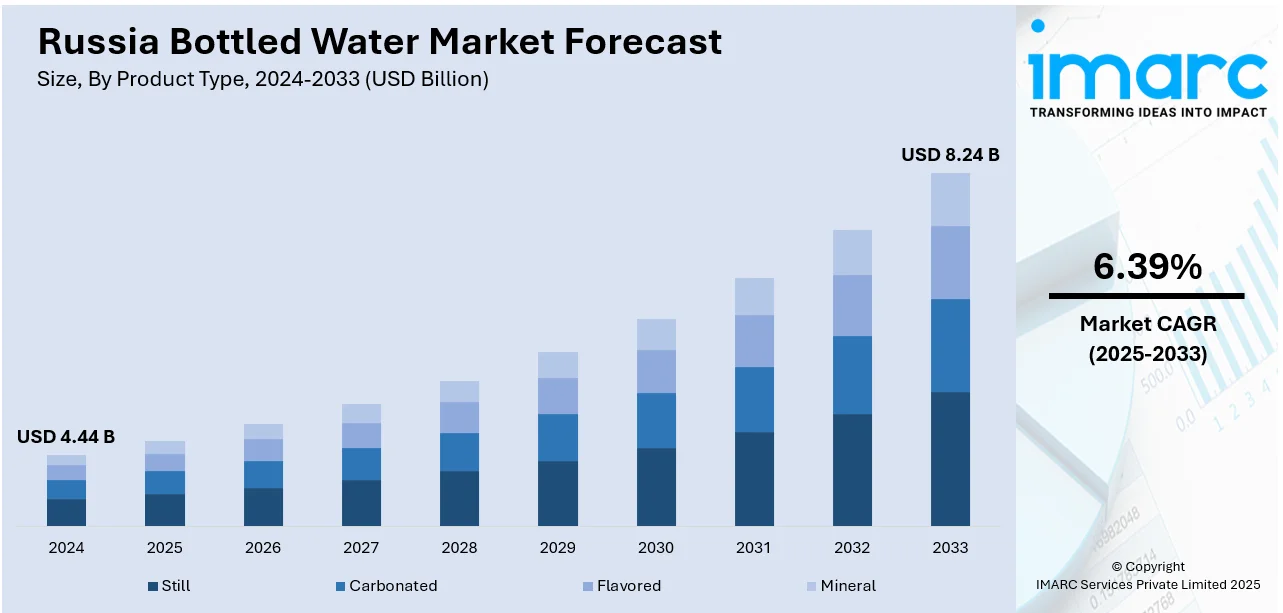

The Russia bottled water market size reached USD 4.44 Billion in 2024. Looking forward, the market is projected to reach USD 8.24 Billion by 2033, exhibiting a growth rate (CAGR) of 6.39% during 2025-2033. The market is steadily expanding amid rising health awareness and improved retail distribution networks. Domestic and international bottled water brands competing through packaging innovation, enhanced mineral content, and eco‑friendly options, and urban consumers increasingly favoring premium and flavored bottled water are also accelerating product sales. As e‑commerce growth accelerates, direct‑to‑consumer channels gain importance, further reflecting shifting lifestyle trends toward convenience and wellness, thereby influencing the Russia bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.44 Billion |

| Market Forecast in 2033 | USD 8.24 Billion |

| Market Growth Rate 2025-2033 | 6.39% |

Russia Bottled Water Market Trends:

Rapid Urbanization Driving Convenience Consumption

The swift urbanization occurring in Russia is greatly impacting consumer behavior, particularly in the bottled water market. As an increasing number of individuals move to urban areas and embrace fast-paced lifestyles, the desire for convenient and hygienic hydration options has risen sharply. According to industry reports, as of July 25, 2025, Russia's population stands at 143,940,781, with an estimated mid-year total of 143,997,393. Urban residents make up 75.04% of the population, totaling 108,062,384 people. Compact and portable bottled water formats are becoming the preferred choice for commuters, office workers, and students who value accessibility and the ability to drink on the go. The growth in single-person households and the demands of time-constrained consumers further enhance this preference for ready-to-drink products. Additionally, busy city dwellers often connect bottled water with safety and purity, especially in public areas where access to clean drinking water may be unreliable. This urban-centric consumption trend is significantly contributing to the Russia bottled water market growth, leading manufacturers to concentrate on packaging innovation and strategic distribution in metropolitan areas.

