Russia Cheese Market Size, Share, Trends and Forecast by Report by Source, Type, Product, Form, Distribution Channel, and Region, 2025-2033

Russia Cheese Market Size and Share:

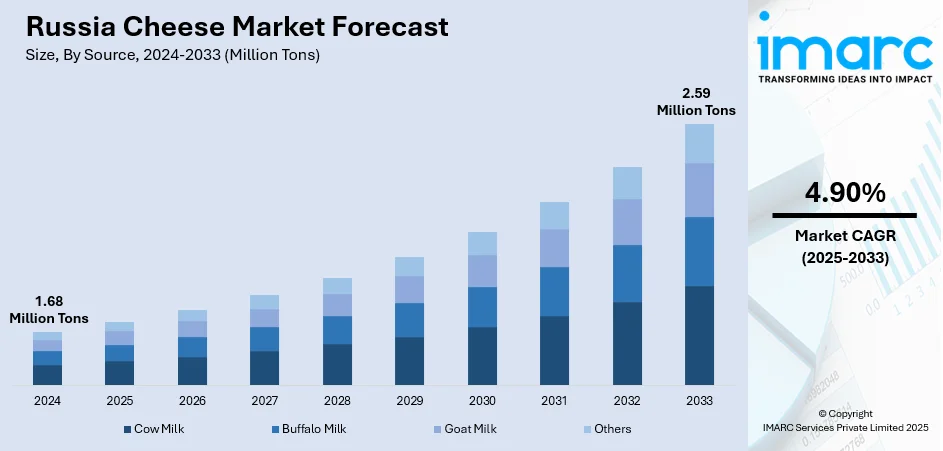

The Russia cheese market size was valued at 1.68 Million Tons in 2024. The market is expected to reach 2.59 Million Tons by 2033, exhibiting a CAGR of 4.90% during 2025-2033. Central District currently dominates the market in 2024. The market is propelled by the growth in consumer demand for high-quality and varied dairy products, fueled by the increasing trend of protein and natural-food consumption. Moreover, rapid urbanization and rising disposable incomes have resulted in higher sales of specialty and premium types of cheese through all retail channels. Besides, the development of modern trade formats and the rising penetration of online grocery platforms have improved product accessibility and exposure, further augmenting the Russia cheese market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.68 Million Tons |

| Market Forecast in 2033 | 2.59 Million Tons |

| Market Growth Rate (2025-2033) | 4.90% |

The market is significantly influenced by the rising consumer preference for premium dairy products, which has encouraged domestic producers to expand artisanal and specialty cheese varieties. According to an industry report, about 65% of households in Russia saw an increase in real incomes between 2022 and 2024. This steady growth of urban middle-income households supports greater demand for diverse cheese types, both local and imported. Besides, expanding retail channels, especially modern supermarkets and online grocery platforms, further improves product availability across major cities. Moreover, the influence of Western cuisine and the popularity of international food service chains continue to shape local tastes, pushing consumption beyond traditional soft cheese.

To get more information on this market, Request Sample

In addition to this, one of the significant Russia cheese market trends is the supportive government measures aimed to boost domestic dairy farming, strengthen supply chains, and help stabilize production costs. As per industry reports, the Russian government boosted dairy industry funding to upwards of RUB 80 Billion (about USD 1.021 Billion) in 2024. Furthermore, investments in cold storage and logistics networks enhance distribution efficiency, maintaining quality and shelf life. Apart from this, changing lifestyles and higher disposable incomes encourage experimentation with cheese as a snack or ingredient in home cooking. Apart from this, the rising focus on branding and marketing strategies also drives awareness and trial among younger consumers. Also, product innovations in low-fat and functional cheese aligns with health-conscious trends, attracting new consumer segments.

