Russia Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2025-2033

Russia Business Process Management Market Overview:

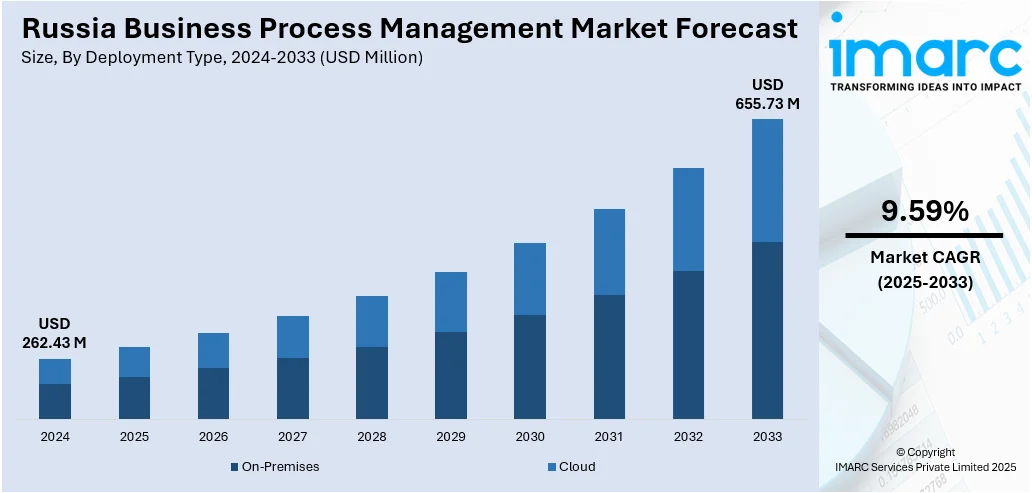

The Russia business process management market size reached USD 262.43 Million in 2024. The market is projected to reach USD 655.73 Million by 2033, exhibiting a growth rate (CAGR) of 9.59% during 2025-2033. The market is growing as organizations direct their attention to increasing efficiency, minimizing operational expenses, and transforming through digitalization. Increased adoption of automation technologies and cloud-based BPM platforms is pushing adoption through major industries such as banking, manufacturing, and logistics. Firms are spending more on process optimization to drive performance improvement and stay competitive. Government initiatives towards digital infrastructure also support BPM adoption. All these will have a positive impact on the Russia business process management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 262.43 Million |

| Market Forecast in 2033 | USD 655.73 Million |

| Market Growth Rate 2025-2033 | 9.59% |

Russia Business Process Management Market Trends:

Cloud-Driven BPM Scaling Enhances Public and Private Workflows

In early 2025, Russia saw accelerated adoption of cloud-based BPM platforms among both government agencies and private entities, bolstered by incentives for digital modernization. This drive is supported by the recent expansion of national data infrastructures and secure sovereign cloud services launched in late 2024, enabling organizations to migrate from legacy systems with greater confidence. These platforms provide scalable architectures, real-time process orchestration, and improved compliance via audit trails, critical for sectors facing elevated regulatory expectations. Cloud BPM adoption also supports hybrid and remote workforce models, offering seamless operational continuity across distributed teams. Additionally, integration with process-mining tools and low-code environments allows organizations to quickly map, automate, and refine workflows. As a result, this technological evolution significantly supports Russia business process management market growth, positioning BPM as a strategic mainstay for operational resilience and agility. With supportive public policy frameworks in place, cloud-enabled BPM is expected to see sustained adoption throughout 2025 and beyond.

To get more information on this market, Request Sample

Service Sector PMI Rise Fuels Intelligent BPM Uptake

In early 2025, Russia’s services sector gained strong momentum, prompting increased reliance on intelligent business process management (BPM) systems across finance, logistics, and public administration. Organizations are integrating advanced features like process mining, predictive analytics, and automated decision support to enable real-time monitoring, workflow optimization, and adaptability to dynamic service demands. AI-powered tools are being used to anticipate bottlenecks, identify inefficiencies, and ensure regulatory compliance. This strategic adoption reflects a broader transition toward data-driven, adaptive process management. A key development reinforcing this shift came in January 2025, when President Vladimir Putin instructed the Russian government and Sberbank to expand AI collaboration with China under the BRICS “AI Alliance Network.” This move signals a national push to enhance digital capabilities amid global tech restrictions, accelerating investments in smart infrastructure like BPM platforms. As service-based sectors continue to grow, intelligent BPM is proving essential to support decision-making, ensure compliance, and scale operations. These developments underscore evolving Russia business process management trends, where enterprises are prioritizing intelligent systems to strengthen operational planning and long-term competitiveness.