To get more information on this market, Request Sample

Expansion of E-Commerce and D2C Channels

The increasing adoption of e-commerce and direct-to-consumer (D2C) models is transforming the bottled water market in Russia. According to the data published by Sberbank Branch in India, in 2024, Russia’s online grocery market reached INR 1.05 Lakh Crore (1.2 Trillion RUB), a 44% increase from INR 72,392 Crore (824 Billion RUB) in 2023. Online grocery orders hit 788 Million, up 33%. As internet connectivity and smartphone usage continue to rise, more consumers are turning to online platforms for the convenience of home delivery and a broader selection of products. Bottled water companies are utilizing these digital avenues to extend their reach beyond traditional retail, aiming at both urban and semi-urban populations. Subscription services and bulk delivery options are becoming increasingly popular, particularly among health-conscious individuals and those with busy lifestyles. D2C approaches allow brands to foster stronger connections with their customers, obtain real-time feedback, and provide tailored promotions. Additionally, the digital landscape offers opportunities for enhanced brand storytelling and differentiation through targeted content and collaborations with influencers. This shift towards digital is essential in boosting bottled water sales and enhancing brand loyalty, supporting ongoing growth in the Russian bottled water market.

Russia Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

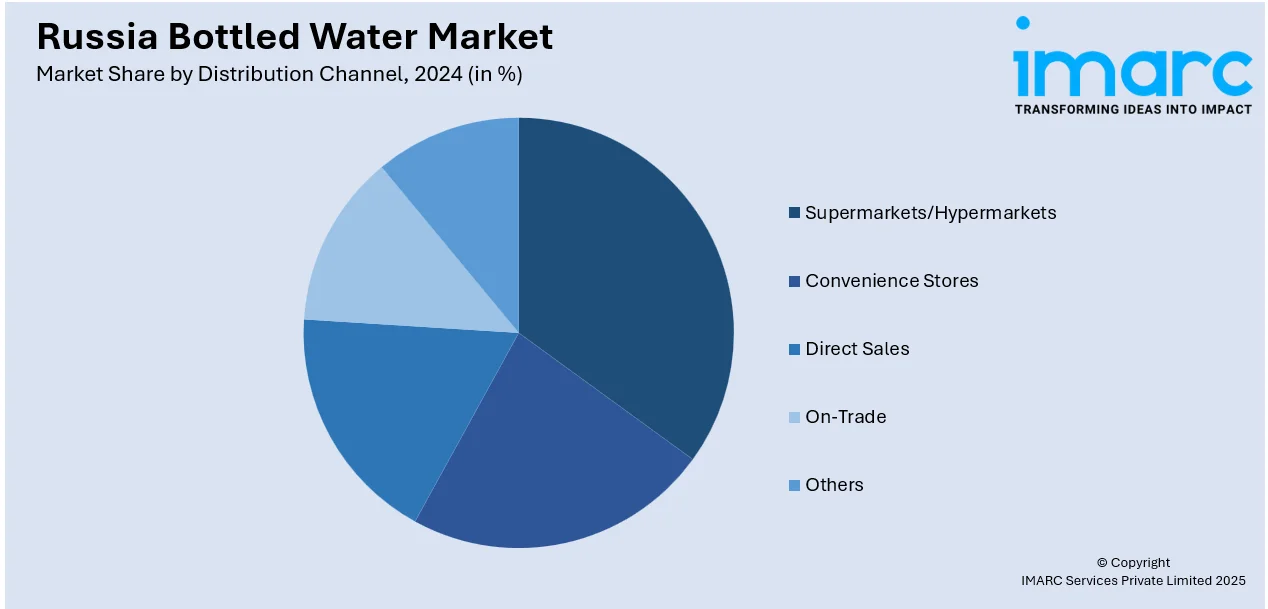

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes PET bottles, metal cans, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Bottled Water Market News:

- In May 2025, Russia's Aqua Holding announced its plans to enter the Indian market with its mineral water production by late 2025, following successful certification. CEO Svyatoslav Vilk highlighted ongoing expansion efforts in Southeast Asia and the Persian Gulf. Currently exporting to 23 countries, the company reports over 30% annual growth in water exports.

Russia Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia bottled water market on the basis of product type?

- What is the breakup of the Russia bottled water market on the basis of distribution channel?

- What is the breakup of the Russia bottled water market on the basis of packaging type?

- What is the breakup of the Russia bottled water market on the basis of region?

- What are the various stages in the value chain of the Russia bottled water market?

- What are the key driving factors and challenges in the Russia bottled water market?

- What is the structure of the Russia bottled water market and who are the key players?

- What is the degree of competition in the Russia bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)