Russia Cheese Market Trends:

Growing Consumer Demand for Cheese

Russia is witnessing a growing domestic demand for cheese that can be attributed to the changes in consumer dietary preferences and increasing purchasing power. A rising number of consumers with inflating disposable incomes in Russia are increasingly seeking a diversified diet that includes different types of cheeses. According to an industry report, the average household net-adjusted disposable income per capita in Russia is approximately USD 19,546 annually. Moreover, continuously developing retail chains and supermarkets throughout the country are making cheese more accessible to a greater number of consumers who have become curious about it, which is fueling the market. Along with this, the increasing popularity of Western cuisine and expansion of Western restaurants are exposing the Russian consumer to a greater variety of cheese types, thus driving interest in premium and specialty cheeses. Another factor driving the Russia cheese market growth is the increased product demand from health-conscious consumers, given that cheese is increasingly being recognized for its nutritional value and positive health benefits, such as high protein and calcium levels. The value-addition efforts by the cheese manufacturers expressing these health-positive aspects through marketing have resonated with consumers, leaning towards more consumption.

Growth of Online Grocery Shopping

The rise in online grocery shopping platforms has also made a wider variety of cheeses more accessible, further driving consumer demand across different regions in Russia. As per an industry report, the online grocery market in Russia is forecasted to grow at a CAGR of 5% during 2025-2033. Besides, increasing internet penetration and smartphone usage have driven demand for online food retail, allowing consumers to conveniently purchase a wide variety of cheese from home. The shift has also been influenced by busy lifestyles, prompting a preference for time-saving shopping methods. E-commerce platforms have enhanced their cold chain infrastructure, ensuring the safe delivery of perishable items such as cheese. Additionally, attractive promotional campaigns, flexible payment options, and user-friendly interfaces have contributed to higher online cheese sales. Many domestic producers have begun listing their offerings on digital marketplaces to reach a wider audience, while established retailers have integrated omnichannel models to bridge physical and digital touchpoints in cheese retail.

Government Support and Protectionist Policies

The implementation of support and protectionist policies by the Russian government is one of the major factors positively impacting the Russia cheese market outlook. Due to the international sanctions and trade restrictions, the Russian government opted for self-sufficiency policies in food production. These initiatives, with a significant focus on dairy products such as cheese, encompass import substitution, subsidization of dairy farmers and cheesemakers, and investments in infrastructure and technology. The market is also expanding due to significant local production gains, driven by restrictive measures on imports, and substantial governmental support. In Russia, a total of 3.1 Million cows and 20,000 agricultural companies are involved in milk production, the key raw material for making cheese, as per industry reports. Moreover, milk output in all farm categories reached 32.3 Million tons in 2021, an increase of over 100,000 Tons in comparison to the previous year. Improved technology and consumer preference for locally sourced products have further bolstered the competitiveness and quality of domestic cheese. For instance, the consumption of cheese in Russia was projected to grow by 5.6% in 2020, as per industry reports. Effectively, these policies created a good environment for the development of the local cheese industry by encouraging investments and innovations. Furthermore, the current government’s food security agenda is leading to programs aimed at expanding the production capacity of the dairy sector to ensure a stable supply of raw materials for cheesemaking.

Russia Cheese Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia cheese market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on source, type, product, form, and distribution channel.

Analysis by Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

Cow milk leads the market with around 85.9% of market share in 2024. Most domestic cheese producers rely heavily on locally sourced cow milk because it’s widely available, cost-effective, and well-suited for traditional varieties like Russian, Poshekhonsky, and Dutch-style cheeses, which remain popular with Russian consumers. Local dairy farms provide a steady supply that helps meet the demand for semi-hard and hard cheeses, which are staples in households and food service. The importance of cow milk grew after import restrictions pushed the market to focus more on domestic production. Producers have adapted by strengthening supply chains and supporting local dairy farmers. Cow milk’s high fat and protein content makes it ideal for producing consistent cheese textures and flavors that Russian buyers expect. This dependency also drives investment in local herds and dairy processing facilities, helping the sector maintain self-sufficiency and adapt to changing trade conditions.

Analysis by Type:

- Natural

- Processed

Natural leads the market with around 75.9% of market share in 2024. Buyers increasingly prefer products with minimal additives and clear labeling, which is a key factor propelling this segment. Many Russian consumers associate natural cheese with quality, freshness, and traditional craftsmanship. Local dairies and mid-sized producers have used this demand to promote cheeses made with simple ingredients and traditional techniques, often highlighting regional milk sources and time-tested recipes. The shift toward natural options gained speed when import restrictions limited access to well-known European brands, creating an opening for domestic producers to fill shelves with locally made natural cheeses. This trend has encouraged more investment in artisanal production and small-batch processing. Natural cheese is now promoted as a healthier choice, especially among younger urban buyers. Retailers and food markets highlight its authenticity and traceable origins, turning it into an important part of Russia’s evolving food culture and local identity.

