Russia Children’s Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2025-2033

Russia Children’s Entertainment Centers Market Overview:

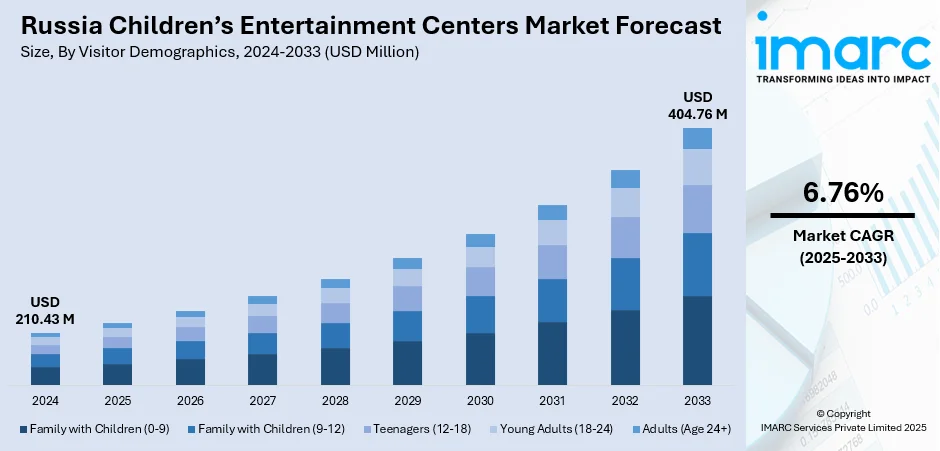

The Russia children’s entertainment centers market size reached USD 210.43 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 404.76 Million by 2033, exhibiting a growth rate (CAGR) of 6.76% during 2025-2033. Growing urbanization, rising disposable incomes, and increasing demand for safe, themed indoor play areas are some of the factors contributing to the Russia children’s entertainment centers market share. Parents seek engaging, educational experiences. Shopping malls offer space and footfall. Franchising and foreign investment fuel expansion, especially in tier-one and tier-two cities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 210.43 Million |

| Market Forecast in 2033 | USD 404.76 Million |

| Market Growth Rate 2025-2033 | 6.76% |

Russia Children’s Entertainment Centers Market Trends:

Shift Toward Localized, Community-Focused Centers

In smaller Russian cities and suburban areas, there's growing demand for compact, neighborhood-based entertainment centers. These venues cater to repeat visits rather than one-off attractions. Operators are focusing on loyalty programs, birthday packages, and educational play zones tied to local school calendars. This trend reflects a broader shift toward making entertainment more routine and integrated into everyday family life. Rather than investing heavily in flashy, large-scale indoor theme parks, businesses are adopting modular setups that can adapt to smaller retail spaces or shared facilities like malls or fitness centers. Parents see value in affordable, accessible options that reduce travel and time costs. Operators, in turn, are minimizing overhead and gaining customer stickiness through personalization and familiarity. This model is proving more resilient during periods of inflation or shifting consumer priorities. These factors are intensifying the Russia children’s entertainment centers market growth.

To get more information on this market, Request Sample

Tech-Driven Premium Experiences in Urban Markets

In major Russian cities like Moscow and St. Petersburg, there’s a trend toward immersive, tech-heavy children’s entertainment experiences. These include VR game zones, interactive floors and walls, and AI-enabled storytelling rooms. Affluent families are drawn to novelty and innovation, expecting facilities that rival or exceed international standards. Operators are collaborating with international IPs, animation brands, and tech startups to design attractions that blend play with cutting-edge interactivity. There's also a push toward app-based bookings, smart wristbands for kids, and digital dashboards for parents to track engagement or safety. These premium offerings target a different audience, less price-sensitive, more experience-driven, compared to traditional soft play centers. This approach is capital-intensive but fetches higher margins and repeat footfall among urban dwellers who prioritize quality and novelty.

Russia Children’s Entertainment Centers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on visitor demographics, facility size, revenue source, and activity area.

Visitor Demographics Insights:

- Family with Children (0-9)

- Family with Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

The report has provided a detailed breakup and analysis of the market based on the visitor demographics. This includes family with children (0-9), family with children (9-12), teenagers (12-18), young adults (18-24), and adults (age 24+).

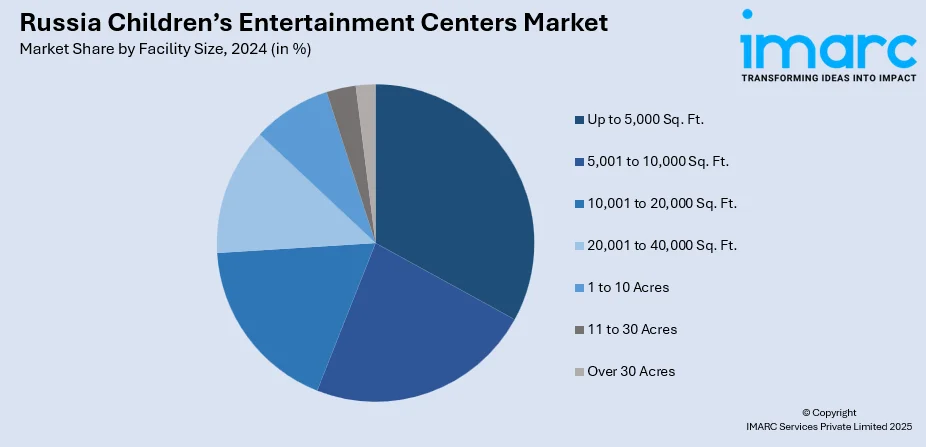

Facility Size Insights:

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 11 to 30 acres, and over 30 acres.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes entry fees and ticket sales, food and beverages, merchandising, advertising, and others.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

A detailed breakup and analysis of the market based on the activity area have also been provided in the report. This includes arcade studios, AR and VR gaming zone, physical play activities, skill/competition games, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family with Children (0-9), Family with Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia children’s entertainment centers market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia children’s entertainment centers market on the basis of visitor demographics?

- What is the breakup of the Russia children’s entertainment centers market on the basis of facility size?

- What is the breakup of the Russia children’s entertainment centers market on the basis of revenue source?

- What is the breakup of the Russia children’s entertainment centers market on the basis of activity area?

- What is the breakup of the Russia children’s entertainment centers market on the basis of region?

- What are the various stages in the value chain of the Russia children’s entertainment centers market?

- What are the key driving factors and challenges in the Russia children’s entertainment centers market?

- What is the structure of the Russia children’s entertainment centers market and who are the key players?

- What is the degree of competition in the Russia children’s entertainment centers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia children’s entertainment centers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia children’s entertainment centers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia children’s entertainment centers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)