Russia Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Russia Diaper Market Overview:

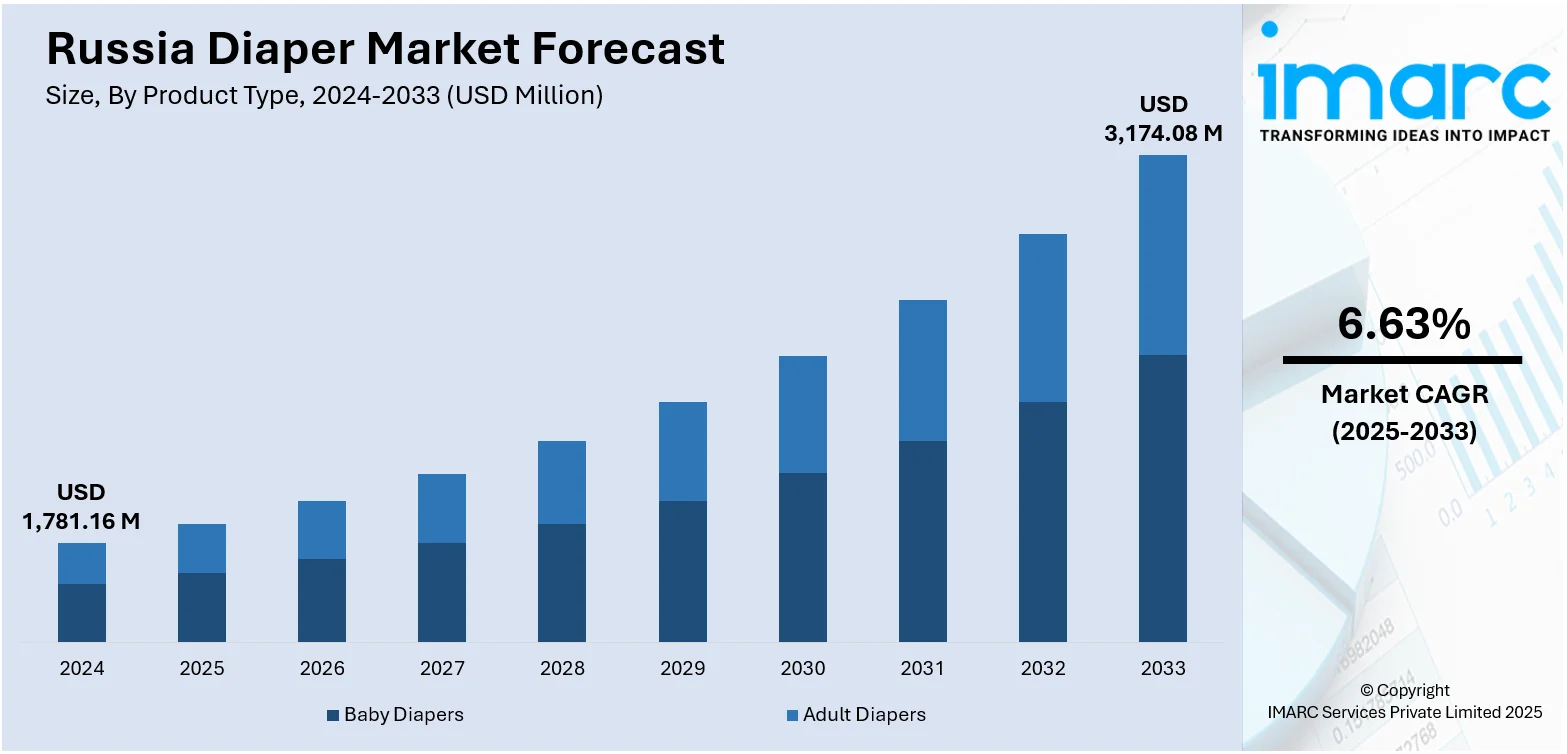

The Russia diaper market size reached USD 1,781.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,174.08 Million by 2033, exhibiting a growth rate (CAGR) of 6.63% during 2025-2033. Rising birth rates in some regions, growing awareness of hygiene, increased urbanization, higher disposable income, expansion of e-commerce, aggressive pricing and promotion by domestic and international brands, and a growing demand for eco-friendly or biodegradable products are some of the factors contributing to Russia diaper market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,781.16 Million |

| Market Forecast in 2033 | USD 3,174.08 Million |

| Market Growth Rate 2025-2033 | 6.63% |

Russia Diaper Market Trends:

Automation in Diaper Packaging

There’s a growing shift toward automation in Russia's diaper industry. Recent advancements in high-speed packaging machines are allowing for faster production and greater flexibility. These machines are designed to accommodate a variety of product sizes, enhancing the ability to handle different SKUs efficiently. As a result, the industry is moving toward more streamlined, cost-effective operations. The push for automation is reshaping diaper packaging, helping manufacturers meet increasing demand while optimizing their production lines. This focus on improving packaging efficiency is setting the stage for further innovations, with an emphasis on speed, flexibility, and reducing operational costs within Russia. These factors are intensifying the Russia diaper market growth. For example, in June 2024, BROAD successfully shipped its High-Speed Full-Servo Baby Diaper Packaging Machine to Russia. The machine, capable of 50 packs per minute, is among the fastest in the country. It supports customizable packing dimensions for various SKUs: width (120–400mm), height (90–190mm), and length (150–500mm). The shipment marks a step forward in automating and optimizing diaper packaging in the Russian market.