Analysis by Product:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

Mozzarella leads the market with around 28.5% of market share in 2024. The segment is driven mostly by the thriving popularity of pizza and Italian-style dishes. Restaurants, cafes, and home cooks rely on fresh or semi-soft mozzarella for its melting state and mild taste, which makes it a staple for both food service and retail. Local producers stepped up production when imported mozzarella faced restrictions, investing in new technology and know-how to match quality standards. Russian dairies now produce mozzarella in various formats, from fresh balls to shredded packs for convenience. Major retail chains stock locally made mozzarella alongside imported options from countries like Belarus. The product’s versatility supports its steady demand in urban areas where fast food, casual dining, and ready-made meals keep growing. Its role extends beyond pizza, too, showing up in salads and sandwiches. Furthermore, the segment reflects how Russian cheese makers adapt quickly to consumer trends and popular global cuisines.

Analysis by Form:

- Slices

- Diced/Cubes

- Shredded

- Liquid

- Others

Diced/cubes leads the market with around 48.9% of market share in 2024. Pre-cut cheese cubes appeal to households, catering companies, and snack producers who want quick, ready-to-use options for salads, party platters, or grab-and-go snacks. Russian dairies and large processors have expanded their product lines to include diced versions of popular types like hard and semi-hard cheeses, including Gouda, Cheddar, and local varieties. Retail chains highlight these packs for their time-saving benefit and portion control, which fits well with growing interest in easy meal prep. Food service suppliers also rely on diced cheese for consistent size and reduced waste in commercial kitchens. The popularity of diced cheese mirrors the rise of ready-to-eat and convenience foods across Russia, blending traditional cheese preferences with modern eating habits. This segment helps domestic producers stay competitive and reach several urban buyers.

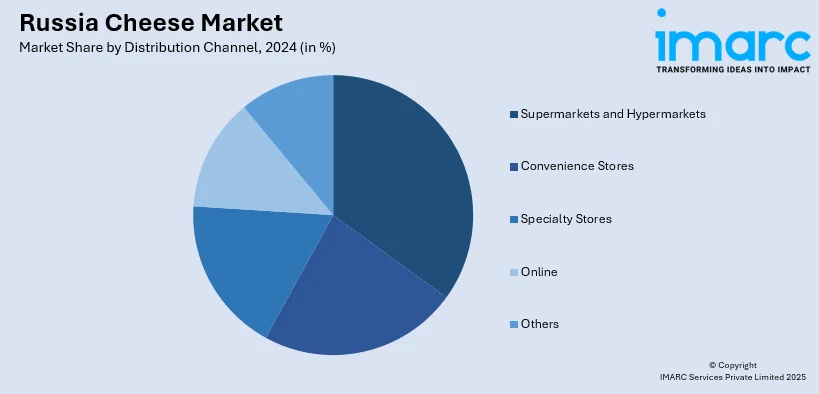

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets lead the market with around 63.3% of market share in 2024. The segment serves as the main shopping destination for Millions of households. These supply chains dominate urban and suburban areas, offering wide selections that cater to varied tastes and budgets. These outlets attract buyers with extensive cheese ranges, from affordable local staples to premium imported brands and specialty options like natural and organic cheese. Big retail stores invest in cold chain logistics and modern display systems to keep cheese fresh and appealing, which helps boost sales volume and product rotation. Many Russian families prefer supermarkets and hypermarkets for their one-stop convenience, combining cheese purchases with other groceries. Promotional campaigns, loyalty programs, and in-store tastings help push new or seasonal cheese varieties. By stocking diverse formats, these outlets shape demand and give domestic producers vital shelf space to reach a wide customer base.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

In 2024, Central District dominated the market. The segment is widely expanding due to its dense population, strong purchasing power, and developed retail network. Major cities like Moscow drive high demand for various cheese styles, from traditional Russian varieties to imported specialties and modern formats like sliced or shredded packs. Many cheese producers and processors set up operations in this region to stay close to large urban markets and logistics hubs. The Central District also attracts significant investment in new dairy farms and processing plants, supporting local milk supply for cheese production. Retailers here offer wide assortment, giving shoppers access to premium, natural, and convenience-focused cheese products. In addition, the expansion of the food service industry is another strong factor, with restaurants, cafes, and catering businesses relying heavily on a steady supply of cheese.

