Russia Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End-Use Industry, and Region, 2025-2033

Russia Cyber Insurance Market Overview:

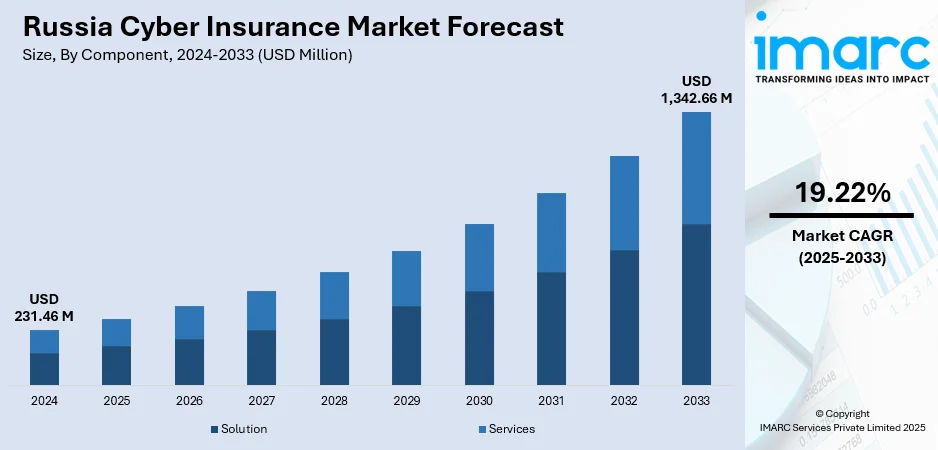

The Russia cyber insurance market size reached USD 231.46 Million in 2024. The market is projected to reach USD 1,342.66 Million by 2033, exhibiting a growth rate (CAGR) of 19.22% during 2025-2033. The market is expanding due to increased awareness of cyber threats and growing adoption of digital risk management strategies. In addition, rising focus on regulatory alignment and security education continues to support Russia cyber insurance market share across critical sectors including finance, energy, and public infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 231.46 Million |

| Market Forecast in 2033 | USD 1,342.66 Million |

| Market Growth Rate 2025-2033 | 19.22% |

Russia Cyber Insurance Market Trends:

Focus on Cross-Border Risk Cooperation

Growing international cooperation on cyber risk regulation is shaping the Russia cyber insurance market growth by encouraging clearer standards and response frameworks. Countries are acknowledging that cyber threats do not follow national boundaries, prompting a stronger focus on global communication and alignment in cyber risk management. This shift is especially relevant to Russia, where regulatory clarity and global engagement remain key factors in strengthening its cyber insurance framework. In July 2024, SIPRI and the German Federal Foreign Office held a cyber risk reduction event in New York, gathering experts from Russia, China, the US, and the EU. The discussions highlighted areas of alignment and divergence in regulatory approaches, supporting transparent definitions, best practice sharing, and cooperation. This multilateral focus contributes to better understanding of risk exposure and paves the way for cross-border underwriting strategies. Russian insurers may use this momentum to build more reliable assessment models and update existing policies with broader regional awareness. The trend supports stronger compliance alignment with global insurers and reinsurers, making the market more predictable and viable for international players. These developments can ultimately support better coverage terms and improve Russia’s positioning in the global cyber insurance space.

To get more information on this market, Request Sample

National Education Fuels Policy Demand

The push for cybersecurity education and digital literacy is becoming a key driver for cyber insurance expansion in regions facing hybrid threats. When awareness increases among citizens and civil servants, it naturally leads to stronger demand for risk transfer solutions. Russia, with its complex threat environment, stands to benefit from a similar path where public engagement plays a role in market development. In March 2025, Estonia expanded its cyber insurance relevance in France by promoting cyber hygiene through national awareness and AI education initiatives. The model, shaped by Estonia’s past cyberattacks and security-by-design approach, directly influenced how France positioned its coverage strategies for both infrastructure and individuals. This example shows how national cyber literacy efforts can influence insurance adoption rates. For Russia, introducing similar education-based initiatives could encourage market maturity, particularly in underserved business segments and public institutions. As AI-related risks grow, informed stakeholders are more likely to invest in tailored cyber insurance products. Adopting an education-first mindset, combined with policy support, could help the Russian market adapt to evolving threat patterns and establish broader coverage demand across various sectors.

Russia Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end-use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

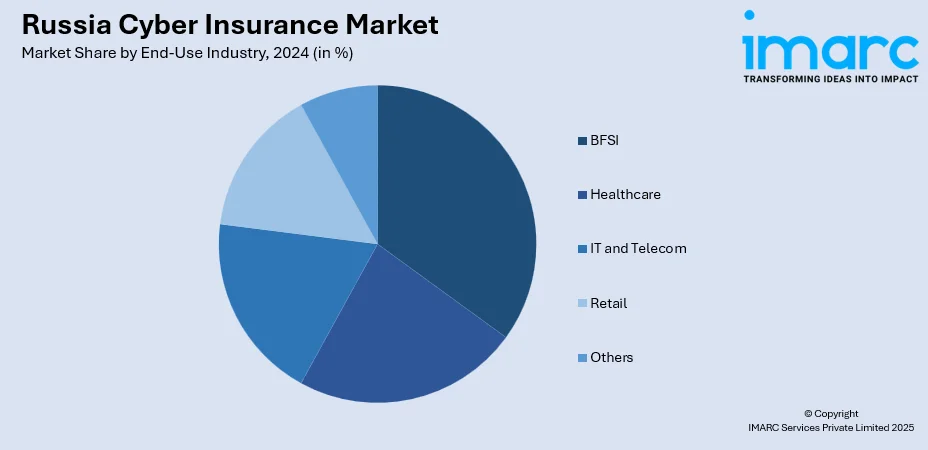

End-Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes BFSI, healthcare, IT and telecom, retail, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Cyber Insurance Market News:

- May 2025: Markel launched a unique cyber insurance product offering up to USD 5 Million coverage for collateral war-related cyber losses. It is designed for large corporates, addressing gaps left by restrictive war exclusions, enhancing market confidence, and expanding cyber insurance scope amid rising geopolitical threats.

- July 2024: SIPRI and the German Federal Foreign Office hosted a cyber risk reduction event addressing regulatory approaches in Russia, China, the US, and EU. The discussion supported clearer definitions and cooperation, encouraging stronger cyber insurance frameworks and cross-border risk assessment standards globally.

Russia Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia cyber insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia cyber insurance market on the basis of component?

- What is the breakup of the Russia cyber insurance market on the basis of insurance type?

- What is the breakup of the Russia cyber insurance market on the basis of organization size?

- What is the breakup of the Russia cyber insurance market on the basis of end-use industry?

- What is the breakup of the Russia cyber insurance market on the basis of region?

- What are the various stages in the value chain of the Russia cyber insurance market?

- What are the key driving factors and challenges in the Russia cyber insurance market?

- What is the structure of the Russia cyber insurance market and who are the key players?

- What is the degree of competition in the Russia cyber insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia cyber insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia cyber insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)