To get more information on this market, Request Sample

Growth in Diaper Exports

The disposable diaper sector is witnessing a notable shift as manufacturers focus on expanding exports to Russia, a key market for their products. One company recently highlighted that a significant portion of its revenue comes from Russia, showing a rise in market share. By categorizing diapers as “humanitarian” goods, manufacturers have found a way to bypass sanctions, driving strong growth in both revenue and profits. This strategy has become crucial in maintaining a steady supply chain despite challenging international regulations. The increasing reliance on the Russian market indicates a broader effort by companies to tap into emerging opportunities, enhancing their global reach while adapting to geopolitical complexities. For instance, in May 2024, Soft International Group Ltd., a disposable diaper manufacturer, focused on booming exports to Russia, where it sold the majority of its products. The company filed for a Hong Kong IPO, noting Russia accounted for 58% of its 2023 revenue, up from 50% in 2022. It classifies diapers as “humanitarian” goods to bypass sanctions, fueling strong growth in revenue and profit.

Russia Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diapers

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diapers

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diapers (disposable diaper, training diaper, cloth diaper, swim pants, and biodegradable diaper) and adult diapers (pad type, flat type, and pant type).

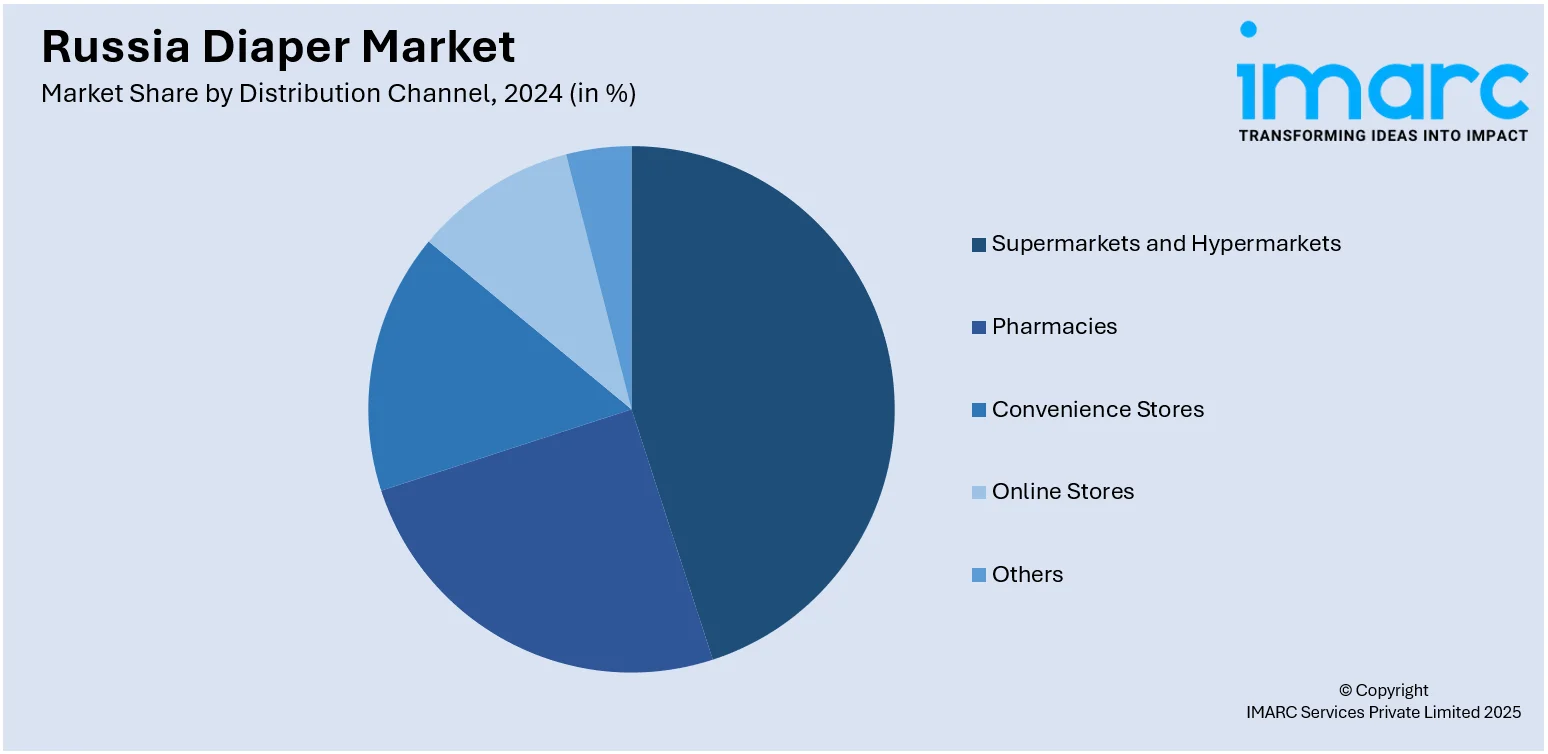

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Diaper Market News:

- In May 2025, Ontex Group NV introduced a new 360° leak protection system in its baby diapers, now available in Russia. Designed for newborns, the upgraded diapers offer front, back, and side coverage with anti-leak barriers, a built-in navel cutout, and a channeled absorbent core. Soft, skin-friendly materials ensure comfort and safety, aligning with Ontex’s focus on high-quality, parent-trusted solutions in the Russia diaper market.

Russia Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia diaper market on the basis of product type?

- What is the breakup of the Russia diaper market on the basis of distribution channel?

- What is the breakup of the Russia diaper market on the basis of region?

- What are the various stages in the value chain of the Russia diaper market?

- What are the key driving factors and challenges in the Russia diaper market?

- What is the structure of the Russia diaper market and who are the key players?

- What is the degree of competition in the Russia diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)