Competitive Landscape:

The market is characterized by an intense competitive environment influenced by local production, changing customer needs, and policy dynamics. Restrictions on trade have lowered the supply of imports and opened avenues for local manufacturers to gain more market share with a variety of products across processed semi-hard and artisanship cheeses. Mass producers rely on cost-effectiveness and quantity, whereas small dairies focus on authenticity and local taste profiles to attract sophisticated consumers. Supermarkets and hypermarkets dominate retail distribution, although online shopping platforms are expanding their base, particularly among urban residents seeking convenience and variety. The market caters to both price-sensitive buyers and premium product consumers, resulting in segmentation by price, quality, and country of origin. According to the Russia cheese market forecast, domestic production is expected to rise steadily due to ongoing investment in new dairy facilities and technology. This trend will continue to increase domestic competition and further decrease dependence on imported foreign cheese.

The report provides a comprehensive analysis of the competitive landscape in the Russia cheese market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: EkoNiva Group, a provider of raw milk headquartered in Voronezh, Russia, opened its first retail location in China, providing customers with ultra-pasteurized milk and coffee drinks. The company intends to increase the variety of exports in the future, starting with premium hard and semi-hard cheeses.

- May 2025: TH Group, a renowned dairy manufacturer based in Vietnam, launched a cutting-edge fresh milk processing facility in the Borovsk area of the Kaluga oblast of Russia, marking a significant turning point in its closed-loop manufacturing strategy. The facility will be involved in the production of various dairy products, including cheese, butter, yogurt, and pasteurized and ultra-high-temperature milk.

- February 2025: Health & Nutrition obtained its first halal certification for its product range, including the company’s cream and cottage cheese products under the Prostokvashino brand. With this certification, H&N will be able to provide its vast collection of products to the Persian Gulf countries.

- February 2025: Health & Nutrition (H&N) finished a significant manufacturing upgrade at its Saran Dairy Plant in Mordovia, Russia. With the completion of this expansion project, the company plans to introduce a new collection of loose-textured cottage cheese under the Prostokvashino brand.

- May 2024: The EkoNiva Group, a prominent producer of raw milk in Russia, announced that it reached preliminary agreements to supply China with both premium hard and semi-hard cheeses.

- February 2024: Danone is reportedly divesting its Russian operations to local dairy producer Vamin Tatarstan. As per a letter reviewed by The Financial Times, the French food giant, known for its Activia brand, has agreed to sell the business for Rbs 17.7 Billion (approximately USD 191 million). Under the terms of the deal to pay Rbs 10 Billion to Danone for its equity and Rbs 7.7 Billion to go towards debt servicing.

Russia Cheese Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalow Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Forms Covered | Slices, Diced/Cubes, Shredded, Liquid, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia cheese market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia cheese market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia cheese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cheese market in the Russia was valued at 1.68 Million Tons in 2024.

.The growth of the Russia cheese market is driven by steady demand for locally produced dairy products, a rise in cheese consumption in urban households, and growing interest in premium and specialty cheese varieties. Domestic production has increased due to import restrictions and support for local producers, encouraging innovation and boosting overall cheese availability in retail and foodservice.

.The cheese market in Russia is projected to exhibit a CAGR of 4.90% during 2025-2033, reaching a value of 2.59 Million Tons by 2033.

Cow Milk holds the largest share in Russia cheese type due to its consistent supply, well-developed dairy farms, and high yield compared to other milk sources. Its versatility for producing various cheese styles, cost-effectiveness, and consumer preference for familiar flavors made from cow milk also keep this segment dominant across mass-market and premium cheese categories

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)