Industrial Automation Drives Process Standardization via BPM

In 2024, Russia’s industrial sector saw renewed momentum, driven by national programs promoting digital transformation and intelligent automation. Manufacturers increasingly turned to business process management (BPM) systems to standardize production workflows and integrate automation across high-volume operations. By combining BPM platforms with industrial Internet of Things (IIoT) systems, organizations began implementing centralized process control, condition-based monitoring, and real-time production analytics. These tools allow for more precise scheduling, maintenance forecasting, and regulatory compliance, particularly in sectors handling complex production lines. In February 2024, digital industry initiatives outlined under Russia’s “Technological Sovereignty” strategy emphasized the need for integrated process governance as a foundation for industrial modernization. This focus has led to wider BPM adoption beyond administrative tasks, embedding process orchestration within critical factories and logistics operations. These advancements contribute significantly to Russia business process management market growth, as companies seek scalable, transparent, and adaptive tools to manage evolving production requirements. With industrial output expanding and modernization policies in force, BPM is becoming central to Russia’s digital industrial ecosystem.

Russia Business Process Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment type, component, business function, organization size, and vertical.

Deployment Type Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud.

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes IT solutions (process improvement, automation, content and document management, integration, and monitoring and optimization) and IT services (system integration, consulting, and training and education).

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The report has provided a detailed breakup and analysis of the market based on the business function. This includes human resources, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SMEs and large enterprises.

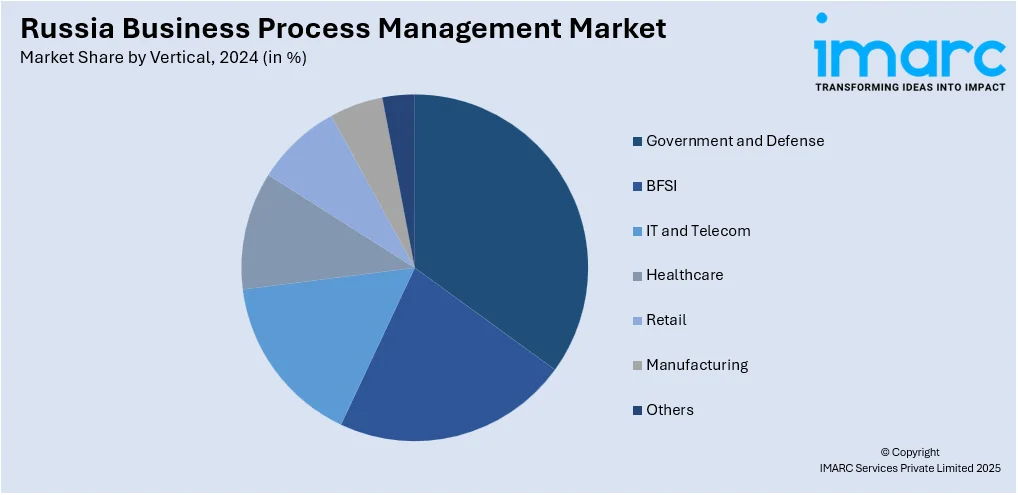

Vertical Insights:

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Business Process Management Market News:

- June 2025: Mobile TeleSystems (MTS) has integrated Russia’s low‑code ELMA BPM system into its corporate IT infrastructure, enhancing business process automation. The deployment supports streamlined workflows, rapid application development, and reduced reliance on traditional coding across MTS operations. By leveraging ELMA’s platform, MTS aims to boost internal efficiency, agility, and collaboration. This strategic implementation underscores MTS's commitment to modernizing IT capabilities and embracing cutting-edge digital transformation.

Russia Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia business process management market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia business process management market on the basis of deployment type?

- What is the breakup of the Russia business process management market on the basis of component?

- What is the breakup of the Russia business process management market on the basis of business function?

- What is the breakup of the Russia business process management market on the basis of organization size?

- What is the breakup of the Russia business process management market on the basis of vertical?

- What is the breakup of the Russia business process management market on the basis of region?

- What are the various stages in the value chain of the Russia business process management market?

- What are the key driving factors and challenges in the Russia business process management?

- What is the structure of the Russia business process management market and who are the key players?

- What is the degree of competition in the Russia business process management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia business process management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia business process management market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)