Russia Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Russia Drones Market Overview:

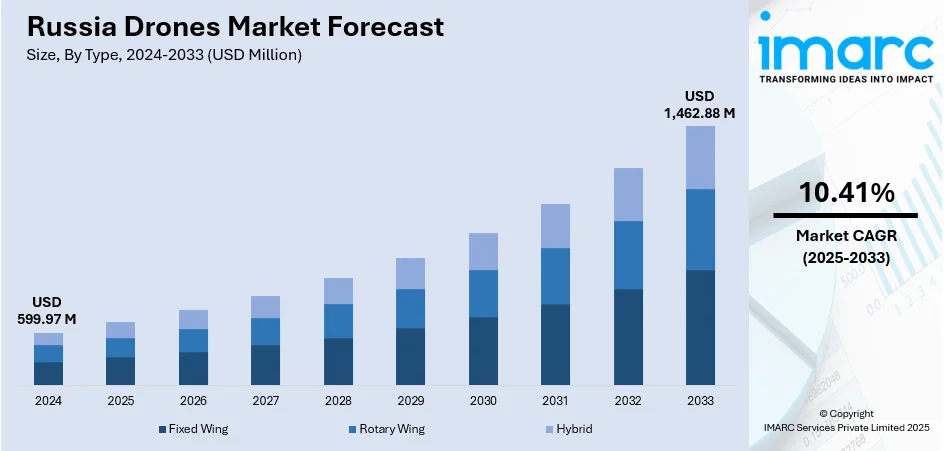

The Russia drones market size reached USD 599.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,462.88 Million by 2033, exhibiting a growth rate (CAGR) of 10.41% during 2025-2033. The market for drones is powered by government support, innovation in the defense sector, and growing civilian use over large geographic regions. Military demand drives investment in local production of drones, especially for reconnaissance and tactical purposes. In the civilian market, drones find use in agriculture, inspection of infrastructure, and management of energy resources, particularly in inaccessible regions such as Siberia. Such varied, region-specific uses, as well as initiatives to increase local production, are playing a major part in fueling Russia drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 599.97 Million |

| Market Forecast in 2033 | USD 1,462.88 Million |

| Market Growth Rate 2025-2033 | 10.41% |

Russia Drones Market Trends:

Government Strategy and Defense-Driven Innovation

One of the factors driving the market for Russian drones is the concerted effort of defense institutions and government agencies to create indigenous unmanned systems. Russia's military and security establishment are focused on self-sufficiency, channeling investment into domestic drone production and applications. Strategic government-sponsored programs enhance the creation of drones specific to reconnaissance, border control, and tactical missions in remote or mountainous areas like Siberia and the Arctic. These programs have fueled partnerships among defense organizations, aerospace companies, and technology startups to spur innovation in drone platforms capable of functioning in harsh climates and large spaces. Domestic producers are incentivized to design robust, modular drones for long-endurance and flexible payloads that address the logistical and environmental requirements characteristic of Russia. Government contracting and regulatory systems also enable instant deployment of military-grade drones, supporting national security objectives and accelerating widespread adoption of drone technologies across the civilian marketplace.

To get more information on this market, Request Sample

Rural Regions' Agricultural and Infrastructure Applications

Russia's infrastructure and agriculture industries are promoting civilian drone use by exploiting unmanned platforms for extensive terrain control. In long grain belts and farm areas, drones are used more and more for crop inspection, soil mapping, and precision spraying, maximizing input application across expansive farms with varying terrain. Aerial surveying and inspection are advantageous to the nation's infrastructure projects, especially in remote locations of the Far East and transportation networks along long distances, providing quicker land evaluation and route planning. In areas like the Volga and Ural crop production zones, drones facilitate water management, seasonal monitoring, and land-use planning. The use is also promoted by agrotechnical cooperatives and regional administrations, which encourage drone systems to improve agricultural productivity and maintenance of road and rail infrastructure. These locally designed applications emphasize drones' ability to fill operational gaps in areas subject to Russia's vast geography and logistical complications, which further contribute to the Russia drones market growth.

Expansion of Security, Energy Sector and Emergency Response

The Russian energy industry, encompassing oil and gas, mining, and utility grids, is significantly enhanced by the capabilities of drones, driving market expansion. Unmanned aerial vehicles facilitate the inspection of pipelines, offshore platforms, and remote facilities for anomalies, avoiding interruptions, and enhancing worker safety. Drones also aid in environmental monitoring and spill detection in sensitive areas such as Siberia and the Arctic coastline. Furthermore, civil defense departments and local emergency departments use drones for search and rescue operations in mountainous areas, forest fires, city incidents, and industrial accidents. Police units use drone technology for crowd monitoring, border security, and traffic control in cities such as Moscow and rural border zones. An expanding ecosystem of drone service providers is developing to serve these industries, constructing specialized solutions like thermal scanning, long-endurance flight, and autonomous navigation, that respond to Russia's singular topography and operational requirements. This intersection of industrial, environmental, and security uses continues to fuel demand and inscribe drone platforms into strategic regional systems.

Russia Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 kilograms, 25-170 kilograms, and >170 kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

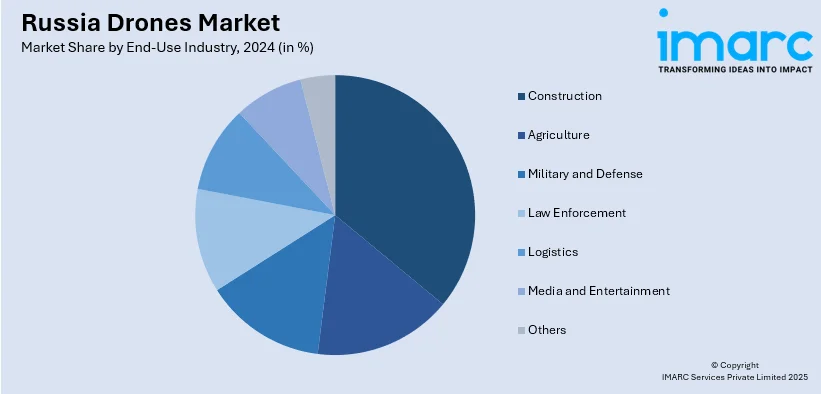

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Central district, Volga district, Urals district, Northwestern district, Siberian district, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Drones Market News:

- In July 2025, a Russian factory, touted by its director as the largest producer of strike drones globally, was featured on the Russian military's television channel with adolescents assisting in the production of kamikaze drones aimed at Ukraine. The video, featured in a documentary aired by the Zvezda channel on Sunday, displayed hundreds of finished large black Geran-2 suicide drones arranged in lines within the covert facility, which has been attacked by Ukrainian long-range drones.

Russia Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia drones market on the basis of type?

- What is the breakup of the Russia drones market on the basis of component?

- What is the breakup of the Russia drones market on the basis of payload?

- What is the breakup of the Russia drones market on the basis of point of sale?

- What is the breakup of the Russia drones market on the basis of end-use industry?

- What is the breakup of the Russia drones market on the basis of region?

- What are the various stages in the value chain of the Russia drones market?

- What are the key driving factors and challenges in the Russia drones market?

- What is the structure of the Russia drones market and who are the key players?

- What is the degree of competition in the Russia drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)